Written by: Mankun

In the current wave of globalization, Web3 projects are rapidly advancing to the international stage, with Chinese enterprises being an undeniable force. However, the uncertainty of industry policies, lack of legal frameworks, and ambiguous regulatory attitudes in China have made Web3 enterprises hesitant in their development. These factors collectively create compliance challenges for Web3 projects domestically, forcing many practitioners to turn overseas or seek breakthroughs within limited compliance frameworks. Nevertheless, by closely monitoring policy trends and combining favorable policies from different countries, Web3 industries can still potentially find suitable development models by reasonably constructing enterprise compliance frameworks.

Enterprise Overseas Expansion Purposes

(I) Market Opportunities

The global market provides Web3 projects with a broader user base and growth potential. Particularly in regions like Asia and Europe, where blockchain technology and cryptocurrencies have higher user acceptance, this brings more business opportunities and development space for projects.

(II) Regulatory Environment

Different countries have significantly varied regulatory policies for blockchain and cryptocurrencies. Some countries, like Singapore and Hong Kong, have relatively relaxed and friendly regulatory environments, providing greater flexibility and safety for Web3 project operations and development. In contrast, strict regulations in certain countries might limit project development. In some nations, Web3 projects may face legal and compliance challenges. Expanding to countries with more legal-friendly environments can effectively reduce these risks and ensure long-term stable operations.

(III) Talent Acquisition

Web3 is a technology-intensive field where attracting top developers and experts is crucial for project success. By expanding overseas, projects can search and recruit outstanding talent globally, thereby accelerating technological and product innovation and development.

(IV) Funding and Investment

Overseas expansion enables Web3 projects to access more potential investors and funding sources. Especially in regions with active venture capital and cryptocurrency investments, such as the United States or Southeast Asia, projects can more easily obtain financial support and drive rapid development.

(V) Industrial Cluster Effect

Different countries and regions have formed industrial clusters with inherent technological and policy advantages, creating regional supply chains that provide different foundational support for local Web3 enterprises.

(VI) Risk Diversification

Operating in multiple countries can disperse risks, avoiding significant impacts on projects from economic, political, or regulatory changes in a single market, thereby enhancing project risk resistance.

[The translation continues in the same manner for the rest of the text, maintaining the original structure and translating all non-tagged content to English.]Singapore is a leading financial technology hub in Asia, with an advanced technological ecosystem that attracts numerous Web3-related enterprises. The Singaporean government maintains an open attitude towards blockchain and Web3 technologies, establishing clear regulatory policies that help companies develop rapidly while remaining compliant. Singapore's relatively favorable tax system reduces operational costs for Web3 companies, enhancing their attractiveness.

(III) BVI (British Virgin Islands)

BVI is known for its fast, simple company registration process and low registration fees, making it suitable for Web3 startups to establish themselves quickly. BVI provides strict privacy protection policies that safeguard company and shareholder information, which is particularly appropriate for Web3 projects that prioritize privacy. The local legal system is flexible and offers significant tax advantages, making it an ideal choice for offshore registration.

Advantages: Simple structure, easy to manage and control.

Disadvantages: May face relatively high tax burden and lack of risk isolation mechanism.

1. Hong Kong: First 2 million profit tax rate 8.25%, with tax exemption buff from over 50 countries

Advantages: Corporate income tax (profit tax) 8.25%-16.5% (first 2 million HKD profits taxed at half rate), no capital gains tax, no VAT, signed tax agreements with over 50 countries, free foreign exchange, convenient listing and financing;

2. Singapore: 17% tax rate, wide coverage of bilateral tax agreements

Advantages: 17% corporate income tax, tax exemption for first three years, established bilateral tax agreements with 100+ countries, conducive to cross-border tax avoidance;

3. BVI: Zero tax haven, high confidentiality

Advantages: 0 corporate income tax, 0 VAT, 0 capital gains tax, extremely simple company registration process, strong shareholder information confidentiality;

