- Stablecoin reserves on exchanges have reached $50 billion, signaling a strong increase in liquidation and investors' readiness for the cryptocurrency market.

- USDC leads growth, while macroeconomic factors and regulatory clarity increase the momentum for stablecoin accumulation.

Stablecoin Reserves on Exchanges Reach Peak of $50 Billion

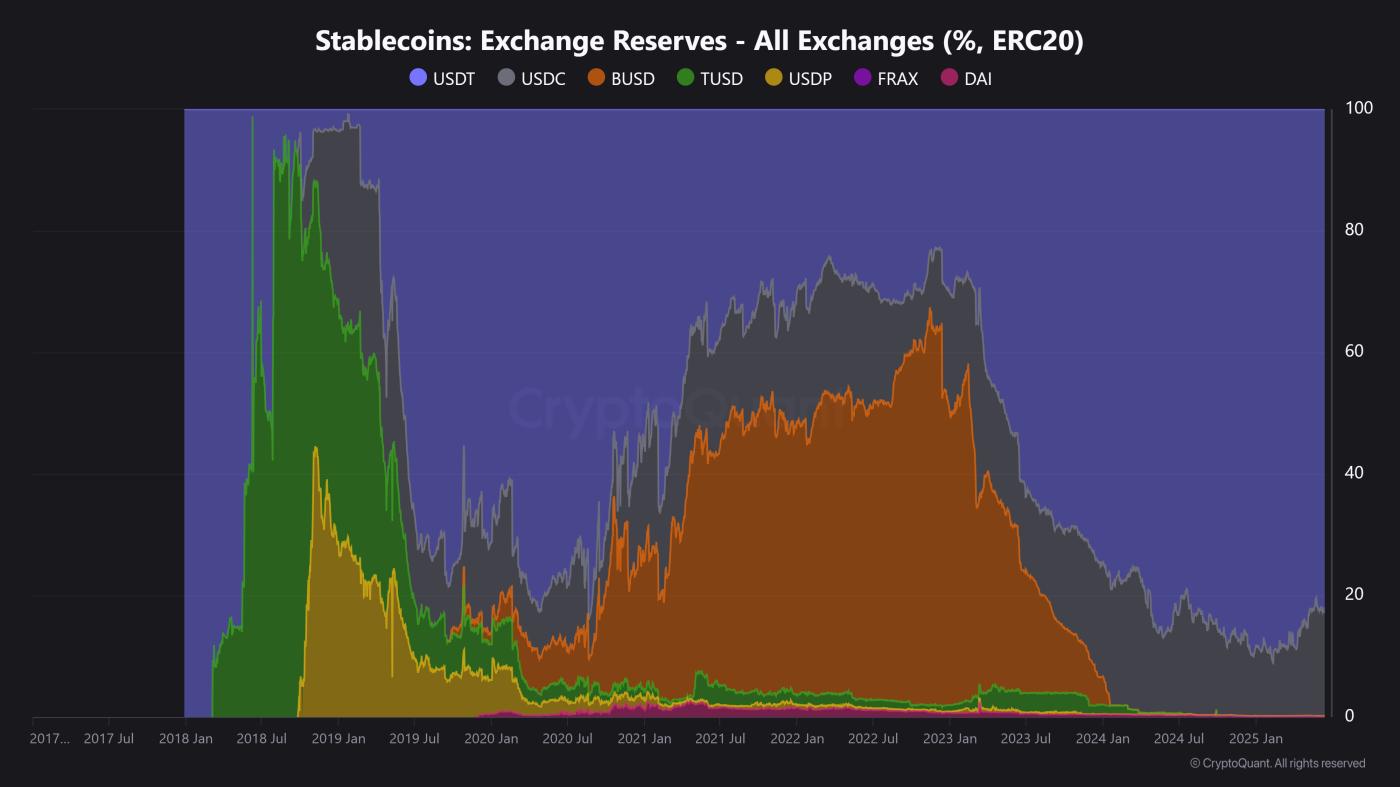

Stablecoin reserves on cryptocurrency exchanges have just set a new record, reaching the $50 billion mark, thereby consolidating strong market confidence and an unprecedented level of liquidation.

According to on-chain data from CryptoQuant, this is the highest reserve level since the stablecoin concept emerged.

The sudden surge reflects investors' preparedness for a new price increase cycle, while opening up prospects for strong growth across all digital assets.

