1/ @Maplefinance, an institutional overcollateralized lending protocol, is demonstrating a significant resurgence, with TVL now exceeding $1B.

This thread breaks down fundamentals, growth trajectory, current valuations, and revenue:

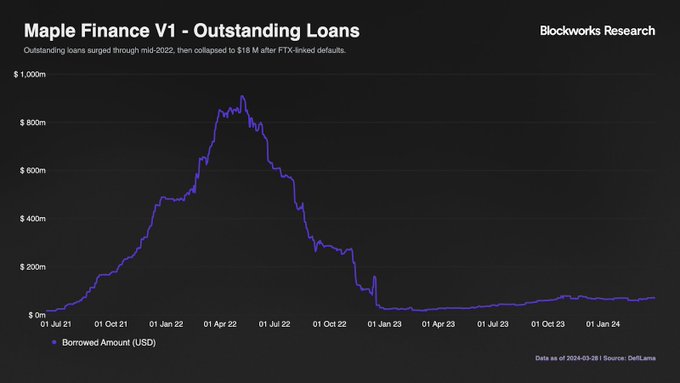

2/ Initially an undercollateralized lending protocol, Maple's v1 loan book peaked at $910M in 2022. The FTX collapse led to $54M in defaults, reducing active loans to $18M by March 2023.

This catalyzed a strategic pivot to a v2 model, emphasizing secured, overcollateralized

3/ Following its v2 upgrade, Maple Direct began originating its own KYC-gated loans.

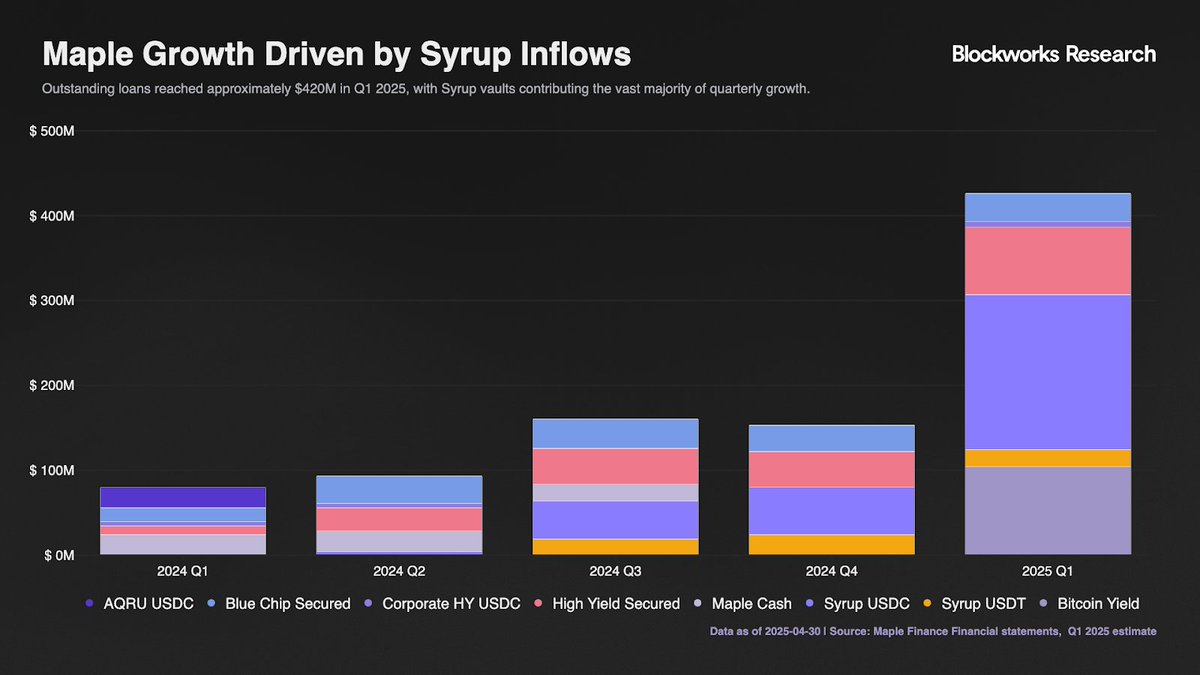

The May 2024 launch of Syrup pools (SyrupUSDC & SyrupUSDT) under Reg S unlocked DeFi liquidity. Syrup loans surged from $4M to $64M in the quarter post-launch and became the primary driver for

