summary

Blockchain technology is the underlying architecture of stablecoins and RWA. As the underlying architecture of Web3.0, blockchain realizes the three characteristics of openness, transparency, decentralization and immutability through the block structure of hash links (each block contains the hash value of the previous block), and realizes on-chain functions in combination with smart contracts. Stablecoins and RWA are inseparable from the characteristics of the underlying architecture of blockchain - stablecoins are anchored by legal currency/treasury bonds, etc., and rely on blockchain smart contracts to achieve 1:1 asset mapping, becoming a value bridge connecting traditional finance and Web3.0. Traditional payment infrastructure such as SWIFT emerged in the pre-Internet era, ensuring security but low efficiency; while stablecoins based on blockchain have significant efficiency and cost advantages on the basis of security. In addition, RWA (real world assets) also use blockchain to tokenize physical assets such as bonds to improve liquidity and transaction transparency.

There are advantages to deploying stablecoins on the Internet. We believe that the popularization of stablecoins will have limited impact on existing businesses such as WeChat Pay. Domestic third-party payments (WeChat Pay MAU exceeds 1.1 billion, Alipay MAU reaches 900 million) are essentially a "quasi-stablecoin" mechanism anchored to the RMB, relying on legal reserves to ensure currency stability, and domestic fees are as low as a few thousandths (such as WeChat online payment commission of 0.6%), which is much better than overseas platforms of a few percent (such as PayPal). Therefore, we believe that under the current efficient and low-cost mature third-party payment system, the necessity for independent blockchain stablecoins to be popularized in China is not high, so the impact on existing businesses is limited. On the other hand, Internet companies related to cross-border payments (with cross-border commodity/service transaction behaviors) are more actively deploying the field of stablecoins, such as JD.com and Ant Financial. Overseas companies such as Amazon have also explored this. We believe that Internet companies have advantages in the layout of stablecoins: 1) User scenarios: Amazon and other companies have hundreds of millions of users and mature payment scenarios (such as cross-border e-commerce), and can quickly promote the application of stablecoins; 2) Technical capabilities: Internet companies have technical research and development capabilities; 3) Ecological synergy: The closed loop of B-end (supply chain) + C-end (retail payment) can enhance the network effect of stablecoins.

Stablecoins can also reversely expand the influence of the Web3.0 ecosystem. From another perspective, as a value anchor for DeFi lending, trading, and liquidity, the market growth of stablecoins may attract compliant stablecoins to enter the chain (according to DeFi Llama, the current DeFi TVL has exceeded 100 billion US dollars), introducing large-scale incremental liquidity to the Web3.0 ecosystem and promoting the prosperity of the DeFi ecosystem. In addition, stablecoins are not only the value anchor of DeFi, but also can realize automated returns through the programmability of smart contracts, which is difficult to achieve in traditional finance; at the same time, the synergy between stablecoins and RWA (such as real estate and sovereign debt tokenization) can also continue to broaden the DeFi asset category and bring incremental liquidity to connect to traditional financial markets.

