Have you ever thought that entrepreneurship may have completely changed? I recently conducted an in-depth analysis of the growth data of a large number of AI startups and studied the views of investors from top investment institutions such as NFX and a16z. I found a shocking fact: we are at a historic turning point. The traditional entrepreneurial rhythm, product development cycle, user growth model, and even the definition of "fast" have been completely subverted by AI.

When Perplexity AI went from zero to 15 million monthly active users and a $1 billion valuation in 18 months, when Cursor AI reached a $9 billion valuation with a team of 30 in less than two years, and when the monthly subscription fee for consumer AI products jumped from $50 per year to $200 per month, I realized that we need to completely rethink what "fast enough" means. What shocked me even more was that this speed is no longer an advantage for startups, but a basic threshold for entry. If you are still doing things with traditional entrepreneurial thinking and rhythm, you may have been eliminated. For example, taking the developer market that Cursor is targeting as an example, if you want to make AI coding products for developers now, I think the chances are slim. I have also written an analysis article before, "In-depth Analysis | The Future of AI Coding and the Rise of Replit".

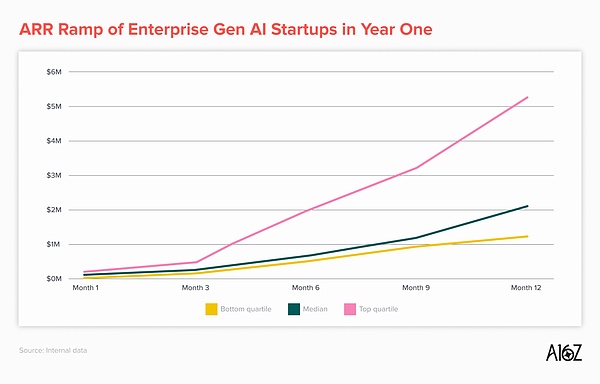

Traditional enterprise startups are considered excellent if they achieve $1 million in annual revenue in the first year, and consumer companies usually wait until they have millions of users before considering monetization. But now, these standards seem too conservative. According to data from a16z investors, the median AI enterprise company achieved an annual revenue of more than $2 million in the first year, and the performance of consumer companies was even more amazing, with a median of $4.2 million. What is even more surprising is that the business model quality of consumer AI products has far exceeded that of traditional consumer products. Users are willing to pay $20 per month for ChatGPT Plus and $250 per month for video generation tools such as VEO, which completely subverts our perception of consumer product pricing.

The following is a summary and sharing of my recent research and analysis. I hope it will be helpful to everyone. As it happens, I have already published a separate article last week about the speed moat, "Speed will become the only moat in the AI era". Friends who are interested can read it.

Of course, nothing is absolute, and non-consensus is precisely where opportunities lie. As the saying goes, "hearing both sides leads to enlightenment, while hearing only one side leads to ignorance." All my sharing is just a perspective, and I hope it can bring some inspiration to everyone.

AI is redefining the concept of "speed"

The most profound change I have observed is that AI is transforming speed from a relative advantage to an absolute necessity. In the past, speed may have been a competitive advantage for some startups, but now it has become a basic capability that all companies that want to survive must have. In their analysis, NFX investors pointed out that the fundamental reason for this transformation is that AI itself will not hesitate or procrastinate. It can continuously ingest information, process data, and output results. When your competitor may be an AI system or a team that uses AI extensively, the traditional pace of work seems extremely slow and inefficient. As a16z investors have observed, we are living in the early days of AI, in which speed is the moat.

Let me use some concrete numbers to illustrate the scale of this change, according to NFX research. Mistral AI built the top open source large language model Mistral 7B just four months after its founding. Replit integrated a complete tool chain of code completion, debugging, and deployment within 12 months. Runway launched the second generation of video generation products just eight months after the release of the first generation, achieving a breakthrough in generating videos directly from text. And companies like 11Labs, according to the observation of a16z investors, took less than two years from early products to now having a huge voice library and a large number of corporate customers. These cases tell us that in the AI era, the product iteration cycle has been shortened from years to months or even weeks.

NFX investors have found that the most successful teams are not only fast in building, but also fast in learning. They have established a fast iterative cycle between learning and releasing, which is compounded over days, weeks, months, and years, forming a huge competitive advantage and may eventually build a future moat. This learning-release cycle speed is becoming a key indicator that distinguishes excellent companies from mediocre companies. When your competitors are releasing new features, optimizing user experience, and responding to market feedback every week, the traditional monthly or quarterly release rhythm is extremely passive.

