TRDR:

- Concentrated holdings: MicroStrategy (MSTR) alone accounts for 2.865% of all BTC; companies outside top ten account for only a negligible share.

- Project homogeneity: Most treasury‑reserve plays lack any sustainable competitive edge, so their NAV premiums are likely to erode over time except for a few higher‑quality cases.

- Emerging valuation bubble: NAV multiples are generally above 2× (with only a handful below 1×); share prices are easily driven by announcements, and a bear market could wipe out premiums.

- Metaplanet funds purchases via zero‑coupon convertibles and SARs, benefiting a 20 % stock tax vs 55 % BTC tax gap

- SPACs, PIPEs, ATM, convertible bonds and in‑kind BTC commitments dominate funding; Twenty One and ProCap listed with full reserves through multi‑step mergers

- SharpLink raised $838 M, staked nearly all ETH, added Joseph Lubin to its board and OTC‑settled 10 k ETH with the Ethereum Foundation

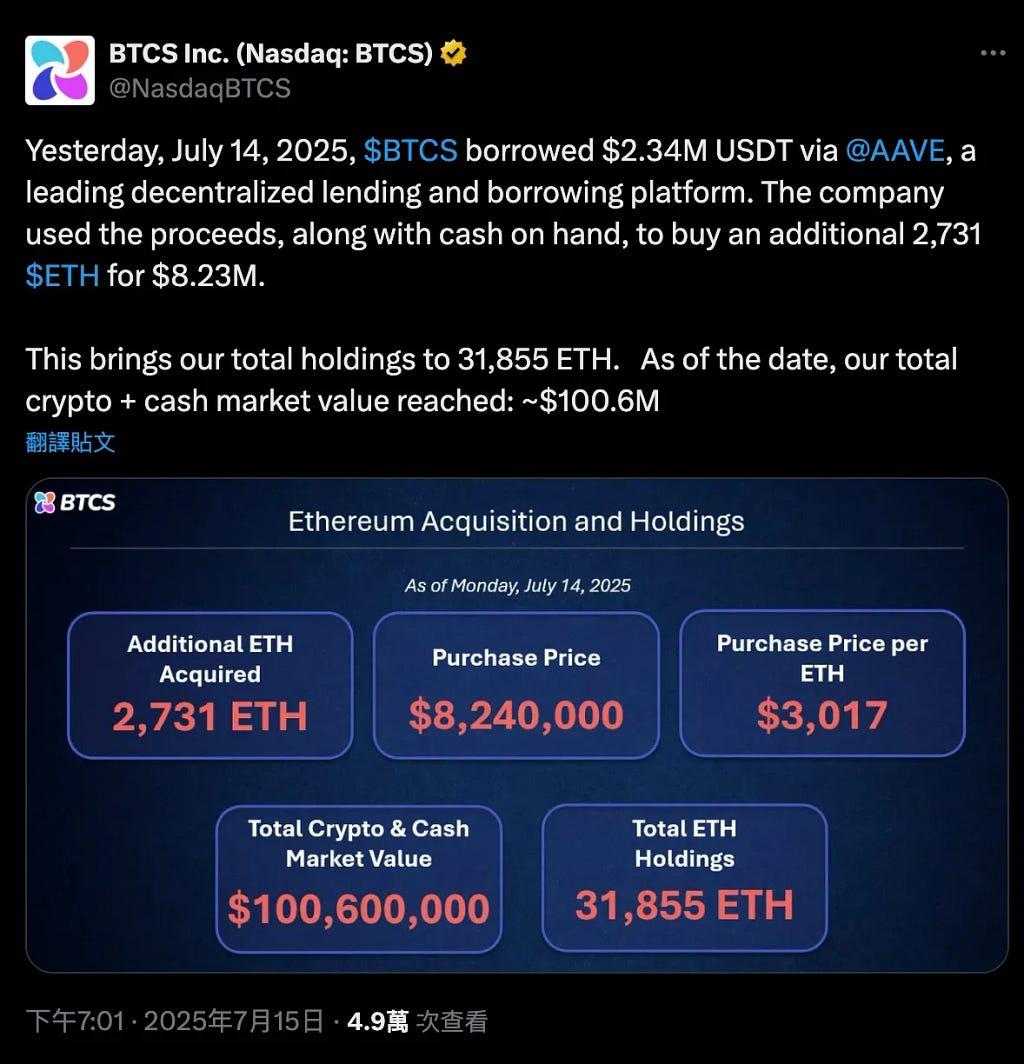

- BTCS borrows USDT on AAVE to buy and stake ETH, making its edge while sensitive to lending rates and onchain liquidity

- Crypto funds use PIPEs and similar mechanisms to build strategic reserve equity and launch dedicated funds, with seasoned industry veterans serving as advisors to provide hands‑on support and expert insight.

Introduction

The hype around public companies transitioning to crypto treasury strategies shows no signs of slowing. While some are making the shift as a last‑ditch effort to revive their businesses and others are simply copying MicroStrategy’s playbook, a handful of genuinely innovative projects have emerged with features that go well beyond the headlines.

In this article, we’ll explore the dominant players in the Bitcoin and Ethereum treasury space — examining how they could offer alternatives to spot ETFs, deploy sophisticated financing structures, unlock tax efficiencies, generate staking yield, DeFi integration, and leverage unique competitive advantages.

Bitcoin

Landscape Overview

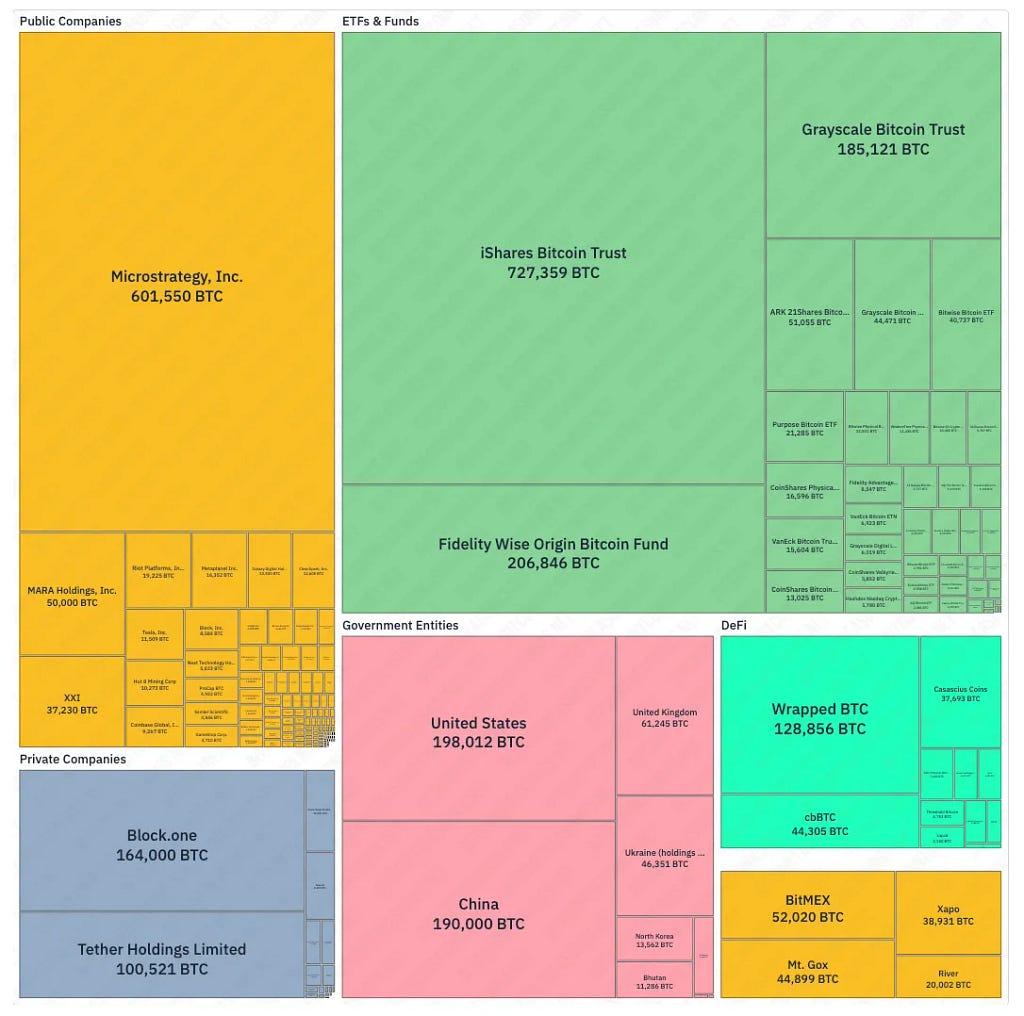

According to the treemap on BitcoinTreasuries.net, among entities with publicly disclosed holdings, MicroStrategy has rapidly climbed to become the largest corporate holder — second only to the iShares Bitcoin Trust — and today alone controls nearly 2.865% of the 21 million supply.