Blockchain: The infrastructure cornerstone of stablecoins

Stablecoin innovation based on blockchain infrastructure

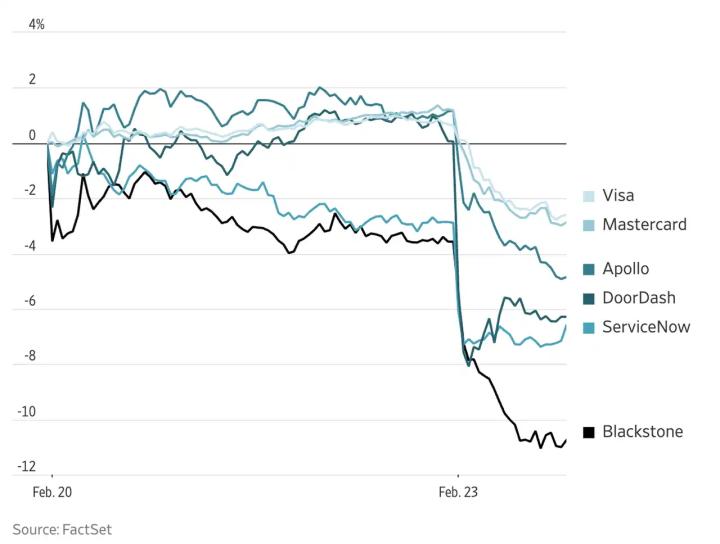

Blockchain: Achieving strong security with decentralized "ledgers". Tracing the underlying structure of stablecoins and RWA, we inevitably have to discuss blockchain - from the principle of data structure, blockchain is a chain composed of blocks connected together, each block stores certain information and is connected in the order of their generation. Each block contains the hash value of the previous block to ensure the accuracy of the connection. Compared with traditional networks, the core characteristics of blockchain are: openness, transparency, decentralization and immutability (security) - 1) The entire chain is stored in all nodes, and the servers in the system provide storage space and computing power support for the entire blockchain system, and all nodes can see the information on the chain. 2) Any network node on the blockchain stores the same data, and any node's modification of the data on the block (such as transaction information) requires more than half of the nodes to confirm and agree, and once the information changes, everyone else on the chain will know. Therefore, it is quite difficult to tamper with the information in the blockchain. In theory, the more nodes there are, the higher the degree of decentralization and the security of the blockchain. In addition, the blockchain is equipped with "smart contracts" that execute programs under specific conditions to achieve consensus among participants. The essence of a smart contract is a collection of codes (with characteristics such as automation, irreversibility, and code transparency). All parties digitally sign contracts to allow and maintain their operation, which is used to automatically complete certain specific functions (such as transactions, etc.). Therefore, smart contracts represent the consensus of all participants on the chain (if you do not agree, you should not join).

Over the years, blockchain technology has been continuously iterating to adapt to the development of the Web3.0 ecosystem. From the initial Bitcoin, which only supported the basic ledger function using the PoW mechanism and a low transaction rate (7 TPS, TPS: the number of payments processed per second), to 2014, Ethereum achieved programmability through smart contracts and virtual machines (15-45 TPS). Faced with performance bottlenecks, after 2018, the third-generation public chains (such as EOS and Solana) adopted new consensus mechanisms (such as DPoS/PoS/PoH) and sharding concepts to push throughput to thousands of TPS, and Ethereum also switched from PoW to PoS mechanism. At the same time, in order to further achieve capacity expansion, two ideas emerged: side chain (such as Polygon) technology provides independent and efficient expansion space through two-way anchoring; Layer 2 expansion technology (such as Rollup) that emerged to solve the congestion of the mainnet uses off-chain batch verification to increase TPS to 2000+. After 2021, a new paradigm of blockchain will emerge, and the latest modular/featured public chains (such as Aptos and Sui) will theoretically achieve a leap of more than 100,000 TPS through innovative programming languages (Move), parallel execution engines and zero-knowledge proof lightweight design.

Figure 1: How blocks are connected in a blockchain (each block contains the hash value of the previous block)

Source: Shermin Voshmgir, "Token Economy: How the Web3 reinvents the Internet" (2020), CICC Research Department

Figure 2: Development of public chain technology

Source: Tencent Cloud Developer Community, Qubi.com, ProcessOn, CICC Research Department