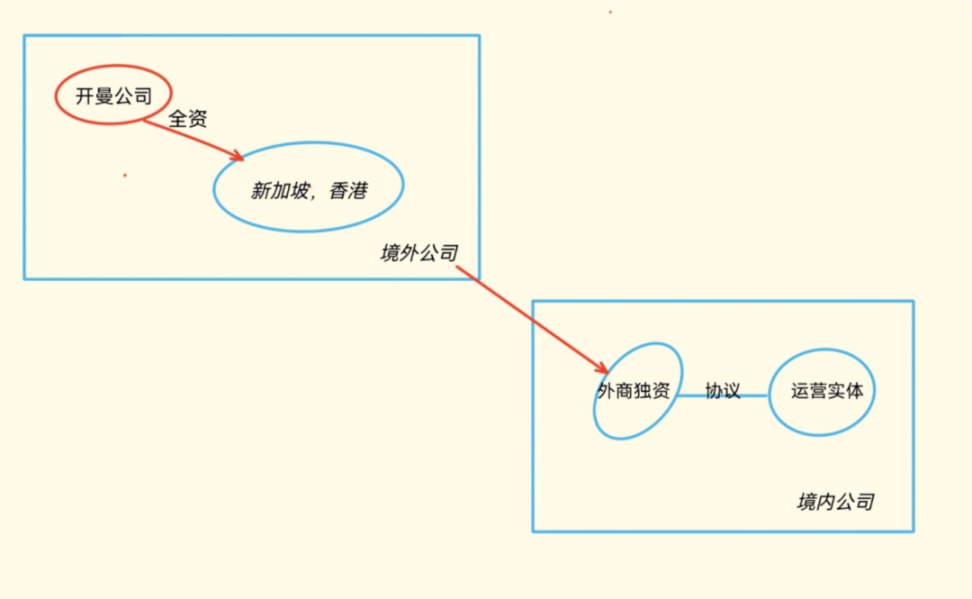

(II) Multi-entity Architecture

By adopting a multi-entity architecture, tax planning can be more effectively implemented. Domestic enterprises establish one or more intermediate holding companies in countries or regions with low tax rates (usually Hong Kong, Singapore, BVI, or Cayman) for investment in target countries. By utilizing the low tax rates and confidentiality of offshore companies, enterprises can reduce overall tax burden, protect corporate information, diversify parent company risks, and provide convenience for future equity restructuring, sale, or listing financing.

Advantages: Can utilize tax incentives from various countries, reduce investment costs, and support global layout.

Disadvantages: Complex management and increased tax compliance costs.

1. Top Layer: High confidentiality + Low tax rate + Free capital circulation

Registration location: Cayman Islands, British Virgin Islands (BVI), and other offshore financial centers

Function: Shareholder and beneficiary information protected by law, avoiding single market risks (dispersing geopolitical impacts).

2. Operational Layer: Connecting top-tier investors with bottom-tier operational entities + Improving investment returns + Profit retention

Registration location selection: Hong Kong/Singapore (trade compliance), Ireland/Netherlands (EU market), Dubai (Middle East market)

Function: Sign double taxation treaties (DTT) to enhance overall investment returns.

3. Actual Operating Company: Business implementation + Direct/Indirect holdings

Registration location selection: Local companies in target markets

Function: Local production, market marketing, localized services, meeting local operation requirements, selecting registration location based on operating projects.

Case: Cross-border E-commerce

Architectural Design:

Holding Layer: BVI Company (confidentiality) + Hong Kong Company (financing and supply chain coordination)

Operational Layer: Hong Kong Company (offshore trade tax exemption) + Dubai Company (Middle East warehousing and logistics)

Entity Layer: Mainland China factory (export tax rebate) + Brazilian subsidiary (localized sales)

By controlling the Hong Kong company through the BVI company and reinvesting in the entity layer, the offshore holding company controls the operating entity companies through a layered structure via VIE agreements.

