This article is a contribution and does not represent the views of ChainCatcher, nor does it constitute investment advice. Please treat it with caution.

Author: bms

When Circle rings the bell on Nasdaq in June 2025, the large-scale adoption of stablecoins will get rid of the label of "proof of concept" for the first time and have real capital market coordinates. As Circle CEO Jeremy Allaire said in TOKEN 2049: "We are moving towards a world where asset flows are as chain-free and borderless as sending emails." Today's multi-chain environment is still like a gateway in the dial-up era: developers patch everywhere to be compatible with various chains, and users jump back and forth between wallets, networks, and gas fees. Web3 assets urgently need an infrastructure upgrade similar to cloud native to Web2 - encapsulating the underlying complexity into a unified abstraction layer so that application innovation is no longer bound by the boundaries of the chain, and the friction caused by multi-chain on asset issuance and application needs to be completely eliminated.

1. Why Web3 assets need a “superconductor” that connects multiple chains

In the past two years, the explosive growth of Layer 2 and application chains has made on-chain assets seem to be "blooming everywhere", but for end users, in the cross-chain financial topology, Web3 assets are not simply facing transfer delays, but a set of overlapping systemic problems:

1. “Multiple constraints” at the capital level

If institutional capital pools want to be deployed simultaneously on networks such as Ethereum, Berachain, and Sonic, they need to repeatedly go through the cycle of "locking → minting → unlocking → re-minting"; each state migration is exposed to gray rhino risks such as bridge contract reentrancy, beacon delay, and final confirmation.

The compliance perspective is even more acute: when a stablecoin or securitized asset is on multiple chains and across multiple jurisdictions, it is often necessary to meet the KYC/AML reports of both the “source of funds” and the “destination of funds”. If an enterprise or individual fails to submit a simultaneous report, the assets may be frozen at best, or even face charges of money laundering. In addition, some countries stipulate that when overseas on-chain assets flow back to the local area, they must be re-included in the local capital account.

2. User experience and developers’ “protocol blindness”

For the C-end, the four steps of "transaction signature → network switching → Gas calculation → waiting for confirmation" essentially expose the internal complexity of the protocol to users; once it crosses the chain, it is necessary to additionally recognize information noise such as "discount of mapped tokens, depth of liquidity on the bridge, and timeliness of the oracle". The result is that the composability of funds is divided and the friction rate between chains increases sharply.

Developers face "three-way coupling damping". When calling multi-chain liquidity, developers need to manually handle asynchronous gas fee replenishment, flash loan rollback boundaries, and Merkle Proof depth differences; even with the help of a universal bridge, they must always pay attention to Router reordering and Sequencer congestion.

Due to different security models, the contract call path presents the paradox of "shortest logic stack ≠ lowest trust stack": the seemingly simple exchange of 2 chains is actually stretched to N + 1 potential attack surfaces.

2. The path to reducing friction of Web3 assets in the multi-chain era

Currently, the industry has formed three ideas around "making assets available anywhere and usable anywhere", each targeting different aspects of inter-chain friction:

Everclear focuses on “netting intent” – it uses the Netting Solver to offset redundant paths locally, helping institutions reduce rebalancing and hedging costs when deploying multiple networks;

Particle Network starts with account abstraction, using Universal Account to unify the identities, signatures, and authorizations of different chains into the same interface, saving users the mental burden of switching wallets and networks back and forth;

One Balance focuses on real-time portfolio + lightweight cross-chain exchange, which aggregates tokens, LP positions and NFTs of each chain into a total asset view, and has built-in native routing to support small-amount chain exchange. The three have their own strengths, but they all still rely on underlying bridging or decentralized liquidity to varying degrees.

Cycle Network, which has recently entered the public eye and was incubated by Yzi Labs and led by Vertex Ventures under Temasek , chose to go one step further: through Verifiable State Aggregation, it aggregates the states of multiple chains into a unified security consensus, allowing "settlement finality" and "liquidity depth" to be brought together at the same time, providing an abstract base similar to "cloud native" for upper-level applications, which can be freely called by the above three categories and even more innovations.

