Author: Tindorr, Crypto KOL

Translated by: Felix, PANews

In just over a year, USDe has grown to become one of the largest crypto dollars, with its supply currently approaching $6 billion and nearing its all-time high.

But this is perhaps not surprising.

Every design choice by Ethena Labs and its founders has focused on building systems that can expand exponentially.

- Building products scalable to billions of dollars by acquiring CEX liquidity.

- Using perpetual contract funding rates as a yield engine: one of the few sources that can maintain yields over 10% annually at a scale of billions of dollars.

- Designing custody methods that allow large capital allocators to hold USDe with confidence. USDe has withstood major liquidation events and the Bybit hack.

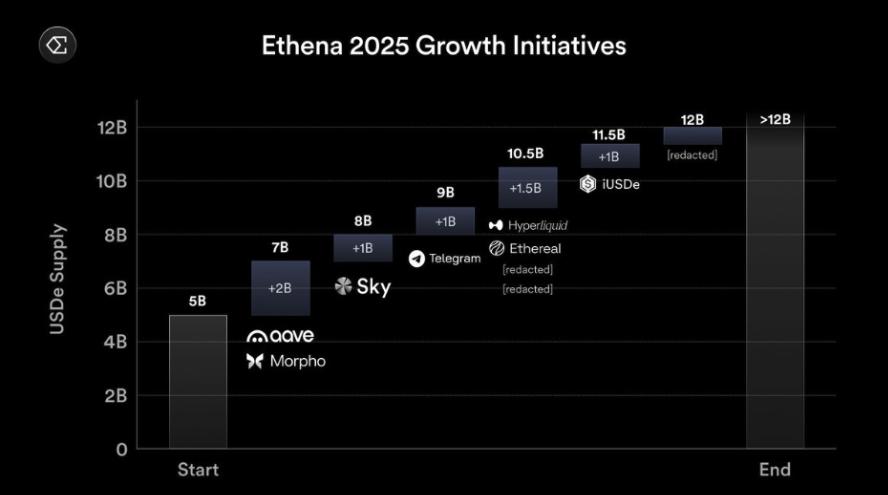

As USDe grows into a blue-chip asset, the team is planning the next phase of product decisions aimed at expanding USDe's scale to tens of billions of dollars, attracting millions of new users, and unlocking new crypto-native and external capital waves.

With basic integrations completed, Ethena is targeting all major stablecoin demand channels in the next growth round.

Ethena plans to target four key areas in the coming years to win market share:

