Written by Daii

In recent days, the biggest news in the crypto circle is undoubtedly the passage of the US GENIUS Stablecoin Act.

I once said that the US dollar is like China's college entrance examination - not the best system, but the least bad system. Against the backdrop of the increasingly fragmented global currency trust system, the implementation of the GENIUS Act can only be described in four words: mixed.

The good news is that from now on, the on-chain traffic entrance for US dollar assets will be completely opened. Bitcoin has reached 107,000 and Ethereum has reached 2,600 US dollars. The jump in market sentiment seems to have explained everything. More importantly, this is just the beginning.

What is worrying is that the principle of decentralization will once again encounter "institutional squeeze". The GENIUS Act explicitly puts the issuance of stablecoins into the "license cage". Both algorithmic stablecoins and over-crypto-collateralized stablecoins will have to face a head-on collision with regulation.

However, we have to admire the cleverness of the US empire: the US dollar is indeed heading for decline, but it has indeed found a way to prolong its life. After the petrodollar, the crypto dollar has become the "last shot in the arm" of the US dollar hegemony.

In the global frenzy of de-dollarization, the US dollar has regained its place on the stage through on-chain stablecoins. Liquidity is once again occupied by the US dollar, but this time it is presented in the form of on-chain addresses.

Of course, fortunately, it is US dollars, not rubles.

But the question is: Is it a blessing or a curse that centralized US dollar stablecoins have entered the crypto world that originally promised "decentralization"?

It may bring compliant traffic, or it may replace truly decentralized experiments; it may promote global trading freedom, or it may once again return control of value to "licensed people."

This is exactly what we must discuss today.

Today is the third and final chapter of the Decentralization Trilogy. Before we begin, let’s briefly review the main threads of the first two chapters:

In the first article, we talked about disillusionment.

In the early morning of April 15, 2025, an AWS optical cable in Tokyo was accidentally disconnected, global cryptocurrency trading volume plummeted by 15% within an hour, and mainstream exchanges were collectively paralyzed; 8 days later, European small and medium-sized cryptocurrency platforms were hit by Google's new advertising regulations, and traffic exposure dropped by 67% in just 3 days.

These two real shocks have completely torn off the mask of "fake decentralization". No matter how decentralized the chain is, the backend is still Web2. No matter how redistributed the code is, the traffic is still in the hands of the giants.

In the second article, we try to redefine "true decentralization".

True decentralization does not mean that everything must be turned into on-chain code, but it must achieve three important features:

Data is distributed and cannot be tampered with;

The incentive mechanism is built in, and the network maintains itself through market forces;

Governance rules are automatically enforced, transparent and open, and not based on random decisions.

We even used the HHI index to measure the three mainstream chains - and unexpectedly found that Ethereum's degree of decentralization far exceeded that of Bitcoin and Solana.

Today, let’s lower our perspective and get closer to life.

We only ask one thing -

What does this abstract "decentralization" have to do with you?

The answer is: It matters a lot.

It concerns your wallet, your source of income, and even your future entrepreneurial opportunities. It is not some kind of idealistic slogan, but an economic reality that is already happening and continuing to evolve.

This article will describe how decentralization can be transformed from an idea into a new economic order through three core paths:

Tokenization of everything: Let value flow as freely as information;

Airdrop economy: From user payment to platform reverse profit sharing;

Open source innovation flywheel: Using puzzle-like modules, you can build global applications.

These three are not isolated from each other, but rather form a closed-loop system, a new economic paradigm of exponential innovation.

Next, we will expand on each one.

1. Tokenization of Everything: The Internet is Upgrading from an Information Network to a Value Network

When email was first introduced, people were pleasantly surprised to find that text, pictures, and audio could be transmitted to the other side of the world in an instant. But for decades, we have not been able to solve another problem: Can "values" such as real estate, currency, gold, and future income circulate as freely and efficiently as information?

Today, this question finally has a clear answer - Tokenization.

