Following the MCP concept, the Internet Capital Market (ICM) concept from the Web2 domain has also been introduced to Web3. ICM is a decentralized financing method where funds flow directly to developers without the need for venture capital or intermediaries. Developers publish ideas, users participate with tokens, and if the project is popular, the token appreciates; if not, it naturally dies out. ICM breaks down the boundaries between crowdfunding, financing, and speculation, making capital flow more direct and free.

In the ICM narrative, Believe was the first project to run out. As a representative project under the ICM concept, its platform token $LAUNCHCOIN saw a daily increase of over 500%, with its market value once breaking $300 million. On the Believe platform, users can issue tokens by posting, investing in creators' creative ideas. Token creators and early participants can receive more incentives, and Believe has also received support from the Solana Foundation. Meanwhile, after experiencing short-term explosive popularity, the entire ecosystem quickly cooled down, and the project has sparked community doubts and controversies. Let's explore further.

Believe's Daily Transaction Fees Rank First Among New Solana Platforms

On May 23rd, Believe optimized its original token issuance model, and the X account @launchcoin's "post to issue tokens" method will be temporarily suspended. Currently, the platform will adopt an open launch mechanism, allowing developers to submit and publish projects instantly through the official website without official review. At the same time, to prevent "pumping" and projects lacking actual products, the platform will block such developers from obtaining platform fees and conduct preliminary screening based on community feedback, with plans to introduce internal product mandatory mechanisms in the future. The official will also implement a Verified tag for some projects, representing that the project party has communicated with the platform and demonstrated integrity, but this does not constitute endorsement or guarantee.

Believe is one of the new issuance platforms on Solana, but according to Dune data, token issuance on Solana is still concentrated on Pump.fun, with MemeCoin issued by Pump.fun accounting for over 90% of the entire public chain.

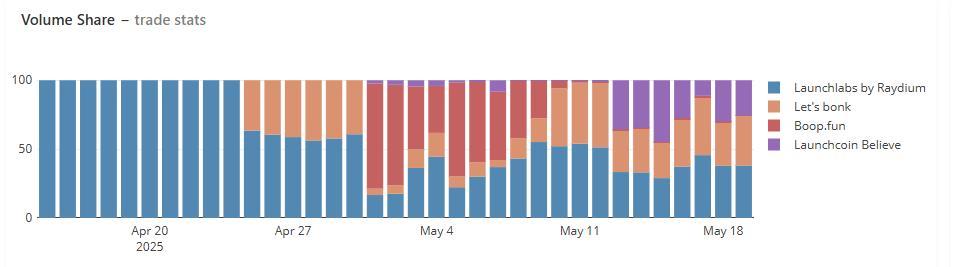

However, some new faces have emerged among Solana's new issuance platforms. Based on market value proportion, Raydium's new launch platform LaunchLabs currently accounts for 38.1%, followed by Let's bonk at 36%, then Believe at 25.8%, and Boop.fun at 1%.

Figure 1 Source: analytics.topledge

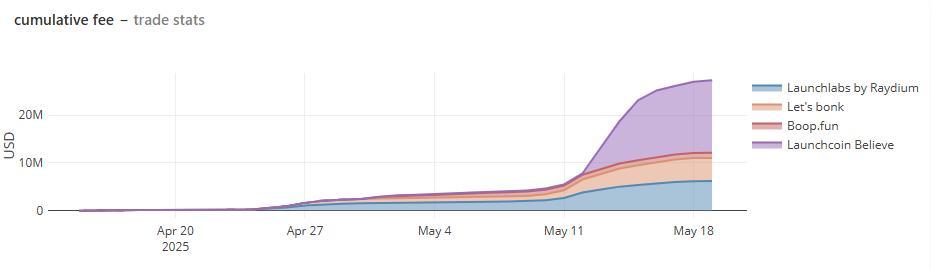

At the same time, in the cumulative transaction fees of new platforms, Believe ranks first, with daily cumulative transaction fees close to $15 million. This is closely related to Believe's transaction fee mechanism and is one of Believe's pain points, which we will elaborate on below.

Figure 2 Source: analytics.topledge

Believe's Three Major Pain Points Trigger Trust Crisis, Lack of Benefit Effect Difficult to Drive Growth Flywheel

On the Believe platform, creators must issue tokens through a Bonding Curve mechanism. This means creators need to create a token and initiate trading through the bonding curve. When the token's market value reaches a certain standard, the token will "graduate" into a deeper liquidity pool. Under these mechanisms, some of Believe's platform pain points are also implied.

1. High Transaction Fees

The Believe platform mandatorily charges 2% fees on all transactions, with 1% allocated to creators, 0.1% rewarding Scouts (early token promoters), and 0.9% going to the platform. This rate is far higher than mainstream launch platforms (about 1%-1.5%), and users need to pay in both buying and selling directions, with an actual burden of up to 4%. More importantly, this model can easily erode user profits during significant token price fluctuations, suppressing the activity of short-term trading behaviors. Many community users question whether the platform uses transaction fees as its primary profit source, rather than truly promoting creator and community win-win.

2. Unclear Creator Token Income

Although the platform claims creators can receive 1% of transactions, many users found their actual income surprisingly low even after on-chain transaction amounts reached hundreds of thousands of dollars. Some creators revealed completing $450,000 in transaction volume but only receiving $50 in income, far below reasonable expectations. Meanwhile, the platform's lack of transparent settlement documents or on-chain queryable contracts further weakens user trust.

