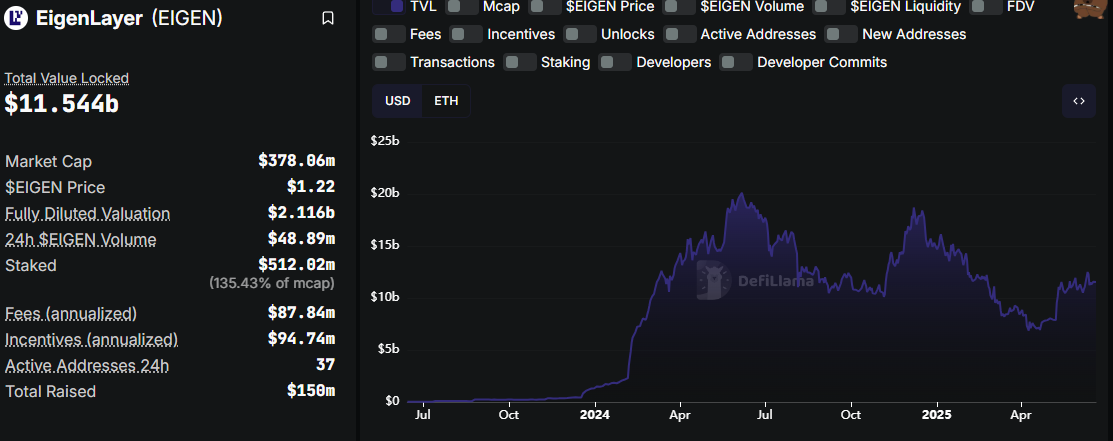

EigenLayer is undoubtedly the most heated track in the crypto world in 2024. Its total locked value (TVL) has skyrocketed from zero to over $11 billion in just a year, like a giant beast breaking into the DeFi enclosure, with a scale large enough to make any veteran protocol take notice.

On June 12, 2025, its founder Sreeram Kannan directly renamed it "EigenCloud", with ambitions targeting Amazon AWS clearly revealed. This move is not just a brand upgrade, but more like a declaration of war, completely igniting the market's long and short confrontation.

With the rise of EigenLayer, top capital like a16z rushed in, throwing hundreds of millions of dollars to endorse its "cloud holy grail" narrative. However, Ethereum founder Vitalik Buterin had already publicly issued a warning, like a prophet in the wilderness, directly pointing out its potential systemic risks. A fierce debate about trust, capital, and risk thus unfolded.

a16z's Billion-Dollar Bet is Just the Beginning

a16z led a $100 million Series B funding round for Eigen Labs, with a clear and grand investment logic: EigenLayer is "decoupling crypto economic security from execution environment", which will release "100x innovation speed". In the grand narrative of capital, this means new projects will no longer struggle for security, they can directly rent Ethereum's trillion-dollar top trust, just like renting a server on AWS. This is a potential trillion-dollar market that would make any venture capital firm's blood boil.

This investment is far from the end. Just three days ago, on June 17, a16z general partner Ali Yahya publicly announced that the institution has additionally invested $70 million in purchasing EIGEN tokens, with a lock-up period. He emphasized: "In the past few years, the EigenLayer team has pioneered a new paradigm for building verifiable and trust-neutral applications." This massive additional investment with a lock-up commitment is undoubtedly the strongest bet on its long-term vision, showing that a16z's confidence remains unshaken by market controversies.

The magic of this "decoupling" is that it allows innovators to focus entirely on application logic without becoming cryptography and economic security experts. Imagine a team wanting to build a decentralized AI model marketplace or a high-performance on-chain game engine. In the past, they would have to issue their own tokens and spend months or even years bootstrapping a billion-dollar validator network for security. Now, they can directly "purchase" security from EigenLayer, switching the startup's "hard mode" to "normal mode" with one click.

With strong capital support, EigenLayer's ecosystem has rapidly expanded. Over 50 Active Validation Services (AVS) projects are being built on it, covering all key areas of the blockchain technology stack, including oracles, cross-chain bridges, data availability (DA) layers, decentralized sequencers, ZK co-processors. Its first flagship AVS project, EigenDA, has attracted integration plans from multiple well-known public chains and L2s such as Celo, Mantle, Fluent, and Movement.

The entire market's sentiment has been completely ignited. Over $11 billion in TVL, most of which rushed in within just a few months, with a growth curve that is extremely rare in DeFi history. This seems to strongly validate capital's judgment, representing the market's absolute confidence in the reStaking track, or rather, a frenzied pursuit of its potential excess returns.

Pulling the Rug: Why Project Parties Are Reluctant to Pay

However, behind the TVL data's surge, a fundamental contradiction begins to emerge: EigenLayer's target customers - those projects needing security guarantees - seem not eager to pay for this "cloud security".

This reflects the common sentiment of project founders, and an ancient maxim in the crypto world: your native token is not just a token, it is everything. For most founders, their native staking system is a carefully designed "money printer" and "central bank", not a "server bill" that can be easily outsourced. It is used to lock token supply, stabilize secondary market prices, gather the most loyal community members, and capture every bit of value created by the protocol - this is the core economic sovereignty.

A deeper analysis reveals that project parties need a self-reinforcing, continuously rolling value flywheel, not an plug-and-play security plugin that causes value to leak out. This flywheel is driven by several key gears:

First is token price management. Staking creates a massive "supply black hole", sucking circulating tokens into long-term lock-up. This directly reduces potential selling pressure and provides solid bottom support for token price. For emerging projects that need to manage massive treasuries and maintain team and investor morale, a stable token price is far more important than saving some security costs.