1.1 What is tokenization?

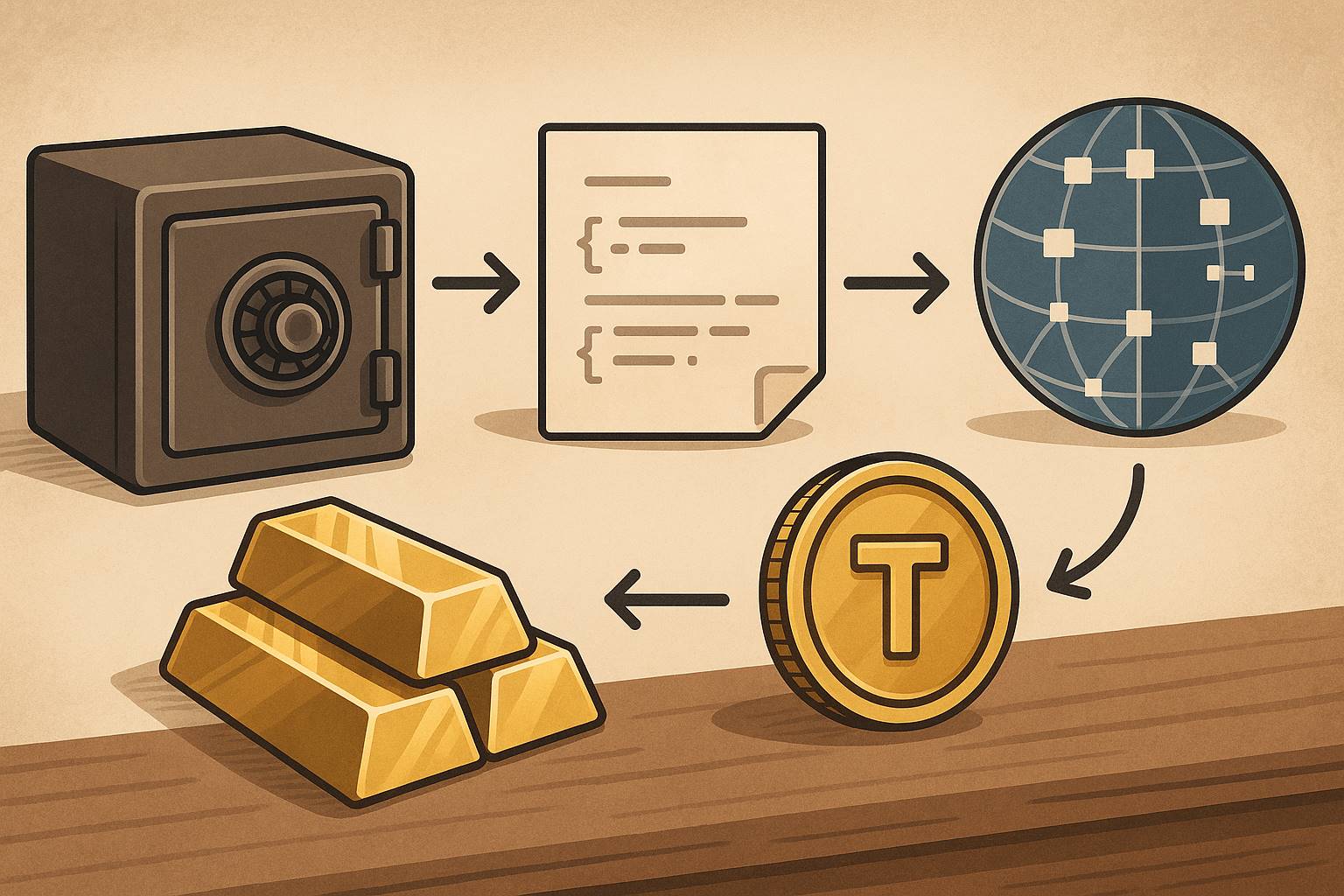

In short, tokenization is the conversion of valuable assets in the real world (such as houses, cars, gold, and dollars) into digital certificates (Tokens) on the blockchain. These certificates can be transmitted instantly around the world like emails.

For example, if you have $1 million, cross-border remittances used to take days or even weeks to go through lengthy banking processes. Now, with the stablecoin USDC issued by Circle, you can tokenize the funds into 1 million USDC and send them to any blockchain address in the world with almost zero delay.

If the other party needs to exchange it into legal currency, they only need to go through compliant financial channels. The assets on the chain and off the chain are thus seamlessly connected, and value begins to flow freely like text.

1.2 How to achieve tokenization?

The whole process can be summarized into three steps:

The first step is asset custody and title confirmation. Taking gold as an example, physical gold needs to be handed over to a compliant custodian for safekeeping; if it is a chain-born asset (such as ETH), it is locked in a smart contract.

The second step is to issue token certificates. After the custody is completed, the system generates tokens according to preset rules (such as 1:1 anchoring). For example, Paxos's PAXG is a gold token issued based on physical gold.

The third step is on-chain circulation and redemption. Once issued, the tokens can be used for global transfers, transactions, and DeFi applications, and holders can also redeem the corresponding assets according to the agreement.

This process greatly simplifies the traditional asset circulation logic, making it as efficient as email.

1.3 Why is tokenization the core of the Web3 era?

To understand the importance of tokenization, we need to quickly review the three stages of the development of the Internet:

Web1 (read-only era): In the 1990s, the Internet was an aggregation of static content, and users were readers of information;

Web2 (read-write era): After 2000, social platforms emerged, and users began to create and interact, but the platforms firmly controlled the data and revenue;

Web3 (Ownership Era): Decentralized networks give users true ownership of digital assets and data, and tokenization is the key tool to realize this "user ownership".

In the Web3 era, the significance of tokenization is reflected in three aspects:

1.3.1 Value can flow freely around the clock

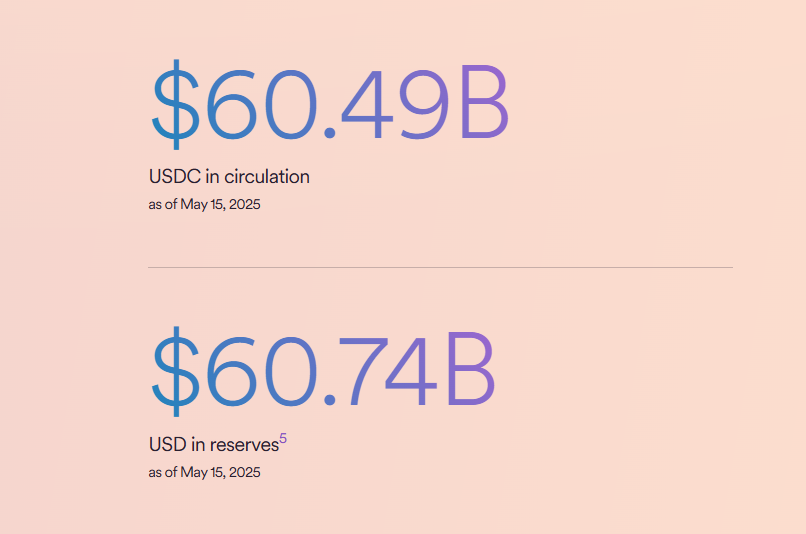

Taking USDC as an example, data released by Circle shows that as of May 15, 2025, its circulating market value has stabilized at around US$60.49 billion, and the on-chain transaction volume has exceeded trillions of dollars. Without being restricted by bank business hours, holidays or regions, funds can be truly "received in seconds", and the efficiency of capital flow has reached an unprecedented new height.