Nonetheless, ETFs and trusts remain the dominant cohort, led by iShares, Fidelity, and Grayscale. At the sovereign level, the United States and China hold the most Bitcoin, with Ukraine also maintaining a significant reserve. In the private‑company segment, Block.one and Tether Holdings head the list of major holders.

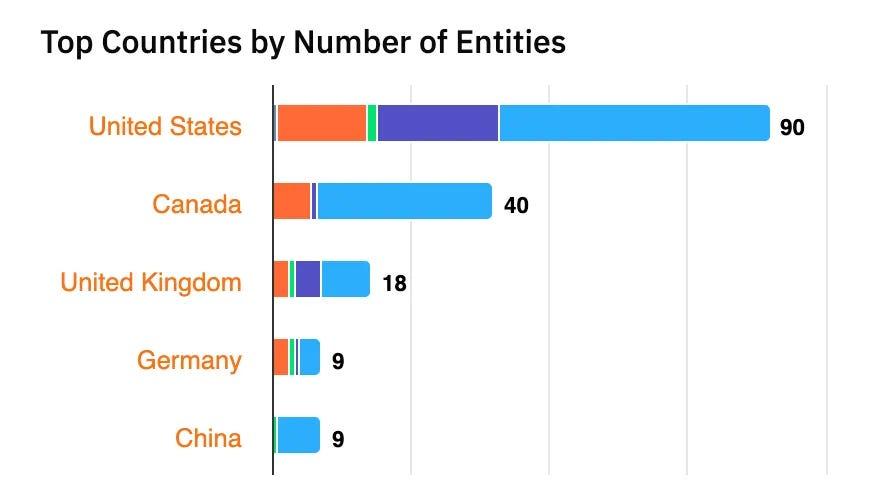

For entities that hold Bitcoin, those in the United States and Canada lead, followed by the United Kingdom. However, notable players also include Japan’s Metaplanet (ranked 5) and China’s Next Technology Holding (ranked 12).

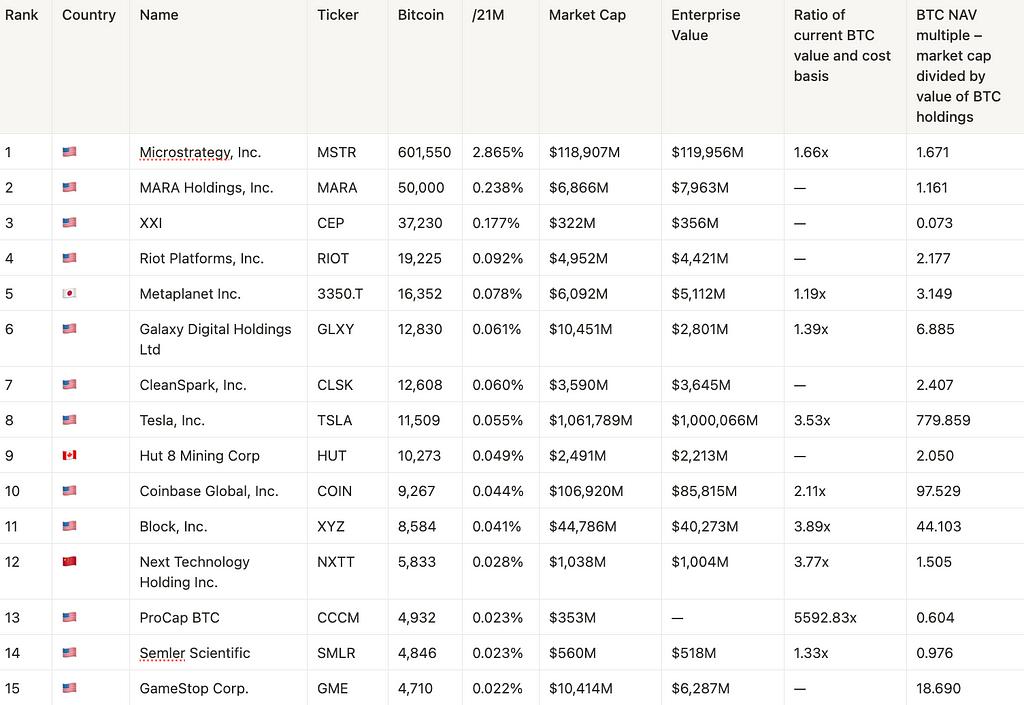

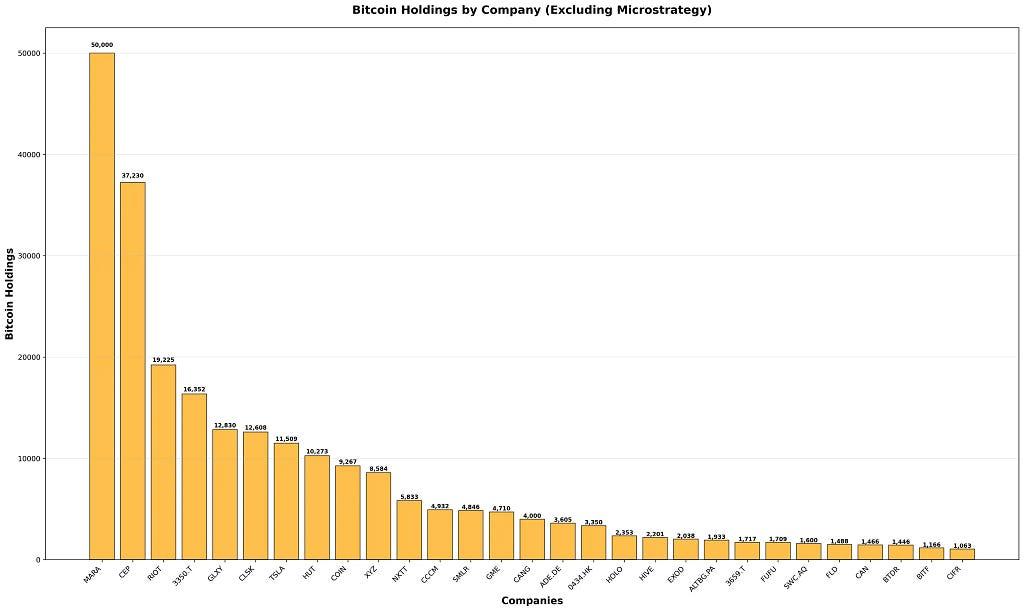

The following list highlights the top 30 publicly traded companies holding Bitcoin, with MicroStrategy commanding a substantial lead.

Even without MicroStrategy, MARA and XXI remain prominent, yet the distribution stays heavily skewed — most companies outside the top ten hold only moderate Bitcoin amounts compared to the leaders.

When assessing public companies with Bitcoin treasuries, two metrics are particularly informative:

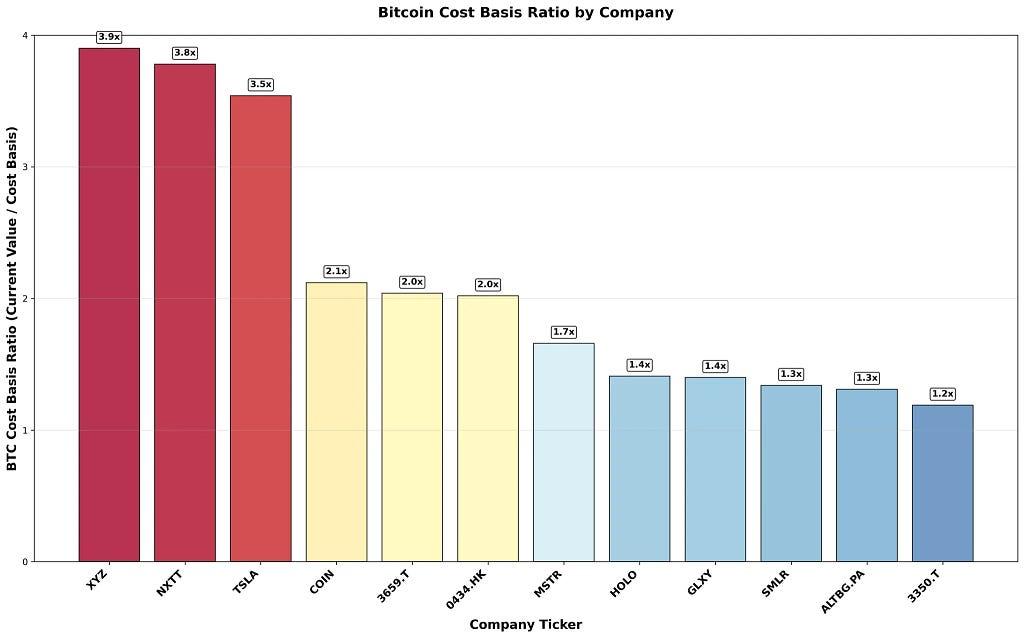

Current‑Value‑to‑Cost‑Basis Ratio

Compares today’s USD value of Bitcoin holdings to what the company originally paid. A higher ratio indicates large unrealized gains — boosting returns and providing a built‑in cushion against market volatility.