But I also realized a profound problem pointed out by NFX investors: most people don’t actually know that they have been limited by their past experiences. What you learn in school is to advance by semester, and what you learn in large companies is to make decisions by committee. Both environments teach you to avoid making mistakes as much as possible. They reward not making mistakes, reward writing more words, deeper analysis, and rewarding robustness in slow-moving systems. This logic is effective at the glacial speed of academic knowledge creation, but in the entrepreneurial world, especially in the entrepreneurial world in the AI era, this logic is completely inapplicable.

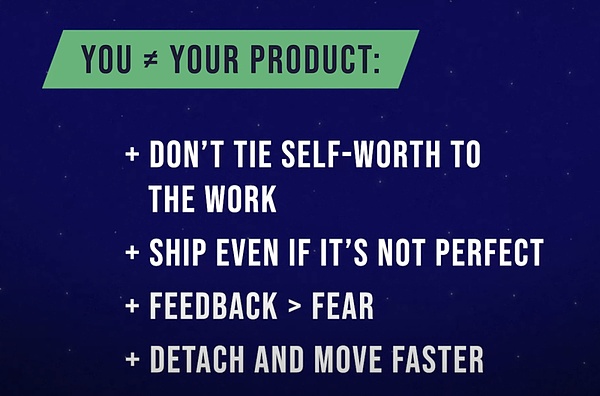

NFX investors have observed that many entrepreneurs closely tie their self-worth to their products. They think: I launch this product into the world, and if people don’t like it, then they don’t like me. This unconscious psychological connection makes them extremely cautious when launching products, overly pursuing perfection, and procrastinating because of fear of making mistakes. They feel that they have a lot to lose, but in fact this idea makes them lose the most precious things: time and opportunity.

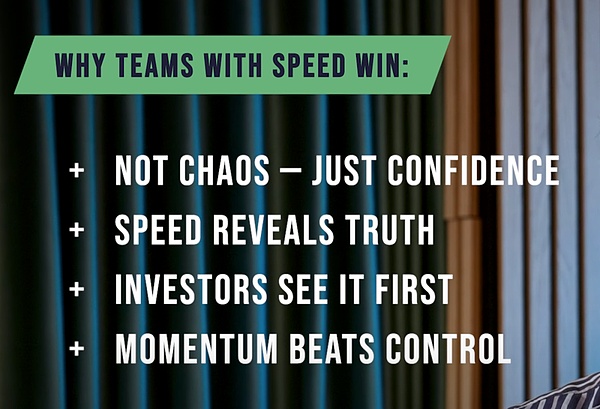

Speed is not recklessness, but a precise choice

I want to clear up an important misconception: speed does not equal recklessness. The truly successful startups that NFX investors have observed are not fast because of chaos, but because of precision. They are fast because of clarity of thought, they are fast because of clear goals, and they are fast because of smooth team communication. Speed is essentially choosing motivation over perfection, and choosing progress over self-esteem. These companies can move fast because they get rid of the excessive need for "safety" and bring the desire to move fast to every day of product development.

When I look back at all the traits that NFX investors have summarized for entrepreneurs and companies, I find that they all converge on one indicator: speed. Whether it is excellent communication skills, obsession with products, resilience in the face of setbacks, deep market insights, or understanding of marketing, sales, and technology, all of these factors that make a company successful are ultimately reflected in the dimension of speed. When NFX investors see that founders can respond to email requests immediately, see them quickly modify presentations, see them quickly release products, and see them quickly interact with customers, this speed is the indicator they are looking for, and it is also the indicator that everyone who wants to enter the entrepreneurial career should pay attention to.