1.3.2 Assets can be split infinitely, and the investment threshold is greatly reduced

The rise of tokenization of real-world assets (RWA) has allowed ordinary people to access financial products that were originally exclusive to high-net-worth individuals. For example, Ondo Finance (see figure below) and BlackRock’s BUIDL Fund are putting stable income assets such as US Treasury bonds and money market funds on the blockchain, with as little as a few dollars to participate.

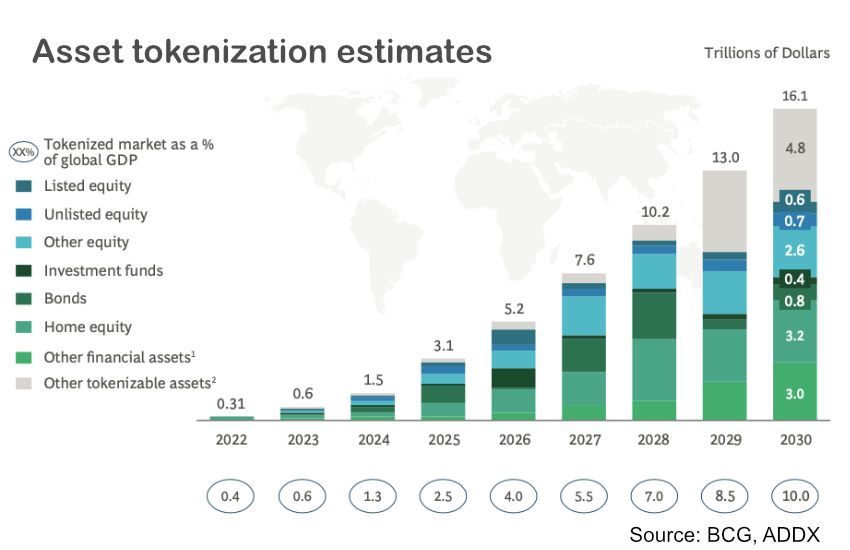

In its 2023 report, the Boston Consulting Group (BCG) predicted that the global illiquid asset tokenization market is expected to reach $16 trillion by 2030 (see figure below).

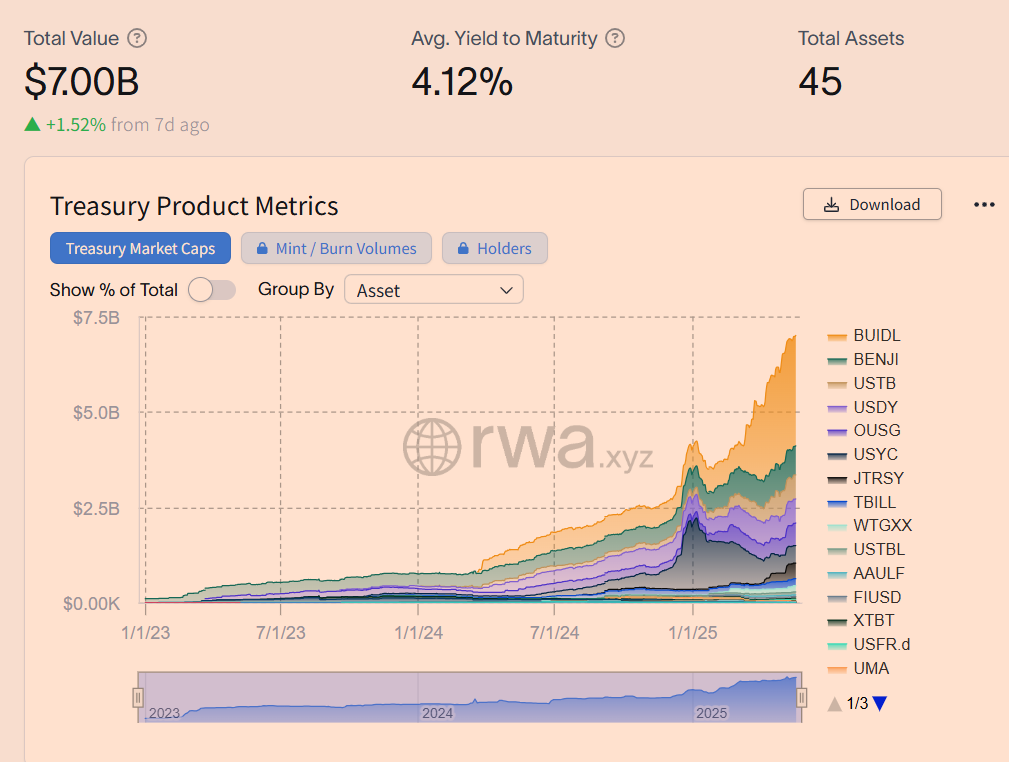

At the beginning of 2025, the on-chain tokenization scale of U.S. Treasury bonds alone exceeded US$7 billion (see figure below) and continues to grow.

1.3.3 Assets are combinable and programmable, freeing up space for innovation

Tokenization not only brings liquidity, but also has high composability and programmability like "Lego blocks". Taking the Ethereum re-staking protocol Ether.fi as an example, users can get eETH by staking ETH, which can be used as collateral to participate in lending, investment and other operations.