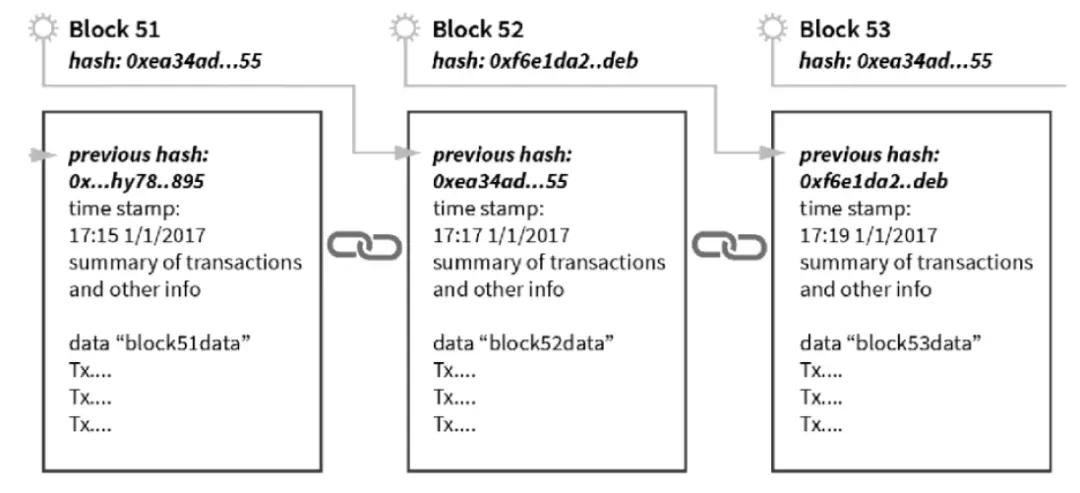

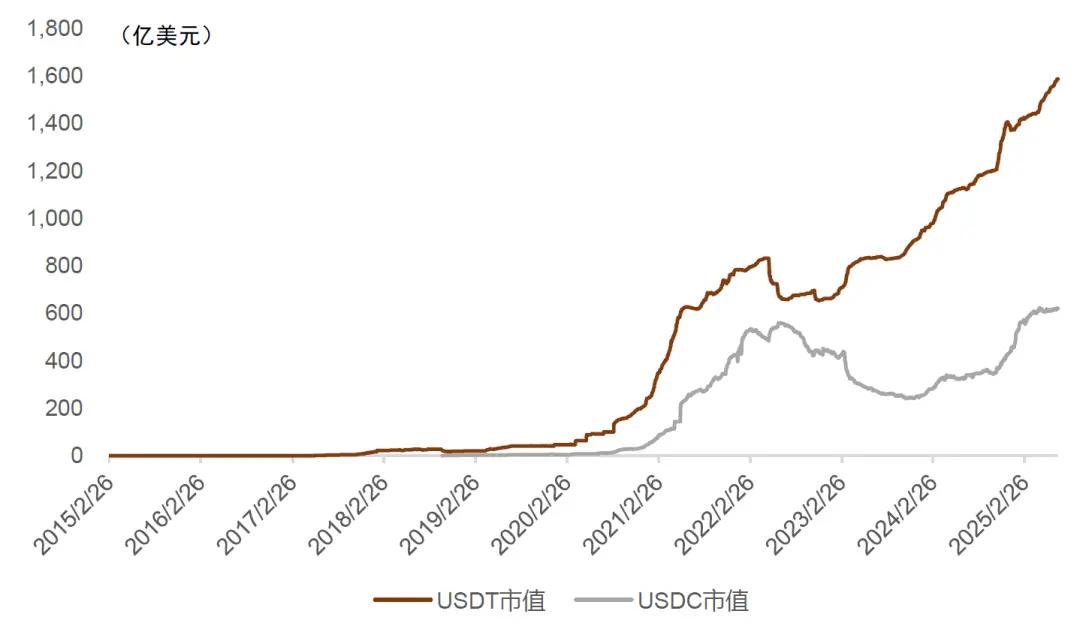

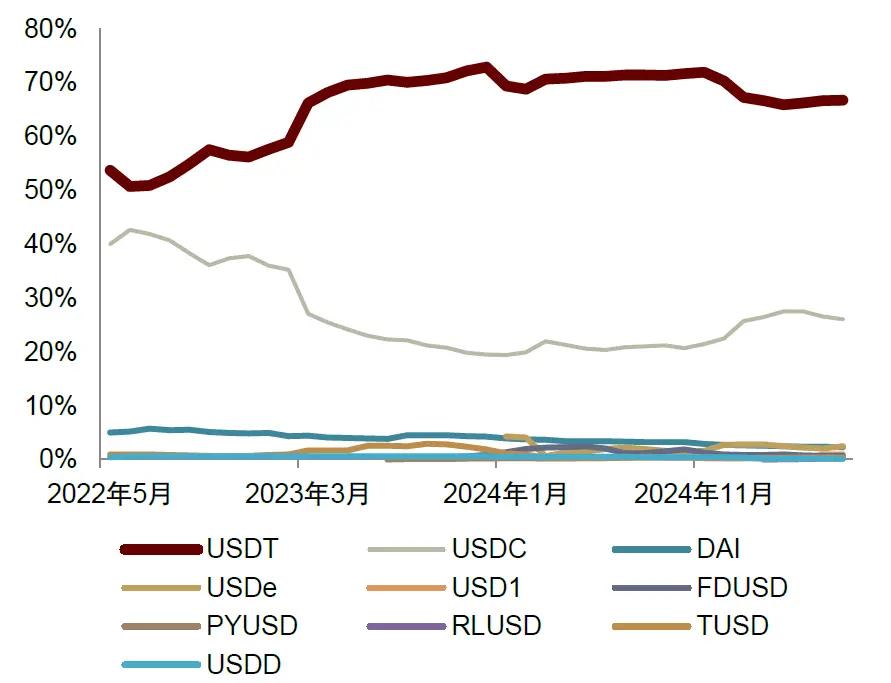

Stablecoin: Based on blockchain technology, it is more efficient and has low fees based on security. Stablecoins are anchored by assets such as fiat currencies and government bonds. Their issuance and circulation are completely based on the smart contracts and decentralized ledgers of blockchain. Their mechanisms are completely executed by on-chain contracts. In theory, there is no need for centralized institutions to intervene. For example, the current largest stablecoins by market value are USDT and USDC. The two achieve a 1:1 mapping of US dollar reserves through smart contracts. The on-chain transaction records are open and transparent. According to CoinMarketCap, as of July 8, 2025, the market value of USDT is approximately US$158.7 billion and the market value of USDC is approximately US$61.9 billion. From a functional point of view, stablecoins are not only the circulating "currency" in the virtual asset market, but also serve as the basic medium in cross-border payments, cross-market transactions, DeFi lending and other scenarios. The decentralized nature of blockchain makes stablecoins both efficient and secure. Recently, there have been new developments in the regulation of stablecoins in some parts of the world, promoting them to become a bridge connecting traditional finance and virtual asset markets. In May, the Legislative Council of Hong Kong, China formally passed the Stablecoin Ordinance; in June, the US Senate passed the Guidance and Establishment of a U.S. Stablecoin National Innovation Act, establishing a comprehensive regulatory framework for stablecoin issuance and related activities.