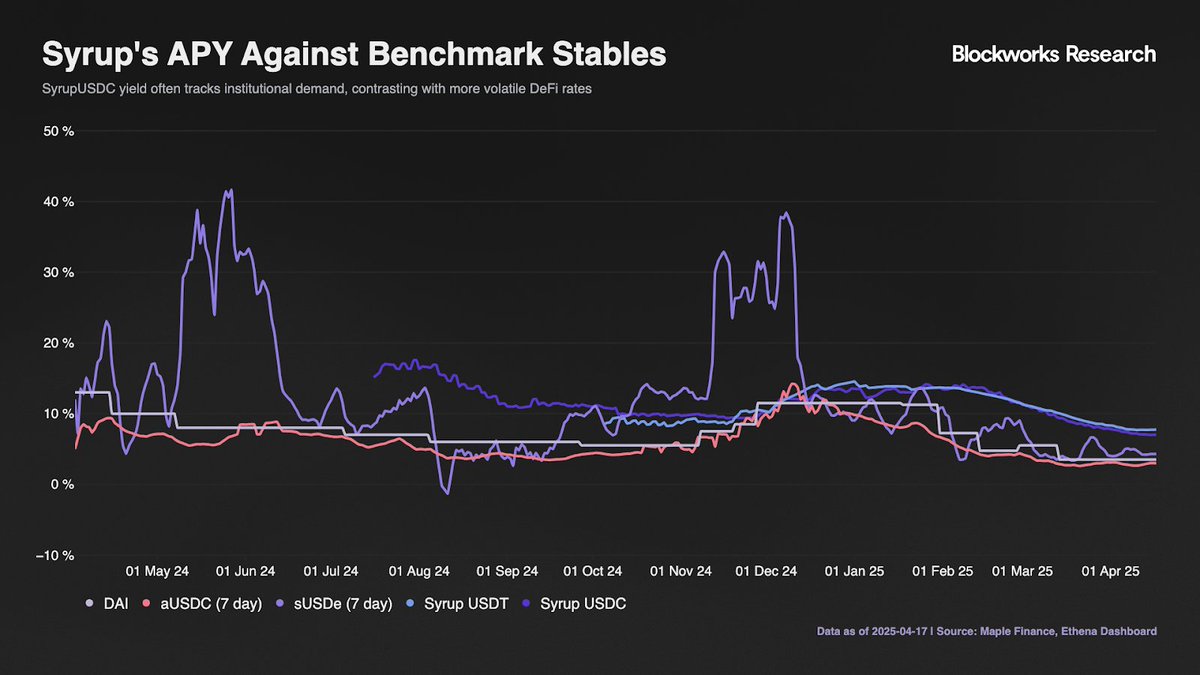

4/ SyrupUSDC achieves sustainable, high yields (avg. 10.8% APY, 11.3% median YTD 2025), outperforming benchmarks like aUSDC (+6.6ppt) & DSR (+4.6ppt). This is driven by:

1) Fixed-term institutional loans via Maple Direct.

2) Idle capital deployed into Aave/Maker (per

5/ Maple’s second major growth vector is istBTC, addressing institutional demand for native Bitcoin yield. It aims for approximately 5% APY on BTC through a custody-first model (leveraging Core Chain's "Satoshi Plus"), mitigating smart contract and custody risks.

Demonstrating

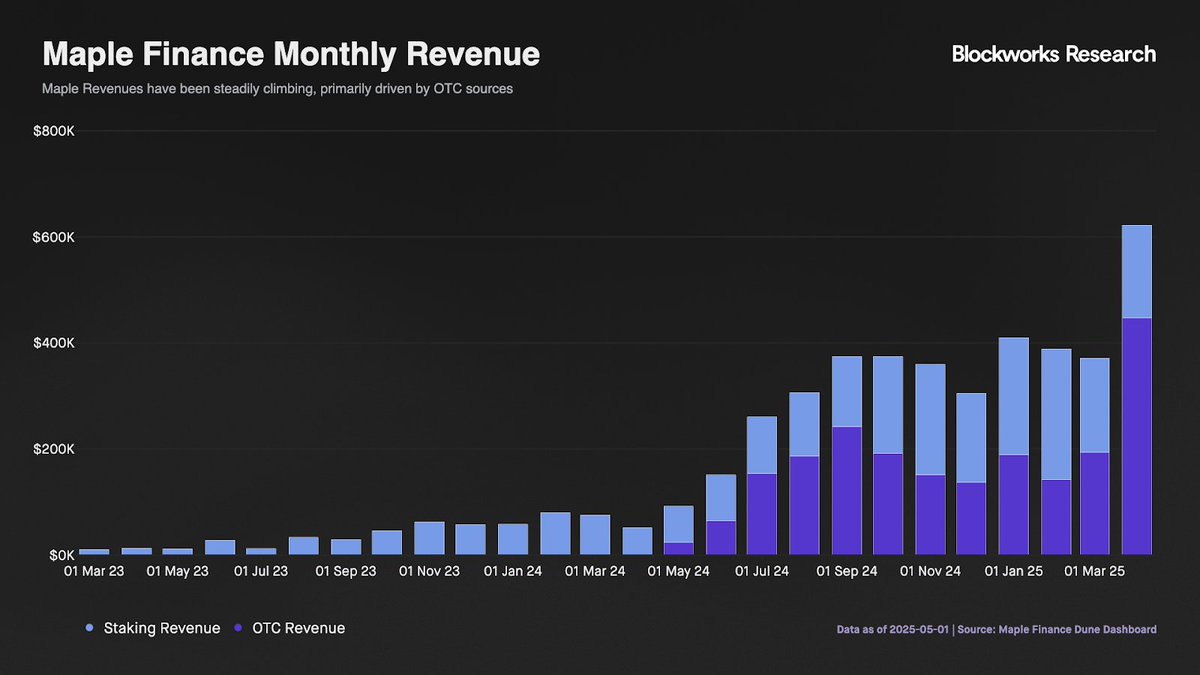

6/ Maple's distinct revenue advantage lies in its diversified streams via Maple Direct, earning from yield strategies on institutional capital and collateral management, not just borrower fees.

April revenue rose 70%; annualized revenue is ~$7.4M, yielding a P/S ratio of ~43x

7/ For a comprehensive analysis covering detailed valuations, catalysts, forecasts, tokenomics, and risk vectors for Maple Finance, find the full report by @shaundadevens on @blockworksres

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share