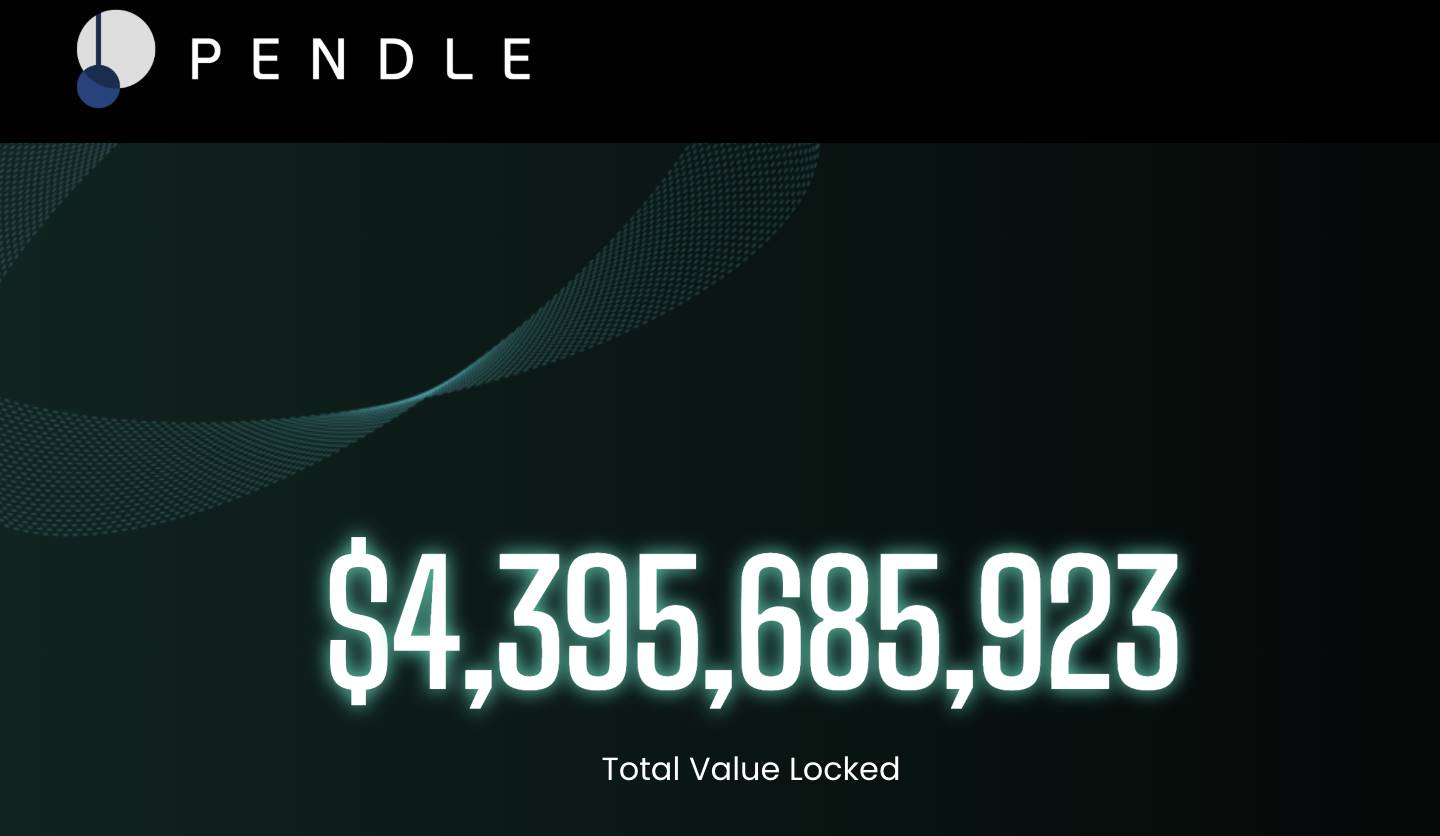

Another example is Pendle Finance, which separates, prices and trades future earnings, and builds complex financial instruments such as on-chain fixed income and interest rate swaps. As of May 2025, DeFiLlama data shows that Pendle and other income token protocols also manage more than $4 billion in assets (see the figure below), demonstrating the powerful financial innovation momentum brought by tokenization.

1.4 Challenges that tokenization still needs to overcome

Despite its promise, tokenization still faces two core challenges:

Asset custody security and compliance transparency

How to ensure that off-chain assets are authentic, secure, and auditable? The current mainstream practices include regular third-party audits, on-chain reserve reports, and compliant escrow account systems, and the regulatory framework is also being gradually established globally.

Risks of Oracles and Price Feeds

If there is an error in the price oracle, it may lead to large-scale liquidation events on the DeFi platform. The current industry response methods include using decentralized oracles (such as Chainlink) and adopting the time-weighted average price mechanism (TWAP), but the overall mechanism is not yet mature and still needs to be continuously optimized.

Through the above analysis, it is not difficult to see that it is tokenization that has promoted the Internet from a simple information carrier to a "value Internet" that can exchange real value. It has lowered the threshold for ordinary people to participate in global high-value investments and has completely changed the logic and speed of financial services.

When value can flow freely, the way the platform attracts users will also change - from traditional charging users to directly sharing value with users. The airdrop economy is the best example of this change.

2. Airdrop Economy: The value transition from “users” to “shareholders”

If tokenization allows value to flow freely like information, then the rise of the airdrop economy has completely rewritten the economic relationship between platforms and users.

We are experiencing an unprecedented business model revolution——

From "users pay" → to "free to use" → to "platform gives money".

In this process, users were included in the core of benefit distribution for the first time, and truly upgraded from "consumers" to "co-builders" and "beneficiaries."

2.1 The essence of the airdrop economy: benefits sinking + user shareholder system

In the past, users paid for services; later, users used them for free and the platform made money through advertising. Now, decentralized platforms have gone a step further: paying users directly.