The BVI company serves as the top-tier holding, with Hong Kong dividends to BVI exempt from withholding tax, future equity transfers exempt from capital gains tax, protecting founders' privacy.

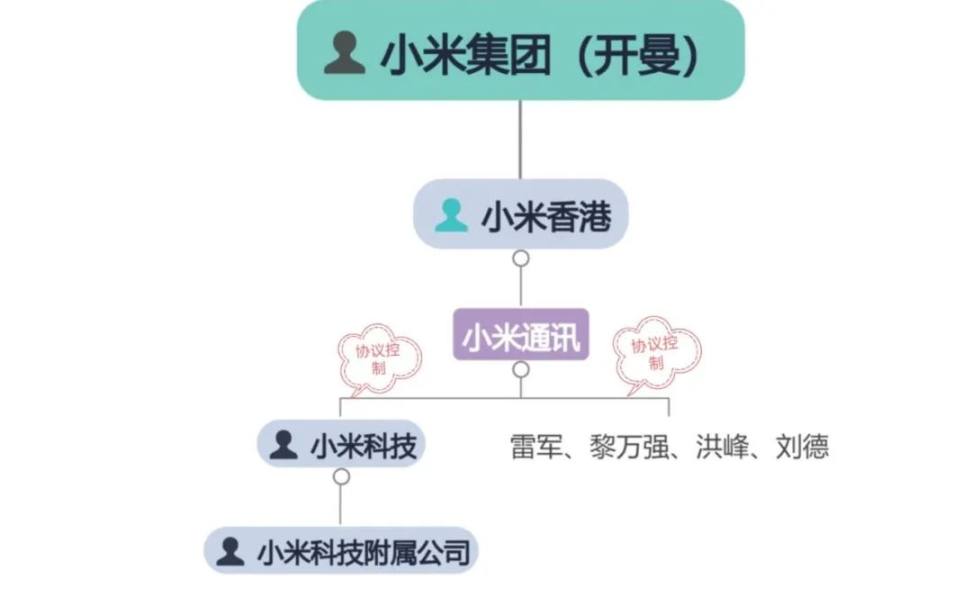

Case: Xiaomi Group

Architectural Design:

Holding Layer: Xiaomi Group (Cayman)

Operational Layer: Xiaomi Hong Kong (global procurement + profit retention)

Entity Layer: Xiaomi Communications (direct consumer facing), Xiaomi Technology and its subsidiaries

Xiaomi Group (Cayman) controls Xiaomi Hong Kong and reinvests in Xiaomi Communications and other entity layers. Xiaomi Communications signs control agreements with Xiaomi Technology and its registered shareholders, controlling Xiaomi Technology through VIE agreements and indirectly controlling its subsidiaries.

Summary

In the context of globalization, Web3 project overseas expansion has become a key strategy for Chinese enterprises to break through domestic regulatory restrictions and explore international markets. Through overseas expansion, enterprises can effectively avoid compliance risks, seize international market opportunities, attract quality resources, and achieve risk diversification. Places like Hong Kong, Singapore, and BVI have become ideal destinations for Web3 enterprises due to their relaxed regulatory environment, tax incentive policies, and comprehensive infrastructure.

In architectural design, enterprises can flexibly choose single-entity, multi-entity, or parallel architectures based on their scale and objectives to ensure compliance and isolate potential risks. By leveraging policy advantages in different regions, enterprises can optimize capital flow through multi-entity architectures, significantly reducing tax burdens.

Looking to the future, as Web3 projects develop globally, enterprises are transitioning from single architectures to hybrid architectures to achieve risk isolation, capital flow, strategic synergy, and tax planning. By establishing multiple entities in different jurisdictions, enterprises can effectively isolate market risks and ensure compliance, while using offshore companies and holding structures to optimize capital flow, reduce tax burdens, and integrate global resources to enhance innovation capabilities and market competitiveness, leveraging global layout for new opportunities brought by blockchain technology.