The top Ethereum altcoin has increased by over 40% in the past week, thanks to new optimism in the cryptocurrency market. At the time of writing, this coin is firmly holding above the psychological price level of 2,500 USD.

However, this price increase may be losing momentum, especially as US investors seem to be taking profits. How will this affect ETH's price performance in the short term?

ETH Price Faces Risk as US Investors Withdraw

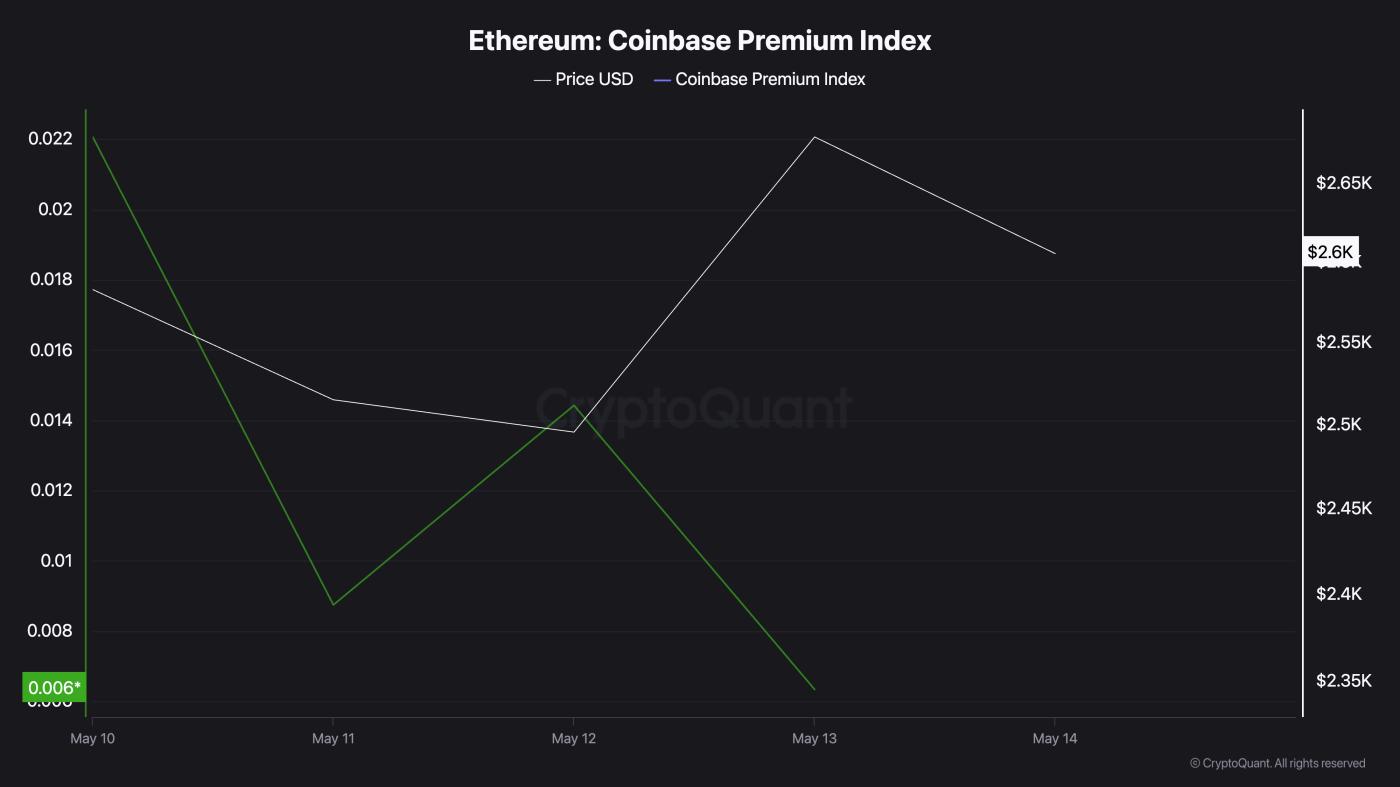

According to CryptoQuant, ETH's Coinbase Premium Index (CPI) reached a weekly peak of 0.022 on 05/10/2025 and has been gradually declining since then. At the time of writing, this index is at 0.0063.