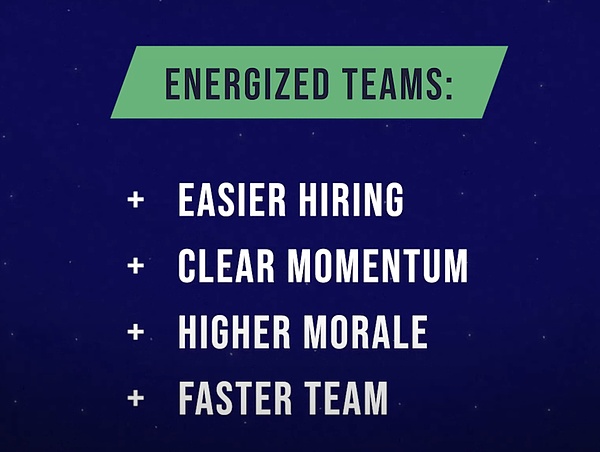

NFX investors see the concrete benefits of speed every day. This is not a theory, but a real phenomenon. The benefits of speed are mainly reflected in four aspects: products can be brought to market faster, the speed at which you bring features and the ability to change quickly for customers, customers can feel this rhythm and they will support you; the team becomes more dynamic, the faster the speed, the more excited the team is, and the more attractive you are to top talents, which makes you faster; you will get a lot of attention from the media and social media, energy will gather around you, and everyone can feel your rhythm; you need to raise less funds and can retain more equity, because you may spend $100,000-300,000 per month. If you can save three months, you save $600,000 in expenses, which also saves you $600,000 in equity.

As the NFX investors said, speed compounds, and so does hesitation. You can choose your poison. Based on their observations in the current AI era, I have summarized six mindset changes that must be made to enable entrepreneurs to move quickly in this new era.

A new business model for consumer products in the AI era

When a16z investors delved into consumer AI products, they discovered a shocking phenomenon: consumers are now willing to pay unprecedented prices for AI products. Traditional consumer subscription products may only charge an average of $50 per year, but now people are happy to pay $200 per month for AI products, and some users even said they feel they are undercharged and are willing to pay more. I think this change in price acceptance reflects the different nature of the value provided by AI products: they are no longer tools to help you entertain or improve yourself, but assistants who can directly do your work for you.

As a16z investors point out, Deep Research, for example, can replace the 10 hours you spend generating market reports yourself, and for many people, just one or two uses are worth the $200 per month fee. Video generation tools such as VEO allow people to create unprecedented content, and users can make personalized video messages and create complete stories. This release of creative power makes the high price reasonable. I have observed that the value proposition of AI products has shifted from "helping you do something better" to "doing something directly for you." This fundamental shift explains why consumers are willing to pay higher prices.

More interestingly, a16z investors found that consumer AI products exhibit a different "shape" from traditional consumer products. According to their research, one-third of the consumer companies in the sample raised a lot of money to train their models, and many companies saw huge revenue jumps after the release of new models. These growths often take the form of step functions, which may plateau before the next major release, and then jump again. This pattern is completely different from the steady growth of traditional consumer products, and is more like the release cycle of technology products.

a16z investors also noticed an important phenomenon: in consumer AI products, they began to clearly distinguish between user retention and revenue retention, which was rare in previous consumer products. Because users actually upgrade packages, buy more points, and incur excess usage fees, revenue retention is often significantly higher than user retention. This means that even if some users churn, the remaining users will generate more value, which is a very healthy business model signal.

From an investment perspective, a16z investors have observed that the business model quality of these consumer AI products far exceeds that of traditional consumer products. ChatGPT's top package is $200 per month, and Google's top package for consumer products is $250 per month, a pricing level that was unimaginable in consumer products in the past. More importantly, these companies are raising prices rather than lowering them, which shows that there is a strong demand for high-quality AI products in the market and that supply is still scarce.

Social and connected: new opportunities in the AI era

In my research with a16z investors, I found an interesting point: in the current wave of AI products, we have seen a lot of innovation in information processing (such as ChatGPT), practical tools, and creative expression tools, but there is a relative blank in terms of connection and social interaction. Traditional social networks such as Facebook, Instagram, and Twitter are almost all products from 20 years ago, and the new social experience based on AI has not really appeared. a16z investors believe that this may be because most AI products are developed by research teams that are good at training models, and their experience in consumer products is relatively limited.

One phenomenon that I find particularly interesting is that a16z investors have observed that people are beginning to "confide" more personal information to ChatGPT than to Google. Many people may have used Google for more than a decade, but ChatGPT may already know them better than Google because people actively input more content, provide more context, and share more personal thoughts. This deep collection of personal information opens up new possibilities for future social products: what kind of connection experience would it be if this "personal essence" could be shared with others?

a16z investors noted that we have seen some early signs, such as people asking ChatGPT to write five pros and cons based on their understanding of them, or to create an image that represents their essence, or to make comics about their lives, and then share these on various platforms. This kind of self-expression based on AI understanding is becoming a new social behavior, but it currently mainly occurs on existing social platforms rather than on new AI-native platforms.

