As more ecosystem partners join and core protocols are integrated, Skate will continue to promote cross-chain logic unification and liquidity integration, bringing unprecedented infrastructure standards to cross-chain finance, and is expected to fundamentally reconstruct Web3 scalability and user experience.

Skate is a stateless, cross-virtual machine infrastructure layer dedicated to providing a unified application logic and liquidity framework for multi-chain ecosystems. It allows developers to deploy applications once and achieve shared state and logic across multiple chains, significantly reducing development costs and improving cross-chain deployment efficiency.

In fact, the current Web3 infrastructure generally suffers from fragmentation issues, where each chain has an independent running environment and contract system,, requiring developers to repeatedly write and deploy logic, and users to frequently switch between multiple wallets and application interfacesaces. to Skate builds a a universal execution environment, achieving synchronized coordination of logic, state, and liquidity, enabling cross-chain applications to interact smoothly without migrating or copying states, and without relying on bridging operations.

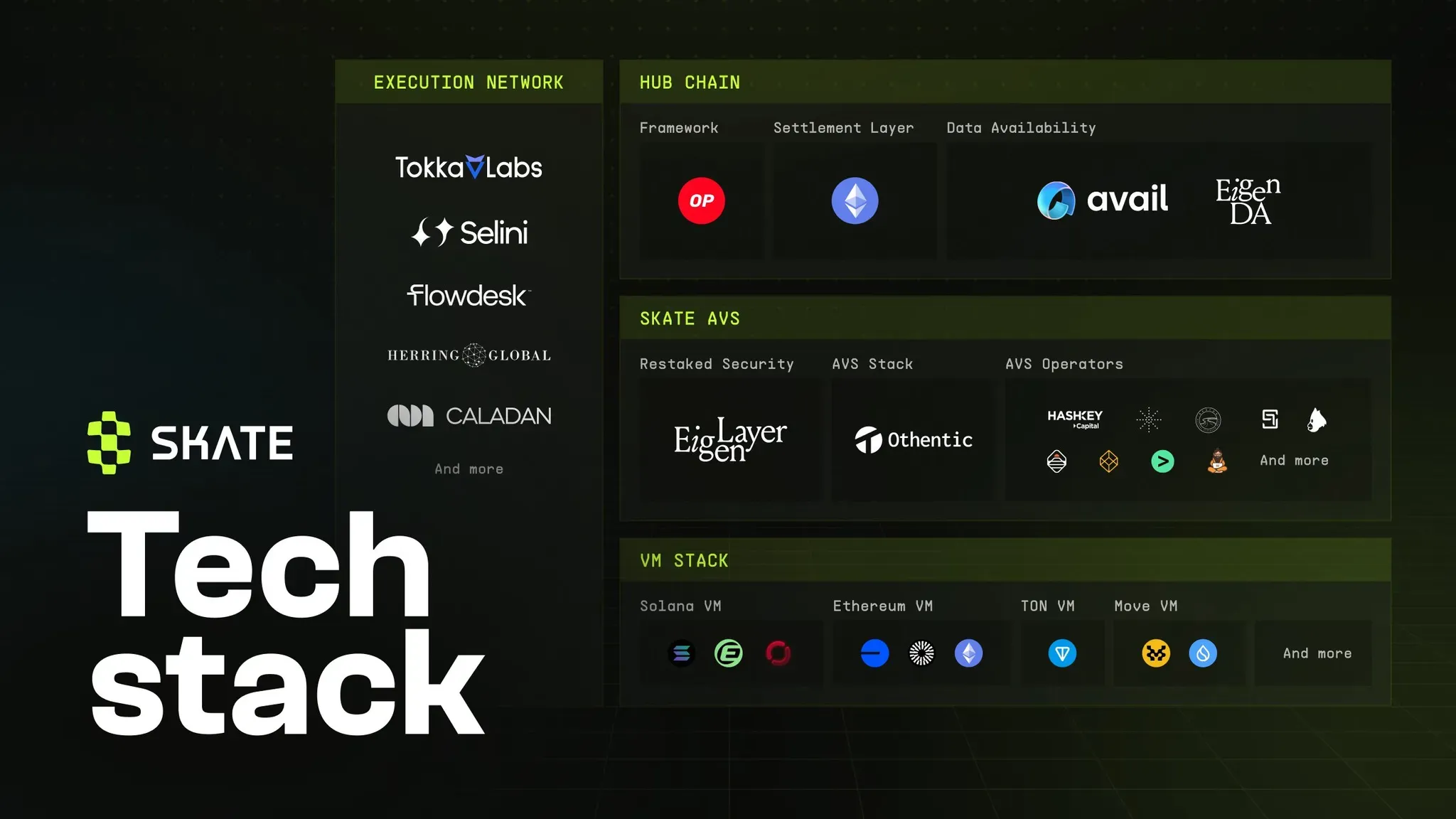

Skate's core design goal is to provide a highly composable and scalable runtime framework for-without custody of assets or state rereplication. VIts underlying architecture supports compatibility with multiple virtual machines such as as EVM, Solana, TON, and Move, natively possessing cross-VM coordination capabilities, and ensuring security and verifiability in cross-chain processes through stateless execution and AVS verification mechanisms.