Chart 3: Changes in market value of USDT and USDC

Note: Data as of July 8, 2025

Source: CoinMarketCap, CICC Research

Figure 4: Stablecoin flow chart

Source: Global X, CICC Research Department

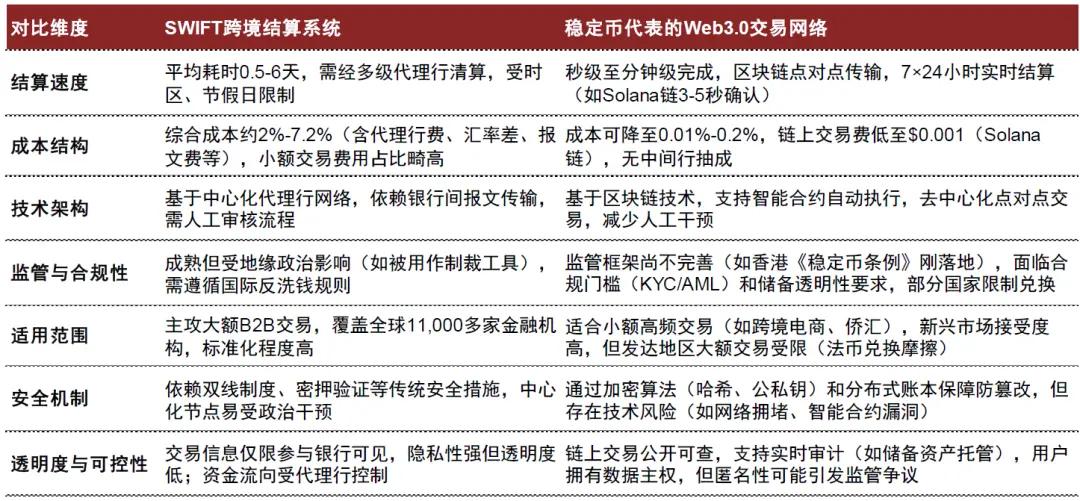

Stablecoins have shown significant advantages in some countries and cross-border payments. When we look back at the SWIFT system, it was essentially born in the era before the large-scale popularization of the Internet. The core design goal is to solve the problem of secure and standardized financial message transmission between global banking institutions. This system that relies on dedicated networks and complex correspondent bank relationships has indeed played a great role in the past few decades. However, with the rise of stablecoins, new solutions that integrate the extensive connectivity of the Internet and the distributed trust and encryption security features of blockchain seem to be able to achieve better results. Not only can it theoretically achieve more efficient cross-border value transfer than SWIFT - near real-time clearing and settlement (reducing cross-border settlement time to seconds and minutes), but it can also significantly reduce payment costs (reducing the take rate of payment losses to 0.01%-2%), and can also greatly improve security through the underlying design of technology, making tamper-proof, traceable and transparent transactions possible. In addition, some countries face the dual dilemma of violent fluctuations in their local currencies and weak payment infrastructure (such as Venezuela, Nigeria, Turkey, etc.). Stablecoins may replace legal currencies to smooth out their exchange rate fluctuation risks on the one hand, and on the other hand, they can also efficiently solve the payment barriers of local users and optimize cross-border settlement costs by going on the chain.

Figure 5: Comparison between SWIFT and Web3.0 transaction networks

Source: Bank for International Settlements, SWIFT official website, McKinsey, Solana official website, Tether official website, CICC Research Department

Figure 6: Process forms of traditional cross-border payment and stablecoin payment

Source: Seven X, CICC Research Department

We believe that the current penetration rate of blockchain in the financial payment industry is essentially a technological iteration. The core of payment is the exchange of value information, and its first element is security. Traditional banks, SWIFT and other payment systems are more of a dedicated value exchange system built in the pre-Internet era, which first ensures the security of payment information, and secondly guarantees efficiency and cost. Blockchain is a new technical infrastructure built on the Internet. It uses a decentralized mechanism to establish a set of difficult-to-tamper accounting systems to ensure the security of transactions. In addition, with the increase of geopolitical risks, decentralization can also maximize the participation rights of any user or country. On the basis of security, compared with the efficiency loss caused by the ever-increasing fees and cumbersome processes of traditional payment institutions, blockchain has shown certain efficiency and cost advantages.

