Original Title: Scoring Crypto Narratives: My Formula

Original Author: Ignas

Compiled by: Luffy, Foresight News

You might have spent countless hours trying to capture the next hot narrative in the crypto space. Judging correctly could make you a fortune, while entering too late would make you the bag holder. In the crypto market, the highest returns come from:

1. Identifying narratives early

2. Mapping capital rotation routes before others

3. Exiting when the expected bubble peaks

4. Locking in profits

Then consider: Will the next wave of narratives arrive? Narratives will cycle, and speculative waves will resurface when:

· There is genuine technological innovation behind the narrative, allowing it to rebound after the first wave of hype subsides

· New catalysts emerge

· A dedicated community continues building after the hype fades

I elaborate on my thoughts in the following article:

https://x.com/DefiIgnas/status/1757029397075230846

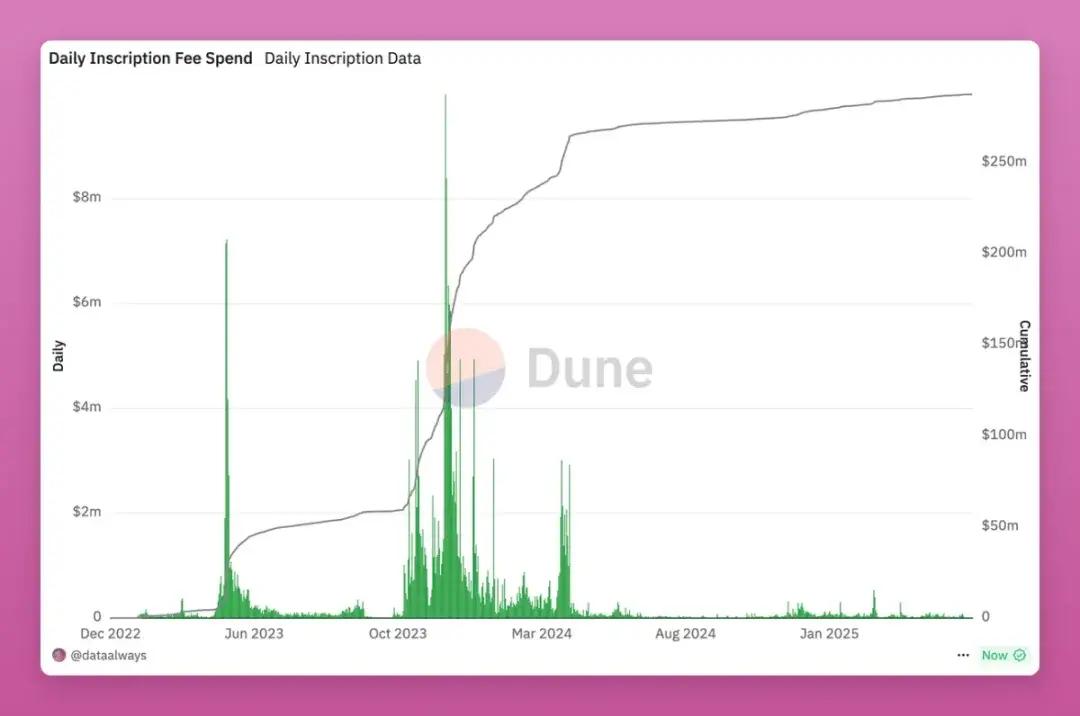

Taking Ordinals on Bitcoin as an example, we can clearly see 4 waves of speculation from the following chart.

December 2022: Ordinals theory released, with minimal on-chain activity.

March 2023: BRC-20 standard triggered the first wave of activity; cooled down for six months.

Late 2023 - Early 2024: Continuous development sparked the second and third waves.

April 2024: Runes launched, prices soared, then faded within weeks.

Ordinals provided months of positioning time and multiple exit opportunities, while Runes offered only a brief single exit window. The field is currently dormant. Will Ordinals (including Runes), Non-Fungible Tokens, or other new forms make a comeback? Perhaps. It depends on my narrative scoring.

Non-Fungible Tokens also face liquidity issues. This is why I had high hopes for the ERC404 Non-Fungible Token fragmentation model, which could have provided passive selling liquidity and annual yields through trading volume. Unfortunately, it failed. I believe liquidity is the primary reason why DeFi options have struggled to rise over the years.

https://x.com/kristinlow/status/1929851536965873977

During recent market volatility, I wanted to hedge my portfolio with options, but on-chain liquidity was terrible. I had high expectations for the crypto options platform Derive, but its future is now uncertain. Liquidity is not just about deep order books, continuous new funds, CEX listings, or high total value locked (TVL) in liquidity pools, which are important. The liquidity formula also includes protocols that achieve exponential growth with increasing liquidity, or projects with built-in liquidity guidance models, such as:

· Hyperliquid: More liquidity means a better trading experience, attracting more users, which in turn brings more liquidity

· Velodrome's ve3.3 DEX: Building liquidity through bribery mechanisms

· Olympus OHM: Protocol-owned liquidity

· Virtuals DEX: Pairing new AI agent releases with VIRTUAL tokens

Tokenomics

Tokenomics is equally important as liquidity. Poor tokenomics can lead to selling. Even with deep liquidity, the continuous selling pressure from unlocks is a huge risk.

