On the 30th, Bitcoin options contracts worth $9.8 billion will expire.

According to Deribit, the largest cryptocurrency options exchange, the outstanding Bitcoin options contracts expiring on the 30th total 92,739 contracts, equivalent to approximately $9.82 billion.

On this day, the outstanding call option contracts are 49,096, and put option contracts are 43,643. The Put/Call Ratio is 0.89, meaning the outstanding put option contracts are 89% of the call option contracts. Typically, below 0.7-0.8 is considered optimistic (bullish), and above 1 is interpreted as cautious or bearish.

The Max Pain Price at the expiration point is $100,000, where both long and short bets could incur losses if the market converges to this price range.

The option contract with the most concentrated outstanding contracts is the $110,000 call option, with 4,927 outstanding contracts. This reflects expectations of an upward breakthrough. Following this are the $120,000 call option (3,567 contracts) and the $100,000 call option (2,960 contracts), recognized as short-term resistance and support levels.

Overall, the $120,000, $110,000, and $130,000 call options have the most concentrated outstanding contracts, suggesting bullish sentiment remains valid in the medium to long term.

In the last 24 hours, call option trading volume was 15,999 contracts, and put option volume was 13,393 contracts, indicating more active call option trading. This shows investors are leaning towards a short-term bullish outlook. The 24-hour Put/Call ratio is 0.84, below the baseline (1), suggesting a predominant optimistic sentiment.

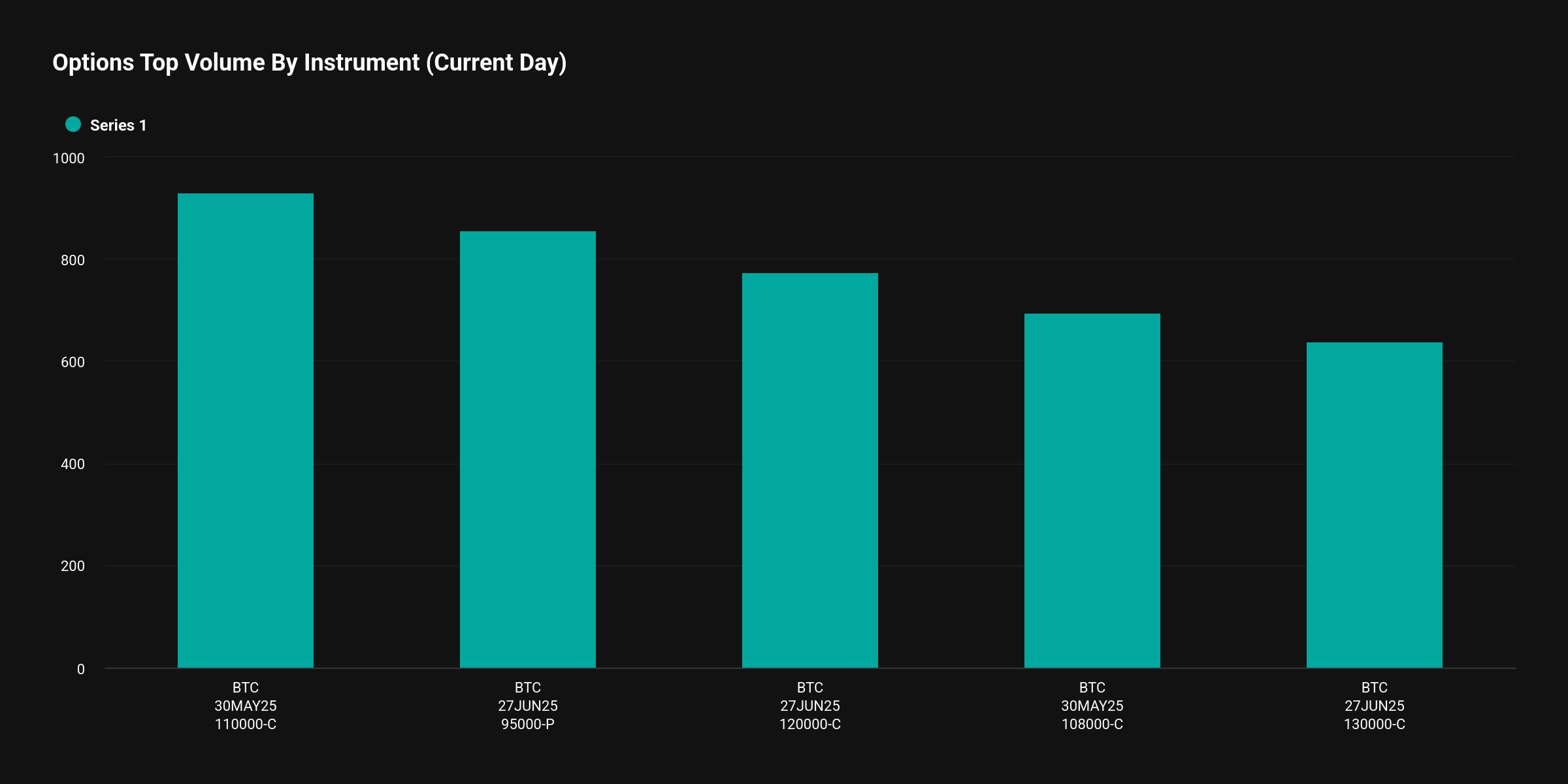

The most actively traded option contract in a day was the $110,000 call option, with 932 trades, indicating concentrated short-term market top expectations. This was followed by the $95,000 put option (856 contracts) and the $120,000 call option (775 contracts), showing ongoing exploration of market direction with both downside defense and upside breakthrough positions.

By expiration date, the most concentrated outstanding contracts are on June 27th, with approximately 111,894 contracts, of which 63% are call options. Following this are May 30th with 92,739 contracts (53% call options) and September 26th with 43,887 contracts (71% call options).

In the last 24 hours, May 30th had the highest trading volume, with 8,275 contracts settled, comprising 59% call options and 41% put options. Significant trading volume was also seen on June 27th (5,950 contracts) and June 6th (3,741 contracts).

According to CoinMarketCap, Bitcoin was trading at $105,646 at 9:04 AM on the 30th, down 1.99%.

Options are derivatives that investors can use to leverage bets on underlying asset price movements or hedge existing positions. Call options provide the right to purchase at a predetermined price, while put options provide the right to sell. Outstanding contracts represent the total volume of option contracts currently in the market.

[This article does not provide financial advice, and investment outcomes are the sole responsibility of the investor.]

Real-time news...Go to Token Post Telegram

<Copyright ⓒ TokenPost, unauthorized reproduction and redistribution prohibited>