Author | Wu Blockchain

This article is for information sharing only and does not constitute any investment advice. Readers are requested to strictly comply with local laws and regulations and not participate in illegal financial activities.

Recently, stock tokenization has been widely discussed in the community, with Backed-supported xStocks and Robinhood's model being representative. Comparatively, xStocks' stock tokenization model has more significant openness and composability, allowing ordinary users to trade freely on-chain; while Robinhood, under compliance premises, only opens to EU exchange users with clear regulatory clarity and does not allow transfers to non-compliant addresses. The following will explore these two models through multiple data sets.

Backed and xStocks

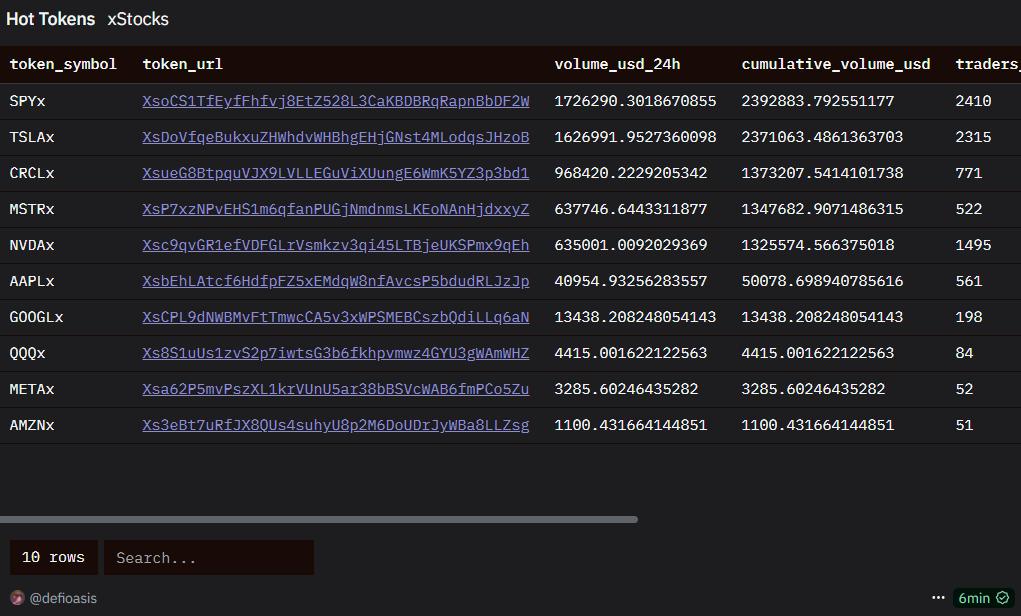

xStocks supports 61 stocks, with 10 already generating trading volume on-chain

Despite being launched only a few days ago, as of July 2nd, SPY, TSLA, CRCL, MSTR, and NVDA have accumulated over $1 million in trading volume. Additionally, AAPL, GOOGL, QQQ, META, and AMZN have also generated user trades. Some meme trading platforms like GMGN have also launched xStocks trading sections.

After being supported by Bybit and Kraken, xStocks stock token trading volume significantly increased

After announcing support from Bybit and Kraken, xStocks trading volume grew significantly for two consecutive days, reaching $6.641 million on July 1st, with over 6.5k trading users and more than 17,800 trades, including TSLA, SPY, and CRCL each exceeding $1 million in daily trading volume.