Stablecoin upgrade: RWA (real world assets): physical assets are digitized and tokenized based on blockchain. Blockchain uses distributed ledgers and smart contract technology to convert physical assets (such as real estate, bonds, new energy facilities, etc.) into on-chain tokens to achieve ownership confirmation, transaction transparency and process automation. Stablecoins are one of the common RWAs. In addition, for example, a property can be divided into tens of thousands of tokens, and investors can obtain partial income rights by holding tokens. The immutability and traceability of blockchain ensure the authenticity of asset information and transaction security, solving the problems of low liquidity and high transaction costs of traditional assets. At the same time, RWA tokenization relies on technologies such as Oracle to bridge the status of off-chain assets with on-chain data, so that complex assets such as artworks can theoretically be included in the virtual asset ecosystem. We believe that RWA is essentially a broader definition, and theoretically all real-world assets can be on the chain.

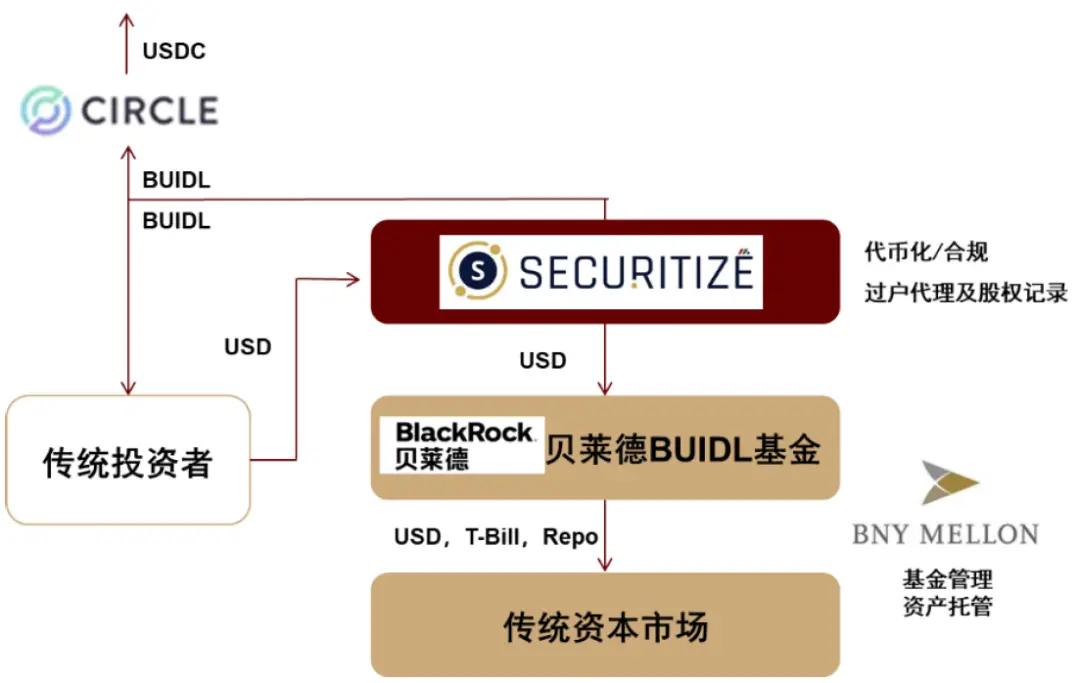

► Case 1: In March 2024, BlackRock Fund launched BUIDL, the first tokenized fund issued on a public blockchain. The fund cooperated with Securitize, a real-world asset (RWA) tokenization platform, to combine the stable returns of traditional finance (TradFi) with the efficiency and accessibility of blockchain technology. As of June 2025, BUIDL’s scale reached US$2.89 billion, making it the largest tokenized money fund with a market share of 40%.

► Case 2: In June 2025, Robinhood announced that it would provide stock tokenization trading services to EU users. It now supports more than 200 US stock assets and ETFs for 24-hour on-chain, 5 days a week circulation and trading, including OpenAI and SpaceX tokens. It plans to expand to thousands of types by the end of this year and launch a Layer2 blockchain dedicated to RWA based on Arbitrum.

Figure 7: BlackRock BUIDL Framework (RWA)

Source: PANews, CICC Research Department

How do stablecoins affect the Internet ecosystem?

How will stablecoins affect existing businesses such as WeChat Pay and Alipay?

Domestic third-party payment can also be regarded as another kind of "quasi-stable currency" in essence. WeChat Pay and Alipay balance can be regarded as a special kind of "quasi-stable currency" in essence, because it is strictly anchored to the value of RMB and relies on legal reserve guarantee. Considering the relative stability of RMB in the long term and the scale effect brought by China's huge market size, the existing electronic payment system has shown a high cost efficiency advantage - the domestic payment rate is generally as low as a few thousandths (such as WeChat Pay's online payment commission of 0.6%), which is much lower than the level of several percent of overseas platforms such as PayPal (the domestic PayPal fee is more than 2.5%). At the same time, the efficiency of third-party payment is also reflected in the massive user coverage (according to QuestMobile, WeChat MAU exceeds 1.1 billion, Alipay MAU reaches 900 million) and near real-time transaction processing capabilities. Therefore, in the current domestic environment, the necessity of popularizing blockchain-based, independently issued stablecoins is relatively weak. The existing third-party payment leaders are highly focused on domestic retail payments, financial services and life scenarios. Relying on their mature compliance system, seamless user experience and low cost, they can basically meet market demand.

