The leading cryptocurrency Bitcoin has steadily recovered since dropping to a daily low of $100,424 on 05/06/2025. Despite the recovery bringing some relief to investors, the cryptocurrency continues to struggle to break through the $105,000 price level.

However, on-chain data suggests BTC may be preparing for a price increase with significant liquidation concentration around the $105,000 price zone.

BTC Ready to Surpass $105,000 as On-Chain Indicators Signal Upward Momentum

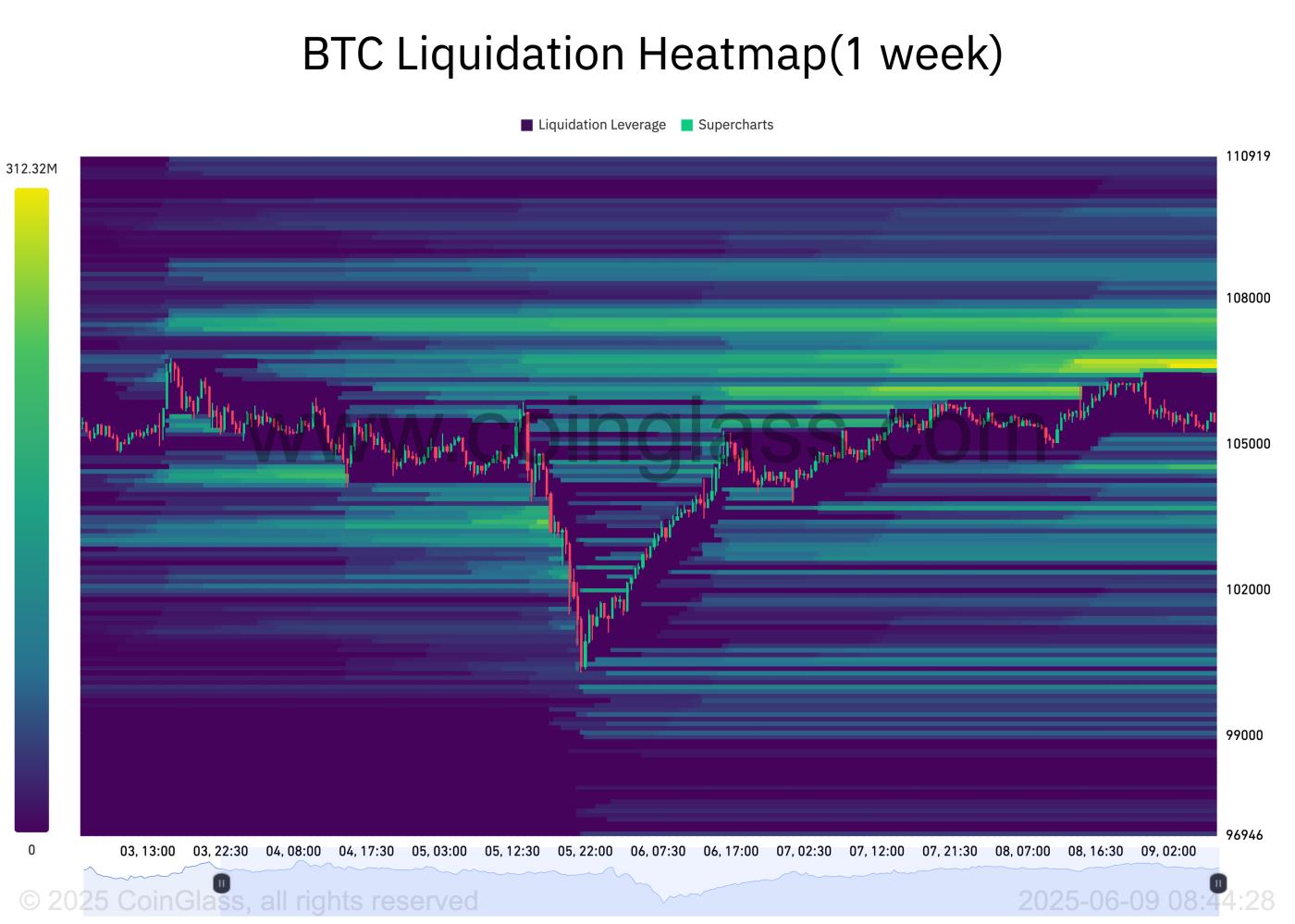

BTC's liquidation heatmap reveals a significant liquidity cluster around the $106,736 price zone. These clusters typically attract Bitcoin buyers, making the potential breakout above $105,000 increasingly likely.