Ethereum Coinbase Premium Index. Source: CryptoQuant

Ethereum Coinbase Premium Index. Source: CryptoQuantThis index has recorded a decline despite ETH's 5% increase during the same period. This indicates increasing selling pressure from US investors, a trend that could significantly impact the price of this altcoin.

ETH's CPI measures the price difference between the coin on Coinbase and Binance. It is a good indicator to track US investor sentiment.

When CPI increases, it means ETH is trading at a higher price on Coinbase compared to international exchanges, reflecting stronger buying pressure from institutional and retail investors in the US.

Conversely, when CPI decreases — or worse, turns negative — it signals that demand on Coinbase is lagging behind the global market, due to profit-taking or diminished interest from US buyers. ETH's CPI declining while the price increases suggests US investors are exiting positions and realizing profits, rather than buying into the price surge.

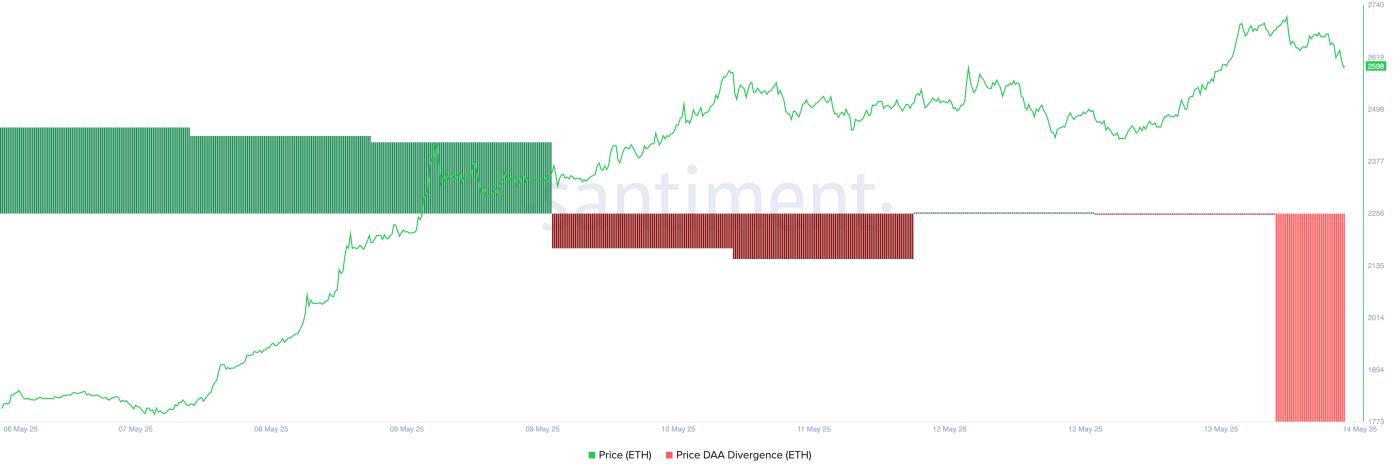

Moreover, indicators from ETH's Daily Active Address (DAA) Price Divergence, an on-chain metric comparing price movement with network activity, confirm this potential price decline. According to Santiment, this index has been negative in recent days despite ETH's price increase. At the time of writing, this index is at -58.2%.

Ethereum Price DAA Divergence. Source: Santiment

Ethereum Price DAA Divergence. Source: SantimentThis negative value indicates that the corresponding increase in user participation does not support ETH's recent price increases. Essentially, there is not enough demand to drive ETH's price surge, thus posing a risk of short-term correction.

Will Buyers Reclaim 2,745 USD or Will There Be a Deeper Decline?

ETH is trading at 2,598 USD at the time of writing, just below the multi-month resistance level formed at 2,725 USD. As US investors take profits, downward pressure on ETH is increasing and could push its price to 2,424 USD.

If the bulls fail to defend this level, the coin's price could drop further to 2,243 USD.

ETH Price Analysis. Source: TradingView

ETH Price Analysis. Source: TradingViewHowever, if buying pressure intensifies, ETH may attempt to climb back to the 2,745 USD level.