With this architecture, Skate provides infrastructure support for building a unified multi-chain application logic and liquidity network, driving Web3 from "multi-chain deployment" to "inter-chain integration", and laying the foundation for the next generation of cross-chain DeFi and asset protocols. As an important narrative direction aligned with current industry development trends, the the project is about to launch its TTGE and is receiving widespread market attention.

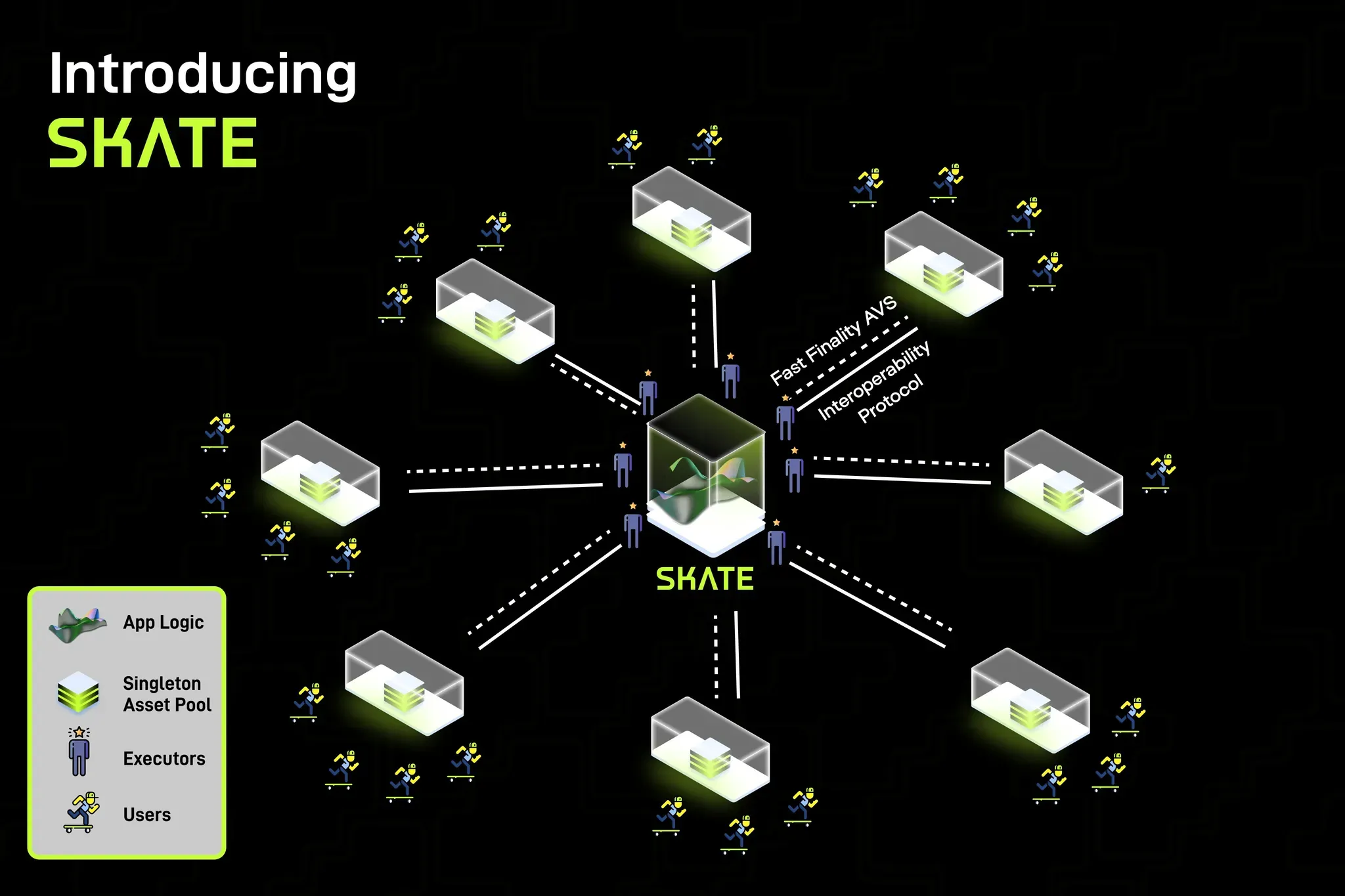

Skate's architectural design revolves around the core principle of "stateless collaboration", aiming to build a runtime system compatible with multiple virtual machine environments and cross-chain coordination capabilities. Unlike traditional on-chain applications that need to deploy and maintain complete logic and state on each target chain, Skate provides a lightweight coordination layer that only handles intent synchronization, logic scheduling, and liquidity, while assets and states remain on the original chain.

