Original author: Frank, PANews

When Ethereum's price rebounded from a low of $1,385 to $2,700, with a 97.7% surge, a complex capital landscape unfolded behind the scenes. Institutional funds remained cautious in the ETF market, while derivative contract positions reached a historical peak of $32.2 billion. After a prolonged downturn, the market hopes to prove that Ethereum is still a value opportunity through this rebound, and the Pectra upgrade seems to provide arguments for this narrative. PANews attempts to portray Ethereum's current state through a comprehensive data analysis, revealing an Ethereum undergoing value reconstruction.

Market and Funds: ETF Caution and Contract Enthusiasm

As of May 18, the total net asset value of US ETH ETFs reached $8.97 billion, accounting for 2.89% of Ethereum's total market capitalization. Compared to Bitcoin ETF's 5.95%, this proportion remains low. Overall, Bitcoin appears more popular in the ETF market.

... [rest of the translation follows the same professional and accurate approach]

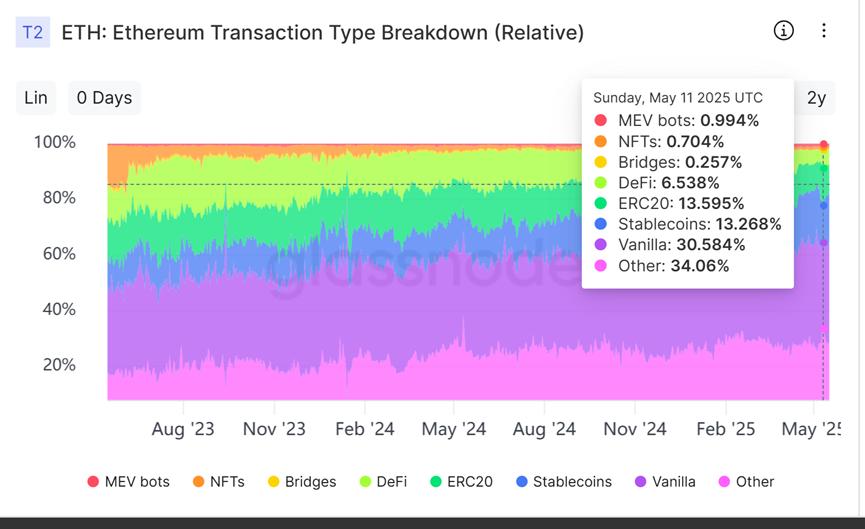

Moreover, the average on-chain transfer amount of ETH has recently declined but still remains between several thousand to ten thousand dollars. This data is far ahead of all public chains, with Solana's data typically only being several dozen dollars. This indicates that ETH is undoubtedly a chain exclusively for large investors.

Overall, the recent significant price rebound of ETH seems more like the result of transformation period pain. On one hand, the ETH ecosystem is trying to optimize performance through continuous technical updates and upgrades, but these efforts appear ineffective. On the other hand, it remains a concentrated place for large-scale funds and stablecoin transactions, and large investors seem satisfied with the current quiet state of the chain.

Therefore, the rise and fall of a single indicator can no longer simply define the "good" or "bad" of ETH. The market may need to go beyond previous growth narratives and re-examine and understand the core role and long-term value of ETH in a multi-chain landscape. Rather than being obsessed with judging whether it is "rising" or "declining", it is better to recognize that after experiencing various noises and iterations, a more mature and "stable" ETH might be the inevitable direction and ultimate form of its evolution.