BTC Liquidation Heatmap. Source: Coinglass

BTC Liquidation Heatmap. Source: CoinglassThe liquidation heatmap identifies price levels where a large number of leveraged positions are likely to be liquidated. These maps highlight high liquidity areas, typically color-coded to show intensity, with brighter areas (yellow) representing greater liquidation potential.

These liquidity zones often act as magnets for price action, as the market moves towards them to trigger liquidations and open new positions.

For BTC, the concentration of a large volume of liquidation at the $106,736 price indicates strong trader interest in buying or closing short positions at that level. This opens up an opportunity for BTC to break through the $105,000 resistance and rise to the $106,000 zone.

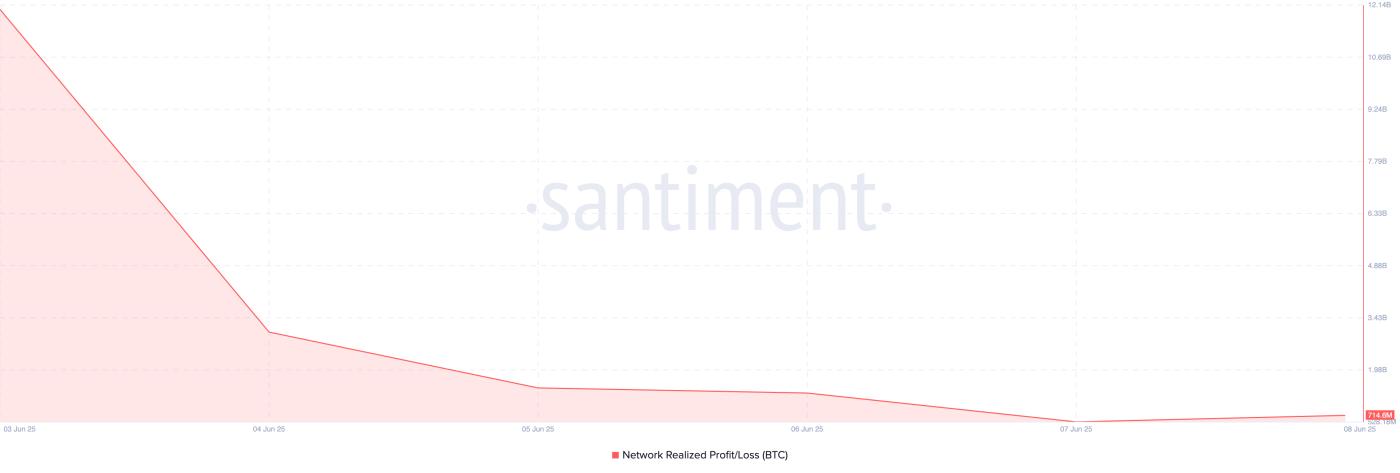

Furthermore, the decline in BTC's Network Realized Profit/Loss (NPL) supports this price increase prospect. At the time of writing, it stands at 715 million, dropping over 90% since 04/06/2025.

BTC's Network Realized Profit/Loss. Source: Santiment

BTC's Network Realized Profit/Loss. Source: SantimentNPL measures the total profit or loss investors realize when moving their coins. Historically, such a decline reduces selling pressure, as traders are less willing to sell their assets at a loss.

This behavior promotes longer holding times, tightens supply, and could potentially push BTC's price higher in the short term.

Bitcoin's Fate Depends on Breaking $106,000 and Adjusting to $103,000

At the time of writing, BTC is trading at $105,630, below the resistance formed at $106,548. With new market demand, it could trigger a breakout above this level and rise to the $106,736 price zone where the liquidity cluster exists.

A break of this level could push BTC's price to $109,310.

BTC Price Analysis. Source: TradingView

BTC Price Analysis. Source: TradingViewHowever, if selling pressure increases significantly, BTC may remain range-bound or face a decline to $103,938.