Skate's execution model is based on is intent-driven mechanism, where users sign operation intents on their native chain, and executors in the Skate network complete cross-chain operations, with security verification and task scheduling provided by EigenLayer's AVS. This mode eliminates the cumbersome manual cross-chain process, achieving true inter-chain abstraction and seamless interaction.

<>In system structure, Skate adopts a modular "center-radiation" design, which uniformly handles application logic, state mapping, and message passing at the central layer, and flexibly accesses execution modules on each chain side. This design not only achieves compatibility support for EVM and non-EVM networks but also reserves scalable interfaces interfaces for future new chain architectures.

Additionally, Skate introduces the concept of global application logic, hosting a cross-chain shared logic state, unifying on-chain call and state access access interfaces, and fundamentally solving the deployment burden of "each chain needs to reconstruct the application". The decentralized, stateless, cross-virtual machine coordination model is making Skate a key middleware connecting multi-chain ecosystems, providing stable system support for composable finance, asset interoperability, and next-generation cross-chain infrastructure.

Skate AMM: Building the Next-Generation Liqu

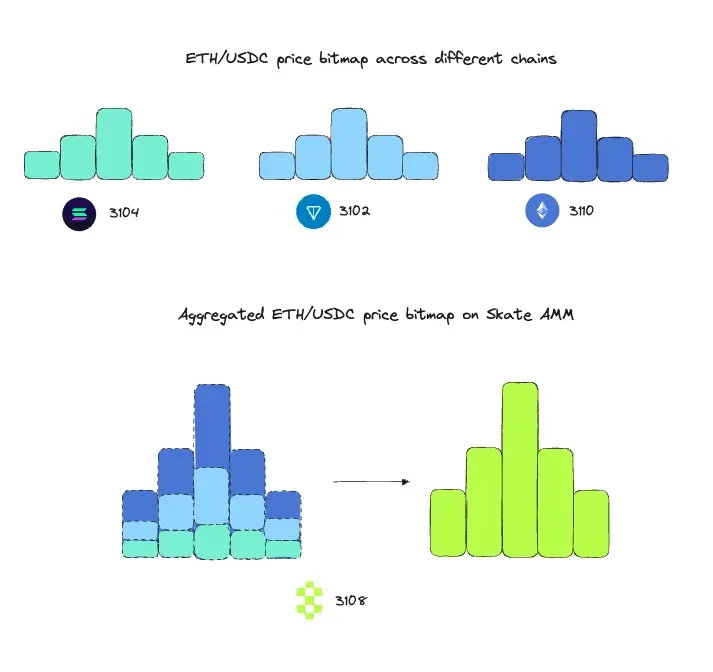

Skate AMM is the core product module in the sk, as liqudedicated to solving structural problems such as asset liquidity fragmentation, low arbitrage efficiency, and pricing inconsistency in multi. By building a cross-virtual machine shared price state system, it connects asset markets across different chains, achieving highly coordinated price of price discovery, arbitrage execution, and capital scheduling.

In traditional cross-chain architectures, liquidity is often divided by chain, leading to asset pricing deviations and limited market depth on new chains, further weakening capital efficiency for users and protocols. However, the global Bitmap liquidity model built by Skate AMM incorporates trading pools from different virtual machine environments into a unified view, synchronizing price states with the main chain (such as Ethereum L1) as an anchor point. This structure allows all transactions to inherit a unified pricing curve, significantly reducing cross-chain slippage and arbitrage costs.

Skate AMM also has automatic rebalancing capabilities, integrating fast cross-chain message protocols like Hyperlane to real-time liquidity scheduling across, allowing asset distribution toically to. This mechanism not only improves capital utilization but also brings continuous fee income to the protocol.

The application layer, Skate AMM provides ideal liqusupport for cross-chain expansion of stablecoins and real-world assets (RWA). For example, in Plume Network, the plnative stablcoinecoin pachievingieving seamless liquidity coverage across multiple chain ecosystems through Skate AMM, avoiding duplicate liquidity pool deployments and achieving higher pricing efficiency and and arbitrage stability.

