Written by: Daii

Compiled by: Blockchain Plain Talk

Yesterday, Bitcoin's price broke through the $110,000 mark, igniting market enthusiasm, with social media filled with cheers of "the bull market is back". However, for investors who hesitated at $76,000 and missed the entry opportunity, this moment feels more like an inner self-interrogation: Am I too late? Should I have decisively bought during the pullback? Will there be another chance in the future?

This leads to the core of our discussion: Is there truly a "value investment" perspective in an asset like Bitcoin, known for its extreme volatility? Can this strategy, seemingly contradictory to its "high-risk, high-volatility" characteristics, capture "asymmetric" opportunities in this turbulent game?

[The rest of the translation follows the same professional and accurate approach, maintaining the original meaning and tone while translating into fluent English.]This emotional amplification cycle leads Bitcoin to often enter a state of "price severely deviating from its real value". This is precisely the fertile ground for value investors seeking asymmetric opportunities.

In one sentence: In the short term, the market is a voting machine; in the long term, it is a weighing machine. Bitcoin's asymmetric opportunity appears before the weighing machine starts.

Mechanism Two: Extreme Price Fluctuations, but Extremely Low Probability of Death

If Bitcoin were truly an asset that could "go to zero" as media often sensationalize, it would indeed have no investment value. But in fact, it has survived every crisis—and become stronger.

In 2011, after falling to $2, the Bitcoin network continued to operate normally.

In 2014, after Mt.Gox's collapse, new exchanges quickly filled the gap, and the number of users continued to grow.

In 2022, after FTX's bankruptcy, the Bitcoin blockchain continued to generate a new block every 10 minutes without interruption.

Bitcoin's underlying infrastructure has almost no history of downtime. Its system resilience far exceeds most people's understanding.

In other words, even if the price is halved again and again, as long as Bitcoin's technical foundation and network effects remain, there is no real risk of going to zero. We have an attractive structure: limited short-term downside risk and open long-term upside potential.

This is asymmetry.

Mechanism Three: Intrinsic Value Exists but is Ignored, Leading to an "Oversold" State

Many believe Bitcoin has no intrinsic value, and therefore its price can drop indefinitely. This view overlooks several key facts:

Bitcoin has algorithmic scarcity (hard cap of 21 million coins, enforced by halving mechanism);

It is protected by the world's most powerful Proof of Work (PoW) network, with quantifiable production costs;

It benefits from strong network effects: over 50 million addresses have a non-zero balance, with transaction volume and computing power repeatedly hitting new highs;

It has been recognized by mainstream institutions and even sovereign nations as a "reserve asset" (ETFs, legal tender status, corporate balance sheets).

This raises the most controversial but crucial question: Does Bitcoin have intrinsic value? If so, how do we define, model, and measure it?

Will Bitcoin Go to Zero?

It's possible—but with an extremely low probability. One website has recorded 430 times Bitcoin was declared "dead" by the media.

However, below this death declaration count, there's a small note: If you had bought $100 of Bitcoin each time it was declared dead, your holdings would be worth over $96.8 million today.

You need to understand: Bitcoin's underlying system has been running stably for over a decade, with almost no downtime. Whether it was Mt.Gox's collapse, Luna's failure, or the FTX scandal, its blockchain has always generated a new block every 10 minutes. This technical resilience provides a strong survival baseline.

Now, you should see that Bitcoin is not "baseless speculation". On the contrary, its asymmetric potential stands out precisely because its long-term value logic exists—yet is often severely underestimated by market sentiment.

This raises the next fundamental question: Can a Bitcoin with no cash flow, no board of directors, no factory, and no dividends really be an object of value investing?

Can Bitcoin Be Value Invested?

Bitcoin is notorious for its violent price fluctuations. People swing between extreme greed and fear. So how can such an asset be suitable for "value investing"?

On one side are Benjamin Graham and Warren Buffett's classic value investing principles—"margin of safety" and "discounted cash flow". On the other side is Bitcoin—a digital commodity with no board of directors, no dividends, no earnings, and not even a legal entity. In the traditional value investing framework, Bitcoin seems to have no foothold.

The real question is: How do you define value?

