The cryptocurrency market gains a new focus as Binance Alpha announces the Huma Finance airdrop on 5/26, sparking project interest. Simultaneously, HumaFoundation has officially announced its native token HUMA's airdrop plan and revealed specific details of its token economic model.

Airdrop Plan in Two Stages

According to the official information from HumaFoundation, the HUMA token airdrop plan will be conducted in two rounds. The first airdrop claiming window will open after the Token Generation Event (TGE) and continue for one month, with an initial 5% of total tokens distributed, including the following allocation methods:

- 65% allocated to LPs, distributed proportionally based onuser Feathers points, which will befully unlocked after TGE, except for some institutions with separate unlock schedules.

- 25% enters theecosystem, rewarding PayFi ecosystem partners who bring genuine revenue on-chain and contribute to Huma's transaction volume and income. The ecosystem airdrop follows a 6-month unlock schedule.

- 10% used forcommunity participation, encouraging growth and engagement, fully unlocked at TGE.

The qualification snapshot for the second airdrop is expected to be taken approximately three months after TGE, distributing 2.1% of the total token supply. Therefore, TGE is not only a key node for determining the start of the first airdrop claiming period but also roughly defines the timeline for the second airdrop snapshot qualification. For early ecosystem participants, this airdrop plan is undoubtedly one of the primary ways to obtain HUMA tokens, though the exact timing remains undisclosed.

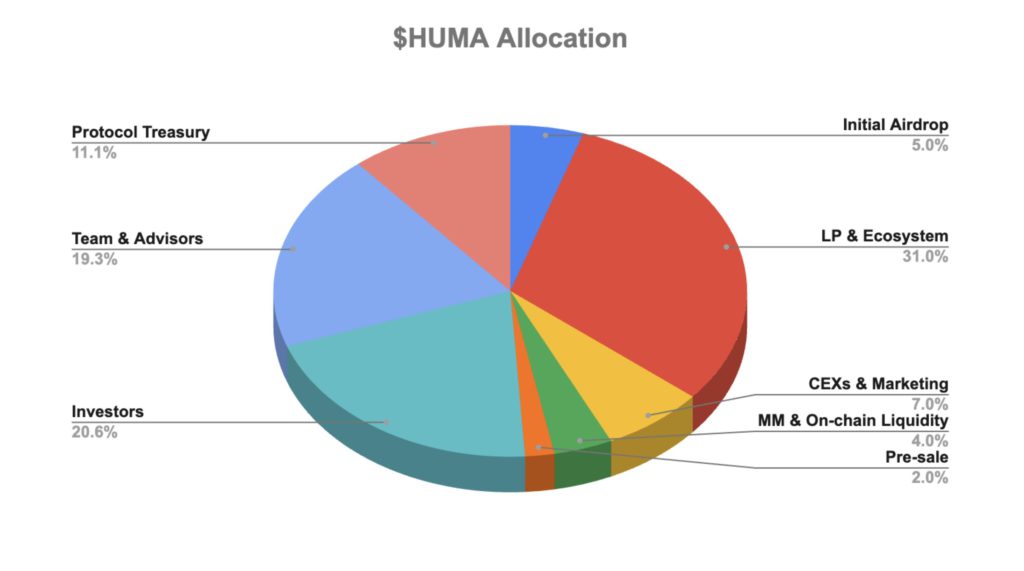

HUMA Token Economic Model

The total supply of HUMA tokens is capped at 10 billion. In the initial stage, 17.33% of tokens will enter market circulation. This initial circulating token composition covers multiple aspects: initial airdrops account for 5% of total supply, 7% is allocated for exchange listings and marketing, 4% supports market-making and on-chain liquidity, 1% is held by the protocol treasury, and 0.33% is for token swaps with strategic partners. Compared to some traditional token economic models, HumaFoundation seems to focus more on accelerating early token distribution and market activity through airdrops and marketing, potentially aiming to quickly establish a broad community base and enhance token visibility.

- Initial Airdrop (5%)

- Liquidity Providers (LP) and Ecosystem Incentives (31%)

- CEX Listing and Marketing (7%)

- Market Makers and On-chain Liquidity (4%)

- Pre-sale (2%)

- Investors (20.6%)

- Team and Advisors (19.3%)

- Protocol Treasury (11.1%)

- Initial Airdrop (5%)

- CEX and Marketing (7%)

- MM and On-chain Liquidity (4%)

- Protocol Treasury (1%)

- Token Swap with Strategic Partners (0.33%)

Initial Circulating Supply:

The initial circulating supply is 17.33%. The first four entries in the table have been explained in the previous section. The last entry is reserved for potential token swaps with strategic partners.

- Initial Airdrop (5%)

- CEX and Marketing (7%)

- MM and On-chain Liquidity (4%)

- Protocol Treasury (1%)

- Token Swap with Strategic Partners (0.33%)

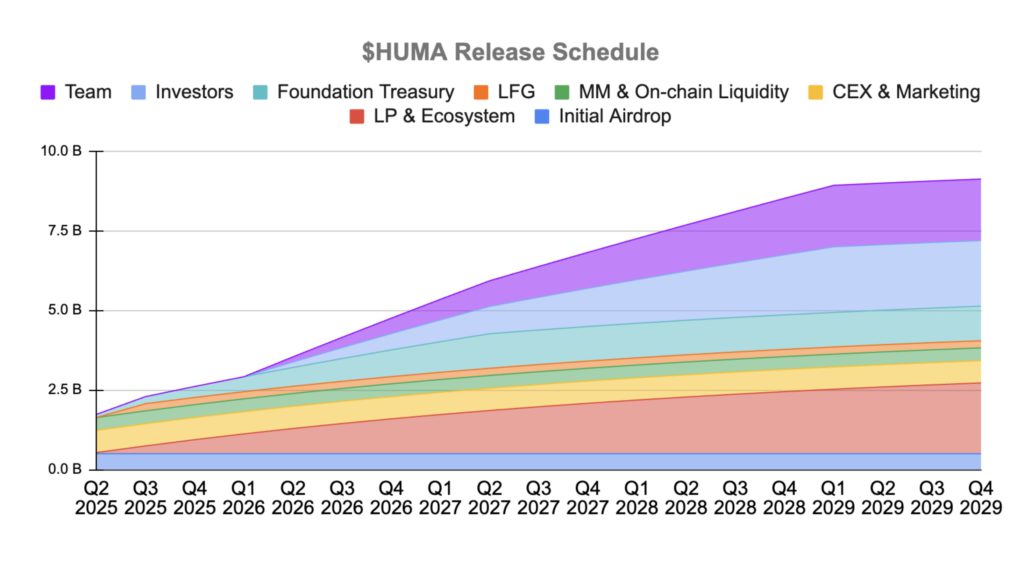

Token Unlock Schedule

According to the official announcement, the HUMA token vesting schedule aims to support long-term commitment and ecosystem growth. The team, advisors, and investors have a 12-month lock-up period, followed by a linear unlock over three years.

Conclusion

From the unlock chart, the largest initial token holders are centralized exchanges and market marketing. The project team initially has limited tokens in hand, so it is expected that the post-TGE market will be primarily driven by CEX market inventory. However, Binance Alpha has not yet announced the actual number of tokens distributed to users, so the number of market maker tokens cannot be estimated. Users are reminded that projects at their Token Generation Event (TGE) carry extremely high risks, and caution is advised to avoid potential financial losses.