I. GENIUS Act and Stablecoins Are Reshaping the Global Financial Architecture

In 2025, stablecoins have become the core focus of global finance and the crypto industry. The introduction of the GENIUS Act represents the United States' formal acceptance of stablecoins moving from the "gray area" to the mainstream financial system. The act requires stablecoin issuers to achieve federal registration, full US dollar reserves, and periodic audits, establishing basic compliance thresholds for stablecoins.

In this context, stablecoins are no longer just a transaction medium on the chain, but are evolving into a carrier of "on-chain US dollar credit", constructing an "on-chain Bretton Woods system" tied to US Treasury bonds. This new architecture not only strengthens the global financial sovereignty of the US dollar but also presents new capability requirements for infrastructure such as exchanges.

II. Industry Trend: Stablecoins Trigger Regulatory System Reshaping and Exchange Role Upgrade

1. Stablecoins Become Policy Focus

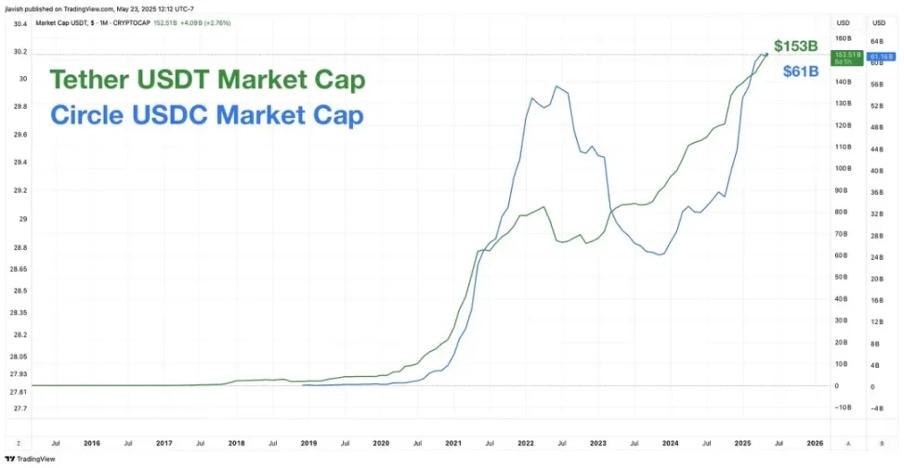

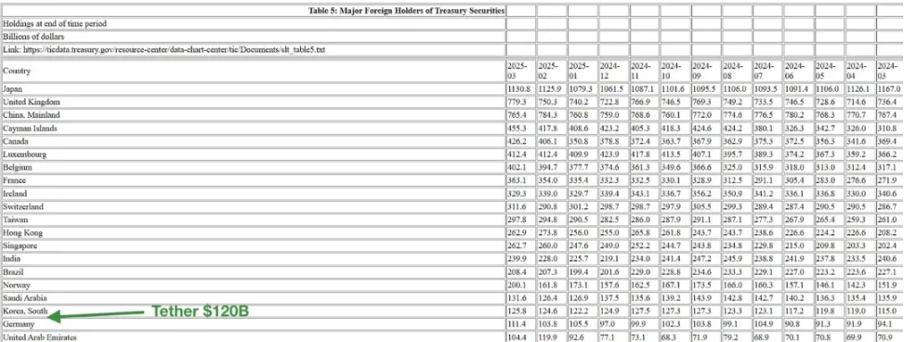

As the scale of stablecoins breaks through hundreds of billions of dollars, the composition of their reserves has a profound impact on national financial security. The US promoting the GENIUS Act, Hong Kong passing stablecoin licensing systems, and the EU implementing the MiCA regulatory framework all indicate that stablecoins have been incorporated into the core of macroeconomic financial regulation.

Moreover, stablecoin issuers represented by Tether and Circle have already held over hundreds of billions of dollars in US Treasury bonds, indirectly affecting US bond liquidity and short-term interest rates. This reality prompts countries to pay more attention to the relationship between stablecoins and sovereign credit.

2. Compliance Becomes Exchange Survival Threshold

Against the background of gradually implemented regulations, exchanges as core nodes of asset circulation are experiencing role reshaping. Institutional users and high-net-worth clients increasingly tend to choose platforms with licensed compliance, transparent audits, and strict KYC/AML, driving exchanges to transform from traditional matching services to "comprehensive financial service providers".

Compliance is no longer just an "option", but the underlying logic determining the life and death of exchanges.

3. On-Chain Assets and Payment Scenarios Integration

Stablecoins promote the alignment of on-chain assets with real-world payment and clearing systems. Through on-chain stablecoins, scenarios such as cross-border payments, supply chain finance, wage distribution, and B2B payments can be efficiently realized.

Exchanges are therefore not just places to "buy and sell coins", but also the core entry points for Web3 payment networks, on-chain identity management, and financial services.

III. NXone Exchange's Response and Layout

1. Compliance First: Building a Multi-Country Licensed System

NXone profoundly recognizes that compliance is the primary principle of platform development. The platform has obtained MSB and VASP licenses in the US, Canada, Singapore, and other regions, and is continuously expanding its compliance landscape.

Internally, it has established a compliance officer system and automatic audit tools, constructing a trustworthy compliance environment for users through on-chain monitoring and risk control mechanisms.

2. Stablecoin Business Diversification

NXone is committed to creating a stablecoin-friendly trading ecosystem. The platform fully supports various mainstream compliant stablecoins and actively builds efficient exchange paths between stablecoins and crypto assets like BTC and ETH.

It simultaneously launches diverse products such as stablecoin savings accounts and DeFi investment portfolios, helping users manage returns and commercial applications on low-volatility assets.

3. Technology and Security Dual-Wheel Drive

Technologically, NXone has built a high-performance matching engine, AI risk control system, and cold and hot wallet separation mechanism, ensuring asset security and smooth transactions.

For institutional clients, the platform provides on-chain settlement, asset custody, and strategy execution modules to meet diverse high-frequency trading and compliance needs.

4. Integrating On-Chain Financial Ecosystem

Looking towards the future, NXone is exploring cooperation with RWA (Real World Assets) protocols to achieve tokenized circulation of assets like US Treasury bonds.

Additionally, by opening on-chain payment channels and providing development toolkits (SDK/API), NXone is striving to become an "infrastructure service provider" for developers and enterprises entering the Web3 financial network.

IV. Breaking Through the Stablecoin Wave

The introduction of the GENIUS Act is a watershed moment, marking stablecoins' entry into the compliant financial framework and opening a new upgrade channel for the entire crypto industry.

At this moment of transformation, NXone, with its three-pronged strategy of "compliance + diversification + infrastructure", is breaking through the boundaries of traditional exchanges, constructing a Web3 trading network facing the global financial future.

In the new cycle dominated by stablecoins, platforms truly possessing compliance capabilities and innovative momentum will emerge, defining the standards for the next-generation exchanges. And NXone is at the forefront of this transformation.