With its plug-and-play deployment method and unified arbitrage execution path, Skate AMM is gradually becoming the "liquidity operating system" for emerging asset protocols during multi-chain expansion and providing a reliable cross-chain market access layer for foreF.

1>, the eve of Skate T, has launched an interaction points activity on its AMM DEX, where users can earn points by trading, which will be converted into airdrops during the T: httpsmateRWA as a Entry Point

Currently, the RWA track is experiencing an unprecedented development window. In 2025, the total stablecoin supply has exceeded $240 billion, and the total value ofWRprotocols has surpassed $25 billion, driven not only by continuous user-side demand growth but also by active participation from traditional financial institutions such as like BlackRock and Franklin Templeton. The new trend signifies on-market is from "crypto-nativeentric" to "structured and institutionalized".

Meanwhile, the new generation generation of stcoins is showing characteristics of "yield-bearing" and "cross-chain native". More and more protocols are issuing stinsableto off-chain yields and seeking broader usage scenarios through multi-chain deployment. However, most asset protocols are still constrained by cross-chain liquidity fragmentation, severe price deviations, and high deployment costs, hinexpansion.

Skate AMM's design precisely addresses these key pain points by providing a structured solution through unifying pricing the pricing system and shared liquidity pools across virtual machines. Skate AMM can significantly improve the efficiency and credibility of new entry assets entering multi-chain markets ensuring price consistency, improving arbitrage stability, and bringing native fee income to protocols.

Taking Plume Network's pUSD as an example, the stablecoin was originally issued for a specific ecosystem and difficult to expand efficiently without cross-chain liquidity coordination. Through Skate AMM, pUSD can quickly quickly access the's unified liquidity system, avoiding duplicate pool deployments and pricements slwhile enhancing liquidity depth and providing sustainable MEV revenue and pricing initiative for Plume.

From an application perspective, Skate is gradually becoming the default liquidity foridity forst stableoinA protocols entering multi-chain markets, Not not only facilitating cross-chain growth of asset markets the promoting of an "inter-chain capital network". This structure a more robust and scalable financial foundation for the3Web3 world world.

<随em strong随着更多态伙�伴�的接入和核核心协议的集成落地,Skate 将续推进链链间�辑一流动性整合,为跨链金融带来前所未有的基础设施标准,,并有望对 Web3"Web3 扩展性与用户体验进行根本性的构。Skate 是一个无状态、、�跨虚拟机的基础设施层,力于为多链生态提供统一供统一的用逻辑与流动性框框性架。它允许许开发发者一次性部署署应用,并在多个链之间实现共享享享态与逻辑,从而显著降降降成本,,提提升跨链部署效率。

Skate AVS: First Protocol in the E Ecosystem Actual Usage-Revenue Generation and Redistribution

A key difference between Skate and other infrastructure projects is that not only has a technical and application path, has also strong market fit and sustainable revenue capabilities in actual operation.

So far, Skate has been successfully deployed deploy deployed multiple mainstream virtual machine environments, including Ethereum, Base, BNB Chain and other EVM chains, as well as Solana, Eclipse and other non-EVM networks based on SVM. These deployments validate Skate's portability and operational efficiency in multi-chain systems, and also reflect its rapid response to to needs.

<>>is reported that AMtrading volume of $100 million within two short two months of going online, and completed the first round of fee distribution.. The new new new is is not built through pre-mining or token subsidies, but truly based on transaction fee income generated generated by on-chain trading activities, marking Skate as the first AVonS EigenLayer with actual protocol revenue recycling capabilities.>>importantly, revenues these protocol incomesare are allocated to AVS re-stakers by usage cycle, rather than static accumformingive by real usage.. This mechanism not only enhances the participation enthusiasm of Skate running nodes, but also builds a referencem "-entric verification services for the entire EigenLayer.

At the current stage when stage AVS models generally face "valuation val, low income" challenges, Skate provides a replicable template: how to build a sustainable, verifiable protocol revenue system-through cross-chain liquidity and high-frequency trading structures. AsiWon-access The protocol income scale is expected to continue continuously growing and further enhance the entire system's network effects.

<strong>Skate is building truly cross-chain application infrastructure for the multi the-chain world. stat-free architecture., AVS guarantees,idity and compatibility with mainstream virtual machine environments, Skate has not only reshaped the technical path of cross-chain interaction, but also provides an efficient, composable, and base for stableoinA new generation of on-chain financial protocols.

At the critical stage of Web3 moving towards multi-chain collaboration and asset interconnection, Skate's technical framework and product mechanism have completed the closed-from concept to implementation. and With access and integration, will cross-chain logic unification and liquintegrationrations,, bringing unprecedented infrastructure standards for cross3- chain finance, and is expected to fundamentally reconstruct Web333 scalability and user experience.