Written by: Maggie @Foresight Ventures

Between 2024 and 2025, Hyperliquid rose at an astonishing speed, becoming a major liquidity aggregation site on-chain. Its total open interest exceeded $10.1 billion, with USDC locked volume surpassing $3.5 billion. Whales like James Wynn showcased their skills here, leveraging billions of dollars in positions with 40x leverage, driving market sentiment and harvesting liquidity. Meanwhile, the launch of HyperEVM further expanded its ecosystem, attracting multiple innovative projects.

[The rest of the translation follows the same professional and accurate approach, maintaining the original structure and meaning while translating into clear English]HyperLend has established partnerships with multiple DeFi projects, including RedStone, Pyth Network, ThunderHead, Stargate, and Theo Network, enhancing its interoperability and influence within the Hyperliquid ecosystem.

HyperLend launched a points reward program where users can earn points by using the protocol, potentially receiving token airdrops in the future.

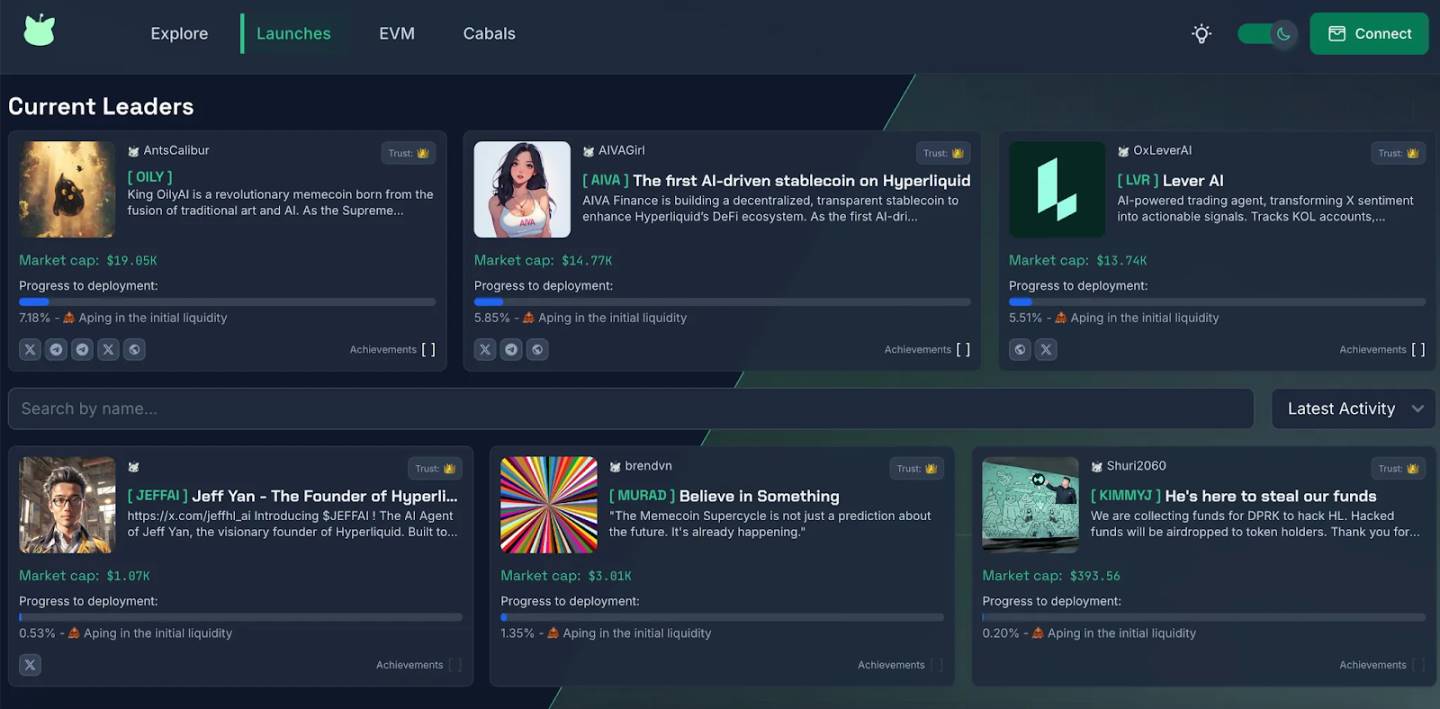

2. Hypurr Fun

Hypurr Fun is a meme launch platform on HyperEVM, providing a Telegram bot and web interface that facilitates quick trading and serves as a major traffic entry point on HyperEVM. Website: https://hypurr.fun/

Key features include:

One-click token issuance and trading: Users can easily issue new tokens and participate in trading through the bot.

Advanced trading tools: Supports TWAP (time-weighted average price), sniping, and portfolio management functions.

Buyback mechanism: All transaction fees will be used to repurchase $HFUN tokens, enhancing their market value.

Community interaction: Provides social features like Whale Chats to promote user communication.