3. Lack of Benefit Effect

Many of Believe's token creators come from Web2 and are not familiar with Web3 concepts. Therefore, projects generally have significant disconnects between tokens and products, with some projects having no products at all. Believe is also suspected of insider trading, with many new token snipers, and many projects' buying and token issuance completed in the same second and block, offering no benefit effect for participating retail investors.

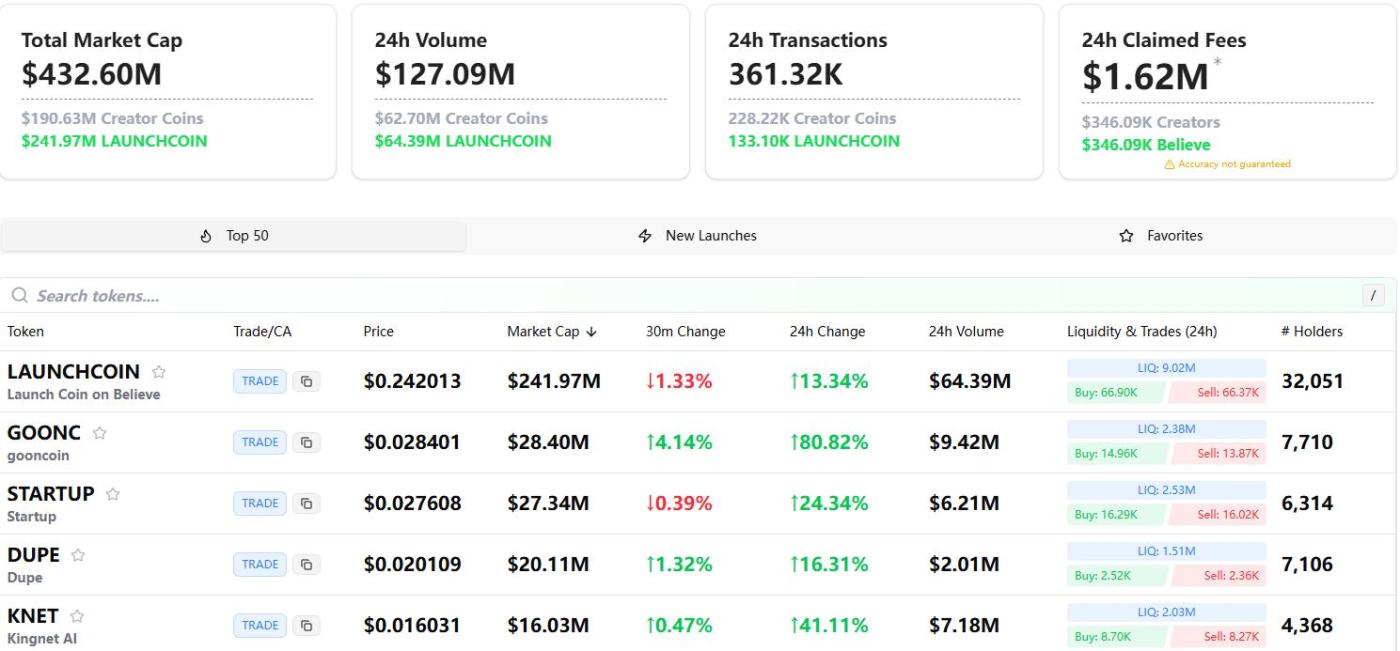

Believe's Ecosystem Looks Bleak, Only Five Projects Exceed $10 Million in Market Value

After the short-term ICM narrative concept, Believe's overall ecosystem heat is gradually declining. According to believescreener data, the platform's total market value is about $433 million, with the platform token $LAUNCHCOIN's market value around $242 million, accounting for 56.2% of the total. Besides this, only five projects in the entire ecosystem exceed $10 million in market value.

Figure 3 Source: believescreener

These circumstances indicate that Believe still faces challenges in landing quality ideas and constructing a sustainable economic model. The current ecosystem more reflects a fragile structure dominated by speculative participation. Without finding a more stable balance between product logic, community incentives, and traffic mechanisms, Believe may struggle to support its long-term vision.

Summary

Believe leads the ICM narrative as an early runner. Currently, Believe has not maintained its market share, and the official responses to existing issues have not solved problems from the root. The optimization of the token issuance mechanism also needs to be tested by the market. However, the thoughts derived from the Believe phenomenon are worth our attention.

Looking at Web2 concepts introduced to Web3, there is still capital and traffic to chase in the initial stage of concept introduction, but in the medium to long term, most are just a wave of heat. Whether it's AI Agent introducing MCP or Launchpad introducing ICM, they struggle to maintain long-term project operations. Perhaps, with deeper reflection, the concepts from the Web2 domain are already very mature. Is introducing concepts to Web3 merely a speculative demand? Or is it only meaningful to introduce mechanisms from Web2 after Web3 has widespread practical applications? At the current stage, investors should objectively view these grafted introductions.

Despite Believe's many problems, it also indirectly reflects the market's real demand for Launchpad innovative mechanisms. From Believe to the previous boop.fun, these cases all show that for Launchpad platforms to develop sustainably, they must return to the core demands of fairness, transparency, and community user interests. Taking Virtuals Protocol as an example, it is precisely through continuous optimization of the user system that it can stand out and move steadily through wave after wave of narratives.