If we go beyond traditional financial statements and dividends, returning to the core essence of value investing—buying at a price lower than intrinsic value and holding until value is revealed—then Bitcoin not only might be suitable for value investing but could even more purely embody the concept of "value" than many stocks.

Benjamin Graham, the father of value investing, once said: "The essence of investment is not what you buy, but whether you buy it at a price lower than its value."

In other words, value investing is not limited to stocks, companies, or traditional assets. As long as something has intrinsic value, and its market price is temporarily lower than that value, it can be a valid target for value investing.

But this raises an even more critical question: If we cannot use traditional metrics like P/E or P/B to estimate Bitcoin's value, where does its intrinsic value come from?

Although Bitcoin lacks financial statements like a company, it is far from valueless. It has a completely analyzable, modelable, and quantifiable value system. While these "value signals" are not compiled into quarterly reports like stocks, they are equally real—and possibly even more consistent.

We will explore Bitcoin's intrinsic value from two key dimensions: supply and demand.

Supply Side: Scarcity and Programmatic Deflationary Model (Stock-to-Flow Ratio)

The core of Bitcoin's value proposition lies in its verifiable scarcity.

Fixed total supply: 21 million, hard-coded and unchangeable.

Halving every four years: Each halving reduces the annual issuance rate by 50%. The last Bitcoin is expected to be mined around 2140.

After the 2024 halving, Bitcoin's annual inflation rate will drop below 1%, making it scarcer than gold.