Source: CryptoQuant

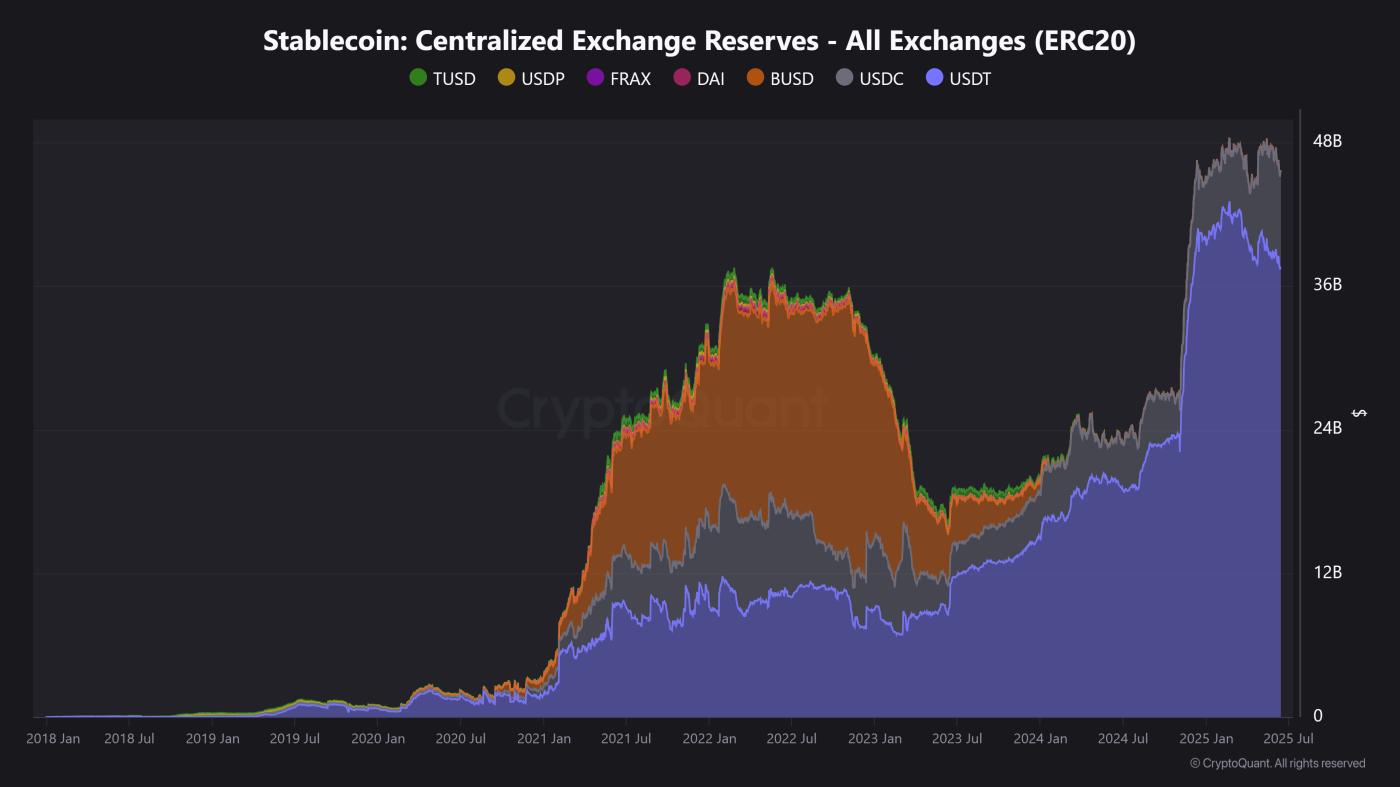

USDC Nearly Doubles Supply on Exchanges

Specifically for USDC — the second-largest stablecoin by market capital — the supply on exchanges has nearly doubled recently.

This significant leap clearly shows the shift in investor cash flow, especially as USDC benefits greatly from connections with traditional financial institutions and U.S. banking system policies.

USDT remains dominant, but USDC's growth signals that the market favors stablecoins with transparent collateralized assets, particularly as the legal framework in the U.S. becomes increasingly clear, building widespread trust.

Source: CryptoQuant

Stablecoin Market Cap Reaches $228 Billion

The total stablecoin market cap now sets a new all-time high at $228 billion — growing 17% YTD thanks to new capital from both large institutions and small individual investors.

The decisive steps of U.S. legislators in perfecting the legal framework for stablecoins are bringing comprehensive positive effects.

The cryptocurrency community is increasingly reassured that USD-pegged stablecoins are recognized as transparent, legal financial assets, an extremely effective risk control tool for strategic capital flows.

Source: CryptoQuant

Macroeconomic Factors Drive Cryptocurrency Accumulation

In the context of increasing geopolitical tensions, investors are increasingly prioritizing cryptocurrencies as a safe value storage tool, especially stablecoins.

The advantages of legal balance, price stability, transparency, and being pegged to USD make stablecoins an inflation shield and an optimal entry point into the cryptocurrency market.

Altcoin Transformation Opportunity Under Stablecoin Stability

The dominance of stablecoins is now very clear, raising a big question: how will this effect spread to altcoins?

As stablecoin reserves on exchanges set a historic peak, the possibility of institutional cash flow strongly entering altcoins is very high, signaling an extremely dynamic capital shift phase about to occur.

It's easy to see that Bitcoin and Ethereum are gradually recovering their status, with large stablecoin volumes always ready to make traders easily switch strategies whenever an opportunity emerges.

The increasingly massive liquidation, market whales gradually accumulating, are all creating the premise for a strong bull run, which might even appear earlier than most expect.