Voice interaction may be an important breakthrough for social products in the AI era. a16z investors pointed out that voice is the basic medium for human interaction, but only now has the technology matured to support natural voice interaction. They have seen many products begin to explore voice modes, such as ChatGPT's advanced voice function, which people are using for various useful purposes.

Six mindset changes you must make

Based on research on hundreds of AI companies, six mindsets that must be transformed in the AI era are summarized.

The first mindset shift is: the product is not you. NFX investors emphasize that you should stop tying your self-worth to the product. Release the product, understand how people use it, and then move on to the next thing. Where you are in seven to ten years is the metric, and that is how you measure your life. I have seen too many entrepreneurs delay the release of their products because they are afraid that the product will not be accepted, but in fact, early user feedback is the most valuable resource, which can help you quickly adjust your direction and find the true product market fit.

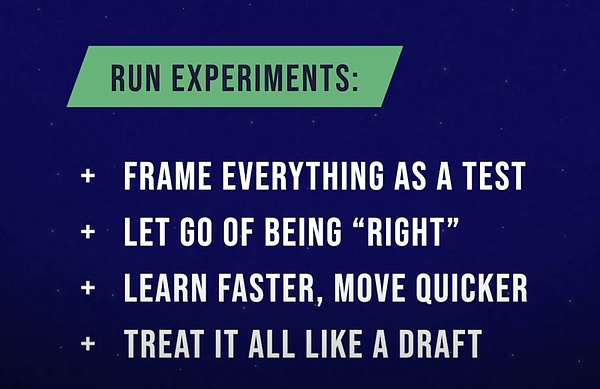

The second mindset is: You are not running a business, you are conducting a series of experiments. NFX investors pointed out that if you have this mentality, things will go much faster. Treat everything you do as a simple test, you will learn more and will not care so much about whether it is correct. This experimental mentality allows you to quickly try and fail, learn quickly, instead of spending a lot of time on perfect planning. Facebook, Google, Airbnb, none of the companies you admire were built from scratch, they all borrowed some things and components from other effective companies and then did it better.

The third mindset is: copy what works. NFX investors emphasize that you don’t get extra points for building from scratch. Your brain is different, your team is different, your moment is different, and the technology you use is different. Don’t worry, just because you are you and in your time, you will eventually get something unique. Don’t be original for the sake of originality, learn for the sake of effect. The smartest entrepreneurs know how to stand on the shoulders of giants and then add their own unique value.

The fourth mindset is: let go earlier. NFX investors sometimes call it the "fuck it moment". By holding on too tightly, you often don't allow the best ideas to emerge. When you let go, when you don't hold so tightly, when you don't always try to be right, the best ideas will emerge, and you will eventually do the right thing. So let go earlier. Perfection is the enemy of excellence, and over-control will hinder innovation.

The fifth mindset is: avoid self-destruction. NFX investors have observed that entrepreneurs are often driven by some fanatical reasons, obsessed with building something in the world, creating something. But behind many of these driving forces, there are some self-destructive tendencies. Be aware of these ways and avoid them. Many times, our biggest enemies are our own fears and limiting beliefs.

The sixth thought is: realize that you are doing this for other people - your employees, your family, your customers. NFX investors pointed out that if for some psychological reason you can't get speed for yourself, or there is some fear that is blocking you, you have to realize that you have a higher mission and you need to do this for them. When you shift your focus from yourself to serving others, many psychological barriers will naturally disappear.

How to get started now

Based on my observations and the advice of NFX investors, there are five specific actions that can immediately bring speed thinking to you and your team. First, redefine what "fast" means with your team. Directly announce that you will adopt a different way of action, a different rhythm, and encourage team members to supervise each other and push each other faster and faster. This is not a one-person battle, but a cultural shift for the entire team. In the successful cases I studied, those teams that can respond quickly to market changes often have this common speed culture.

