I. New Paradigm in Liquidity War: Infrared Finance's Ecological Positioning Reshaping

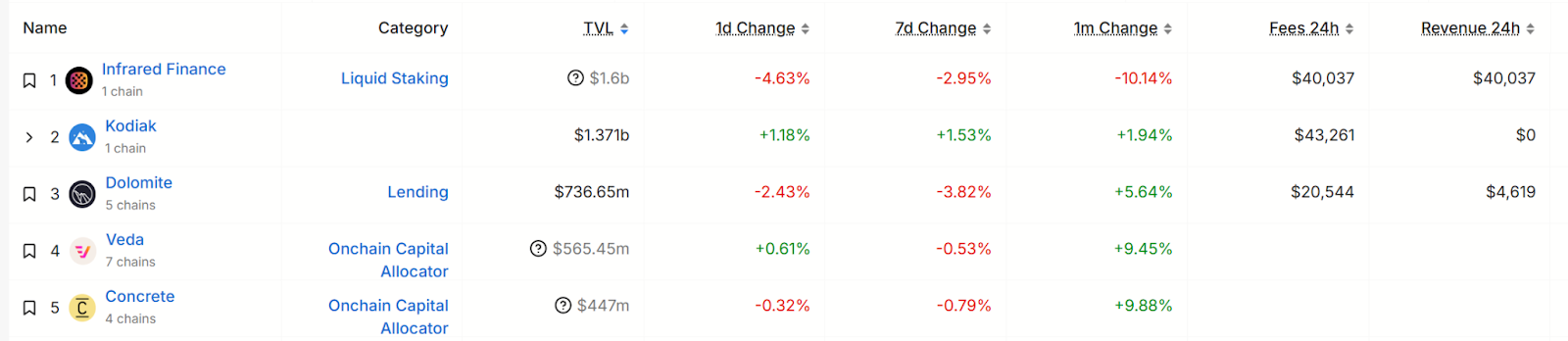

Against the backdrop of Berachain ecosystem becoming a phenomenal public chain with $5.3 billion TVL in 2025, Infrared Finance steadily sits at the top of the ecosystem with $1.5 billion in locked volume.