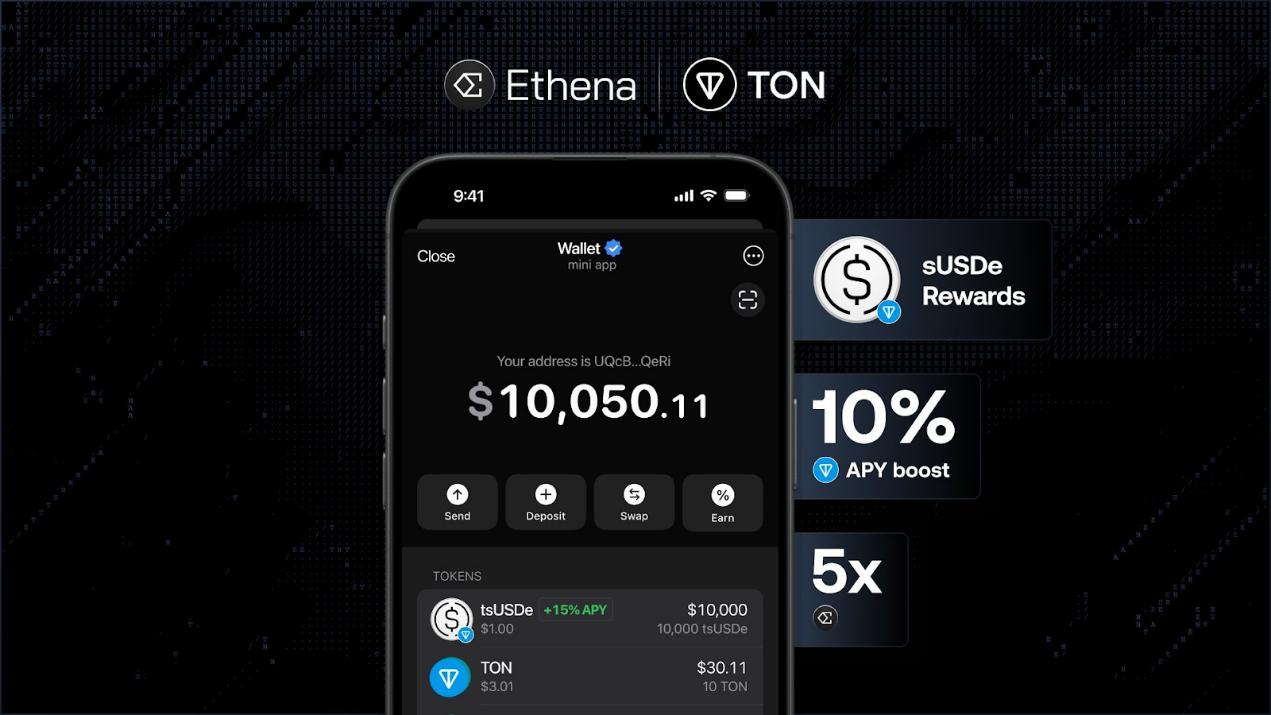

1. Telegram Integration: Unlocking Billions of Users

One of Ethena's most impactful releases to date: directly integrating USDe into the Telegram app with over 1 billion users.

Ethena has partnered with TON, Telegram's official blockchain, to natively deploy USDe and its yield version tsUSDe (TON staked USDe) in Telegram's wallet ecosystem.

For this, Ethena launched a 16-week incentive program with an annualized yield of 18% for tsUSDe, partially funded by the TON Foundation.

Additionally, protocol revenue provides about 8% base yield, with early Telegram users potentially earning double-digit returns.

This integration brings frictionless dollar savings to everyday users, especially in emerging markets where Telegram already has strong penetration: Asia, Africa, and Latin America.

In regions where stable dollar savings tools can be life-changing, Ethena's strategy is simple: interact with users where they already are.

Today, Telegram users can easily acquire USDe, stake it with one click to tsUSDe, and send it to friends as easily as sending a message.

Today, Telegram users can easily acquire USDe, stake it with one click to tsUSDe, and send it to friends as easily as sending a message.

A seamless and familiar user experience can significantly lower the entry barrier for crypto savings, especially for non-DeFi native users.

More importantly, this integration opens a new channel for stablecoin demand: potentially hundreds of millions will use USDe for sending, spending, and saving within Telegram.

By meeting existing users' needs, Ethena can capture a significant portion of stablecoin usage by retail users that previous stablecoin projects overlooked.

This mainstream influence gives Ethena a differentiated advantage in expanding its user base, far beyond the typical DeFi user group.

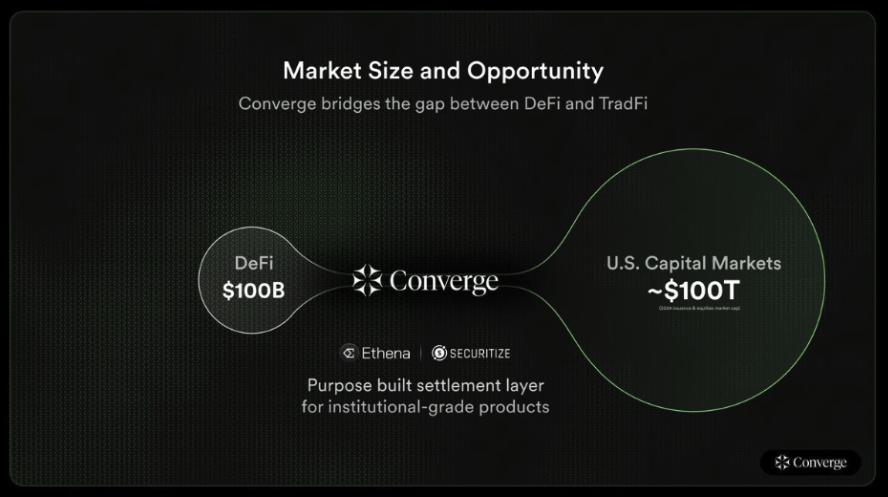

2. Converge: Bringing TradFi On-Chain

Converge is their way of unlocking traditional financial institution potential.

Converge is a new blockchain built in collaboration with Securitize, aimed at bringing TradFi capital on-chain, connecting the worlds of tokenized assets and regulated stablecoins.