Second, NFX investors suggest that you release the 80% completed thing today. Get feedback, maybe release it under a different name, a different URL, but do something and get it out there. I've seen too many entrepreneurs wait for the so-called "perfect time", but in reality, an 80% solution released today is much better than a 100% solution released next month. Market feedback will tell you which direction the remaining 20% should go. According to data from a16z investors, companies that can iterate quickly often achieve revenues several times higher than the industry average in the first year.

Third, NFX investors emphasize that you should not over-plan. Release, learn, and iterate quickly. Traditional enterprises may require detailed planning and a long decision-making process, but in the AI era, the market changes too fast, and over-planning often means missed opportunities. A better strategy is to quickly release a basic version and then iterate quickly based on user feedback. The successful companies I have observed, from Mistral to Cursor, have adopted this rapid iteration approach.

Fourth, NFX investors suggest that you treat AI as your co-founder. Treat AI as your colleague. Let it eliminate your bottlenecks and become part of the team. AI is not just a tool, it should be seen as a team member who can work 24/7, without fatigue and without emotions. It can handle a lot of repetitive work, allowing human team members to focus on more creative and strategic tasks. From the cases I studied, companies that deeply integrated AI into their workflows developed products 3-5 times faster on average.

Fifth, NFX investors recommend having someone on your team dedicated to implementing new AI-based systems and having them work on your behalf. Have them spend their weekends and evenings exploring possibilities and implementing a new system every week or two. After 25 weeks, you will have a lot of broken systems, but you will also find some amazing systems that will save you a ton of time and allow you to serve your clients faster. This ongoing exploration and experimentation with technology is key to maintaining a competitive advantage.

Remember, NFX investors emphasize that you don’t always have to feel ready, you don’t always have to be right, but you have to stay in motion. As investors, that’s what they look for in founders – people who are in motion. When the AI window opens for startups, the cost of hesitation will be higher than the cost of failure, because AI has no fear, AI doesn’t hesitate, and that’s the new standard.

New hardware form factors and future opportunities

When discussing the future of the AI era, a16z investors believe that innovation in hardware form factors may bring the next wave of major opportunities. There are currently 7 billion mobile phones in the world, and few devices can achieve this level of popularity. But I have observed some interesting trends: a16z investors have noticed that young people are beginning to wear devices that can record conversations at technology gatherings, and they have found real value in this. This concept of an "always online" AI companion is moving from science fiction to reality.

A16z investors pointed out that AirPods may be the most widely adopted device after mobile phones, which makes me think it has great potential. Although there are some social etiquette issues at present (such as wearing AirPods at dinner is considered impolite), new social norms may develop to adapt to the continuous interaction between AI and us. Imagine that your AI assistant can hear all your conversations, see everything you do, and then tell you: "If you spend 5 more hours a week doing this, you can become a world expert in this field", or "Based on the huge network of users I serve, you should connect with these three people, this person may be your perfect co-founder."

a16z investors are particularly interested in products that can see what's on your screen and take action on your behalf. These products not only provide suggestions, but can actually perform tasks, such as sending emails and scheduling meetings. As agent models become more powerful, this shift from suggestions to actual execution will bring huge value. Instead of passively responding to your requests, future AI assistants will actively observe your behavior patterns, predict your needs, and even prepare solutions before you realize it.

Voice interaction plays a key role in this new form of hardware. a16z investors have observed that voice is fundamental to human interaction, but the technology has only now matured. They have seen companies begin to adopt voice AI on a large scale to replace human customer service, not only in low-risk conversations, but even in sensitive areas such as financial services. This shows that the quality of voice AI has reached a level that can handle critical business conversations.

These hardware and interaction innovations will provide new opportunities for entrepreneurs. Teams that can seize these new forms and new interaction methods are likely to become the next generation of platform-level companies. But the key is still speed - you need to quickly build and occupy the market before these new opportunities are fully recognized and competition intensifies.

The window is closing faster than you think

I must emphasize a harsh reality: NFX investors pointed out that this window closes faster than you think, always. This is not just a motivational speech, this is reality. If you want to create something valuable and interesting in the AI era, you must accept this reality and act accordingly. The data I have seen shows that those companies that caught the AI wave early are pulling away from the latecomers at an unprecedented speed.

Judging from the data from hundreds of companies analyzed by a16z investors, we are indeed in a new era of startup growth. The median enterprise company in our sample reached over $2 million in annual revenue in the first year and raised a Series A just nine months after becoming profitable. Consumer companies performed even better, reaching $4.2 million in annual revenue and raising a Series A in eight months. The growth rate from zero to $1 million in annual revenue that was once considered "best in class" is now at the lower end of the growth we are seeing.

