Celestia (TIA) is struggling to break free from a prolonged three-month downtrend, with multiple unsuccessful attempts to maintain gains above key resistance levels.

This indicates a lack of strong market confidence, with investors hesitant to push this altcoin into a clear upward trend.

Celestia receives support from investors

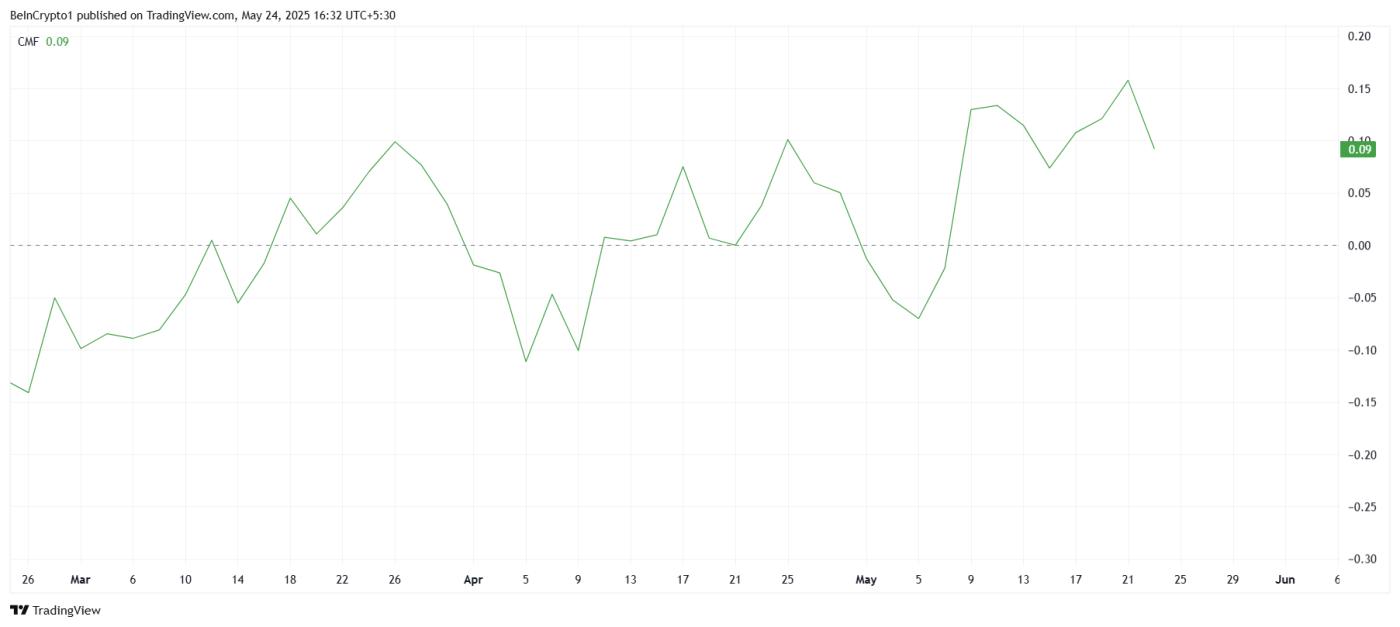

The Chaikin Money Flow (CMF) indicator has shown a slight recent increase but remains below 0. This implies that despite capital inflows, investor confidence remains cautious.

Buyers seem attracted by the relatively low price of TIA, but momentum is not strong enough to break the downtrend.

The CMF's failure to surpass 0 indicates prolonged caution and suggests traders are only carefully entering positions. This restrained interest could lead to increased volatility unless broader market support emerges.

TIA CMF. Source: TradingView

TIA CMF. Source: TradingViewThe Relative Strength Index (RSI) spiked into the bullish zone but then retreated below the neutral 50 level. This pattern indicates fragile price momentum, likely hindered by selling pressure or external market uncertainties.

Dropping below 50 reinforces the idea that TIA's price recovery is precarious. Without new buying pressure, it will struggle to overcome resistance and may continue to trade within subdued ranges.

TIA RSI. Source: TradingView

TIA RSI. Source: TradingViewTIA Price Aims for a Surge

Currently trading around $2.54, TIA is testing a crucial support level at $2.53. This level is critical for stabilizing price action and preventing further losses, especially after failing to break the $3.00 resistance during the prolonged downtrend.

A strong upward breakout seems unlikely at this moment. However, if support at $2.53 holds firm, TIA may consolidate, potentially creating momentum to retest the $3.00 resistance after surpassing $2.73.

TIA Price Analysis. Source: TradingView

TIA Price Analysis. Source: TradingViewConversely, a decisive break below $2.53 could increase downward pressure, pushing the price to $2.27. Such a move would invalidate short-term bullish prospects and increase downside risk.