BTC NAV Multiple

The mNAV is calculated by dividing a company’s market capitalization by the USD value of its Bitcoin reserves; some firms substitute enterprise value for market cap when reporting mNAV.

This multiple shows how much premium investors assign to the company’s core business beyond its crypto assets.

An mNAV greater than 1 means the market is valuing this company above its Bitcoin holdings, and that investors are willing to pay a premium for each “unit of Bitcoin” the company holds.

Crucially, an mNAV > 1 enables anti‑dilutive capital raises: with mNAV > 1, companies can just sell share → buy bitcoin → Boost bitcoin NAV → Boost EV and also BTC/Share increases.

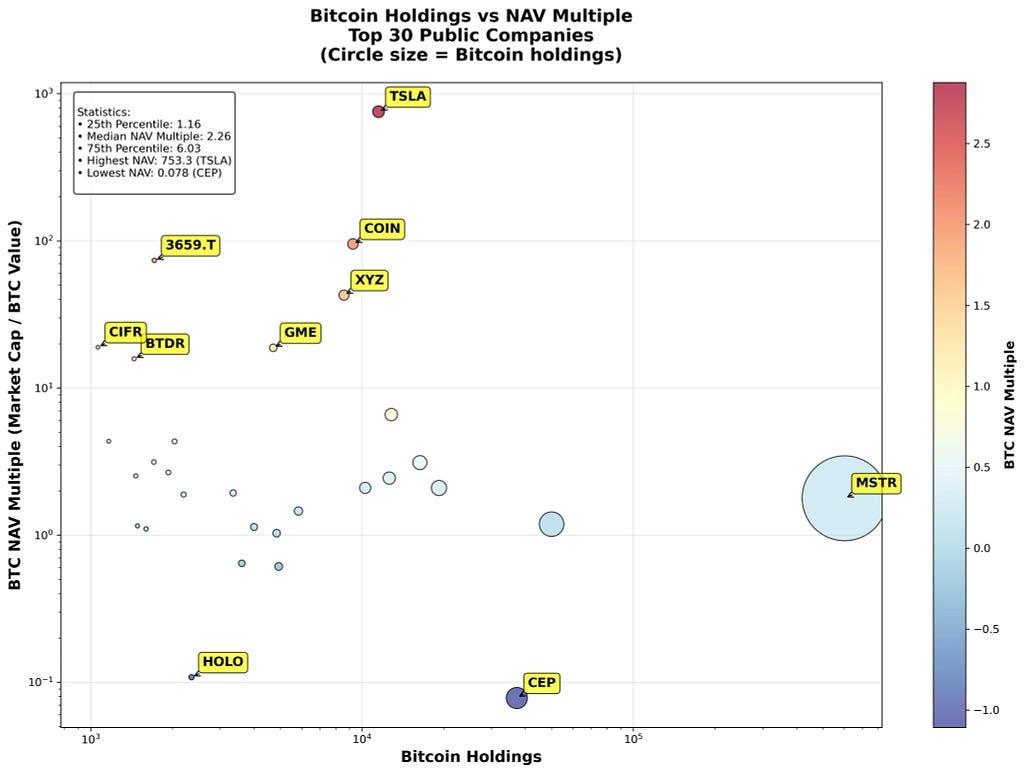

Examining NAV multiples among the top 30 shows a distinct group, such as TSLA and COIN. Because these companies aren’t primarily Bitcoin treasuries and have other core operations, their NAV multiples are correspondingly higher.

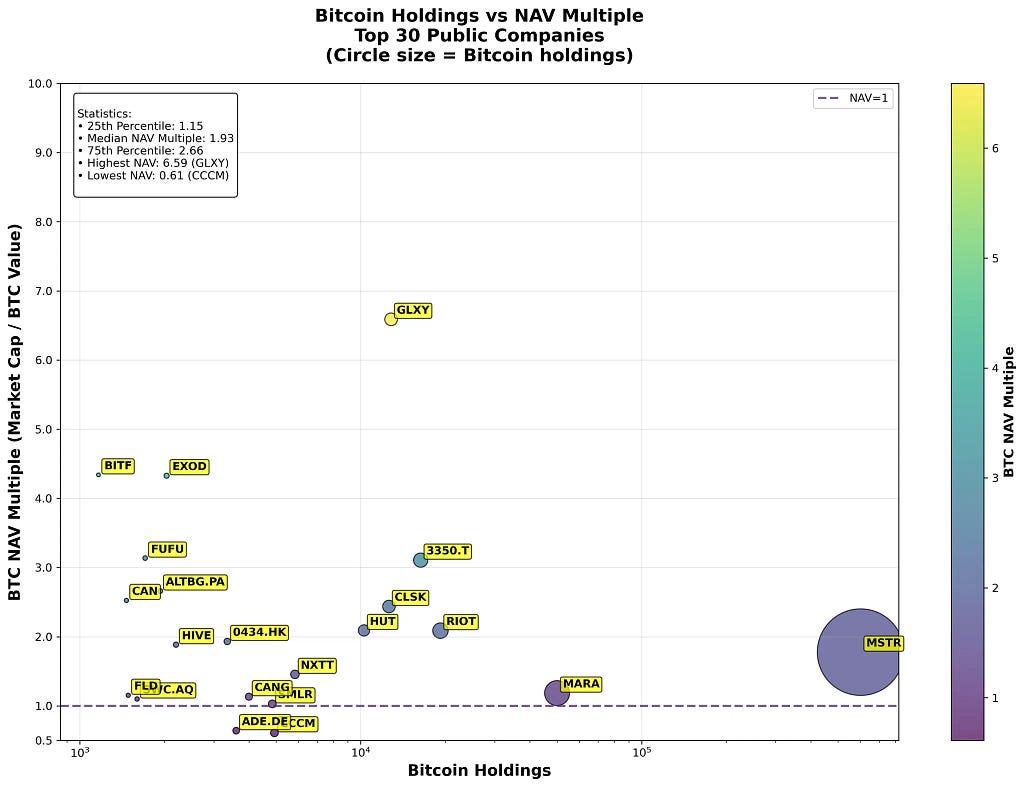

Excluding non‑Bitcoin treasury firms reveals that most companies actually trade at high NAV multiples — many exceed 2. Only four trade below NAV = 1, and larger holders like MSTR and MARA don’t display the extreme multiples seen in smaller firms.

According to BitcoinTreasuries.net, companies that provide comprehensive public disclosures do trade at high cost‑basis ratios, reflecting substantial unrealized gains — likely because more profitable firms are more inclined to disclose.

Metaplanet Inc. (MPLAN)

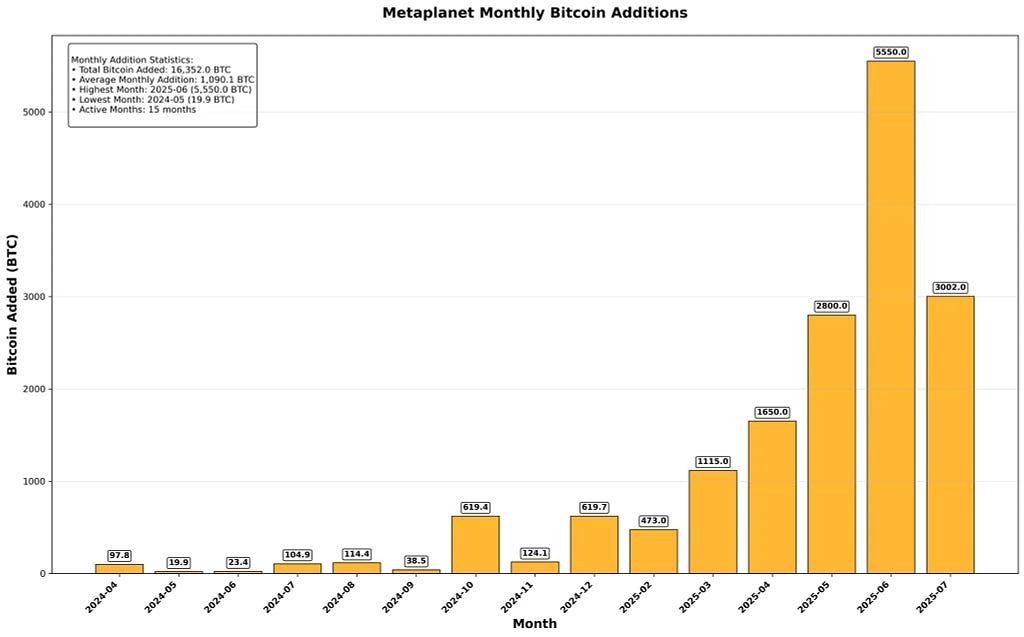

Among the many public companies emulating MicroStrategy’s playbook, one Japanese firm has distinguished itself — Metaplanet, amassing 16,352 BTC to break into the top five public Bitcoin holders and dramatically accelerating its acquisition pace over the past few months.