This may sound like a fantasy, but the reality is better than imagination. The Airdrop Economy is a way to distribute tokens to early users, contributors, developers, and communicators, so that the dividends that were originally exclusively enjoyed by the platform can be transferred to users. These tokens not only represent future income dividends, but also give users governance rights, building a new platform model similar to the "user shareholder system".

To understand the power of the airdrop economy, let’s use the “flywheel model” to see how it works:

Token airdrops to kick-start growth: The platform distributes a certain percentage of tokens to early users or contributors for free.

User benefits bring a sense of belonging: After obtaining tokens, users not only enjoy the dividends of rising coin prices, but also gain identity recognition as "I am a part of the platform."

Feeding back to the platform's activity and liquidity: As users use the platform more and more, the platform's locked value (TVL), trading volume, and reputation will all increase.

The platform value increases and the coin price rises: user participation increases, driving up the overall platform valuation and token prices.

Attract new users to continue to flow in: the positive cycle is triggered again, and token incentives become the engine of growth.

This logic is not a theory, but has been played out many times in reality.

2.2 Airdrop Economy: Becoming a New Paradigm for Web3 Value Discovery and Community Building

In traditional business logic, any form of capital investment, whether it is new user incentives or promotion cashback, must be carefully calculated based on the return on investment (ROI) and customer acquisition cost (CAC). However, the "airdrop economy" that has emerged in the Web3 field is challenging this inherent thinking in a subversive manner. It no longer follows the traditional path of "rewards after contributions", but advocates "value first, trust-driven" - that is, first distributing rights and interests to potential users and contributors, and using this as a lever to leverage their future enthusiasm for participation and ecological co-construction.

2.2.1 Uniswap: "Ownership Revolution" Triggered by Airdrop

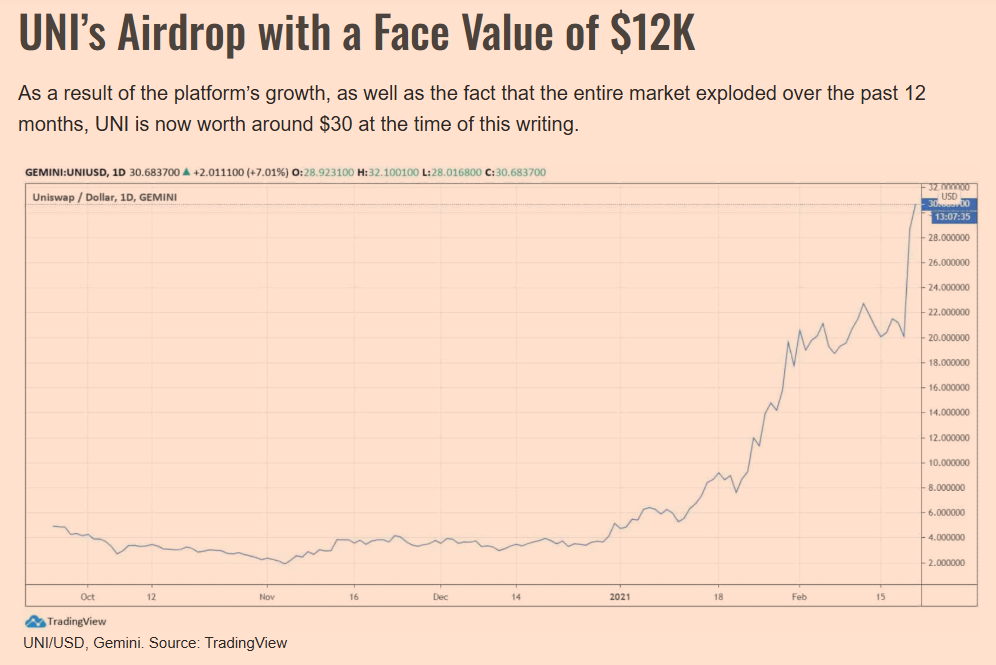

The Uniswap airdrop event in 2020 is a milestone practice of this new paradigm. This is not just a simple token distribution, but also known as the "national stock ownership movement" in the crypto world. Every early user was pleasantly surprised to find that 400 UNI tokens were added to their wallets. This "windfall" was worth about $1,200 at the time, and once exceeded $10,000 in the subsequent bull market.

Uniswap’s innovations are:

For the first time, “airdrops are advertising” was verified on a large scale: it turns out that directly distributing tokens to users is more effective in attracting liquidity (TVL has achieved explosive growth) and enhancing brand influence than traditional advertising.

The governance structure has been reshaped: users are no longer just liquidity providers or simple service users, but have become "shareholders" and direct participants in the formulation of platform rules and future development by holding governance tokens UNI. This marks a new attempt by open source projects to transform community members into a core community of interests.

2.2.2 EigenLayer: Expectation-driven Systematic Market Launch

The success of Uniswap opened the prelude to the airdrop economy, and subsequent practitioners have pushed it to a more sophisticated and strategic level. The re-staking protocol EigenLayer is a typical example. It did not directly issue tokens in the early stage, but by building a clever "airdrop expectation" mechanism, it successfully attracted a large number of users to re-stake the ETH originally locked in the Ethereum mainnet into its protocol.

EigenLayer’s strategy demonstrates the evolution of the airdrop economy:

The strong attraction of expected value: Before the official airdrop of EIGEN tokens, its total locked value (TVL) has exceeded the 10 billion US dollar mark just based on clear expectations and mechanism design.

Systematic market launch experiment: The first round of token issuance in April 2024 not only caused a sensation in the crypto community, but also directly ignited related tracks such as "modular security" and "active verification service" (AVS). This is far beyond the scope of simple feedback, and is more like a grand market experiment that uses future rights and interests to anchor current participation and ecological construction.