Securitize has brought over $2 billion of real-world assets on-chain (clients include BlackRock, Apollo, and KKR), and these tokenized assets (like USDtb) and KYC-supported new stablecoins (iUSDe, an institutional-grade sUSDe) will natively run on Converge.

Ethena believes blockchain has two long-term use cases:

- Settlement for speculation

- Storage and transfer layer for stablecoins and tokenized assets

The second use case may be an even bigger opportunity in the next decade, and Ethena and Securitize have a unique advantage in this area.

Converge aims to bring billions of dollars of TradFi capital on-chain and drive RWA and DeFi fusion.

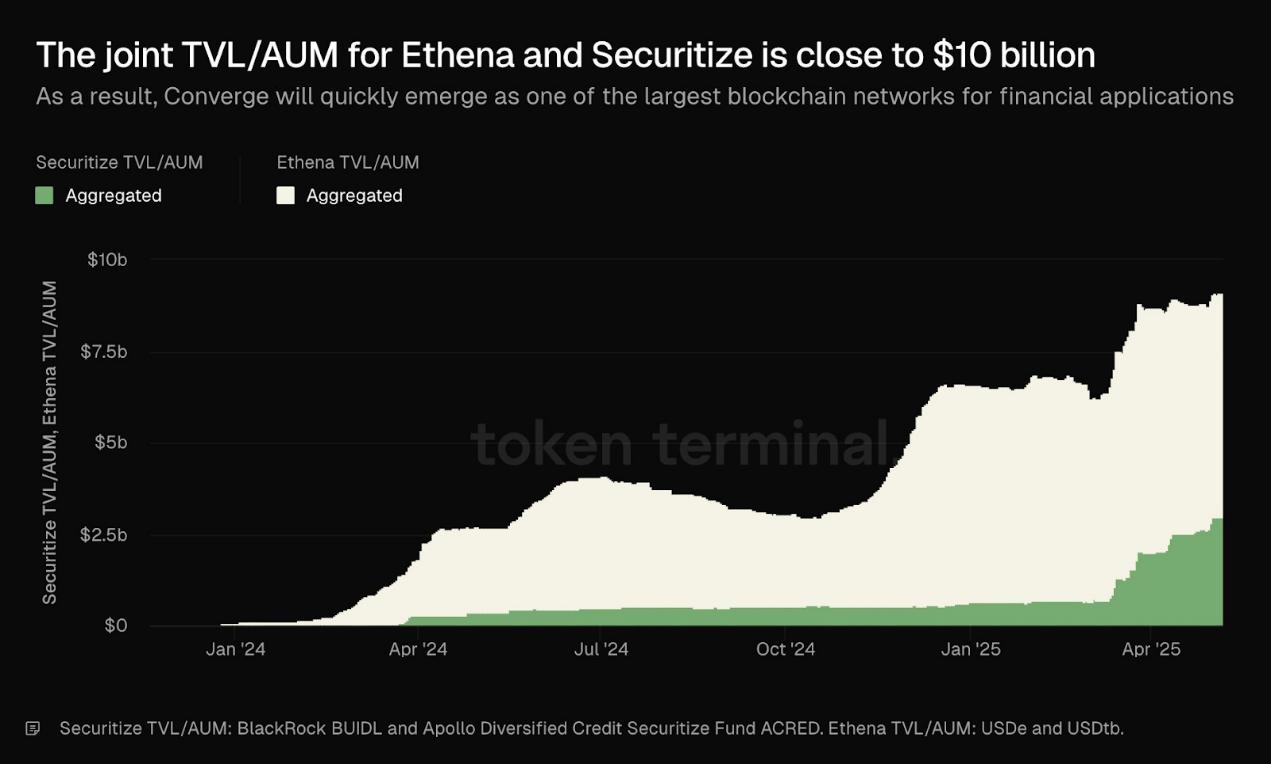

Ethena and Securitize collectively have nearly $10 billion in total value locked/assets under management, making Converge potentially one of the largest blockchain networks.

Every iUSDe issued on Converge or tokenized dollar of real-world assets will ultimately add value to Ethena's ecosystem.

Currently, 5 protocols have committed to supporting by building and distributing institutional-grade DeFi products on Converge:

- Pendle

- Morpho

- Maple

- Ethereal

- Aave

Converge will run on a validator network secured by sENA, requiring $ENA staking.

Operators and delegators can earn protocol fees and ecosystem rewards. This establishes a direct link between institutional trading volume and $ENA holder value appreciation.