As it described itself, “$500m in Equity Capital Raised”, “Japan’s #1 Equity Issuer in 2025”, ”Largest 0% Cost Financing Ever”.

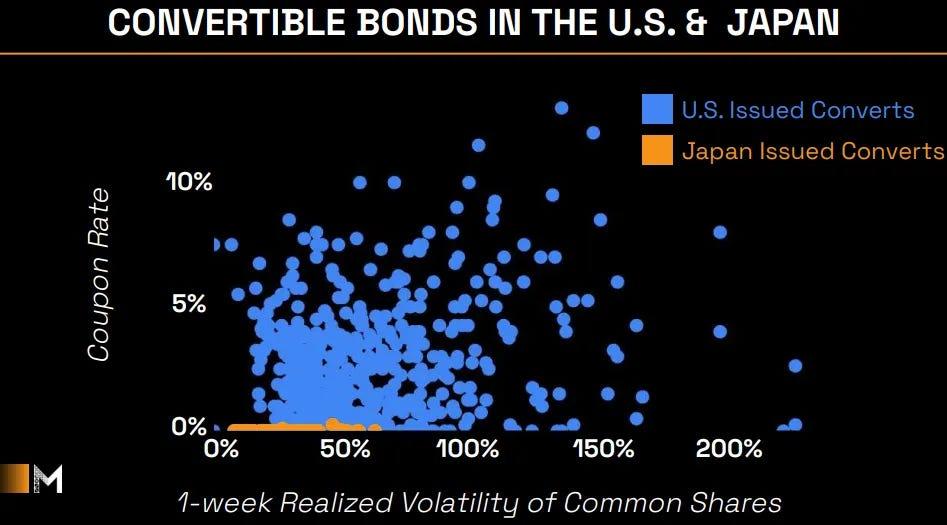

Japan’s interest rate has historically remained low, which only raised to 0.25% in Jul 2024 and raised again in Jan 2025 to 0.5%, and now still remains 0.5%. This difference in interest rates is also apparent in the convertible bond market: as Metaplanet’s chart shows, U.S.‑issued convertibles typically carry higher coupons, whereas Japanese issues feature very low interest rates and lower volatility.

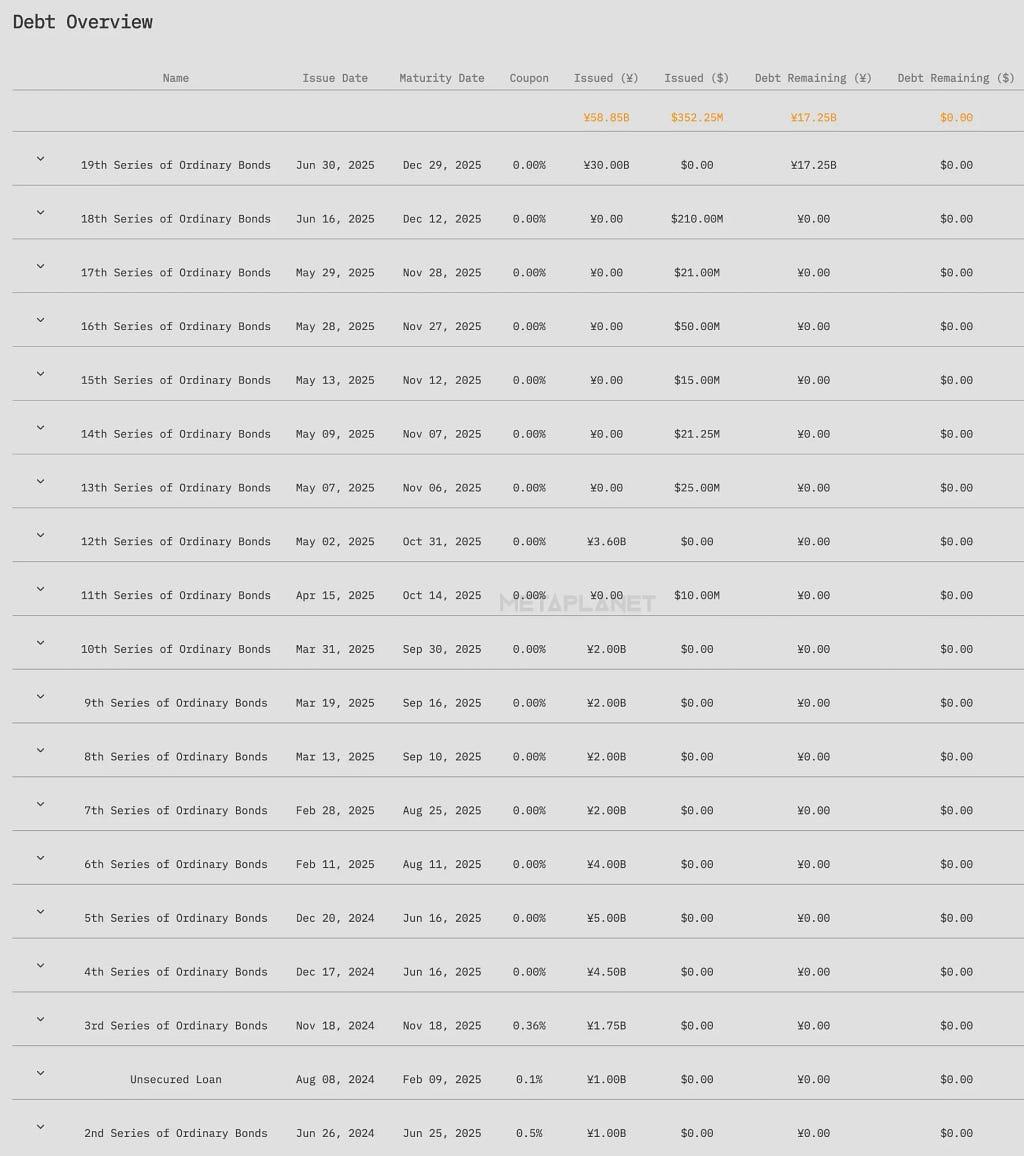

Although prevailing interest rates are generally lower in Japan, MetaPlanet’s zero‑percent financing isn’t cost‑free — it’s offset by the grant of Stock Acquisition Rights (SARs) as compensation.

Metaplanet first raises cash by issuing six‑month, 0 % coupon bonds at par. To secure repayment, it grants EVO Fund a corresponding block of SARs under the same board resolutions.

The bond indentures then require that, at maturity, Metaplanet redeems the bonds exclusively with the cash EVO Fund pays to exercise those SARs at a moving‑strike price.

In this way, Metaplanet avoids any periodic interest outflows.

Instead of receiving coupons, EVO Fund’s return comprises:

- Principal protection: Bond principal is repaid in cash at maturity, insulating EVO from equity downside.

- Upside participation: If Metaplanet’s share price exceeds the moving strike, EVO exercises its SARs and captures the difference between market price and strike.