These large-scale, inclusive airdrops are not a game for a small circle of elites, but are intended to conduct a broad "consensus cold start". They cover a variety of ecological roles from ordinary users to developers to node operators, injecting unprecedented vitality and participation into the entire network.

2.2.3 Airdrop economy has become the core engine of Web3 narrative

From Uniswap’s pioneering attempts to EigenLayer’s expectation management innovations, we can clearly see a trend: airdrops are evolving from sporadic market behaviors to a core, systematic new paradigm in the Web3 field.

It is profoundly rewriting three core business propositions:

Where do users come from? — From “purchasing users” who rely on advertising to “co-building partners” who attract value.

How is the community formed? — From a loose aggregation of interests to a "distributed company" based on common interests and ownership.

Why does the platform grow? — Transformed from a one-way service output to a positive flywheel driven by the token economy and multi-party participation.

The essence of the airdrop economy is far more than just “issuing coins”. It is a new organizational and incentive philosophy that regards the community as the core asset, users as the starting engine, and tokens as the economic medium that connects everything. This perfectly interprets the classic vision of Web3: “No longer rely on advertising to attract users, but use value itself to attract value.”

2.3 The far-reaching impact of the airdrop economy

The emergence of the airdrop economy has reconstructed the most fundamental relationship logic between the platform and users, and also opened a new door to win-win results for creators and developers.

2.3.1 Changes in Customer Acquisition Logic

In the traditional Internet, the way platforms acquire customers is almost the same: spending money on advertising, treating users as "targets", treating attention as "commodity resources", refining the flow of advertising, and bidding between Google and Facebook. The value of users has been defined as "targets to be converted" from the beginning.

But in the Web3 world, this model has been completely overturned.

Airdrops are no longer about platforms paying intermediaries to acquire users, but about directly converting the money that should have been given to advertising giants into tokens and distributing them to users who actually use the product, are willing to share, and participate in the construction. This is a trust-based reverse incentive mechanism. The platform is no longer "looking for people to place advertisements" but "inviting users to become shareholders."

2.3.2 Users become shareholders

This change not only reverses the logic of customer acquisition, but also fundamentally changes the identity of users. In the past, you were just a "tenant" of the platform, leaving after use and being replaced at any time.

Now, you start to participate as a "co-governance shareholder". You are not only a user, but also a contributor, promoter, and even a rule maker and decision maker. Holding platform tokens is like holding shares in a company. It inspires a deeper level of participation motivation and sense of belonging.

2.3.3 Lower-class workers become co-builders

A more profound transformation is happening to creators and developers.

In the Web2 era, platforms control distribution channels and traffic entrances. Creators depend on them for survival, but are often exploited; while they help the platforms grow, they watch them go public to make money.

In Web3, more and more protocols have reserved some tokens in the early stages to incentivize the "bottom-level workers" of the ecosystem: content creators, independent developers, and operators of running nodes. They are not outsourced employees, but true "co-builders" - exchanging shares for contributions and dividends according to the agreement. The platform is no longer a wall that can only be looked up to, but a bridge that can be built together and the results shared.

This structural change not only improves the business model, but also reshapes the basic logic of value distribution. Its profound meaning is that the platform is no longer the center, but the community is; users are no longer the goal, but partners; and all real growth has its own owner from now on.

2.4 Concerns about the airdrop economy: Beware of bubbles and abuse

Of course, this model also has hidden dangers:

Sybil attack: Some people maliciously register multiple accounts to obtain airdrop profits and disrupt fairness.

Bubble formation: Excessive issuance of tokens and airdrops without actual business support can easily lead to short-term speculation and long-term lack of trust.

Compliance gray area: Some countries have regarded some airdrops as securities issuance, and related projects face legal pressure.

These problems remind us that airdrops are not a panacea, but require a carefully designed long-term incentive mechanism.

However, establishing an unprecedented win-win relationship with users by "sharing money" instead of "charging" is a huge progress in any case.

Furthermore, when users get the tokens, they don’t just “sell” or “save for appreciation” - many people will be attracted to start their own projects. More and more people will find that because of decentralization, innovation and entrepreneurship are no longer so out of reach.

3. Open source innovation: From idea to product, only a few lines of configuration are needed

If tokenization has opened up the underlying network for value circulation, and the airdrop economy has reshaped the value distribution model between platforms and users, then what really makes the speed of innovation explode exponentially is the most powerful "engine" of this era - open source innovation.

This is an unprecedented paradigm shift: you don’t need venture capital, a network of connections, or even an office or server. With just a few open source modules, a clear incentive mechanism, and an Internet-connected computer, you can ignite the future of an ecosystem.

But the reason why it came into being still stems from the word "decentralization".

3.0 Open source is a necessity for decentralization

In a system without central review and absolutely trusted intermediaries, if any code is not open source, it means that no one can truly verify its security and credibility - in other words, no one dares to use it.

Decentralization forces the code to be open source, and once it is open source, it is equivalent to setting up a huge "innovation springboard" in front of developers around the world. This is not as simple as lowering the threshold, but directly reconstructing the "productivity of innovation."

Decentralization makes open source a necessity, and open source puts innovation into the flywheel. This path has never been so clear, and has never been so close to every ordinary person.

3.1 How does this mechanism work?

What does traditional entrepreneurship look like? You have a good idea, but first you need to build a team, attract investment, set up the backend, build a server, accept payments, register a company, buy a trademark, and go to the market. After a few months, the "preparation work" alone consumes most of your energy.

The Web3 world is completely different.

In this era of “Onchain-as-a-Service”, all infrastructure has been packaged by developers into reusable “open source building blocks”: wallet login, on-chain payment, NFT issuance, community governance, voting mechanism, content distribution…

All you have to do is download it from GitHub and change a few lines of configuration to complete the deployment. Especially with the maturity of modular blockchains (such as Celestia) and Layer2 solutions (such as Arbitrum Orbit, OP Stack), developers can customize and launch their own application chains more conveniently.