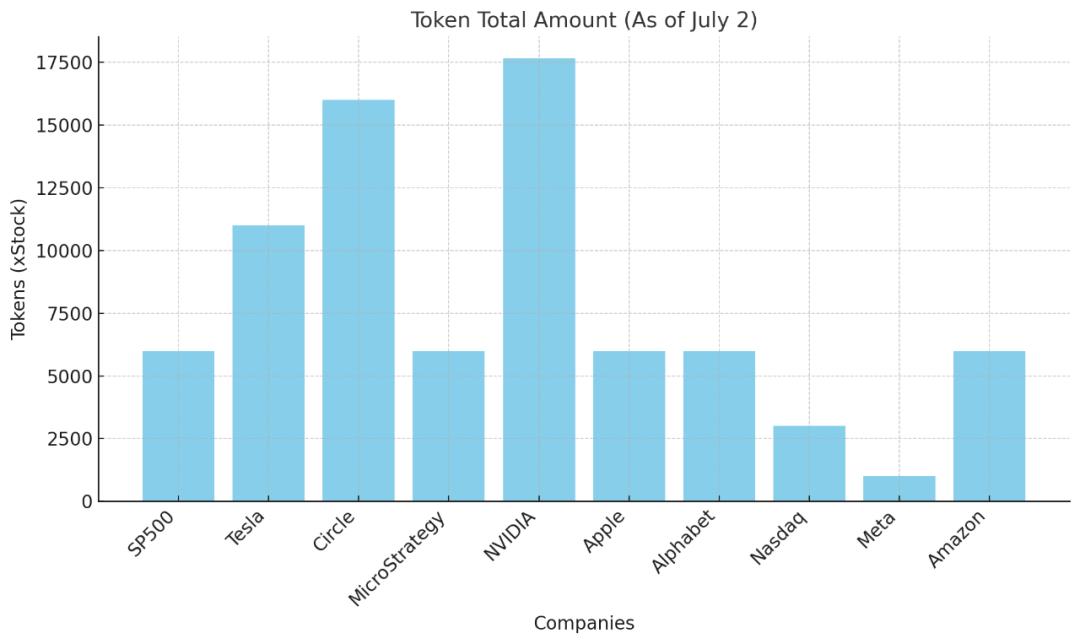

1 Token Anchored to 1 Stock

xStocks follows the logic of 1 token equal to 1 stock, where professional or compliant investors can apply for a Backed Account to purchase stocks through Backed. Backed helps these primary investors purchase stocks from brokers, with purchased stocks custodied by third-party institutions and minting corresponding token quantities through xStocks. Backed Account holders can issue and redeem stock tokens anytime. Currently, among the 10 traded xStocks stock tokens, NVIDIA, Circle, and Tesla stock tokens have the highest total supply, each exceeding 10,000 tokens.

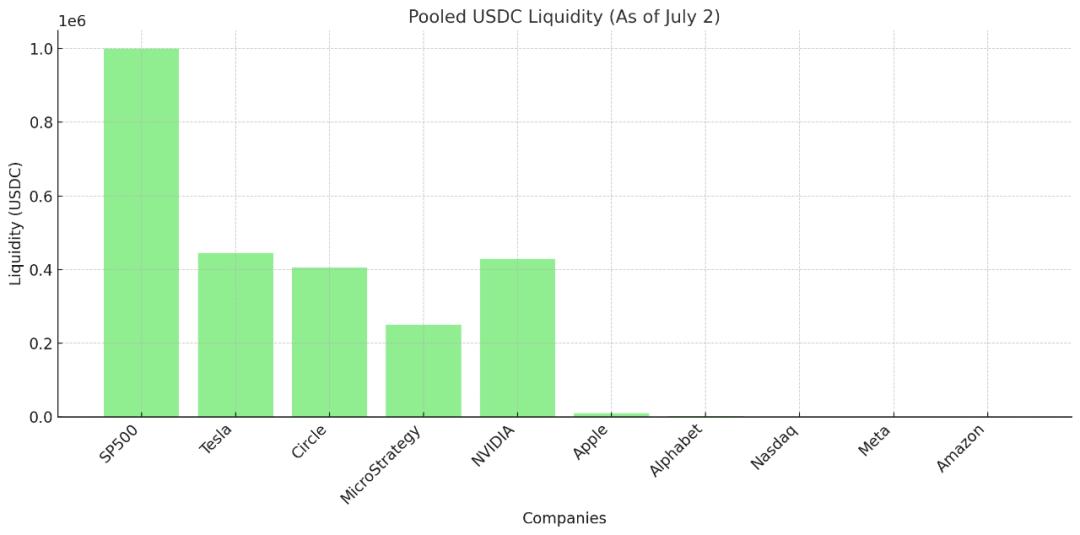

Liquidity Depends on Exchange Market Makers

While stock token issuance rights are concentrated in professional primary investors' hands, the question of liquidity provision remains. xStocks' collaboration with exchanges is significant not only for stock token distribution channels but also for involving exchanges in primary issuance, utilizing exchange market maker resources to provide better liquidity. Trading activity and pool depth are mutually reinforcing, with more active trading attracting more liquidity providers. Particularly, the S&P 500 (SPY) on-chain USDC liquidity has reached $1 million, exceeding the currently issued stock token market value. However, stocks with lower trading volumes face the awkward situation of no liquidity providers.