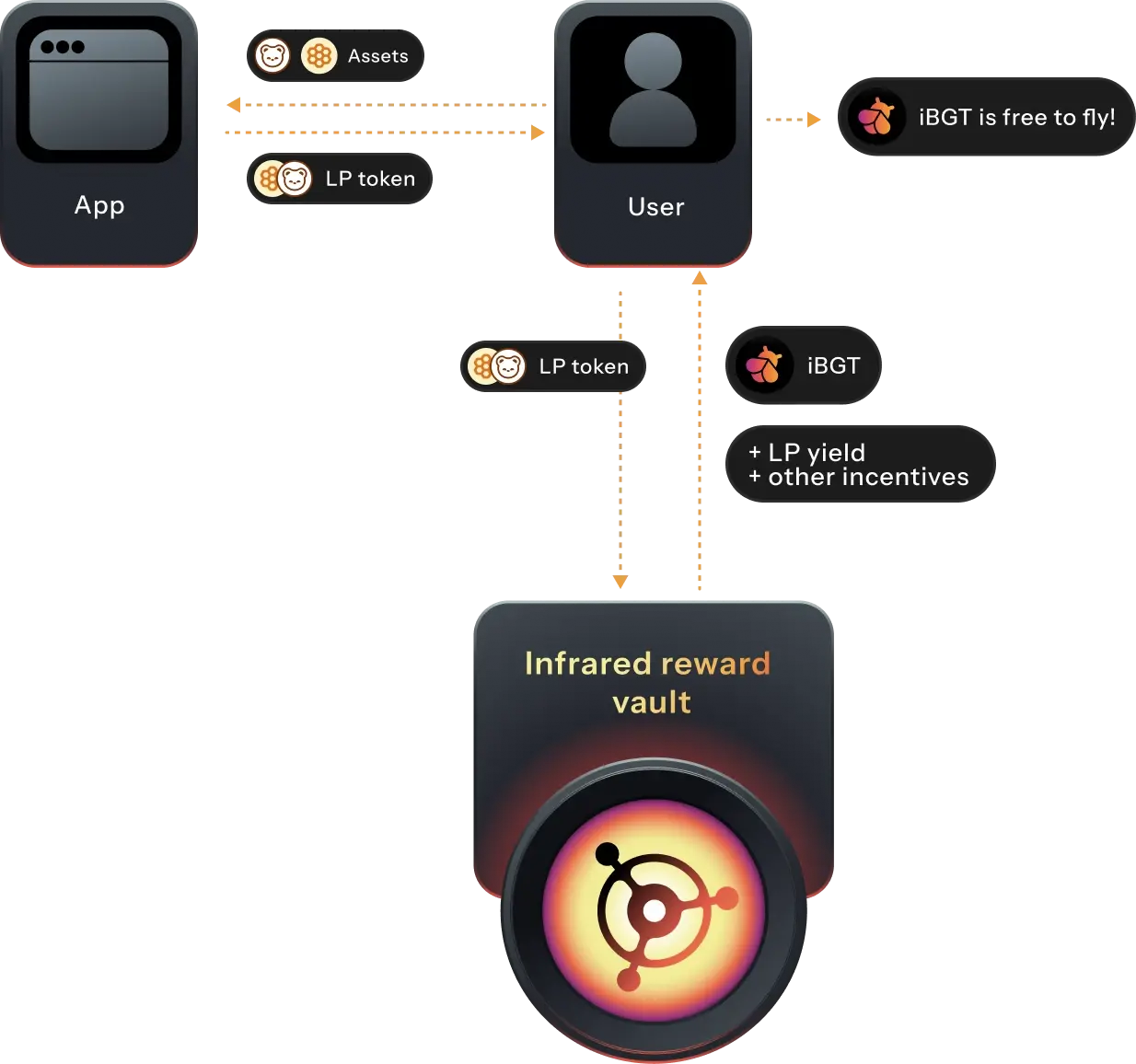

This protocol, incubated by Berachain's official incubator @buildabera, is reconstructing DeFi's liquidity capture logic through two major innovations: liquidity staking tokens (iBGT/iBERA) and automated PoL insurance vaults.

1.1 Infrared's Core Competitiveness from Technical Architecture

Infrared's underlying design directly addresses the complexity pain points of Berachain's PoL mechanism:

- iBGT's Liquidity Revolution: Transforms non-transferable governance token BGT into freely tradable assets. Users obtain 1:1 anchored iBGT by staking LP tokens (such as BEX's BERA-HONEY pool) and enjoy 165%-300% dynamic annual yield. This design preserves BGT's governance value while creating arbitrage space through secondary market premium (currently 40%).

- Node Operation's Scale Effect: Infrared controls 8 out of Berachain's 63 network nodes, all using a 100% commission extraction model, distributing node income (block rewards, bribes, fees) entirely to iBGT stakers. Calculated at maximum stake of 10 million BERA, its actual computing power share far exceeds 12.69%, forming a monopolistic advantage in ecosystem income distribution.

- Zero-Fee Model and Points Flywheel: Unlike traditional protocols charging 2%-5% management fees, Infrared extracts only a tiny fee from performance income. The launched Infrared Points system builds token airdrop expectations by retroactively analyzing historical data (as early as March 2025), driving 22.41% monthly TVL growth.

1.2 Game Theory of Capital War: iBGT's Value Capture Logic

iBGT's premium is essentially a liquidity option pricing game:

- Demand Side: As BGT's sole liquidity exit, iBGT carries over 80% of protocol bribery market fund flow. Taking Kodiak's WBERA-iBGT pool as an example, over 60% of its 199.55% APR comes from validator node BGT emission rights competition.

- Supply Side: Of the 6.88 million iBGT total supply, 66.62% is locked in staking contracts, with actual circulation of only 2.29 million. Kodiak's largest liquidity pool TVL is merely $10 million, with insufficient depth causing price volatility of up to 58%. This scarcity, combined with derivative platforms like Pendle (541% APR iBGT yield rights trading), further amplifies capital leverage.

II. Razor's Edge of Risk and Reward: Complete iBGT Mining Strategy

Under the temptation of 40% premium and 200% annual yield, investors need to construct a multi-dimensional hedging framework to address asymmetric market risks.

2.1 Basic Strategy: Spot Staking and Liquidity Mining

- Unlevered Spot Staking: Staking iBGT on Infrared's official website yields 143%-212% base annual return, paid in HONEY (Berachain stablecoin) and WBERA. Suitable for risk-averse users, but requires bearing iBGT/BERA exchange rate fluctuations (historical maximum drawdown 30%).