Many times, you can build a new product as fast as changing a phone case.

This is not only a change in technological structure, but also a revolution in innovation paradigm.

Farcaster is a decentralized social protocol. It is not a single app, but a "social base" on which everyone can freely build applications.

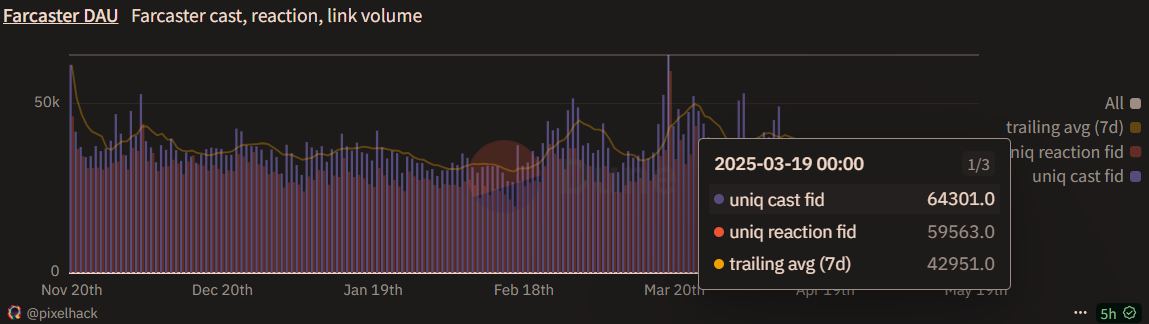

As of early 2025, the Farcaster ecosystem has experienced explosive growth on the Layer2 network Base incubated by Coinbase. With its innovative "Frames" feature (which allows interactive applications to be embedded in information streams), Farcaster's daily active users once exceeded 50,000, and the number of applications in the ecosystem (applets or independent clients in Casts) surged to thousands. Many popular Frames applications can attract tens of thousands of user interactions within a few days, fully demonstrating the speed of innovation brought by the open source protocol combined with the underlying high-performance chain.

3.2 The threshold for innovation has dropped dramatically

For individual developers, the open source innovation mechanism means:

Great cost reduction: basic modules are all open source and deployed on the chain, so startups no longer need a large number of servers, operation and maintenance, and centralized payment.

Speed up: From the idea to the launch, the time has been reduced from "months" to "hours".

The reward mechanism is clear: developers do not rely on "waiting for acquisition", but rely on protocol distribution of tokens, community incentives, and even on-chain dividends to make money while doing it.

According to an influential analysis by crypto investment firm Variant Fund (whose viewpoints have been confirmed in 2024-2025): The average startup cost of Web3 developers has been reduced by more than 90%, while the code reuse rate has increased by nearly 80%. This means:

Creativity is the core asset, while capital and connections are being marginalized.

3.3 Potential risks: fast speed ≠ no risk

Of course, the greater the advantages of open source flywheels, the higher the potential risks:

Long dependency chain: The open source module you use may depend on another module. If one of the components is attacked or shut down, the entire product chain may be affected.

Legal gray area: Not all open source code is “free for you to use.” Different open source protocols (such as MIT, GPL, Apache) have different restrictions on commercial behavior, and unauthorized use may face the risk of infringement.

Security issues: Code reuse also means vulnerability reuse. Once an unaudited contract goes online, it may become a cash machine for hackers. (In 2024, there were many cases of large amounts of funds being stolen due to reentry attacks or oracle manipulation, which once again sounded the alarm.)

Therefore, even in the "flywheel era", basic auditing, testing, and legal compliance are still indispensable.

Having written this, we can easily find that:

In Web2, you need to build an organization to innovate; in Web3, you only need an idea and then hand it over to the community to realize it together.

Decentralization makes "creativity" itself have monetary value, and makes it possible for all wild ideas to be quickly implemented.

This is also directly connected to the previous two flywheels: the new applications you create will bring new assets, new users, and new value, thereby generating new tokens, launching new airdrops, and attracting new contributors... In the end, you yourself become part of the flywheel.

This is the new paradigm of Web3 innovation.

4. What is the logical closed loop of the decentralized business model?

You may have already vaguely felt that tokenization, airdrop economy, and open source innovation flywheel are not three unrelated trends. In fact, there is a very strong logical closed loop between them.

This is not some kind of coincidence, but a completely new way of organizing the economy.

4.1 How is positive feedback formed?

The original essence of the Internet is the free flow of information. The essence of Web3 is to allow value to flow like information.

Step 1: Tokenization, so that everything can be “priced” and circulated freely

Tokenization gives value a specific "format" and "address" on the chain. Any asset can be split, transmitted, and combined. From physical to abstract, from local to global, everything can be put on the chain.

You can use USDC for cross-border payments, use stETH to participate in lending, use BlackRock's BUIDL to invest in tokenized U.S. Treasuries, and even tokenize "non-mainstream assets" such as attention, storage space, bandwidth, and re-pledged security (such as EigenLayer's AVS) and convert them into actual returns.

Everything starts with “on-chain pricing”.

Step 2: Airdrop economy, distributing value directly to ordinary people

With tokens, there naturally arises the question of “value attribution”.

In the traditional Internet, users create value and platforms capture value. You work hard to watch videos, like comments, and attract people to register, but in the end, it is the platforms and capital that make the big money.

The airdrop mechanism of Web3 completely changes the path of value distribution: instead of placing advertisements to buy traffic, it directly "gives money" to users in exchange for loyalty.