Chart 8: Comparison of WeChat Pay and PayPal Fees

Source: PayPal, WeChat Pay, CICC Research

Compared with domestic payments, it may be more reasonable for stablecoins to enable cross-border payment business at this stage. Taking Ant and JD.com as examples, both have a large amount of overseas business settlement. We believe that stablecoins may be able to empower in three aspects: 1) As mentioned above, stablecoin settlement may bypass the traditional SWIFT settlement system to achieve more efficient, lower cost and higher security overseas settlement; 2) In view of the exchange rate volatility risks and geopolitical policy fluctuations in some emerging countries, stablecoins are conducive to stabilizing transaction value and reducing exchange costs; 3) Internet platforms often have a large number of cross-border ecological partners. The establishment of a stablecoin system within the platform may help make the transaction behavior of partners within the ecosystem more convenient, consolidate and activate the ecological value.

What new opportunities do stablecoins mean for the Internet?

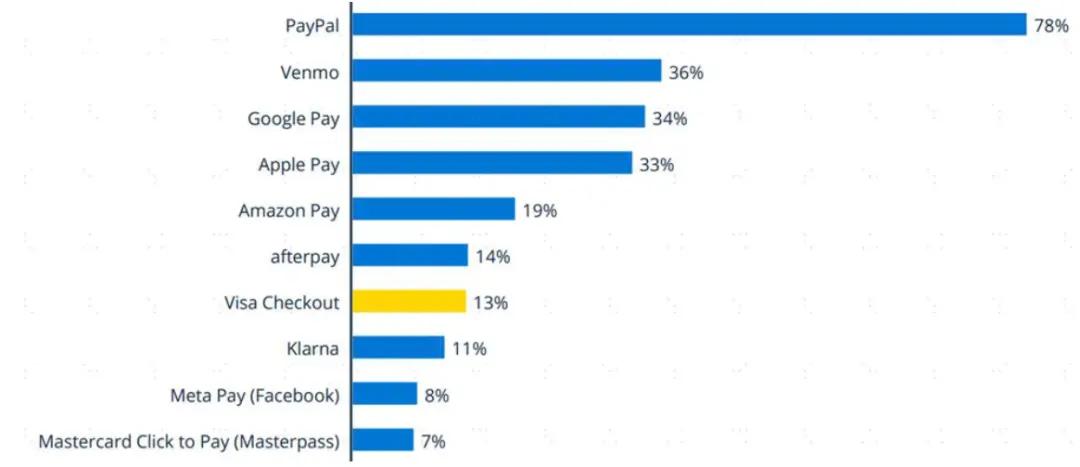

Payment business opportunities: Currently, global technology leaders are accelerating the strategic layout of stablecoins. We can see that Internet companies with cross-border payments (cross-border commodity/service transactions) are more actively deploying in the field of stablecoins. Domestically, JD.com was the first to be selected into the "Stablecoin Issuer Sandbox" of the Hong Kong Monetary Authority in July 2024, and plans to launch a compliant stablecoin anchored to the Hong Kong dollar in the fourth quarter of 2025, which will be used first for cross-border e-commerce settlement; Alibaba's Ant International plans to apply for an issuance license after the Hong Kong "Stablecoin Ordinance" takes effect in August 2025, aiming to serve cross-border payments and treasury management. In the overseas camp, Visa has become the first payment network to support stablecoin settlement in 2023, and announced in June 2025 that it requires partner institutions to formulate a stablecoin strategy; PayPal launched the PYUSD stablecoin in August 2023 and completed commercial implementation; Amazon and Walmart are exploring the issuance of their own stablecoins to optimize e-commerce payment costs; and Apple, social platform X (formerly Twitter), Airbnb and other companies have been intensively negotiating stablecoin integration plans since the beginning of 2025, trying to embed them into the payment system and business ecosystem.

