The US President Donald Trump announced a plan to impose a 50% tariff on all imports from the European Union, effective from June 1, 2024. This announcement has caused anxiety in the crypto market, with the previous upward momentum being adjusted.

The proposed tax rate was introduced in response to what Trump describes as prolonged trade imbalances and regulatory barriers. He accused the EU of maintaining unfair trade practices that have harmed US businesses.

The Long-Short Ratio Reveals Market Confusion

Bitcoin dropped to 108,000 USD after the announcement, decreasing from the session high of 111,000 USD. Currently, it has recovered to around 109,000 USD but remains under pressure. The overall crypto market has declined 4% in the past 24 hours.

Bitcoin's price chart today. Source: TradingView

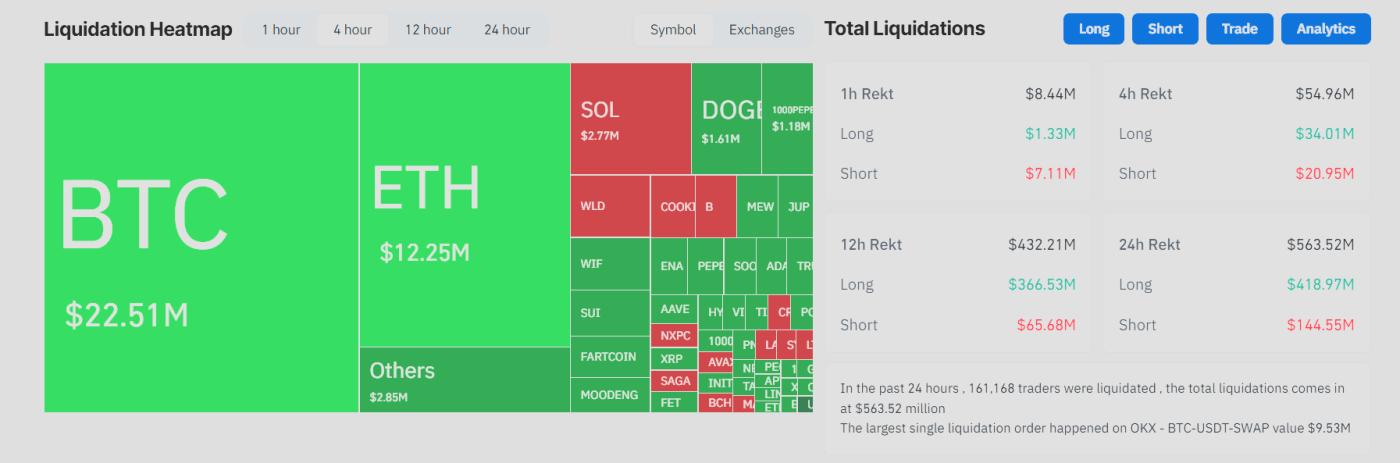

Bitcoin's price chart today. Source: TradingViewData from Coinglass shows 64.13 million USD was liquidated in the crypto market over the past four hours. Long positions accounted for 34.05 million USD, while short positions were 30.09 million USD.

Bitcoin alone saw 24.4 million USD liquidated, with Ethereum at 15.16 million USD.

Meanwhile, Bitcoin's long-short ratio remains nearly equal, indicating short-term uncertainty about the market's direction. Yesterday, Bitcoin's long positions dominated the chart at 54%.

Bitcoin's Long-Short Ratio over the past month. Source: Coinglass

Bitcoin's Long-Short Ratio over the past month. Source: CoinglassSolana, XRP, and several other altcoins also experienced significant volatility, reflecting increased market fluctuations.

Most altcoins witnessed larger declines in long positions, suggesting retail investors were surprised by the sudden policy change.

Growing Concerns About Macro Volatility

The US-China trade deal earlier this month provided necessary momentum for the crypto market. This indicated that macroeconomic uncertainty might have been priced in. However, Trump's threats to the EU have raised new concerns.

Analysts warn that the tariff announcement could be the beginning of broader economic disruption. European stock indices dropped sharply, and US tech stocks also faced selling pressure.

In the crypto market, the liquidation heat map reflects a market caught between price drop fears and recovery efforts.

The situation is evolving. If tariff threats escalate into a comprehensive trade dispute, risky assets, including cryptocurrencies, could face additional obstacles. Traders are closely monitoring any reactions from the EU or signs of negotiations.

Crypto Liquidation Heat Map. Source: Coinglass

Crypto Liquidation Heat Map. Source: CoinglassIn the past 24 hours, 162,419 traders were liquidated, totaling 567.65 million USD. Although crypto typically functions as a hedge during traditional market tensions, today's movements show it is not immune to global policy shocks.

Volatility may continue as geopolitical uncertainty increases.