Projects such as EigenLayer, Starknet, and Wormhole have proven one thing: if you want to attract new users, the most effective way is not to “tell stories” but to “share money”.

Thus, a new entrepreneurial logic was born:

First, build an on-chain application at low cost through open source modules, and then use token airdrops to attract early users and contributors. As popularity increases, TVL increases, and tokens appreciate, market attention and traffic siphoning are generated.

Airdrops are not just benefits, but the igniter that starts this flywheel.

Step 3: Open source innovation flywheel to continuously generate new products

With tokens as the "fuel" and users and funds as the "engine", all that remains is to launch rounds of innovation.

The open source innovation flywheel solves the most painful problem for Web2 entrepreneurs: the resource threshold is too high and the speed is too slow.

Now you don’t need to develop a wallet system, deploy a backend server, or do payment settlement.

Everything is modularized, just waiting for you to "piece together the puzzle".

The lowering of the innovation threshold and the openness of the token incentive mechanism have enabled countless developers around the world to start "starting a business with code". Even one person can start a company, and even an idea can become an application.

As a result, there has been an unprecedented explosion of on-chain innovation.

for example:

For the Frames app on Farcaster, an idea may attract tens of thousands of user interactions within a few days;

On average, new projects are announced or launched every week based on modular blockchains (such as Celestia Tia) or application chains built on OP Stack;

The Restaking ecosystem (such as the AVS project on EigenLayer) has a core protocol that has led to the emergence of dozens of projects and continues to distribute incentives through points and airdrop expectations.

These "projects" will eventually form new assets, accumulate new value, and be further tokenized, starting a new round of growth cycle.

4.2 The ecological flywheel is spinning rapidly

When we string these three together, we see a striking picture:

Tokenization: All values have digital expressions and can flow freely on the chain;

Airdrop economy: users, creators, and developers gain value through incentive mechanisms;

Open source innovation flywheel: New projects continue to emerge, driving the birth of new scenarios, new assets, and new applications...

Then, these new applications will generate new tokenizable value, which in turn will trigger a new round of airdrops, attracting more people to join and form the next wave of innovation.

This structure is not a linear growth, but an exponential explosion. It is not the "rise of a product" but the "self-replication of an ecosystem."

It's like a never-ending accelerating spiral—

A protocol may give birth to a token;

One token can stimulate an ecosystem;

An ecosystem may give birth to a new economic order.

Therefore, the real value of decentralization is not just "data on-chain" or "breaking intermediaries", but for the first time:

Make the creation, distribution and transmission of value extremely efficient;

Allow countless individuals to collaborate without relying on systems or organizations, relying only on consensus and incentive mechanisms;

Allow innovation to replicate and evolve itself at an astonishing speed, forming a "social-level release of productivity."

This is not a technological revolution, but a brand new institutional revolution.

Conclusion: The future is here

When we look back at these three articles, a clear thread gradually emerges:

In the first article, we exposed the fig leaf of "fake decentralization" and saw that no matter how many chains there are or how flashy the codes are, if the lifeblood is still handed over to centralized cloud services and traditional platforms, the so-called "freedom" is just a layer of wrapping paper and an illusion.

In the second article, we disassembled the underlying logic of true "decentralization": distributed ledgers, incentive mechanisms and governance systems, which together build a new order that is more stable, more trustworthy and more resistant to censorship.

Today, we finally answered the most fundamental question:

"What does this have to do with you?"

The answer is: It matters a lot.

Decentralization is not some kind of technological ideal far from reality, but a power reconstruction happening around you and me. It will directly affect:

Can you use a smaller capital to participate in the appreciation dividend of global assets?

Can you skip the intermediary and turn yourself into a shareholder of the platform instead of a "tool man"?

Can you use an idea, piece together a few modules, and let it run online globally without the need for financing, running around for connections, or waiting for approvals?

In the era of Web2, we are "users" - our data is collected, our attention is exploited, and we passively accept terms.

In the era of Web3, we can finally become "co-builders", "partners" and "governors" - true stakeholders.

This is the first time in history that ordinary people have the ability to participate in "institutional design" with a very low threshold.

Not through the ballot box, not through petitions, but through "wallet + signature", by holding a certain token, participating in a DAO, or just using a certain protocol in the early stages, you may become a co-builder of a new round of systems and order.

Ultimately, the decentralized revolution is not just a change in technical architecture, but a change in how value is generated, how it is distributed, and who decides it.

Although the passage of the US Stablecoin Act has brought new variables to decentralization, the true meaning of decentralization lies in:

For the first time, the power, interests and future that were originally only controlled by large companies and big capital fell into the hands of ordinary people.

This is a reconstruction of production relations.

This is a sinking of power from the grassroots level.

This is a paradigm shift that completely subverts the "platform-user" relationship.

We are sitting in the front row of this change.

You don’t need to be a programmer, nor do you need to be a miner. You just need to realize that:

This era is different.

The next round of dividends will not be in the hands of those "platforms" that have already occupied the territory, but in the hands of you who are willing to participate, willing to learn, and willing to exchange actions for equity.

Who will the future belong to? Not to the giants, not to those who know it early, but to those who dare to "act after knowing it early".

The decentralization trilogy ends here.

But your own journey to decentralization may have just begun.

Where should you start?

If you are a newcomer, you might as well start with the collection of zero-based tutorials I have compiled to quickly master the necessary skills. At the same time, you can participate in several zero-cost airdrop projects to build your initial assets and knowledge accumulation at the lowest cost.

If you are already an old player of Web3, welcome to join the Alpha Planet we are building. Here will gather a group of explorers at the forefront. Together we will discover the real dividends of decentralization and look for the next Alpha project with explosive potential.

This time, don't be a bystander.

Are you ready?