3. What is Cycle Network

3.1 Innovative MultiChain Settlement Layer

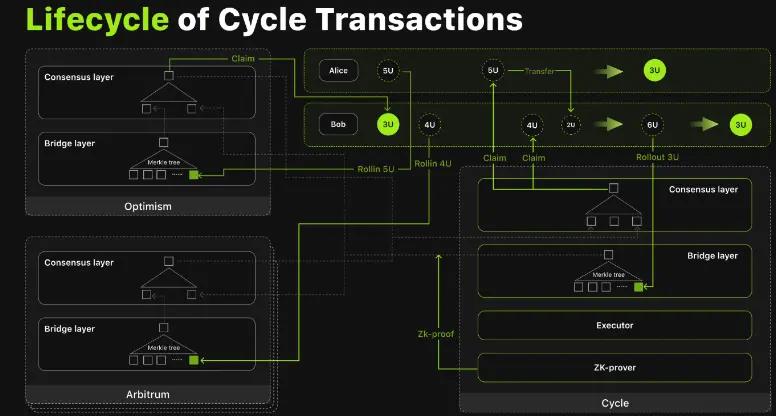

Cycle Network is a "multi-chain settlement layer" designed to eliminate multi-chain friction. Through its self-developed Verifiable State Aggregation technology + Symbiotic security consensus, it aggregates the states of 20+ networks including Ethereum, BNB Chain, Arbitrum, Berachain, Monad, etc. to a unified settlement surface. Users and developers no longer need to rely on traditional cross-chain bridges to call assets on different chains.

3.2 Core Advantages of Cycle Network

The core advantage of Cycle Network lies in "hiding" the complex cross-chain process into the underlying protocol: with the help of Verifiable State Aggregation and Rollin/Rollout API, users only need to sign once to complete asset transfer in any dApp, without having to understand bridges, network switching or gas tokens, thus eliminating the cognitive and operational barriers of traditional cross-chain.

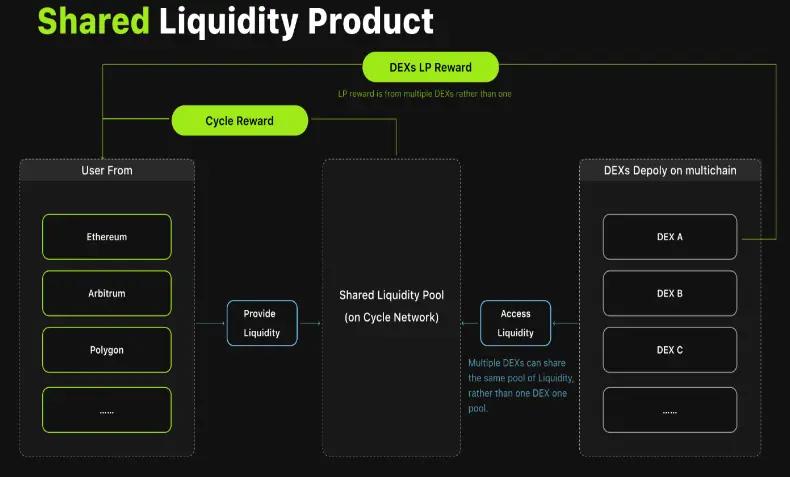

At the same time, Cycle abstracts ETH, BTC, stablecoins and even RWA assets on EVM and non-EVM chains into the same liquidity pool through a unified settlement layer and liquidity routing, enabling free calls to any asset, any chain, allowing developers to combine multi-chain assets like calling an API interface.

Simply put, Cycle is like building a gate at the confluence of multiple rivers - the water flow no longer has to be entangled at the source, just lift the gate and the assets will flow downstream.

3.3 Product Analysis: Simultaneous Development of B-end and C-end

Good news for B-side developers: Chain abstraction SDK is quickly implemented

For developers, Cycle Network has launched Cycle SDK, which is essentially a set of development tools that encapsulates Verifiable State Aggregation capabilities into an easy-to-access set of tools. Developers only need to introduce the Rollin/Rollout module in the contract or server to upgrade the single-chain application to a true chain abstract DApp in ≤ 1 day, without having to hand-write bridge logic or maintain multiple sets of front-end network switching. The SDK has built-in automatic liquidity routing, unified gas estimation and Symbiotic shared security verification, and opens Webhook and Subgraph to facilitate real-time monitoring and risk control of multi-chain transactions in the background.

Actual application scenario cases:

Decentralized Exchange DEX: Utilize the aggregated liquidity of SDK to bring cross-ecological transactions such as ETH — BNB, BTC — wBERA into the same matching pool; the user transaction path is no different from the single-chain experience, but can be automatically split into multi-chain liquidity sources in the background.

Cross-chain lending platform: Developers can call Rollout to pledge assets on one chain and lend stablecoins on another chain. All collateral values and liquidation logic are uniformly verified by the Cycle settlement layer → greatly reducing liquidation delays and price spread risks.

On-chain games: Game studios only need to connect to the SDK once to allow players to use SOL to purchase Bera chain NFT props or use USDC to settle gas. Players perceive it as "direct payment", and the complex multi-chain process is completed in the background.

The popular "goose-raising" game app on TikTok: Golden Goose

Golden Goose is the most representative C-end DeFAI application in the Cycle ecosystem: it writes "chain abstraction + gamification" into a feasible income entry, allowing Web 2 users to obtain on-chain income in one click without switching networks or preparing gas. The platform is divided into Game Mode and Pro Mode: the former packages the income strategy into a goose-raising game, combining the NFT growth system with a circular reinvestment mechanism; the latter integrates structured strategies such as stable spreads, LP mining and loan arbitrage to provide income.