What impressed me even more was that a16z investors observed a widening gap between top performers and average performers. Many breakthrough companies continued to accelerate in their first year, rather than starting to slow down as we often saw in the pre-AI era. This shows that there is a huge demand for excellent products, both for enterprise users and consumers, so it is worth taking the risk.

Of particular note, a16z investors found that consumer companies are now truly profitable businesses. Somewhat surprisingly, B2C revenue benchmarks are surpassing B2B. This is partly because consumer companies are now in a different “shape.” A third of the consumer companies in their sample raised significant funding to train their models, and many saw huge revenue surges after the release of new models. These surges often resemble step function growth, which may plateau before the next release.

While generative AI B2C businesses may have lower paid conversion rates than their pre-AI counterparts, data from a16z investors shows that once users do convert, their retention rates are just as good. This means that while acquiring paying users may require different strategies, once acquired, user value is lasting.

Another interesting phenomenon: B-side enterprises tend to be slow to adopt new technologies, but this situation is changing. The founder of Product Hunt predicts that we will see this situation flipped next year, and enterprise-level AI applications will surpass consumer-level applications in terms of revenue growth. This provides a huge opportunity for entrepreneurs who are now focusing on the enterprise market, but the premise is that they can act quickly and establish a dominant position before the market is fully mature. This point should be paid special attention to for companies going overseas, as the overseas market is still dominated by the B-side enterprise market.

In this new era, if you are still using traditional entrepreneurial thinking and rhythm, if you are still waiting for the "perfect time" or the "perfect product", you may have missed the most important window of opportunity. Entrepreneurship in the AI era is not about waiting, but about action; not about perfection, but about speed; not about avoiding mistakes, but about rapid learning and iteration. Remember, as NFX investors emphasize, in this era, speed is not just an advantage, it is a basic condition for survival.

New model for enterprises to adopt AI: penetration starting from the consumer end

a16z investors have observed an unexpected phenomenon: companies sometimes adopt certain AI products earlier than consumers, which is very different from previous technology diffusion patterns. Taking 11Labs as an example, a16z investors found that the company initially attracted early adopters and consumers who used it to make emoticons, funny video audio and game mods. But then, the company won a large number of corporate contracts and huge corporate customers, covering multiple use cases such as conversational AI and entertainment.

What’s interesting about this model is that corporate buyers now have a strong demand for instructions and AI strategies for using AI tools. They will actively follow Twitter, Reddit, and various AI communications, looking for seemingly random consumer-grade meme products, and then think about how to apply them in their own business. This kind of active learning behavior of corporate decision makers is rare in previous technology waves. Even more surprising is that a16z investors have also discovered a new way to acquire corporate customers: by analyzing Stripe payment data, finding out that a large number of employees within a company are using a certain AI product, and then proactively contacting the company to ask if enterprise-level services are needed.

In the field of music and creativity, a16z investors believe that we are facing a key problem: AI-generated content often appears "mediocre". This is because AI is essentially an averaging machine, while culture should be on the edge and embody uniqueness. The real problem is not AI creators vs human creators, but bad art vs good art. If AI can create works of art of the same quality, people may not care whether the creator is human. But the key is that if you train the model with all the music until the emergence of hip-hop music, it may not be able to infer hip-hop music, because music is the intersection of past music and culture, and culture is crucial to creating new and interesting music.

a16z investors also noticed the evolution of the concepts of moats and defensibility in the AI era. Traditionally, network effects, becoming part of the workflow, and becoming a system of record are all important moats. While these are still important, they found that companies and investments that were examined with moat-first theory did not actually perform as expected. The real winners are often those companies that break the rules, act fast, and have amazing model releases and product iteration speeds. In the early days of AI, speed was the moat, both in terms of distribution (it was difficult to break through the noise) and in terms of product speed, which brought mindshare, which in turn converted into users and traffic, and ultimately into real revenue.

AI's Reshaping of the Creator Economy and the Entertainment Industry

a16z investors have deep insights into the future of the creator economy. They believe that we will see a differentiation between creators and celebrities: one is people like Taylor Swift, whose human experience is important. People not only like her songs, but also resonate with what happens in her life, her stories, her live performances, etc., which AI cannot currently replicate. The other is interest-based creators or celebrities, just like the conversation between ChatGPT and Thomas the Tank Engine that we talked about earlier. In this case, it doesn’t matter whether the person has a real human experience. What matters is whether they can have an interesting conversation or share content around a specific topic.