Figure 9: Stablecoin layout of the Internet industry at home and abroad

Source: Financial Times, Bloomberg, The Information, TechCrunch, CoinDesk, Visa official website, PayPal official website, CICC Research Department

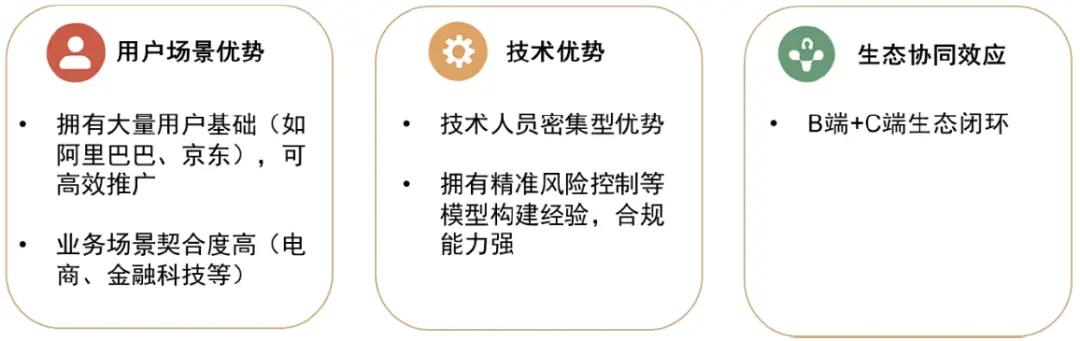

We believe that based on the adaptability of the integration of the Internet and blockchain, Internet companies may have multiple advantages in entering the field of stablecoins:

► User and scenario advantages: In the early stages of industrial development, companies that control supply are often able to get the industry dividends first. For stablecoins, USDT like Tether and USDC of Circle have become the core varieties in the current stablecoin market. However, as regulatory policies are implemented, giants begin to enter the market, and players who control usage scenarios or distribution channels can often catch up. Historically, Microsoft surpassed Netscape Navigator by bundling IE browser for free with Windows, and Tencent made breakthroughs in multiple fields such as games based on QQ and WeChat platforms. We believe that Internet companies, especially those with huge payment scenarios, may become important players or even leaders in the market if they can issue their own stablecoins for payment. Typical representatives include Amazon, the global e-commerce leader.

► Technical advantages: Since the underlying technology of stablecoins is blockchain superimposed on smart contracts, we believe that leading Internet companies have the advantage of labor-intensive technical personnel. In addition, some Internet companies have financial-related business experience (such as JD Finance, Ant Financial, etc.), so we believe that they may be better at building credit and compliance models based on user transaction data, thereby improving the risk control accuracy of stablecoins in trading, lending, insurance and other scenarios, and indirectly improving their security.

► Ecological synergy effect: Taking Ant and JD.com as examples, both of their main businesses have a B-end + C-end closed loop, and have ecological synergy advantages. For example, their B-end ecological partners often have needs for cross-border trade settlement and supply chain financing, while C-end users often have needs for retail payment and cross-border remittances. Stablecoins, as the circulating "currency" within the ecosystem, may enable partners within the platform to reduce friction costs, increase turnover, and make the ecological value chain more stable. We believe that stablecoins also have network effects in the long run, so companies with a more complete ecological chain may have a first-mover advantage.

Figure 10: Advantages of the Internet entering the stable currency market

Source: CICC Research Department

Figure 11: Percentage of U.S. users using mobile payments in 2025

Source: statista, CICC Research Department

The popularity of stablecoin payments may help related Internet companies go overseas and reduce payment costs. The popularity of stablecoins in emerging markets is mainly due to the dual dilemma of violent fluctuations in local currencies and weak payment infrastructure that these regions generally face (such as Venezuela, Nigeria, Turkey, etc.). For Chinese Internet companies such as Chizichuang, Huya, Yalla, and Zhiwen that have overseas entertainment products in overseas countries (such as the Middle East), if stablecoins can effectively solve the payment barriers of users in the target market (such as virtual gift reward scenarios) and optimize cross-border supply chain settlement and remittance costs (such as Chizichuang's payment costs accounted for about 9% of revenue in 2022), we believe that it may be helpful to improve its profit margins in regions with high payment costs.

What does the popularity of stablecoins mean for the Web3.0 world?