Someone on TikTok described Golden Goose as an automatic dividend-paying "on-chain vending machine": you only need to press a "start" button, and the intricate cross-chain gears behind it will quietly start to work, packaging the liquidity and strategies on multiple chains into profit eggs, which will roll from the shipping port to your hands - you don't need to understand wallets or switch networks, you just need to collect money. (Be aware of the risks)

4. Driving on-chain assets: Cycle Network’s value positioning in stablecoins and RWA

4.1 Why Stablecoins and RWA Become Global Focus

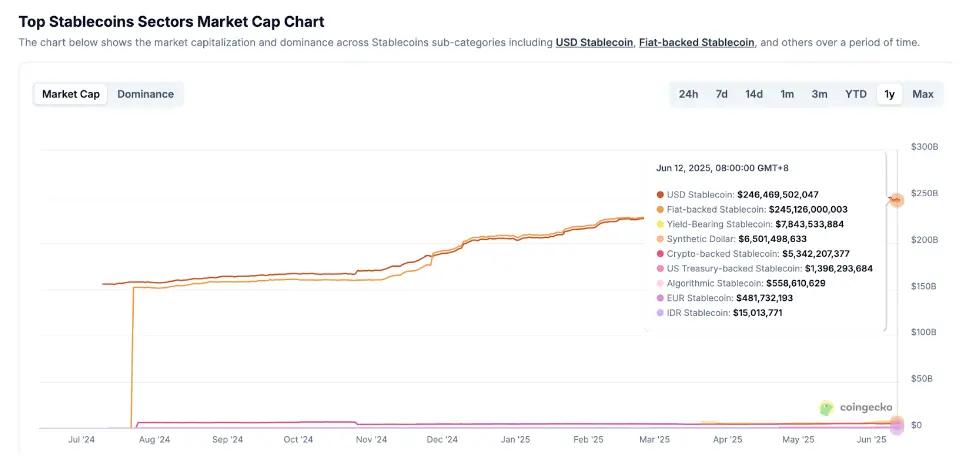

· Risk aversion and liquidity demand: Global macro volatility has intensified, and fiat currency inflation and capital controls have created a rigid demand for USD-denominated, on-chain real-time liquidation assets. According to the latest data from Coingecko, the circulating market value of stablecoins has exceeded 250 B USD.

· Acceleration of asset digitization: Regulatory sandboxes and on-chain settlement pilots are being implemented continuously. Real-world assets such as real estate, accounts receivable, and government bonds are regarded as the most certain track for blockchain implementation.

Cost and transparency advantages: The average transaction fee for on-chain transfers and settlements is an order of magnitude lower than that of traditional cross-border systems, and programmability provides instantly verifiable underlying data for auditing and compliance.

4.2 How does Cycle’s multi-chain settlement mechanism become the infrastructure for stablecoins and RWA?

4.3 From previous “marginal experiments” to specific application scenarios

Multi-chain stablecoin clearing gateway: The issuer can mint USDC on Chain A, and map the same amount of assets to Chain B through the Cycle settlement layer without a bridge, completing merchant payment with zero slippage. For users, the payment path is no different from traditional card payment.

RWA secondary market matching: Assuming that Tokenized treasury bonds are issued on the OP Stack chain, institutional market makers can manage positions on the Berachain side and quote on the Arbitrum side. The underlying net settlement is completed by Cycle aggregation, avoiding the price difference risk caused by bridge delays.

Cross-border salary/supply chain settlement: Companies pay salaries in stablecoins in LATAM, and suppliers pay instantly in local fiat currency in SEA. Through Cycle's automatic path optimization and batch netting, it can save 50%+ in fees and 1-2 working days in arrival time compared to traditional SWIFT.

4.4 Cycle’s long-term impact on the track

The cost curve moves downward: the marginal cost of multi-chain issuance and settlement approaches zero, and the issuance threshold of RWA is significantly lowered.

Improved liquidity depth: Unified liquidity routing reduces fragmentation, and stablecoins and RWA can serve as collateral or payment media on more chains.

Compliance bridge improvement: Standardized APIs and verifiable status proofs provide real-time data interfaces for auditors and regulators, accelerating the formation of compliance frameworks.

5. Growth levers and ecological flywheels: Cycle’s business perspective

5.1 Quantitative Opportunities: From “Niche DeFi” to “Trillion Dollar Real Assets”

DeFi user base: According to DeFiLlama's 2025 data, there are less than 20M active wallets on the entire network chain; if the multi-chain threshold is completely eliminated, referring to the penetration curve of mobile payment from early trial to popularization, it is not an exaggeration to expand exponentially to 100M-150M in five years;

Stablecoin market: The latest total market value has exceeded USD 250 B; if the annual scale of global cross-border payments is USD 150 T (McKinsey, 2024), even if 1% is migrated to the chain, it will be USD 1.5 T of clearable flow for the settlement network;

· RWA potential: The BCG report predicts that the scale of real assets on the chain will reach USD 16 T by 2030; these assets require a secure, low-friction cross-chain liquidity layer.