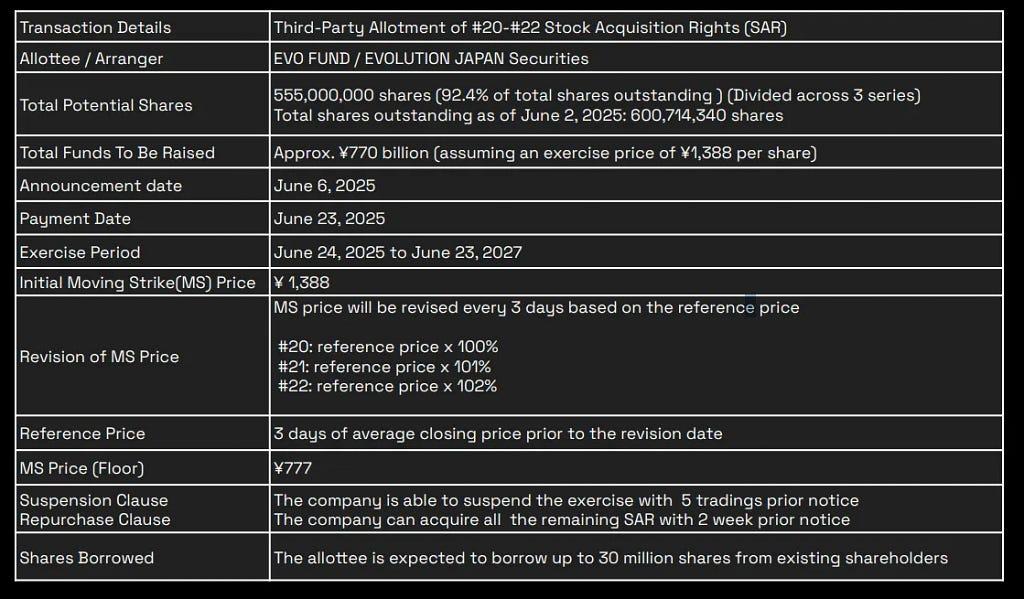

Started on June 6, 2025, the “555 Million Plan” (SAR #20–#22) is by far Metaplanet’s largest single funding package.

In total, 555 million SARs were issued — equivalent to 92.4 % of the 600.7 million shares outstanding — with the potential to raise up to ¥770 billion when exercised. The rights carry an initial “moving strike” price of ¥1,388 per share, which resets every three trading days to 100 %/101 %/102 % of the prior three‑day average closing price, but may never fall below a floor of ¥777.

EVO Fund may exercise its rights any time from June 24, 2025 through June 23, 2027, at which point Metaplanet will issue new shares and receive the exercise proceeds. To manage dilution and market impact, Metaplanet can suspend SAR exercises with five trading days’ notice or repurchase unexercised rights with two weeks’ notice.

Another advantage lies in tax treatment. In Japan, capital gains on stocks and dividends are taxed at a flat rate of around 20 %, whereas profits from spot Bitcoin transactions are classified as miscellaneous income and subject to progressive national rates of 5 %–45 %, plus a 10 % local inhabitant tax (and applicable surtaxes), pushing the effective rate to as high as 55 %. For investors in higher tax brackets seeking Bitcoin exposure, Metaplanet therefore represents a very attractive alternative. Meanwhile no spot BTC ETF is live in Japan yet.

Metaplanet has historically traded at high mNAV multiples — routinely exceeding 5× and even peaking at 20× — far above other major holders. While this premium reflects investor confidence in its financing structure, tax advantages, and optimized Bitcoin yield, it also introduces greater risk and may indicate the stock is overhyped.

Other BTC Treasury Companies: Riding the SPAC Wave

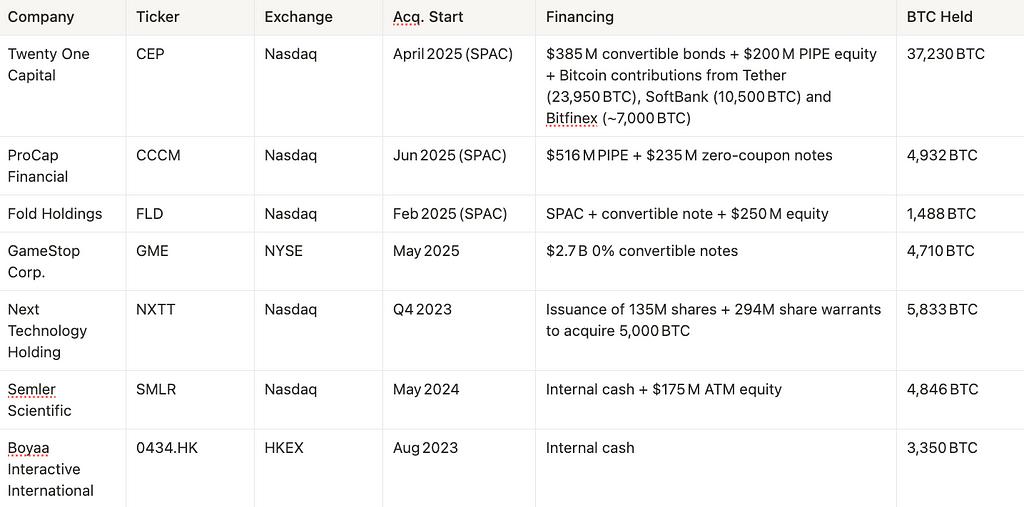

Many companies are now emulating MicroStrategy’s Bitcoin treasury playbook. Notably, SPACs like Twenty One Capital (ranked #3) and ProCap Financial (ranked #13) used complex fundraising structures to leapfrog into major BTC holders immediately after their mergers — a trend likewise seen with Fold Holdings.

Twenty One Capital, Inc

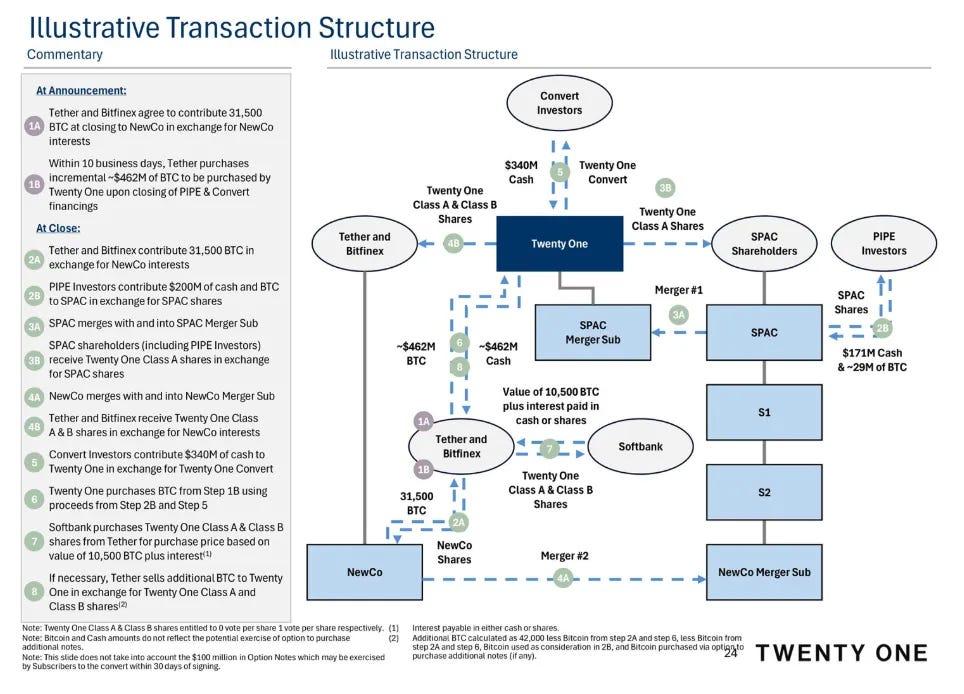

Twenty One Capital, Inc. was co-founded by Jack Mallers, the CEO of Strike. Twenty One SPAC path weaves in‑kind Bitcoin commitments, PIPE and convert financings, and a two‑step merger so that the firm emerges on Nasdaq with a fully funded 42 000 BTC treasury on day one.

The Twenty One transaction begins when Tether and Bitfinex commit 31 500 BTC to a private vehicle called NewCo while Tether immediately acquires an additional 462 million dollars of BTC. A 200 million dollar PIPE funds the SPAC trust, which then merges into its merger subsidiary and issues Class A shares to SPAC and PIPE investors.

Next, NewCo merges into that same subsidiary in exchange for Class A and Class B shares. Simultaneously, a 340 million dollar convertible note financing closes directly into Twenty One. Using the combined PIPE and note proceeds, Twenty One purchases the pre‑acquired coins from Tether and Bitfinex. SoftBank anchors the deal by buying 10 500 BTC worth of equity, and if needed Tether tops up the balance to reach 42 000 BTC.

