Author: Stacy Muur, Web3 Researcher; Translated by: Jinse Finance xiaozou

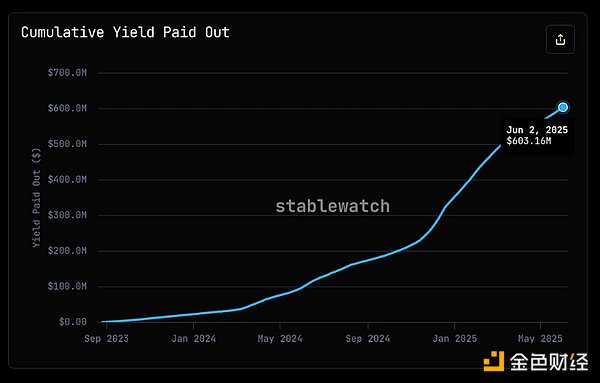

Ethena's SUSDE and sUSDS collectively occupy about 77% of the yield-bearing stablecoin (YBS) liquidity, with cumulative actual earnings exceeding $603 million. Will yield-bearing stablecoins become the next killer application for mass Web2 user adoption?

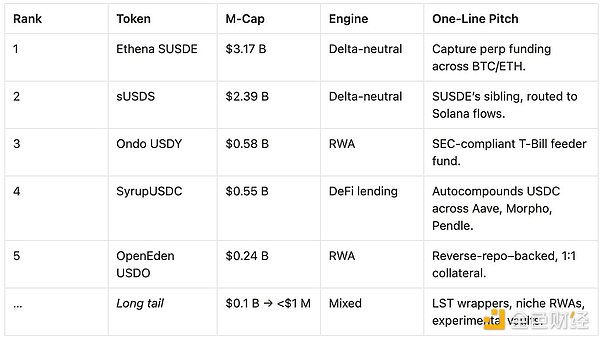

Currently: The total market value of yield-bearing stablecoins (YBS) is $7.19 billion; 24-hour trading volume is $56.18 million (sufficient liquidity for the treasury, but still thin compared to USDT/USDC); forming a monopoly of three giants, with Ethena's SUSDE and sUSDS collectively controlling about 77% of YBS liquidity; cumulative actual earnings paid are $603 million (direct cash earnings paid to holders, excluding token incentives).

1. Core Characteristics of Yield-Bearing Stablecoins

YBS maintains USD pegging while continuously generating passive income. Currently, four major yield engines dominate the market:

Delta Neutral Hedging: Capturing futures funding rates while holding spot collateral (such as SUSDE, sUSDS).

Short-Term Government Bonds (RWA Wrapped): Tokenized government bonds/repurchase agreements (such as USDY, USDO).

DeFi Lending Vaults: Cycling idle collateral into Aave, Morpho, or Pendle PT yield ladders (such as SyrupUSDC, sDOLA).

Validator Staking Wrapper: Wrapping Ethereum or SOL staking rewards into USD-denominated assets (such as SFRXUSD, SLVLUSD).

The result is providing 3%-15% net annual yield while maintaining USD stability, without the need for active yield farming.

2. Current Market Leaders

3. Macro Trend Insights

[The rest of the translation continues in the same manner, maintaining the original structure and translating all text while preserving the technical terms and names as specified.]Core Value: YPO is a tracker for on-chain yield distribution. High yields are meaningful only when truly paid. SUSDE leads with a cumulative payment of $286 million, while sDAI's $117 million demonstrates the persistence of the Maker protocol.

4. Why Yield-Bearing Stablecoins (YBS) Are the "Killer App" for Cash Management

Turning idle funds productive: Delta-neutral synthetic assets (like SUSDE) offer 7-8% annual yield, government bond-wrapped products (like USDY, USDO) provide 4-5% returns, far exceeding most bank savings rates.

12-month TVL growth 4x: Total industry locked volume surged from $1.7 billion to $7.1 billion, synchronized with the Federal Reserve's rate hike cycle.

Reduced friction costs: Through quality entry points like Circle, Coinbase, and Hashnote, retail investors can achieve second-level minting/redemption.

Significant transparency differences: Collateral audit standards are uneven, and on-chain reserve proof standards are still forming.

5. Transparency and Risk Considerations

The upcoming "Yield-Bearing Stablecoin Transparency Framework" aims to establish a standardized assessment system through the following dimensions:

Collateral transparency: Asset holding details and third-party audit reports.

Redemption convenience: Assess redemption frequency, potential slippage, lock-up periods, and KYC requirements.

Yield sources: Clarify whether yields come from fixed-income assets, funding rate arbitrage, validator rewards, or portfolio strategies.

Risk disclosure: Comprehensively cover oracle dependencies, counterparty risks, smart contract vulnerabilities, and regulatory considerations.

Major Risks:

Regulatory reclassification: Some jurisdictions may view yields as securities dividends.

Smart contract attacks: Risks of re-entrancy attacks, oracle failures, or cascading liquidations.

Liquidity limitations: Some tokens have low daily trading volumes, making large redemptions difficult.

Macroeconomic impacts: Federal Reserve rate cuts or funding rate inversions could simultaneously impact multiple yield mechanisms.

Market Cap Classification Overview

Large cap (>$500 million): SUSDE, sUSDS, USDY, SyrupUSDC

Mid cap ($100-500 million): USDO, SDEUSD, SLVLUSD

Small cap (<$100 million): SFRXUSD, sDOLA, Solayer SUSD, DUSD, SUSDE-Fraxtal, YTRYB

6. Conclusion

Yield-bearing stablecoins are transforming idle digital dollars into interest-bearing assets, but this field remains in its early stages, characterized by high market concentration and yield sensitivity. Recommendations include diversifying yield engines, monitoring funding rate spreads, and continuously demanding transparency improvements.

This article is for educational purposes only and does not constitute financial advice. Please do your own research (DYOR).