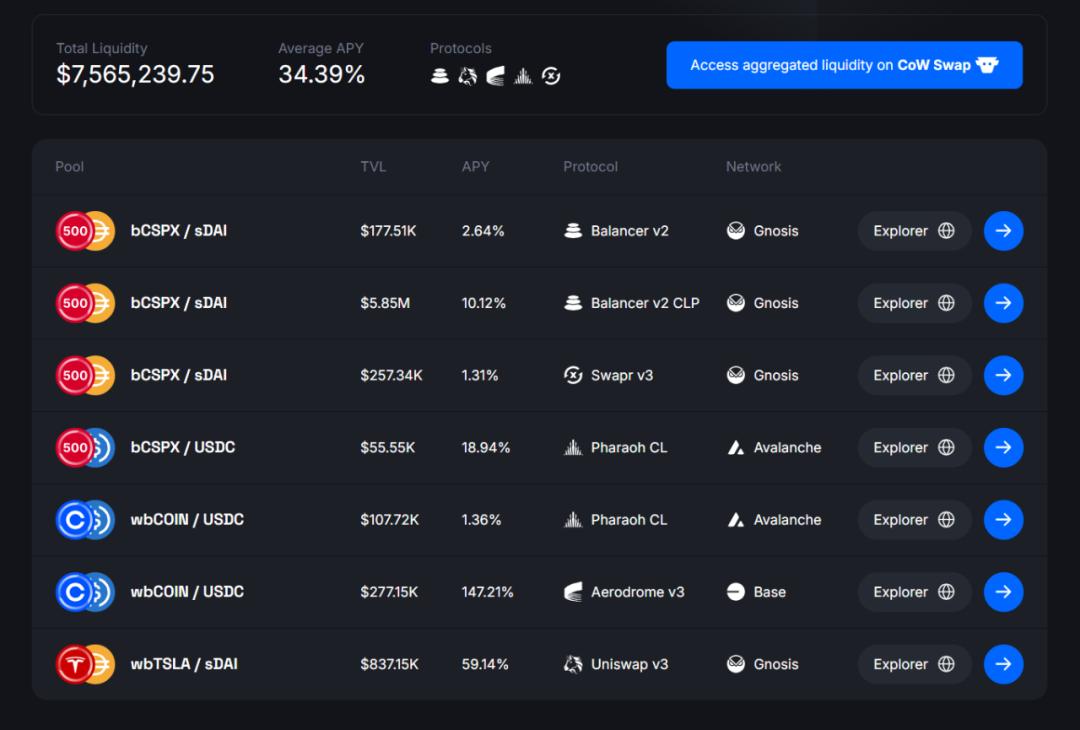

Using Third-Party DeFi Protocol Tokens to Guide and Incentivize Retail Investors' Stock Token Liquidity

xStocks stock tokens issued on Solana should potentially reference bStocks issued on EVM networks, also supported by Backed, by collaborating with public chains and mainstream DEXs, using third-party protocol tokens to incentivize and guide stock token liquidity. Currently, xStocks is actively collaborating with Solana DeFi protocols, including DEX aggregator Jupiter and lending protocol Kamino.

Robinhood Stock Tokenization

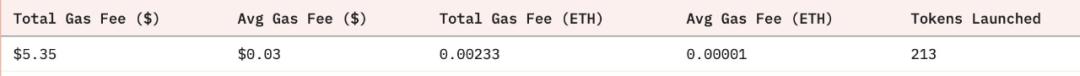

Robinhood: Deployer Has Deployed 213 Tokens or Is Testing Stock Tokens

Robinhood chose Arbitrum to issue its stock tokens, deploying 213 stock tokens at a cost of just $5.35, averaging $0.03 per token. Low transaction fees are a key factor in Robinhood's Arbitrum selection. Subsequently, Robinhood will develop its proprietary Robinhood Chain based on Arbitrum.