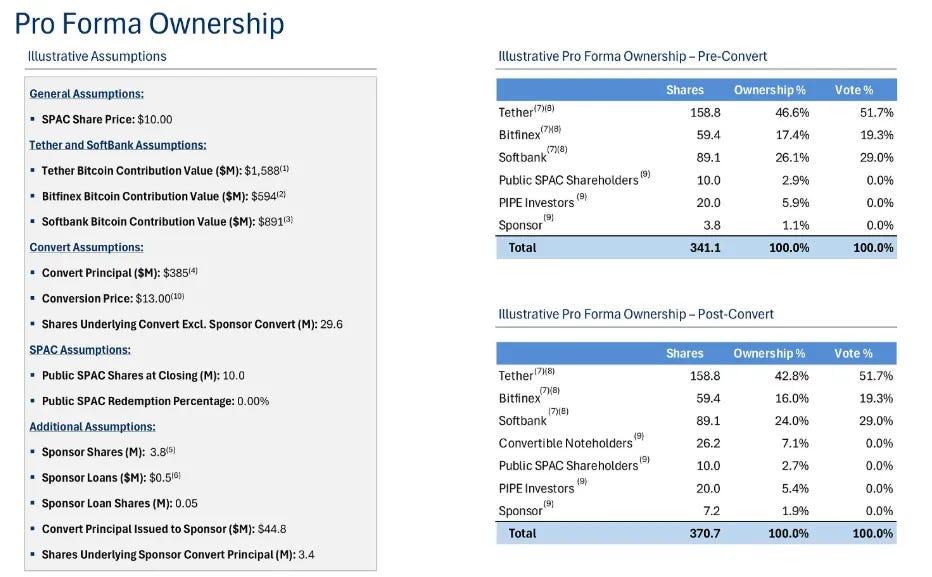

At closing of its SPAC merger, Twenty One will be majority-owned by Tether and affiliated exchange Bitfinex, with a significant minority stake by SoftBank Group.

Tether and Bitfinex each committed lots of BTC up front in exchange for newly issued shares, so they ended up owning the majority (Tether 42.8% and Bitfinex 16.0%). SoftBank then anchored the public financing by buying another 10,500 BTC’s worth of stock at the same price, earning it a similarly large stake (24.0%). In contrast, the SPAC trust’s cash (about $100 million) and the PIPE and convertible note rounds, were smaller relative to the coin contributions.

ProCap BTC (PCAP)

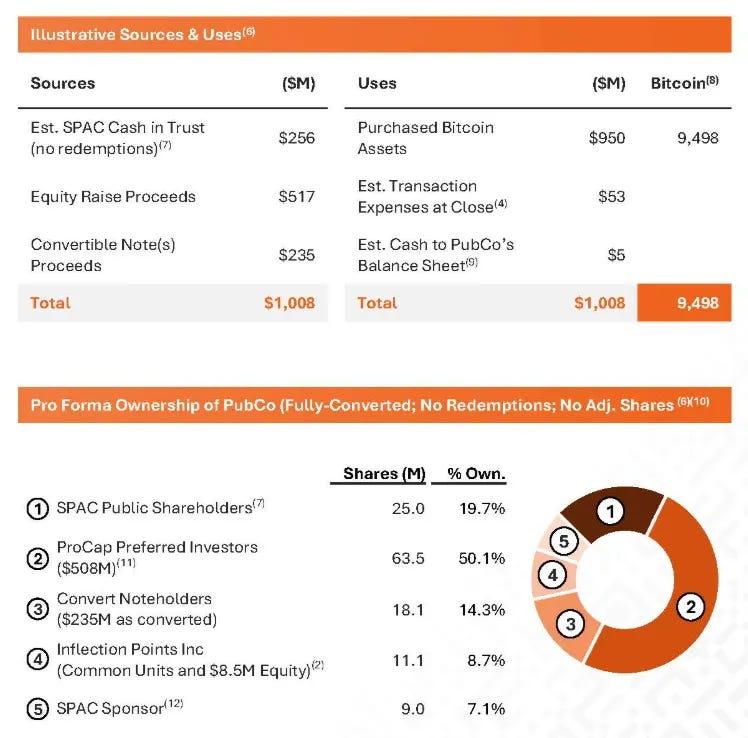

ProCap Financial raised a total of $1.008 billion to kick‑start its Bitcoin‑treasury platform, drawing $256 million from the SPAC trust (assuming minimal redemptions), $517 million via its preferred‐equity PIPE, and $235 million through a zero‑coupon, senior secured convertible‑note round. Nearly all of those proceeds — $950 million — were deployed immediately to acquire 9,498 BTC.

Public SPAC shareholders rolled $256 million from the trust into 25 million shares, or 19.7 percent; a $517 million preferred‑equity PIPE — led by Magnetar Capital, ParaFi, Blockchain.com Ventures, Arrington Capital, Woodline Partners, Anson Funds, RK Capital, Off the Chain Capital, FalconX, BSQ Capital, and others — underwrites 63.5 million shares (50.1 percent); the $235 million zero‑coupon, senior secured convertible note round converts into 18.1 million shares (14.3 percent); Inflection Points Inc. rolled its existing units and added $8.5 million of equity for 11.1 million shares (8.7 percent); and the SPAC sponsor retains its 9 million‑share promote (7.1 percent) .

Although SPACs have often underperformed, Bitcoin‑treasury SPACs still earn credit for the transparency they provide around ownership and cost basis. Their S‑1 and S‑4 filings spell out each sponsor’s cash, equity, and in‑kind BTC contributions — and at what price (for example, Twenty One’s $200 M PIPE at $10 / share and $385 M of zero‑coupon convertibles at $13 / share, with clear pre‑ and post‑conversion share counts). And because these firms share a similar business model — acquiring and holding Bitcoin — those disclosures give investors reliable comparability on dilution, cost basis, and treasury composition.

Whereas many recent SPAC financings rely on intricate structures, early adopters like Next Technology Holding, Semler Scientific, and Boyaa Interactive amassed their Bitcoin reserves through more straightforward equity and cash transactions.

Among the other adopters, GameStop’s announcement is notable. On May 28, 2025, Video game retailer GameStop disclosed it had purchased 4,710 BTC (approximately $513 million worth) as part of a new digital asset strategy. The company’s cash-rich balance sheet ($4.8 billion in liquidity) gave it capacity to allocate to BTC.

Cash‑Rich Crypto Platforms

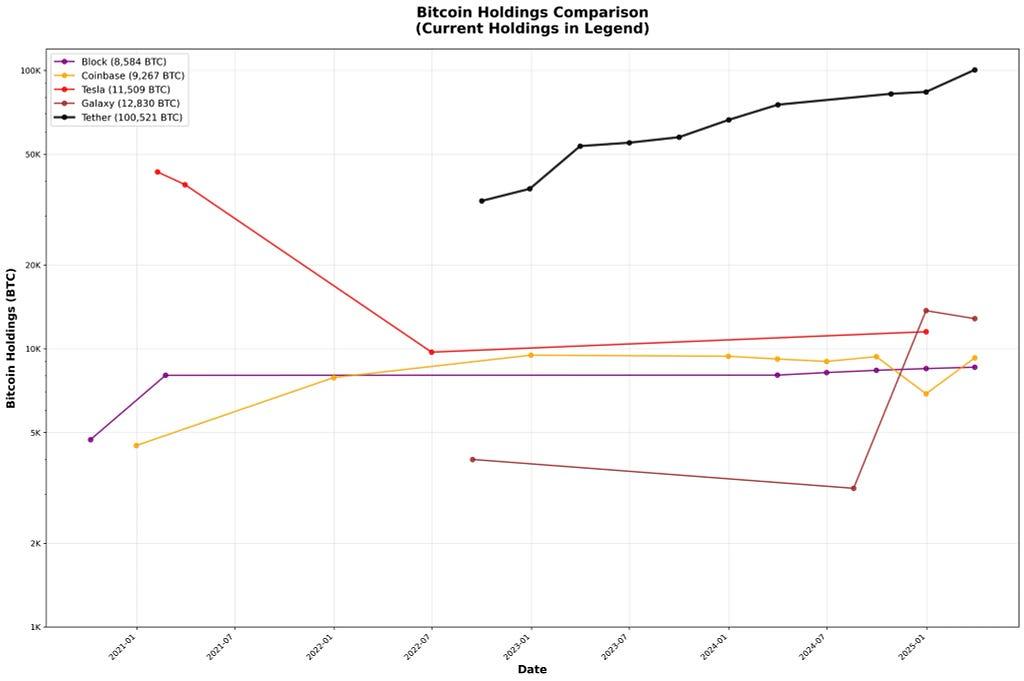

While many firms replicate MicroStrategy’s all‑in Bitcoin strategy, a number of crypto‑native businesses have made steady, ongoing investments in digital assets, and occasional one‑off buyers like Tesla have executed significant purchases.

Tether, best known as the issuer of the USDT, began actively adding Bitcoin to its reserves in late 2022 by allocating up to 15 % of its quarterly net profits to direct market purchases and complementary investments in renewable‑energy mining operations.

