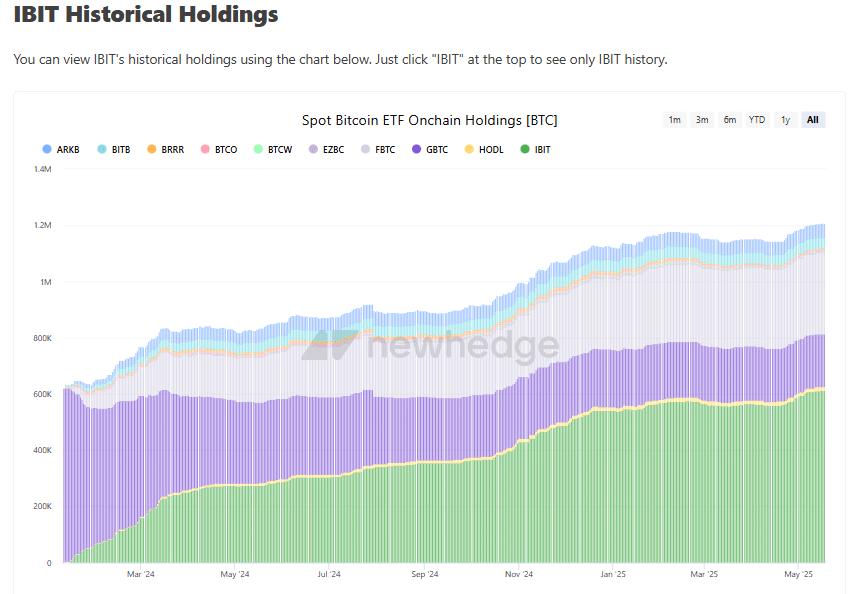

- Bitcoin's IBIT ETF currently controls about 3% of its total supply.

- The new All-Time-High seems less speculative and more aligned with simple economics.

In the Bitcoin [BTC] ecosystem, a new form of centralization is emerging.

Whether this is good or bad depends on perspective. Nonetheless, this is a real change that the market cannot ignore.

Bitcoin's Centralization Transformation: Opportunity or Risk?

Ironically, Bitcoin was built on a decentralized principle. However, that ideal is beginning to fade.

BlackRock's IBIT ETF now holds over 631,000 BTC, valued at around 65 billion USD. This is nearly 3% of Bitcoin's supply in a single institutional wallet.

In summary, a large portion of the fixed 21 million BTC is becoming highly concentrated.

However, according to TinTucBitcoin, this is not just about acceptance. Instead, it represents a structural change in BTC's liquidation profile.

As supply becomes increasingly frozen in non-speculative hands, Bitcoin's volatility motivation is cooling down. Emerging is a more compact, scarcer asset — like a digital gold, and less like a casino chip.

Lower Volatility Lays the Foundation for Next BTC Price Surge

Large capital flows into Bitcoin ETFs, especially BlackRock's IBIT, typically trigger significant price increases.

In November 2024, IBIT led with a 5.6 billion USD capital flow, coinciding with a 45% BTC surge to 99K USD.

Similarly, a single-day 849 million USD flow into IBIT in March 2024 predicted a new BTC peak above 73K USD.

February 2024 saw over 1.10 billion USD weekly flows into spot ETFs like IBIT and Fidelity's FBTC, driving continuous price increases.

Source: Bitbo

With each capital flow wave, BTC's volatility cools down, shifting from sudden advertising-driven surges to movements supported by solid investment.

Therefore, predicting a peak at this stage — just because of increasingly concentrated liquidation — might be hasty.

The broader picture suggests Bitcoin is preparing for the next stage, supported by real capital rather than speculative fever.