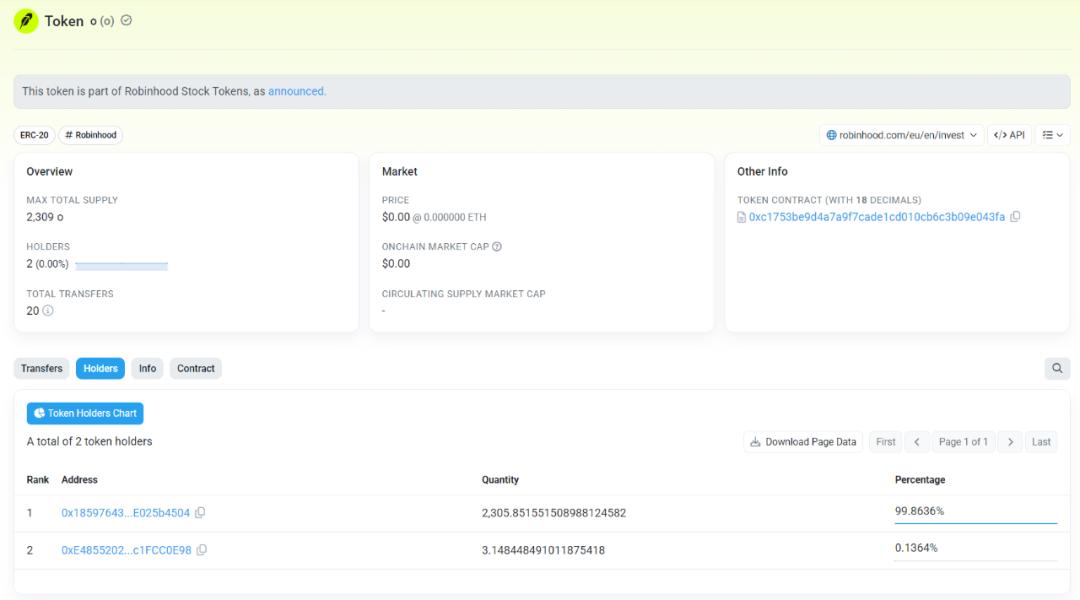

Robinhood Has Minted 2,309 OpenAI (o) Tokens

Robinhood announced that Robinhood EU will launch the world's first non-listed company stock tokens, including OpenAI and SpaceX tokens. Making Crypto a pre-market platform for high-potential non-listed company stocks is undoubtedly the most exciting aspect of Robinhood's stock tokenization. In the future, Crypto users might access and purchase stocks about to go public earlier than traditional stock market investors. Currently, Robinhood has minted 2,309 OpenAI (o) tokens.

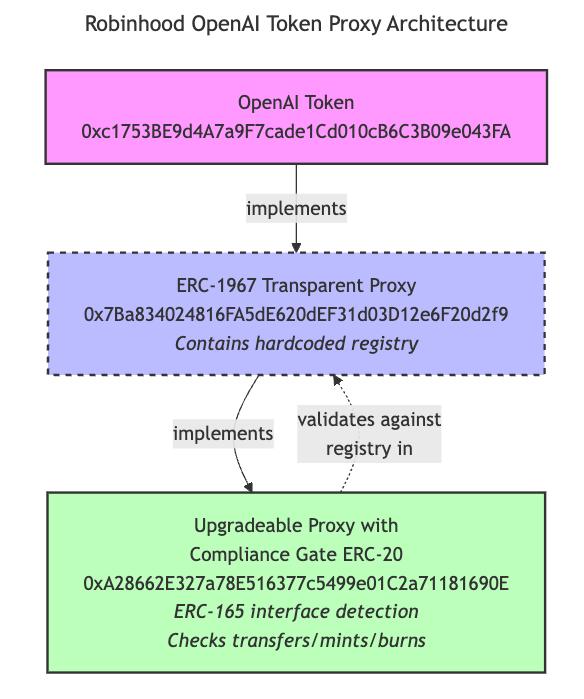

Robinhood's Stock Token Contract Embeds Compliance Requirements

Electric Capital researcher Ren, after reverse-engineering Robinhood's stock token contract, discovered it's a closed system where each transfer requires checking an approved wallet registry (KYC/AML). These tokens may not interact with DeFi, but CeFi with distribution functions might benefit. Even EU users purchasing stocks on-chain cannot transfer stock tokens to non-registered list addresses, and such transfers will be blocked.

79 Stock Tokens Have Set Metadata, Upcoming Launch

Besides OpenAI, Robinhood-related addresses have set metadata for 79 deployed stock tokens, including Robinhood Markets, Trump Media & Technology Group, GameStop stocks, and ETFs like Schwab US Dividend Equity ETF and Yieldmax MSTR Option Income Strategy. Some stock tokens with set metadata have undergone minimal minting.