With Circle's successful IPO, institutional demand for stablecoins and crypto products is increasingly strong. The key now is to build infrastructure that these institutions can actually interact with compliantly.

Converge is committed to solving this problem, hoping to seize one of the industry's largest opportunities.

3. DeFi Integration Driving Growth

Ethena's foundation is DeFi, and over the past year, it has deeply integrated into the DeFi stack.

Ethena x Pendle x Aave DeFi Stack

Integrations with protocols like Pendle and Aave have been the core driver of $USDe demand and supply expansion.

Ethena's last significant growth was in November 2024, almost entirely driven by two DeFi integrations:

- Providing over $1.2 billion of sUSDe to Aave

- Pendle's peak usage exceeding $2.3 billion

And this growth momentum hasn't slowed down. In just one month, Aave added over $1.5 billion in trading volume for USDe by integrating Pendle's PT tokens, with yields around 8%.

As of now:

- Pendle platform trading volume reaches $2.6 billion

- Aave platform trading volume reaches $2.2 billion

- Spark/Sky platform trading volume reaches $600 million

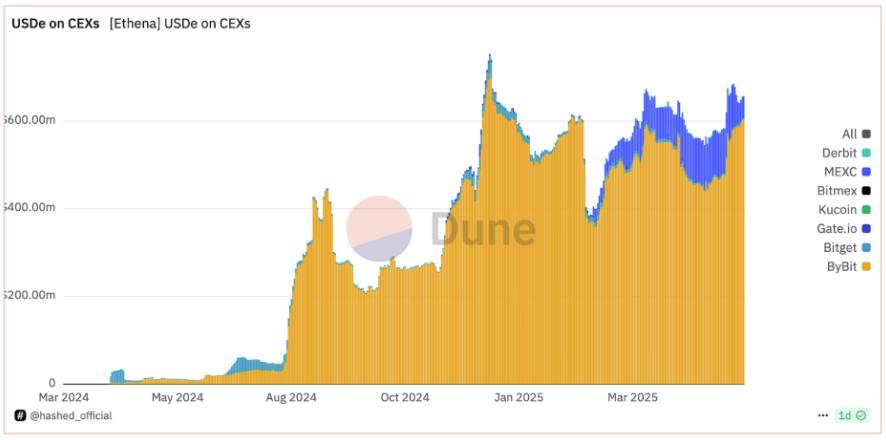

4. Exchange Adoption: Bybit and $6 Billion CEX Opportunity

Another key lever for Ethena's expansion is centralized exchanges (CEX).

Ethena x Bybit: USDe as Margin Collateral

Ethena's first major move was integrating with Bybit, making USDe eligible as margin collateral, with early results being significant.

The Bybit integration went live in May 2024, allowing traders to use USDe as margin and earn yield while trading.

Unlike USDT or USDC (which yield zero), USDe offers an average annual interest rate of 11%, paid daily. Users can offset trading fees or funding rate costs for long positions simply by holding USDe as collateral.

In just a few months, USDe balance on Bybit has surged to over $700 million, surpassing USDC and capturing a significant share of the platform's stablecoin market.

The success at Bybit provides a template for other major exchanges to replicate this model.

CEXs like Binance, OKX, and Kraken hold over $60 billion in stablecoins, but currently USDe only accounts for about 1% of this.

If it can reach Bybit-level shares (10%) on other exchanges, this alone could potentially release 50 to 60 billion dollars of new USDe supply.

To support this initiative, Ethena has collaborated with Chaos Labs and other verification institutions to launch a real-time reserve proof system, publicly verifying USDe's reserve status in real time.

This aims to provide additional confidence to exchanges and users, ensuring USDe's solvency and dollar peg even during market volatility.

USDe's integration with global major exchanges is one of Ethena's largest growth levers.

While these integrations take time, the obvious user benefits will undoubtedly drive adoption. Bybit's success case provides an example for promoting to other exchanges, with each new exchange integration not only adding a new user base for USDe but also bringing Ethena closer to becoming the leading margin token in CEX perpetual contract markets.

Conclusion

With each progress on Ethena's 2025 roadmap, along with its existing DeFi integrations, Ethena's path to becoming a tool driving TradFi, DeFi, and CeFi convergence becomes increasingly clear.

Telegram and Converge attract new users and funds from retail and traditional finance into the crypto space, while DeFi and CEX help USDe become the industry benchmark collateral asset.

Related Reading: Beyond Stablecoins: How Ethena Builds an On-Chain Financial Engine?