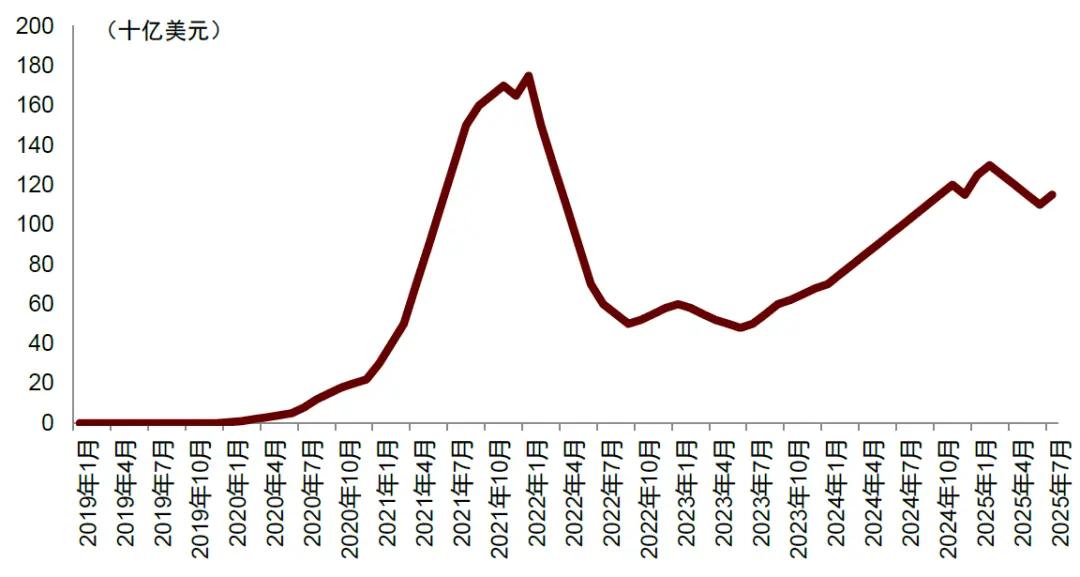

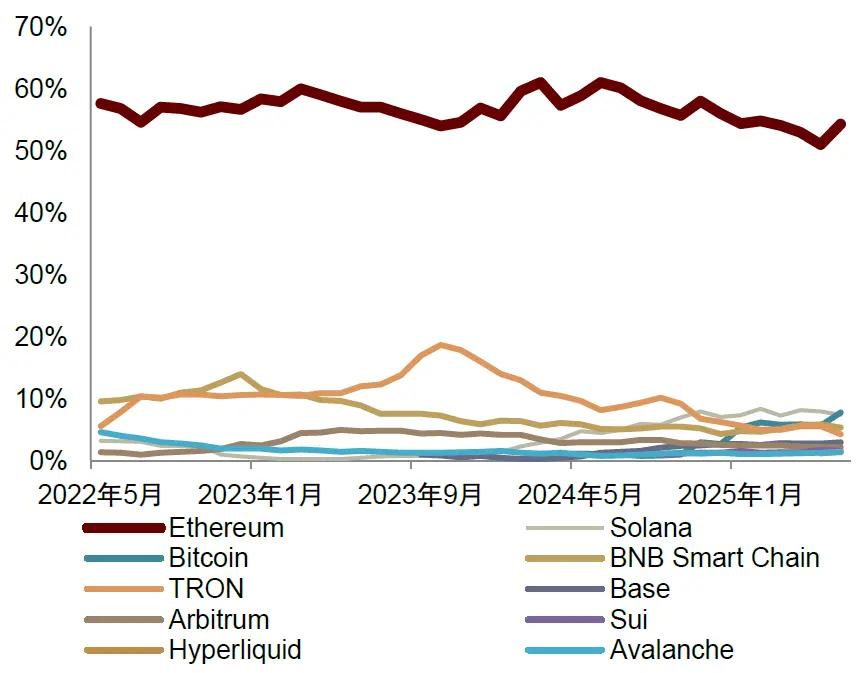

Stablecoins can also further expand the influence of the Web3.0 ecosystem, such as DeFi. We believe that if stablecoins are likened to banks in a narrow sense (the starting point of the financial system), then with the implementation of stablecoins, on the one hand, it is hoped that based on its huge user base, the penetration rate of the Web3.0 ecosystem will be improved, and on the other hand, the prosperity of the DeFi ecosystem will be promoted. Taking DeFi (decentralized finance) as an example, stablecoins not only provide value anchoring functions in scenarios such as lending, derivatives trading and liquidity provision, but also rely on the programmable characteristics of smart contracts to realize an automated income generation mechanism that is difficult to operate on a large scale under the traditional financial system. According to CoinMarketCap, in July 2025, the total locked value (TVL) of DeFi was approximately US$120 billion. We believe that as the stablecoin market expands, DeFi may further attract increasingly mature and compliant stablecoins to enter the on-chain market. At the same time, the coordinated development of stablecoins and RWA (tokenization of real-world assets) is also broadening the boundaries of innovation - converting traditional assets such as real estate and sovereign debt into verifiable collateral through on-chain mapping not only significantly enriches the underlying asset categories of DeFi, but also introduces a considerable amount of incremental liquidity to connect traditional financial markets.

Chart 12: Total locked value of DeFi

Note: Data as of July 10, 2025

Source: coinmarketcap, CICC Research Department

Chart 13: TVL market share of public chains

Note: Data as of July 10, 2025

Source: coinmarketcap, CICC Research Department

Chart 14: Stablecoin Market Share

Note: Data as of July 10, 2025

Source: coinmarketcap, CICC Research Department