1/ Uniswap v4 isn’t just another AMM upgrade, it’s a canvas for new types of DEXs.

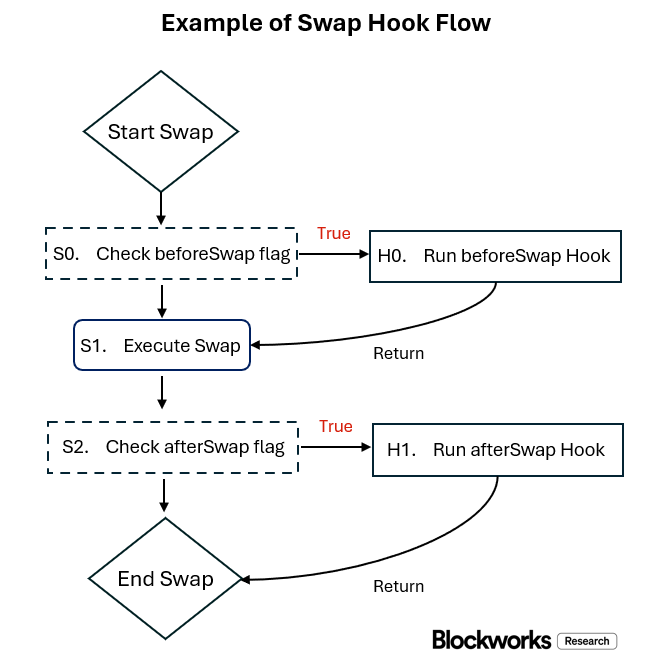

With hooks, devs can inject custom logic into swaps, LP actions & more, unlocking new markets, smarter strategies, and automated onchain agents.

Here’s what’s new in v4 👇

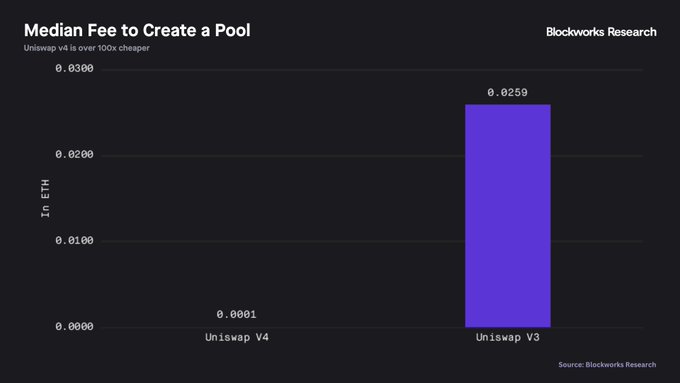

2/ Efficiency Upgrades

Singleton design = 99% cheaper pool creation

Flash accounting = gas savings on multi-hop swaps

Native ETH support = ditch WETH & save more gas

Combined, these features make v4 the most cost-efficient Uniswap version yet.

3/ Security & Trust

9 audits

$2.35M security competition

$15.5M bug bounty (largest ever)

Built publicly with 1,000s of PRs

This is battle-tested infrastructure — and it’s ready for institutions.

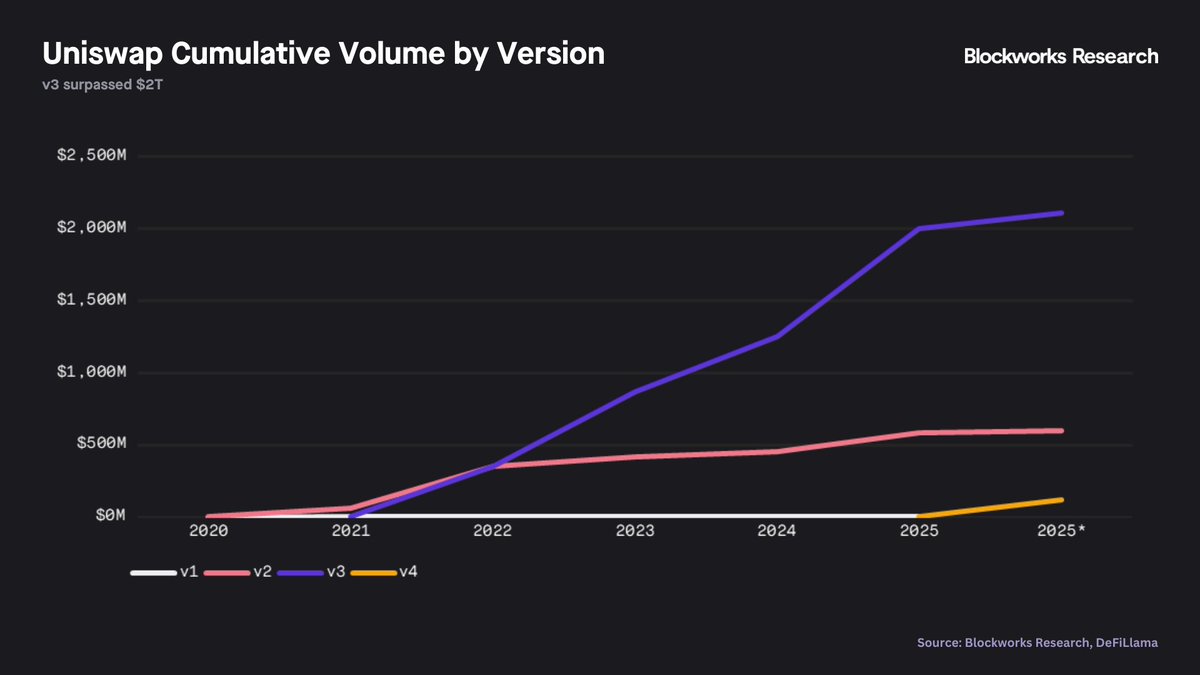

4/ Early traction

200+ external hooks already deployed

$400M+ traded in hooked pools

New apps like Flaunch, Bunni, and AI hedge funds like Silicon Valley Fund are pushing what’s possible

This is just the start, expect continuous iteration and innovation.

5/ v4 opens the door to:

AI-native trading agents

Composable finance apps

Institutional-grade custom pools

MEV-optimized LP strategies

Find the Full Unlocked Report by @marcarjoon here:

app.blockworksresearch.com/res...

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share