Second is community and incentive alignment. Staking screens out the most steadfast believers in the community - those willing to lock real money into the protocol, those "diamond hands" who live and die with the project. They are the project's most valuable assets, natural evangelists, governance participants, and ecosystem co-builders. Through staking rewards, project parties are essentially "purchasing" this loyalty and building a powerful network effect.

Finally, and most critically, is protocol value capture. A successful token model must effectively redirect the protocol's generated revenue (such as transaction fees, service fees) back to token holders. Whether through fee distribution or buyback and burn, staking is the best channel to achieve this. It establishes a direct transmission path from protocol fundamentals to token value, allowing holders to share the protocol's growth dividends.

Now, let's re-examine the founders' choices. Path A (embracing EigenLayer) means paying the protocol's most valuable cash flow - which should have been used to incentivize their own token stakers - to external ETH reStakers. This is tantamount to pulling the rug, undermining the native token's core value proposition. Path B (building security system internally) might be difficult to start, but it preserves the project's economic sovereignty, leaving infinite room for future value growth. Faced with the choice between "value outflow" and "controlling the future", most ambitious founders would choose the latter without hesitation.

Vitalik's "Prophecy": Is It Time to Short EigenLayer Now?

As early as May 2023, when EigenLayer's narrative was still confined to white papers and discussions in technical circles, Ethereum's "oracle", Vitalik Buterin, like a far-sighted chess player, placed a chess piece that still echoes on the chessboard.

In his blog post titled "Don't Overload Ethereum's Consensus", although he did not repeatedly name EigenLayer, the risk model he described was widely interpreted by the entire crypto community (including EigenLayer founder Sreeram Kannan himself) as a direct response and warning to the re-staking model. Vitalik's core argument is that Ethereum's "social consensus" - the ultimate arbitration ability determined by the community through off-chain discussions and coordination on how to handle major events (like the The DAO hack) - is its most valuable and fragile asset and must not be abused. He warned that any attempt to use Ethereum's social consensus to "rescue" failed third-party applications would pollute Ethereum's neutrality and could trigger a disaster.

This design reminds some industry observers of Wall Street before the 2008 financial crisis: packaging, dividing, and repackaging the same asset (mortgages) into countless complex financial derivatives (CDO, CDS), and assuming risks were dispersed. However, when the underlying assets encountered problems, the hidden correlation risks suddenly erupted, triggering a systemic chain reaction. EigenLayer's reStaking is essentially a financial "rehypothecation", repeatedly "selling" the security of the same ETH capital to multiple AVS, which undoubtedly increases the system's complexity and vulnerability.

Vitalik's greatest concern is the "Too Big to Fail" risk. He painted a chilling scenario: when one or multiple reStaking-based systems become large enough to absorb a significant proportion of network ETH (such as 20%-30%), and if they collapse due to their own vulnerabilities or attacks, leading to massive slashing of reStaked ETH. At that point, a massive interest group composed of top venture capitalists, whales, and exchanges might pressure the Ethereum community, claiming they would destabilize Ethereum unless a hard fork is implemented to recover their losses. This is precisely the core of Vitalik's warning: do not let application-layer failures hijack Ethereum's entire consensus.

Facing these profound concerns, the EigenLayer team is also responding with practical actions. In June 2024, EigenLayer announced that its "Re-delegation" mechanism has gone live on the testnet. This new feature allows slashed funds to be redirected instead of being directly destroyed, supporting new use cases like lending markets and insurance protocols. This can be seen as a technical evolution of Vitalik's warning: rather than resorting to the "nuclear weapon" of social consensus hard fork during massive slashing, they are building more refined and economically constructive risk management mechanisms at the protocol layer. While this does not completely eliminate systemic risks, it demonstrates EigenLayer's efforts to transform risks from an "uncontrollable social disaster" to a "programmable economic event".

This remarkably prescient article has also sparked discussions about "shorting EigenLayer". Some argue that the higher its TVL, the greater the potential systemic risk, and behind its value growth lies a massive "black swan" risk not yet correctly priced by the market. But is now really the time?

TVL Soaring, Token Withering: Who's Swimming Naked?

An extremely interesting phenomenon is that despite EigenLayer's TVL soaring, its native token EIGEN has performed quite weakly in the secondary market after launch, far from its TVL data's brilliance.

This stark contrast reveals the market's core paradox: EigenLayer's prosperity is largely built on short-term speculative expectations of points, airdrops, and liquid restaking token (LRT) mining, rather than the success of its core business model—AVS payments. Its "cloud" infrastructure is crowded with "farmers" and arbitrageurs seeking high-leverage short-term yields, while its "paying customers" have yet to materialize significantly. In many participants' eyes, this looks more like a massive capital-driven financial game than a solid technological revolution. Its fundamentals have completely decoupled from short-term market sentiment.

Perhaps, as BitMEX founder Arthur Hayes says, should you short EigenLayer? "Absolutely not."

"You can choose not to buy, but don't short. Sentiment premium is the most terrifying accelerant," Hayes' perspective is resounding, directly pointing to the essence of crypto market trading, "In a market driven by capital and narrative, betting against a16z and the entire reStaking ecosystem is like a mantis trying to stop a chariot."

EigenLayer's valuation, in the short term, might not come from AVS service fees, but from the capital market's re-pricing of "next-generation trust infrastructure". Beyond Cosmos' inter-chain security and Polkadot's parallel chains, it offers a third, most flexible shared security paradigm—a story sexy enough in itself.

"Embed this idea in your fool's brain, trade this turd like a hot potato. But don't short—these new species will make shorts lose everything." Hayes' warning might be the most precise annotation of the current EigenLayer long-short game. Before genuine paying customers emerge, it will be a brutal game of narrative, liquidity, and market sentiment. And in this game, seeing the essence is far more important than predicting tops and bottoms.