As CTO Paolo Ardoino explained, “By holding Bitcoin, we are adding a long‑term asset with upside to our reserves,” and Tether has said the move “will bolster confidence in USDT by diversifying our treasury into a digital‑asset store of value” .

Consequently, Tether’s Bitcoin treasury has grown each quarter — more than doubling since 2023 to exceed 100,000 BTC and accruing roughly $3.9 billion in unrealized gains.

Block took its first skin‑in‑the‑game step in October 2020, purchasing 4,709 BTC for $50 million — about 1 % of Square’s assets at the time. It was followed by an additional $170 million (3,318 BTC) in Q1 2021 to bring its treasury to over 8,000 BTC . Since then, Block has maintained its Bitcoin holdings.

In April 2024, Block introduced a corporate balance sheet dollar‑cost averaging program, directing 10% of its monthly gross profit from Bitcoin products into systematic BTC purchases executed via two‑hour Time‑Weighted Average Price orders through OTC liquidity providers.

Coinbase formalized its corporate Bitcoin strategy in August 2021 when its board approved a one‑time $500 million purchase of digital assets and committed to allocate 10 % of its quarterly net income into a portfolio including Bitcoin.

In January 2021, Tesla’s board approved a $1.5 billion purchase of Bitcoin, motivated by a belief that “we believe in the long‑term potential of digital assets both as an investment and also as a liquid alternative to cash” . A few months later, CEO Elon Musk explained that Tesla sold roughly 10 % of its holdings “to prove liquidity,” realizing a $128 million gain in Q1 2021 . Then in Q2 2022, Tesla reduced its remaining Bitcoin position by about 75 %, with Musk noting the sale was intended to “maximize our cash position amid COVID‑related production challenges in China” — while stressing it “should not be taken as some verdict on Bitcoin” .

Ethereum

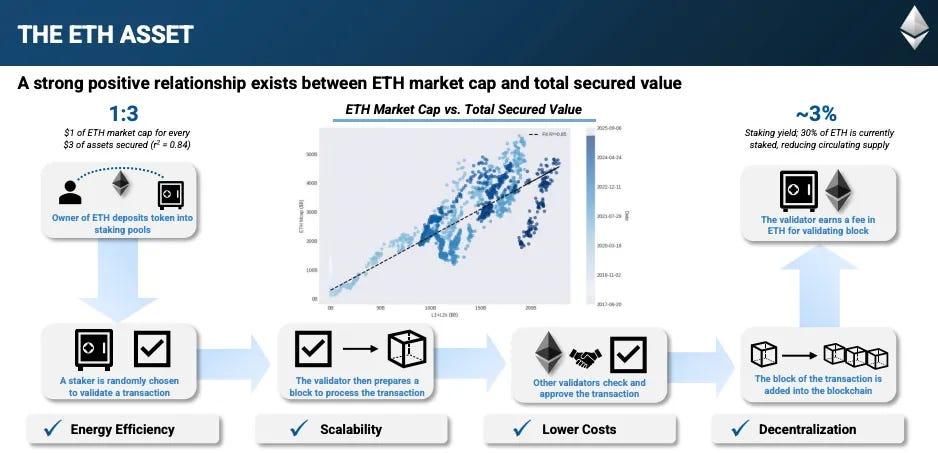

Many companies have jumped on the Ethereum treasury bandwagon with the same zeal that propelled MicroStrategy’s Bitcoin strategy — driven by a bullish ETH outlook, staking rewards, and the fact that ETH ETFs can’t stake yet. As Wintermute founder Evgeny Gaevoy observed on July 17, “there is (clearly) almost no ETH available for sale on Wintermute OTC desk.”

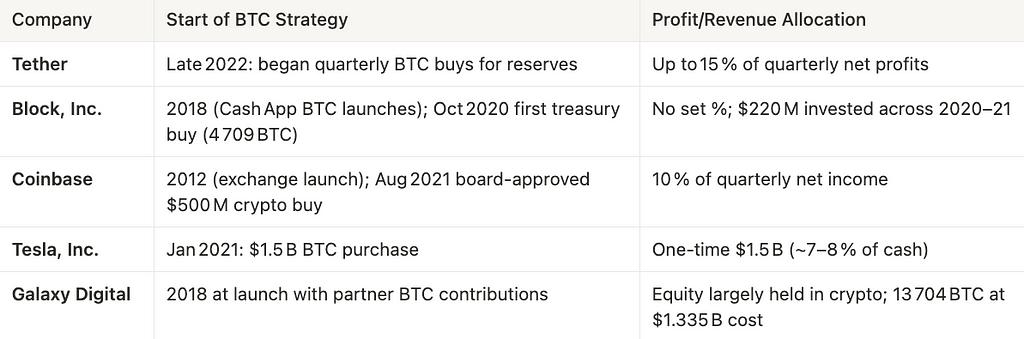

Companies engaged in Ethereum treasury strategies are denoted by a “T” symbol. The leading firms — BitMine, SharpLink, Big Digital, and BTCS — have each posted impressive 30‑day gains in holdings, reflecting their aggressive ETH accumulation.

While Bitmine and SharpLink now hold more ETH than the Ethereum Foundation, their individual stakes remain modest — around 0.25% and 0.23% of total supply — when compared to MicroStrategy which controls nearly 2.865% of Bitcoin’s circulating supply. Moreover, most of these ETH‐treasury programs are very recent, having launched between May and July of this year.

SharpLink Gaming (NASDAQ: SBET)

SharpLink Gaming, a Nasdaq-listed iGaming affiliate firm, announced in 2025 for a $425 million private placement to initiate an Ethereum-focused treasury strategy.

SharpLink structured the strategy around two financing channels: a large PIPE (private investment in public equity) and an ATM (at-the-market) equity facility. On May 27, 2025, SharpLink announced a $425 million PIPE (69.1 million shares at $6.15) led by Consensys (Joe Lubin’s firm) and major crypto VCs like ParaFi Capital, Electric Capital, Pantera Capital, Arrington Capital, GSR, Primitive Ventures and more.

Upon closing, Lubin joined SharpLink’s board as Chairman, guiding strategic direction for the ETH treasury program.

After the PIPE, SharpLink deployed an ATM offering to sell stock into the market as needed. For example, in late June 2025 it raised ~$64 million via ATM sales, and in early July 2025 it sold 24.57 million shares for ~$413 million.

Simultaneously, SharpLink committed to staking nearly 100% of its ETH to earn yield. As of mid-July 2025, about 99.7% of its holdings were staked.

On July 10, 2025, SharpLink completed a definitive agreement to purchase 10,000 ETH directly from the Ethereum Foundation for $25,723,680 (price per ETH: $2,572.37). This marked the first OTC deal between EF and a publicly listed company.