In terms of video content creation, a16z investors have observed some exciting trends. They noticed that tools such as VEO3 unlocked new creative possibilities, such as videos in the format of street interviews, but the interviewees might be elves, wizards, ghosts, or furry characters that the younger generation likes. This kind of content creation with non-human characters has opened up a whole new form of entertainment. We have seen an explosion of AI influencers, but there are still very few who can truly become top influencers like Xiao Mei Le Ya, which shows that creating excellent AI art still requires a lot of time and skills, just like traditional art creation.

a16z investors particularly emphasized an important point: Although it is easier for anyone to generate art now than before, it still takes a lot of time to make really good AI art. At the AI artist event they held, many artists demonstrated their workflow for making AI movies, which actually took the same amount of time as traditional filming, but these artists may not have had filming skills before, so AI allows them to achieve things that they couldn't do before. This democratization effect will produce a large number of AI talents and human talents, and the best will stand out. The conversion rate may be low, but this is exactly as it should be.

Redefining moats in the AI era

In discussing the defensibility of AI companies, a16z investors made a thought-provoking point. They noted that while all the underlying models may appear to be interchangeable to some extent, which means price pressure, different people use them for different purposes, and these models are actually increasing in price rather than decreasing in price. This shows that even in seemingly commoditized areas, there is still room for differentiation and value creation.

Taking 11Labs as an example, a16z investors observed an interesting network effect. When they made AI-generated videos that needed dubbing, 11Labs had a better model because of its leading edge, more people used the product, making the model better, and accumulated a large library of user-uploaded voices and characters. Therefore, when a very specific voice is needed, such as an ancient mysterious wizard voice, 11Labs may have 25 options, while other platforms may only have 2-3. This data network effect is similar to the network effect of traditional markets, but built on AI capabilities.

a16z investors also observed an important phenomenon: many successful AI companies are experiencing a "Gingerbread Man strategy of Snap." This concept comes from a blog post ten years ago, and the basic idea is "anything Snap can do, Facebook can do better, but Snap will continue to come up with the next innovation." The same is true in the field of AI. The key lies in continuous innovation and rapid iteration, rather than trying to build a one-time moat.

But I think the most important observation is that a16z investors emphasize that distribution and network effects will eventually play out. Snap also has network effects in its own field, with a young user base as a corner of the core messaging platform. In AI products, we have not seen the emergence of true network effects, mainly because most of them are currently creation products, and there is no closed-loop social network of creation-consumption-network effect. But once this closed loop is formed, it will create an extremely powerful competitive advantage.

Redefining "work" in the AI era

When I delved into the data of a16z investors, I realized that we need to redefine what "work" means. In the traditional software era, "work" means that users need to learn the interface, remember the operation steps, and adapt to the software logic. But in the AI era, the real "work" is to directly produce results and value . A16z investors found that the most successful AI applications are not those with the most functions, but those that can most directly complete tasks for users. This is also my point of view - the product must be closed-loop .

I have observed three significant changes: from clicks to conversations, from learning to expression, and from process to results. Users no longer need to click a dozen buttons to complete a report, they only need to say "help me analyze the sales trend of the last quarter." Users no longer need to learn complex software operations, they only need to clearly express their needs. Users no longer care about how the software works, they only care about whether they can get the desired results.

Data from a16z investors shows that this transformation is creating unprecedented business value. Companies that understand this transformation are growing at a rate that traditional software companies can’t imagine. The median revenue of enterprise AI companies reached $2 million in the first year, and consumer AI companies reached $4.2 million. These figures would take 3-5 years to achieve in the traditional software era.

More importantly, a16z investors have found that the retention and expansion rates of AI applications are far higher than those of traditional software. Because when software can truly "work" for users instead of making users "work", users will naturally rely on and trust these tools more . This explains why consumers are willing to pay 4-10 times more for AI products than for traditional software.

