📝 Editor’s Note:

Welcome to OurNetwork's Zoomed-in edition on Spark, a project for which analytics platform DefiLlama created a new category — Onchain Capital Allocator.

Because that's what Spark is, at least partially — the project, in case it needs introduction, launched in 2023 from the MakerDAO (now Sky) team and with a total value locked over $5B, is now the eighth largest protocol in DeFi, according to DefiLlama.

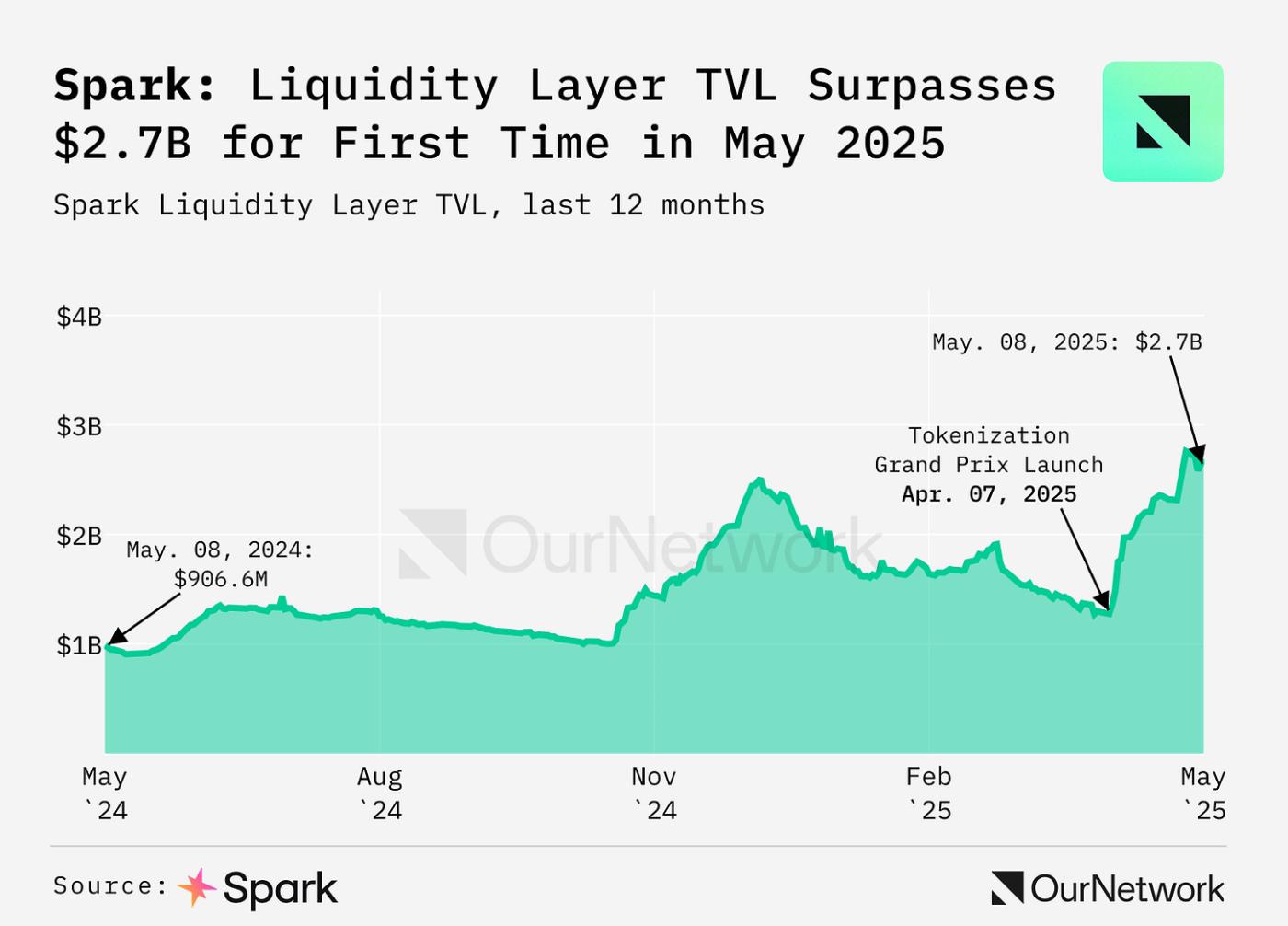

Spark's most recent move has been the development of the Spark Liquidity Layer (SLL), a product with over $2B in total value locked. The SLL automatically allocates stablecoins, primarily from Sky, into major DeFi protocols across multiple networks. This allows the SLL to both generate a high risk-adjusted return to users of Spark’s saving product, while also producing revenue for the protocol.

As you'll read below, a key element to appreciate is Spark’s sheer sheer size — no protocol has been in a position to, for example, take advantage of opportunities like providing USDC for Coinbase's new collateralized loan product.

Let's get into it.