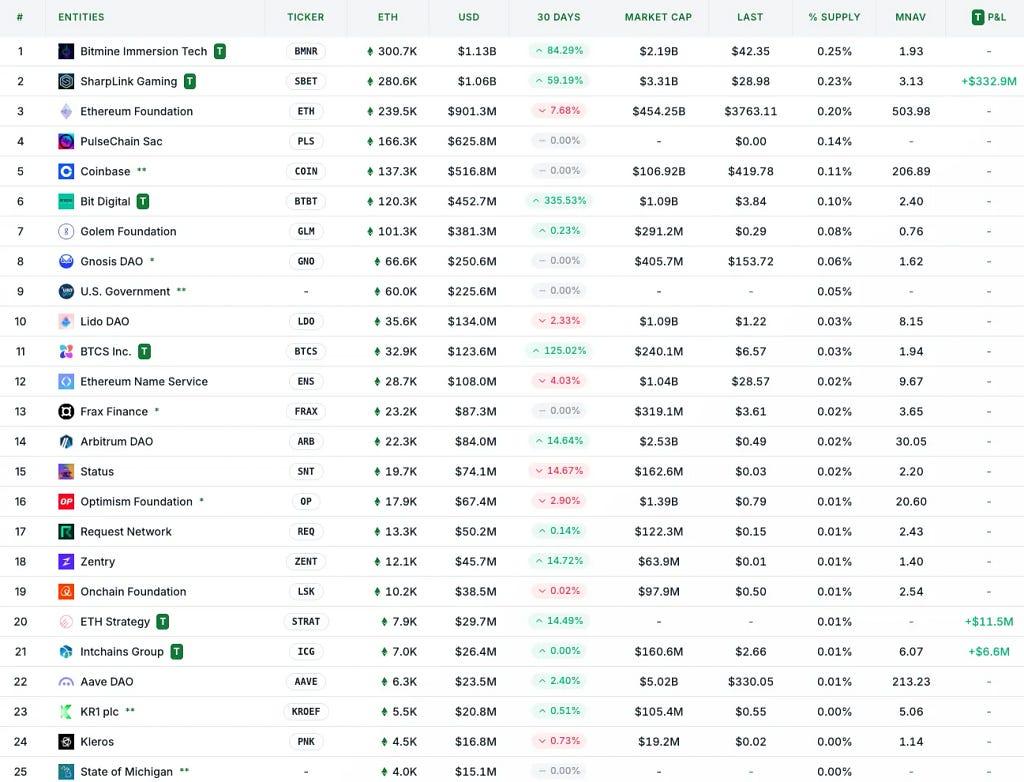

SharpLink’s ETH‑treasury value proposition rests on four core pillars: compelling staking yields, a high Total Value Secured (TVS), operational efficiency, and broader network benefits. Staking rewards not only provide a steady yield buffer for treasury allocations but also help offset acquisition costs. As of today, Ethereum’s TVS stands at $0.80 trillion, yielding a security ratio of 5.9× — that is, $0.80 trillion in ETH, ERC‑20 tokens, and NFTs secured on‑chain divided by $0.14 trillion in staked ETH. Beyond these financial metrics, Ethereum offers superior energy efficiency compared to proof‑of‑work networks, deep decentralization through thousands of independent validators, and a clear roadmap for scaling via sharding and Layer 2 solutions.

BTCS Inc. (NASDAQ: BTCS)

July 8, 2025. BTCS (Blockchain Tech. Consensus Solutions) announced plans to raise $100 million in 2025 to acquire Ethereum for its treasury.

BTCS outlined a hybrid financing model combining traditional and decentralized finance: it will utilize ATM equity sales, convertible debt issuance, and on-chain DeFi borrowing via Aave to fund ongoing ETH accumulation。

For onchain part, BTCs’ strategy centers on Aave as It borrows USDT on the Aave protocol (using ETH as collateral) to fund additional ETH purchases. The company then stakes this ETH (via its NodeOps validator network) to earn rewards. CEO Charles Allen emphasizes that this disciplined, low-dilution strategy (“slow and steady wins the race”) aims to increase ETH per share at low cost.

For example, in June 2025 BTCS borrowed an additional $2.5 million USDT on Aave (raising its Aave debt to $4.0 M) secured by ~3,900 ETH. In July 2025 it borrowed another $2.34 M USDT (total Aave borrowings ~$17.8 M) against ~16,232 ETH of collateral.

Most of the acquired ETH is put to work in staking. BTCS adds the ETH to its NodeOps validator network, running both solo validators and Rocket Pool nodes.

BTCS’s on‑chain strategy is innovative — at the intersection of DeFi and Ethereum treasury management. However, its cost advantage depends on Aave’s interest‑rate environment, and its leveraged approach carries inherent risks. Meanwhile, a sudden surge in ETH demand from other treasury‑focused firms threatens to drain on‑chain liquidity. As an on‑chain leveraged buyer that could amplify this situation, BTCS may help support prices in the short term, but the long‑term impact requires close monitoring — especially if its position grows large enough to influence the Aave market.

Others

BitMine Immersion Technologies (NYSE American: BMNR)

July 8, 2025 (initial funding). BitMine, a crypto mining firm, pivoted to an “asset-light” Ethereum treasury strategy in July 2025. It closed a $250 million private placement (PIPE) on July 8 to acquire ETH for its treasury. Within a week, BitMine accumulated about 300,657 ETH.

The company publicly stated its goal to acquire and stake 5% of all ETH long-term.

Bit Digital (NASDAQ: BTBT)

July 7, 2025. Bit Digital, originally a Bitcoin mining company, announced the completion of its transition to an Ethereum-based treasury strategy.

In a July 7 press release, Bit Digital revealed it raised ~$172 million via a public equity offering and liquidated 280 BTC from its balance sheet to redeploy into Ethereum.

As a result, the company held about 100,603 ETH (having already been accumulating ETH through staking operations since 2022).

GameSquare Holdings (NASDAQ: GAME)

July 10, 2025. GameSquare — a digital media/gaming firm — unveiled a crypto treasury reserve program of up to $100 million in Ethereum. In a July 10 release, GameSquare confirmed its first deployment of $5 million to purchase ~1,818 ETH at ~$2,749 each.

GameSquare raised an initial $9.2 M (gross) in a public equity offering in July, and soon after announced a larger $70 M follow-on equity offering (with overallotment up to $80.5 M) to scale up the ETH reserves.

Conclusion

The growing enthusiasm around corporate crypto treasuries now goes well beyond Bitcoin and Ethereum — many firms are diversifying into SOL, BNB, XRP, HYPE, and more, each staking a claim with its own value proposition.

Yet most of these programs remain strikingly similar and lack sustainable competitive advantages; over time, they’re likely to see their NAV premiums erode relative to better-positioned peers.

The truly advantaged companies tend to have stronger financing structures and strategic partnerships that unlock differentiated opportunities. For example, Metaplanet benefits from Japan’s favorable tax treatment on stocks and the absence of an ETH spot ETF; Twenty One employs a sophisticated funding structure to leverage every available channel to acquire Bitcoin — and has strategically partnered with Tether, Bitfinex, and SoftBank to vault into the position of the third‑largest holder, maximizing its scale advantage. SharpLink, meanwhile, is spearheaded by Consensys alongside leading crypto VCs, with Joseph Lubin joining its board, and BTCS tapps into DeFi.

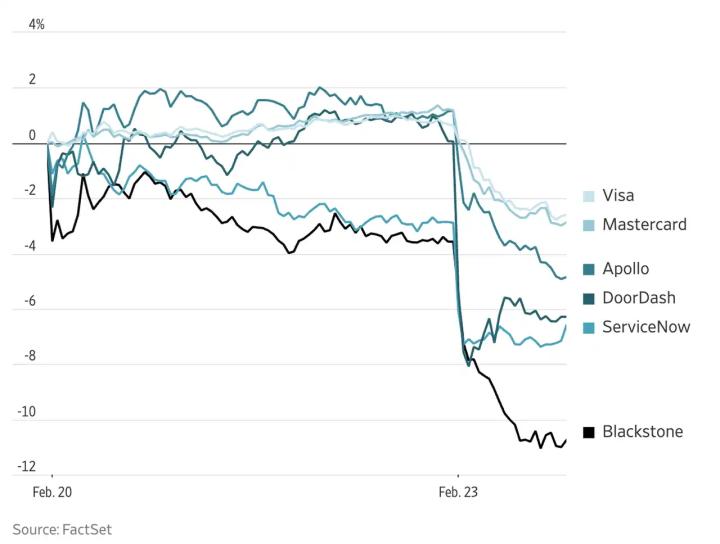

For public investors, caution remains essential: many of these companies trade at elevated NAV multiples amid significant hype, and their share prices often move on announcements — while investors lack the transparent, real‑time insight needed to assess shifts in each firm’s position. Moreover, broader market risks — particularly in a bear market — can swiftly erode any premium these strategies command.

We’re also seeing a surge of crypto‑focused funds actively deploying capital via PIPE transactions and establishing dedicated vehicles to back these treasury companies. At the same time, seasoned industry veterans are stepping in as strategic advisors — tapping into this space to provide hands‑on support and expertise.

Sources

MSTR:

Metaplanet:

https://metaplanet.jp/en/analytics

Others BTC:

https://bitcointreasuries.net/

https://www.sec.gov/Archives/edgar/data/1865602/000121390025034374/ea023922201ex99-3_cantor.htm

https://www.sec.gov/Archives/edgar/data/1889123/000121390024063750/ea020989901ex99-1_ftac.htm

Ethereum:

https://www.strategicethreserve.xyz/

https://investors.sharplink.com/

https://d2ghdaxqb194v2.cloudfront.net/2597/197831.pdf

https://bitminetech.io/investor-relations/

https://bitminetech.io/wp-content/uploads/2025/06/BitMine-Corporate-Presentation-6-10-25.pdf

https://bit-digital.com/wp-content/uploads/2025/06/BTBT-IR-Deck-Mar-2025.pdf

https://x.com/aya_kantor/status/1946303119077286105

https://www.galaxy.com/insights/research/beyond-btc-ethereum-as-a-corporate-treasury-asset

Others:

https://solstrategies.io/wp-content/uploads/2025/01/2025-01-28-presentation.pdf

The Crypto‑Stock Showdown— Innovation or Bubble? was originally published in IOSG Ventures on Medium, where people are continuing the conversation by highlighting and responding to this story.