5.2 Revenue structure: multi-source cash flow rather than single-point game

C-end: For example, Golden Goose has generated more than $200,000 in in-app purchases and strategic revenue in the first two quarters of 2025. With the continuous increase in daily activity and reinvestment rate, this curve is growing the fastest.

B-side: Cycle SDK adopts a hybrid model of subscription + commission on transactions; once more DApps hand over settlement to Cycle, SDK fees and enterprise customization services will bring predictable annual fee income;

Infrastructure: Although the inter-chain settlement fee of Rollin/Rollout starts low, with the simultaneous access of 20+ chains and the daily cross-chain volume increasing to tens of millions or even billions of dollars, its "infrastructure tax" will become the most stable cash flow.

Key points: The revenue side is a three-tier progression of C-end consumption (quick money) + B-end subscription (stable money) + infrastructure taxation (long tail), avoiding reliance on a single hit product or airdrop speculation.

5.3 User Funnel: Let Web2 Flow Naturally to the Chain

Cycle is not "another cross-chain bridge", but makes the logic of the cross-chain bridge into an invisible public base, which makes it a natural lever for superimposing traffic entrances.

The promotion side first achieves exposure through TikTok and X videos, and then uses the "coin wallet installation" landing page to guide the audience into the site. Afterwards, one-click binding and direct fiat currency recharge allow customers to complete account activation; quantifiable KPIs are established at each level of the funnel, so that marketing budgets and product optimization can be accurately iterated, rather than relying on airdrops to attract attention.

When new liquidity is transferred to Cycle through Rollin/Rollout, it not only directly contributes to the handling fee, but also increases the strategy capacity and yield of C-end products; higher returns attract more C-end users and funds, driving the continued expansion of liquidity. At the same time, the profit demonstration will attract developers to adopt Cycle SDK and reuse the same settlement layer in scenarios such as DEX, lending, chain games, and payment gateways - the more developers there are, the higher the capital turnover rate, the lower the handling fee, and the faster the flywheel turns.

6. Liquidity Hub — Injecting liquidity into the underlying settlement layer

Cycle Network announced that it will launch the public beta of Cycle Liquidity Hub this week , opening the underlying liquidity pool to any user holding USDC or USDT. Unlike traditional liquidity mining, which locks funds in a single protocol, funds in Liquidity Hub will be directly injected into Cycle's multi-chain settlement buffer and used as real-time liquidation reserve for Rollin/Rollout.

As of mid-June, Cycle mainnet has secured over 400M USD TVL of funds through Symbiotic’s shared security mechanism, ranking among the top three in the Symbiotic network and becoming one of the core multi-chain settlement networks under its heavy pledge system. This means that the multi-chain liquidity and settlement operations carried by Cycle are running on a high-security foundation supported by real assets.

Key points:

· 30-day liquidity incentives will be launched in the first month of launch, including liquidity mining + token airdrop dual-track rewards;

· Estimated annualized returns exclusively for early liquidity;

The withdrawal experience is the same as ordinary staking - deposit and withdraw at any time;

Participants will receive on-chain certificate NFT, which can be mapped to Cycle ecosystem governance weight later.

This means that Cycle users are not just participants, but also co-builders of the settlement network: your stablecoins not only pursue returns, but also provide deep liquidity for the multi-chain clearing system, directly enhancing the capital efficiency and security redundancy of all DApps.

Conclusion: A key link towards the era of Web 3 for the masses

From the dial-up era to mobile Internet, from check clearing to second-level payment, every reconstruction of infrastructure is an upgrade of the value transmission paradigm. In the world of Web3, the real "popularization storm" is never born from a single protocol or hot narrative, but from the joint evolution of underlying trust and experience.

It is at this juncture that Cycle Network has proposed a new answer: reshaping the interaction paradigm with chain abstraction, breaking liquidity barriers with unified settlement, and building a multi-chain clearing network without bridges based on the vision of "any asset, any chain, one click" - making the flow of value on the chain no longer a technological gamble, but a daily life.

When stablecoins and RWA become the main force of on-chain assets, and when a new generation of users seamlessly access Web3 through games, content, and payments, Cycle not only provides a path, but also becomes a high-speed channel for trust to freely shuttle between multiple chains.

In the future, Web3 applications will no longer ask "which chain is it on?" Instead, they will be used to "it's there," just like we use electricity and the Internet today. And that invisible but powerful value channel is likely to be called Cycle. The cloud-native era on the chain has begun.