· Good cases: High circulation, no large VC/team allocations, clear unlock plans, burning mechanisms (like HYPE, well-designed fair launch), etc.

· Bad cases: Malignant inflation, massive cliff-like unlocks, no revenue (like some Layer2 projects).

A narrative with 10/10 innovation but 2/10 tokenomics is a ticking time bomb.

Incentive Mechanisms

Incentive mechanisms can make or break a protocol, even an entire narrative. The reStaking narrative depends on Eigenlayer's performance, but token issuance failure (possibly due to complex narrative or weak community) has stalled the narrative. Assessing liquidity in the early stages of a narrative is challenging, but innovative incentive mechanisms help build liquidity. I'm particularly interested in new token issuance models. If you've read my previous articles, you'll understand what I mean: when tokens are issued in innovative ways, the market often undergoes a transformation.

· BTC hard fork → Bitcoin Cash, Bitcoin Gold

· ETH → Ethereum Classic

· Initial Token Offering (ICO)

· Liquidity mining, fair launch, low circulation with high fully diluted valuation (FDV, suitable for airdrops but unfavorable for secondary markets)

· Points narrative

· Pump.fun

· Private sale - public sale on Echo/Legion

As the market changes, token issuance and incentive mechanisms evolve. When an incentive model is overused and its patterns are widely known by the market, it means the market has entered a saturation phase and hype peak.

The latest trend is crypto treasuries. Public companies buying cryptocurrencies (BTC, ETH, SOL) with stock valuations exceeding the value of held cryptocurrencies. What's the incentive mechanism here? Understanding this is crucial to avoid being the bag holder.

Market Environment

The best narratives launched during brutal bear markets or macro risk events (like early tariff wars) can be drowned out. Conversely, in a liquidity-loose bull market, even ordinary narratives can soar. The market environment determines the following multipliers:

0.1 = Brutal bear market

0.5 = Oscillating market

1.0 = Bull market

2.0+ = Parabolic frenzy

Case: Runes (April 2024) had innovation, community, initial liquidity, and some incentive mechanisms, but its launch coincided with a significant market pullback after Bitcoin halving hype subsided (market environment multiplier ~0.3). Result: Mediocre performance. If launched 3 months earlier, it might have performed better.

How to Use the Formula

Score each factor from 1-10:

Innovation: Is it a breakthrough from 0 to 1? (Ordinals: 9, Memecoin: 1-3)

Community: True believers or speculators? (Hyperliquid: 8, VC-dominated projects: 3)

Liquidity: Market depth? (Quick listing on top CEX: 9, Trading like Runes NFT: 2)

Incentive Mechanisms: Attractive and sustainable? (Hyperliquid airdrop: 8, No incentives: 1)

Simplicity: Can it become a meme? ($WIF: 10, zkEVM: 3)

Tokenomics: Sustainable? (BTC: 10, 90% pre-mine: 2)

Market Environment: Bull market (2.0), Bear market (0.1), Neutral (0.5-1)

Scoring is subjective. I gave Runes an innovation score of 9, but you might give 5. This formula is just a suggestion of factors to consider. Using Runes as an example: Innovation = 9, Community = 7, Liquidity = 3, Incentive Mechanisms = 3, Simplicity = 5, Tokenomics = 5, Current Market Environment = 0.5

Plugging into the formula:

1.5× Innovation × Simplicity = 1.5×9×5 = 67.5

1.5× Community × Simplicity = 1.5×7×5 = 52.5

Liquidity × Tokenomics = 3×5 = 15

Incentive Mechanisms = 3

· Subtotal = 67.5 + 52.5 + 15 + 3 = 138

· Multiplied by Market Environment (0.5): Runes Narrative Score = 138×0.5 = 69

In comparison, Memecoin scored higher in my subjective scoring (116 points):

Innovation = 3 (due to Pump.fun's innovative issuance model, not completely zero)

Community = 9

Liquidity = 9 (integrated into AMM, high trading volume = high LP rewards, CEX listing)

Incentive Mechanisms = 7

Simplicity = 10

Tokenomics = 5 (100% circulation upon issuance, no VC, but small group risk/front-running, no revenue sharing)

Market Environment = 0.5

Summary

· Scan narratives early: Use tools like Kaito, Dexuai, focus on innovation and catalysts

· Strict scoring: Assess honestly. Poor tokenomics? In a bear market? Lack of incentives? Market environment changes constantly, native innovations in new fields might revive narratives (like Runes' AMM DEX)

· Exit before incentive mechanism decay: Sell at token release peak or airdrop landing

· Respect trends: Don't fight macro trends. Hoard cash in bear markets, deploy funds in bull markets

· Keep an open mind: Try protocols, buy popular tokens, participate in community discussions... Learn through practice

This is just my 1.0 version of the formula, which I will continue to refine.