$HFUN is the native token of Hypurr Fun, with a maximum supply of 1 million tokens.

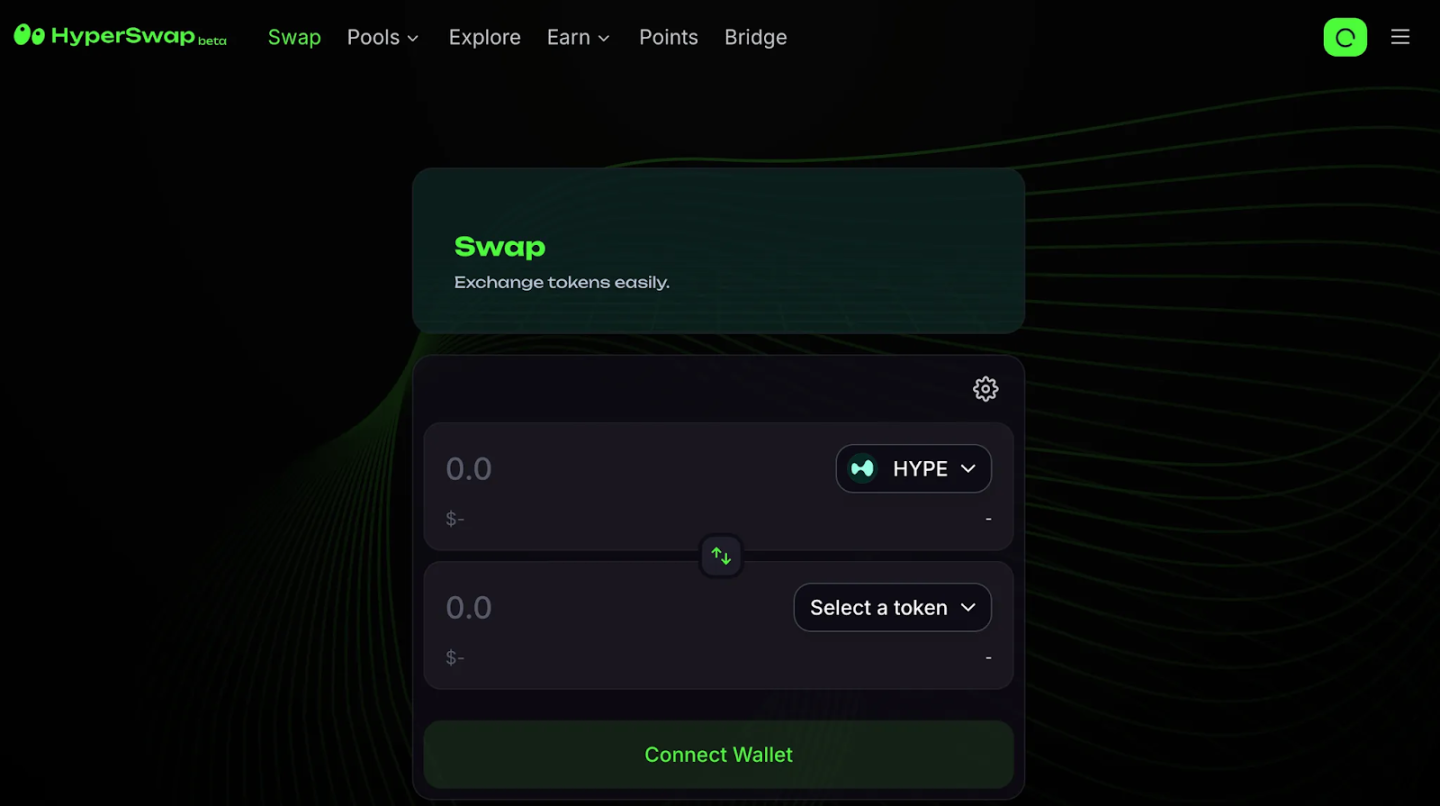

3. HyperSwap

HyperSwap is a low-slippage AMM on HyperEVM.

Main functions include:

Token trading: Supports token exchanges with fast and low-slippage trading experiences.

Liquidity provision: Users can create and manage liquidity pools, earning transaction fees and platform rewards.

Token issuance: Allows users to issue their own tokens in a permissionless environment.

HyperSwap adopts a dual-token model, consisting of $xSWAP (liquidity mining token) and $SWAP (governance and revenue-sharing token). Users obtain $xSWAP by providing liquidity and can convert it to $SWAP to participate in platform governance and revenue distribution.

Additionally, HyperSwap launched a points program where users accumulate points through trading, liquidity provision, and token issuance activities.

Summary

Hyperliquid's rise is the result of multiple factors including technology, products, marketing, and economic models. Its marketing strategy and economic model design are particularly worth learning. However, regulatory pressure and cyclical challenges are two key risks to consider. The HyperEVM ecosystem is in its early stages and developing rapidly.