- DEX Liquidity Enhancement:

- Kodiak's WBERA-iBGT Pool: Current TVL $10 million, 199.55% APR + 1.375x points acceleration, but requires bearing Impermanent Loss (IL). When iBGT premium drops 10%, IL is approximately 4.7%.

- Pendle's Yield Rights Separation: By encapsulating iBGT's future income into PT (principal token) and YT (yield token), investors can achieve 541% APR arbitrage, but must be cautious of derivative liquidity drought risk.

2.2 Advanced Strategy: Hedging and Preservation Model

For the primary risk of iBGT premium narrowing, institutional investors often adopt Delta neutral strategy:

- Spot-Futures Hedging:

- Buy $1 million iBGT and stake (200% APR), simultaneously opening $600,000 BERA perpetual short contract on Binance (funding rate -22.08%).

- When iBGT/BERA premium drops from 40% to 20%, spot side loses $200,000, futures side profits $120,000, net loss $80,000, but staking income can cover $166,000 (non-compounded).

- Volatility Arbitrage:

- When iBGT premium >50%, deposit iBGT as collateral on Dolomite lending platform (LTV 65%), borrow BERA and sell, locking premium difference.

- Close position when premium returns to 30%, with net profit around 5% after deducting 15% lending costs.

2.3 Golden Rule of Position Management

- Liquidity Threshold Control: Single address iBGT holdings should not exceed 5% of Kodiak's largest capital pool TVL (current upper limit $500,000), otherwise large redemptions may trigger over 15% slippage loss.

- Cross-Protocol Risk Dispersion: Allocate funds to Infrared (40%), Kodiak (30%), Pendle (20%), Beraborrow (10%), utilizing APR differences (68.79%-224.58%) to balance returns.

III. Dark Forest Survival Manual: Full Risk Panorama and Warning Signals

iBGT's high returns are essentially risk pricing of governance rights securitization, and investors must be wary of three gray rhinos:

3.1 Chain Reaction of Premium Collapse

- Historical Reference: In March 2025, BeraPaw's $LBGT premium plummeted from 300% to 15% due to reduced node bribes, triggering cascading liquidations. Current iBGT's CEX futures open interest (OI) is only 12% of spot trading volume, insufficient market depth to support large-scale selling.

- Warning Indicators: When Kodiak's iBGT/BERA trading pair 24-hour volume continuously falls below 10% of TVL for 3 days, or Pendle's YT implied volatility drops below 50%, emergency withdrawal plan should be activated.

3.2 Governance Rights Centralization Paradox

Infrared's 8 controlled nodes can theoretically launch governance attacks, such as concentrating BGT emissions to their protocol pools. Although the team promises 90% income distribution to the community, the opacity of anonymous team operations remains a sword of Damocles.

3.3 Liquidity Black Swan

Berachain's stablecoin HONEY has not yet undergone extreme market test. If a de-pegging event similar to UST occurs (current collateralization rate), 185HONEY denominated parts will instantly evaporate.

IV. Future Battlefield: From Points War to Ecological Integration

Infrared's Q3 token TGE will become a critical turning point:

- Airdrop Economics: If the point exchange ratio is lower than 1:100 (i.e., 10,000 points exchanged for 100 IRED tokens), it may trigger mining capital withdrawal. Referencing Dolomite's $DOLO 3x increase after listing on Binance Alpha, institutional valuation of IRED is centered around $1.2-1.8.

- Ecological Synergy: Infrared's deep collaboration with Kodiak and Gummi (such as integrating iBGT into lending protocols as high-quality collateral) may unlock 10x leverage mining scenarios, further driving governance rights premium.

V. Conclusion: Between Ponzi Scheme and Innovation

The essence of Infrared Finance is an experiment of converting governance rights into tradable assets through liquidity tokenization. Behind its 200% annual yield is Berachain ecosystem's collective belief in liquidity proof mechanism. For rational investors, this is both a battlefield of capturing Alpha with precise mathematical models and a risk game racing against human greed.

As Duan Yongping emphasized in his investment philosophy "One only needs to be rich once", in the iBGT mining frenzy, setting strict stop-loss lines (recommended maximum drawdown of 20%), maintaining 30% stablecoin position, and continuously monitoring whale addresses, might be the ultimate rule for survival in this liquidity war