1/ @Pendle_fi remains one our highest conviction projects:

- 90% market share in its vertical

- A primary beneficiary of YBA and stablecoin growth

- Strong secondary demand for PTs on money markets

- Boros, to dramatically expand its addressable market for yield trading 🧵

The Spartan Group

@TheSpartanGroup

05-21

Pendle has emerged as the premier infrastructure for yield-bearing stablecoins—capturing 30 %+ market share, 60× TVL growth in 18 months, & onboarding 18 new issuers @Pendle_fi

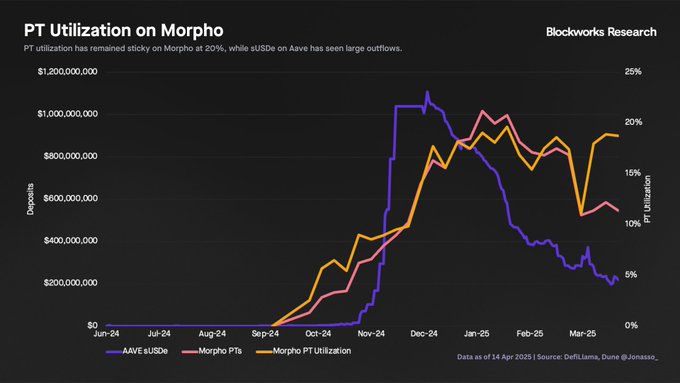

4/ Beyond YT speculation and airdrop farming on the AMM, Pendle's PTs, functioning as zero-coupon bonds with fixed yields to maturity, exhibit strong and growing demand for utilization as collateral on money markets.

Blockworks Research

@blockworksres

04-21

2/ Pendle's PTs can make for highly attractive collaterals on money markets.

Particularly for carry trades, the fixed yield offered by PTs can reduce the variance and uncertainty in the realized yield on the long leg of these strategies.

Historically, @MorphoLabs has won the

5/ Since listing USDe and sUSDe PTs on @aave's main market just 1 month ago, PT deposits have eclipsed $1.05B.

Between Aave, Morpho, Euler, and Silo, over $1.7B in PTs are utilized as collateral on money markets, representing 37% utilization of Pendle's TVL.

Blockworks Research

@blockworksres

05-07

1/ Last week, @aave listed @pendle's Principal Tokens (PTs) as eligible collateral on the main market, beginning with eUSDe and sUSDe PTs.

Demand for these new markets is hot 🔥

Let's check in on the results 🧵 x.com/blockworksres/…

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content