What this means for founders

Based on my in-depth analysis of these trends, I believe that the current entrepreneurial environment has put forward three fundamental requirements for founders. The first is a faster pace of financing. Data from a16z investors show that the median time for AI companies to complete Series A financing from the beginning of profitability is 8-9 months, more than twice as fast as traditional companies. This means that founders need to start preparing for financing earlier and prove product-market fit faster.

The second is a new understanding of the gap between "good" and "excellent". A16z investors have observed that while overall standards are rising, top performers are leading by a large margin. Many breakthrough companies not only did not slow down their growth in the first year, but accelerated. This shows that the market has a huge demand for excellent products, and it is worth it for founders to pursue higher goals. At the same time, it also means that if you are not making truly excellent products, it will become extremely difficult to compete.

The third is the fundamental change in the business model. Consumer AI companies are now truly profitable businesses, rather than having to accumulate a large number of users before considering monetization like traditional consumer products. This provides new opportunities for founders, but also requires them to think about how to create real value from the beginning, rather than just gaining user attention.

I would like to emphasize that speed has changed from a competitive advantage to a barrier to entry. NFX investors pointed out that teams that still work at a traditional pace may miss market opportunities because of their slow speed, even if their products are good. In an era where AI is tireless and will not hesitate, human teams must match or even exceed the speed of AI to win in the competition.

From a practical perspective, I suggest that founders re-examine their product development processes. The traditional "plan-develop-test-release" model is too slow, and it needs to shift to a fast cycle of "build-measure-learn". At the same time, AI should be used as a team member, allowing it to take on a lot of repetitive work and unleash the creativity and judgment of the human team.

Ultimately, I think the successful founders will be those who can achieve high velocity while maintaining high quality. This is not an either/or question, but rather a challenge that must be solved simultaneously. As the NFX investor said, velocity compounds, and so does hesitation. The choice is in the hands of the founder.

In this new era, if you are still using traditional entrepreneurial thinking and rhythm, if you are still waiting for the "perfect time" or the "perfect product", you may have missed the most important window of opportunity. Entrepreneurship in the AI era is not about waiting, but about action; not about perfection, but about speed; not about avoiding mistakes, but about rapid learning and iteration. Remember, as NFX investors emphasize, in this era, speed is not just an advantage, it is a basic condition for survival.

My deep thoughts on the nature of entrepreneurship in the AI era

After studying the views of these investors and a large number of cases in depth, I began to think about a deeper question: What we are experiencing is not just a technological upgrade, but a fundamental reconstruction of business civilization. The traditional business world is based on scarcity - time scarcity, talent scarcity, and resource scarcity, and AI is systematically eliminating these scarcities. When content creation, code writing, data analysis, and other tasks that once required a lot of manpower and time can be completed instantly by AI, the logic of value creation will inevitably change fundamentally.

I realized that in this new era, what is truly scarce is no longer execution ability, but judgment and sense of direction. Anyone can let AI generate 10,000 ideas, but those who can identify which ideas are truly valuable will gain a huge advantage. Anyone can let AI write perfect code, but those who can design the right product architecture will dominate the market. This shift from execution-oriented to insight-oriented requires us to rethink the logic of education, training, and even the entire career development.

On a deeper level, I think we are entering an era of the "intention economy". In the past, our economy was based on the exchange of goods and services, and people bought specific products or services. But in the AI era, people are increasingly buying results and experiences. Users don't care how many parameters your AI model has, or how complex your algorithm is, they only care whether you can help them achieve the results they want. This shift from process-oriented to result-oriented will completely reshape the business model of all industries.

I am also thinking about a more philosophical question: When AI can complete more and more "intellectual work", where is the unique value of human beings? My conclusion is that human value will be increasingly concentrated in three dimensions: creative imagination (proposing unprecedented possibilities), emotional connection (establishing sincere interpersonal relationships), and moral judgment (making the right choices in complex situations). These three dimensions are precisely the most difficult for AI to replicate at present, and they are also the abilities that should be focused on in future education and personal development.

Ultimately, I believe we are standing at the most exciting moment of innovation in human history. Just as the Renaissance unleashed human artistic creativity and the Industrial Revolution unleashed human productivity, the AI revolution is unleashing human intellectual creativity. Those who can understand the essence of this unleashing and redesign their way of thinking, working, and even living accordingly will have unprecedented opportunities in this new era. Those who still think about new era problems with the logic of the old era are destined to be left behind by the wheel of history. Speed is not only a requirement for success, but also a necessity for evolution.