– ON Editorial Team

Quick Links: Website | Twitter | Dashboards

📈 The Spark Liquid Layer Has $2.58B Deployed Across DeFi, RWAs With Another $1B on the Horizon

Through the first quarter of Q1, Sparklend, Spark's lending platform, was driving total value locked (TVL) for the protocol. On Apr. 7 however, the Spark Tokenization Grand Prix, a nine-month-long competition, was launched. Over the next month, the Spark Liquidity Layer (SLL) allocated $1B in stablecoins to three partners — Blackrock, Superstate, and Centrifuge.

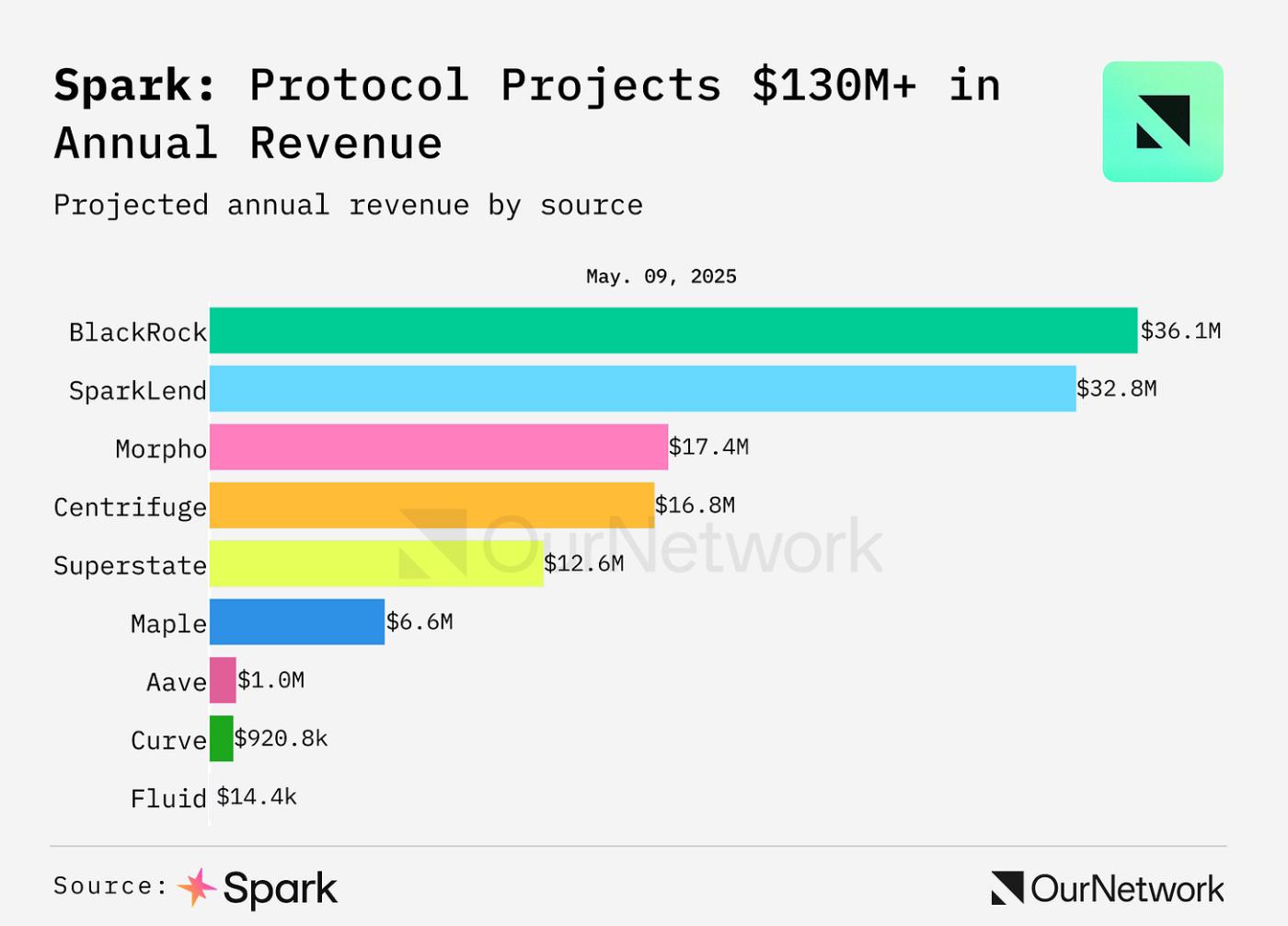

The Tokenization Grand Prix, and SLL more broadly, has been paying off so far. Spark is projected to generate over $130M for the protocol. Over 43% is projected to come from the three partners of the SLL. Spark's number one source of revenue is BlackRock, which is projected to generate $35.1M in the next 12 months.

Quick Links: Disclosures

ork! Subscribe for free to receive new posts and support our work.