Author: Fairy, ChainCatcher

Editor: TB, ChainCatcher

Friendly Reminder: The "Seven Deadly Sins of the Bitcoin Ecosystem" listed in this article are purely satirical, without malicious intent to discredit or diminish Bitcoin's faith attributes. We respect Satoshi Nakamoto and revere time. If any viewpoints sound harsh, we hope ecosystem builders will be understanding.

Pizza Day marks its 14th anniversary, and Bitcoin has today broken through $110,000, reaching a new high. While Bitcoin continues to rise, the Bitcoin ecosystem seems to be heading downward.

Bitcoin has grown from a white paper to a new global asset anchor, and the narrative of the Bitcoin ecosystem has transformed from a simple technical story to a complex landscape intertwining humanity, markets, power, and faith. Yet beneath all the noise, the real issues are rarely addressed.

Pizza Day is worth commemorating and reflecting upon. At this juncture, let's examine the "Seven Deadly Sins" hidden behind the Bitcoin ecosystem with a more clear-headed perspective.

Idealistic Light Shines into Realistic Difficulties

Bitcoin's market value returned to the trillion-dollar mark in early 2024, nearly a year and a half ago, but its ecosystem's activity is severely disproportionate to its asset volume.

As of now, only 13 projects in the 2025 Bitcoin ecosystem have completed financing, compared to 72 in the same period last year and 126 for the entire year. Financing numbers have nearly halved, with capital enthusiasm rapidly receding.

Image source: RootData

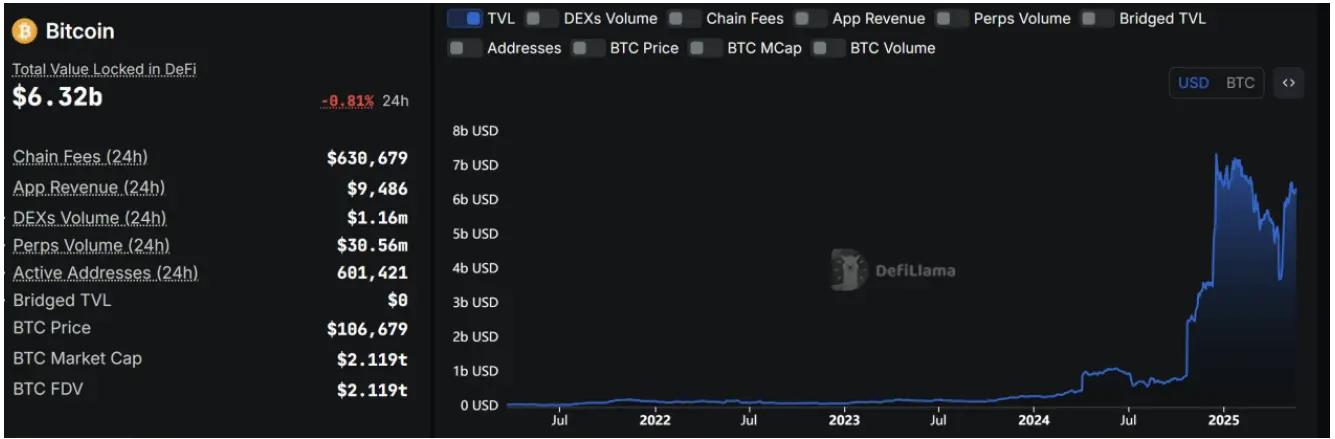

Looking at on-chain data, defillama shows the current Total Value Locked (TVL) in the Bitcoin ecosystem is only $6.3 billion, one-tenth of the Ethereum ecosystem's ($62.3 billion). Among this, Babylon contributes $5 billion, accounting for over 80%, indicating an extremely concentrated ecosystem structure.

Comparing TVL with token market value reveals an even more striking issue: BTC's TVL/market value ratio is merely 0.2%, far below the average of mainstream public chains. Ethereum, Solana, TRON, and others generally maintain over 10%, with significantly higher capital utilization efficiency.

Image source: defillama

Moreover, looking at the Bitcoin ecosystem's star projects like L2 solutions Stacks and Merlin Chain, staking tracks Solv Protocol, Babylon, BounceBit, and inscription assets ORDI and SATS, most have continued to perform poorly in price.

While Bitcoin is the "gold standard" of the crypto market, its ecosystem is almost an empty tower. Here are the "Seven Deadly Sins" we've compiled.

(Note: The translation continues in the same manner for the rest of the text, maintaining the specified translations for specific terms.)The Fifth Sin: The Sin of Misaligned Attention

Recent upgrade discussions in the Bitcoin community have fallen into a "high-heat, low-efficiency" cycle: truly technically profound and developmentally potential proposals are rarely proposed, while trivial issues are repeatedly debated.

Take BIP177 as an example, which sparked prolonged disputes in the community despite being merely about unit display adjustments; while proposals that could genuinely enhance protocol capabilities, such as the CTV + CSFS combination for implementing asynchronous and optional payment paths, and BIP360 addressing future security challenges (quantum attack resistance), receive minimal attention.

The originally inefficient BIP system in Bitcoin's governance mechanism becomes increasingly rigid under this attention misalignment. Core upgrades that genuinely require extensive testing, evaluation, and collaborative promotion quietly fade away amid discourse struggles. Community member @blapta stated: "Hope Bitcoin community discussions return to normal discussions soon, or development will grow old."

The Sixth Sin: The Sin of Narrative Closure

In the fast-paced crypto industry, Bitcoin's ecosystem narrative appears particularly monotonous. The "digital gold" narrative has played a role in establishing stable consensus and value transmission, but should not evolve into a framework that restricts innovation and imagination.

In contrast, other blockchain ecosystems continuously inspire new interests and narratives around reStaking, meme, DePIN, AI, driving sustained community vitality and capital attention.

Although Taproot Assets and Ordinals briefly sparked imagination space, the lack of continuous narrative promotion and systematic support ultimately failed to form a stable growth curve.

The Seventh Sin: The Sin of Investment Deficiency

In a capital-driven market system, "investability" determines the ultimate capital flow. Speculation represents the most authentic and honest liquidity logic. Bitcoin's ecosystem's shortcomings are particularly evident: complex deployment, weak liquidity, primitive trading mechanisms make market makers, arbitrageurs, and hot money difficult to enter and exit efficiently.

Data also reveals this: except for the brief capital attraction in 2024 due to Ordinals and Runes fever, Bitcoin ecosystem's financing performance in other years has been unremarkable. Notably, large financing projects exceeding millions of dollars are rare, directly reflecting mainstream investment institutions' doubts and reservations about BTC ecosystem's "investability".

Facing Problems, We Can Go Further

We look back to our original intention and confront reality. Today's Bitcoin ecosystem is both a mid-point review of a technological experiment and a mirror reflecting culture and order. The "Seven Sins" description is just a jest; the true starting point is hoping the ecosystem can rejuvenate and find a direction for continuous growth.