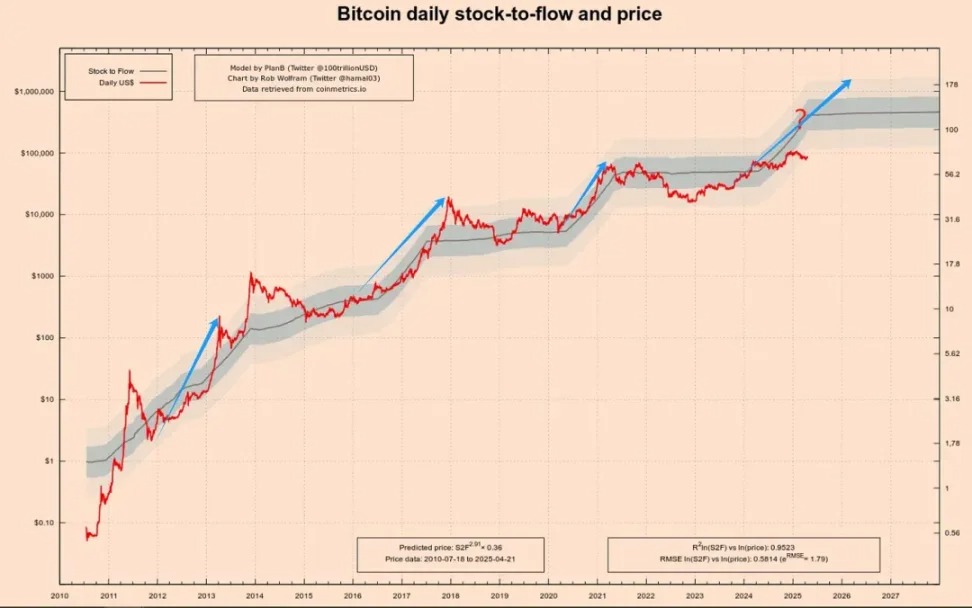

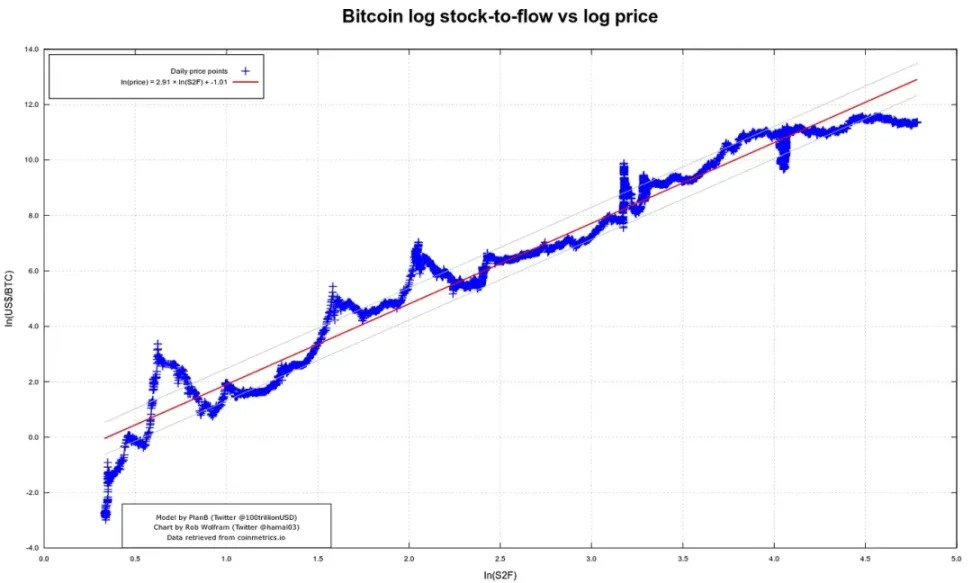

The Stock-to-Flow (S2F) model, proposed by analyst PlanB, is widely recognized for its ability to predict Bitcoin price trends during halving cycles. The model is based on the ratio of an asset's existing stock to its annual production.

Stock: Total existing assets.

Flow: Newly produced amount per year.

S2F = Stock / Flow

A higher S2F ratio indicates the asset is relatively scarce, theoretically more valuable. For example, gold's S2F ratio is high (about 60), supporting its role as a store of value. Bitcoin's S2F ratio steadily increases with each halving:

2012 halving: Price rose from about $12 to over $1,000 within a year.

2016 halving: Price climbed from about $600 to nearly $20,000 within 18 months.

2020 halving: Price rose from about $8,000 to $69,000 within 18 months.

Will the fourth halving in 2024 continue this trend? My view is: Yes, but the increase may be more moderate.

Note: The vertical axis on the left uses a logarithmic scale to help visualize early trends. Jumps from 1 to 10 occupy the same space as jumps from 10 to 100, making exponential growth easier to read.

The model is inspired by valuation logic for precious metals like gold and silver. Its logic is:

The higher the S2F ratio, the lower the asset's inflation, theoretically able to hold more value.

In May 2020, after the third halving, Bitcoin's S2F ratio rose to about 56, almost on par with gold. The S2F model's key words are scarcity and deflation, algorithmically ensuring Bitcoin's supply decreases yearly, thereby driving up its long-term value.

Of course, no model is perfect. The S2F model has a key weakness: it only considers supply and completely ignores the demand side. Before 2020, when Bitcoin's adoption was limited, this might have been effective. But since with institutional capital, global narratives, and regulatory dynamics entering the market - has become the driving force.

Therefore, to form a comprehensive valuation framework,, we must turn to the demand side.

Demand Side: Network Effects and Metcalfe's Law

If S2F locks the "supply valve", network effects determine how high the "water level" can rise. The most intuitive indicator here is the expansion of on-chain activity and user base.

By the end of 2024, Bitcoin has over 50 million non-zero balance addresses.

In February 2025, daily active addresses rebrebounded to around 910,000, creating a 3-month new high.

According to Metcalfe's Law - the network's value is roughly proportional to the square of the number of users (V ≈ k × N²) - we can understand that:

When the number doubles, the theoretical network value might increase four times.

This explains why Bitcoin often shows "leap-like" value growth after major adoption events.

Again, the image of Metcalfe enthusiastically appreciating Bitcoin is an AI-generated fictional portrayal.

Bitcoin - an asset born from code-enforced scarcity, evolving value through networks, and repeatedly reborn in fear - might be the purest expression of asymmetry in our era.

Its price may never be calm. But its logic remains steadfast:

Scarcity is the bottom line

Network is the ceiling

Volatility is opportunity

Time is leverage

You may never perfectly buy the dips. But you can cross cycles again and again - buying misunderstood value at reasonable prices.

Not because you're smarter than others - but because you've learned to think in different dimensions: you believe the best bet is not placed on price charts - but standing on the side of time.

So, remember:

Those who bet in the depths of irrationality are often the most rational. And time - is the most loyal executor of asymmetry.

This game always belongs to those who can read the order behind chaos, the truth behind the crash. Because the world does not reward emotions - the world rewards understanding. And understanding, ultimately - is always proven correct by time.