SPK, the native token of the decentralized finance (DeFi) platform Spark, surged to a new All-Time-High yesterday.

However, this price increase did not last long. Within hours of reaching its peak, SPK dropped nearly 25% due to a profit-taking wave from investors that triggered a reversal in momentum.

SPK's Surge Slows Down: Strong Net Outflow and Increased Short Bets

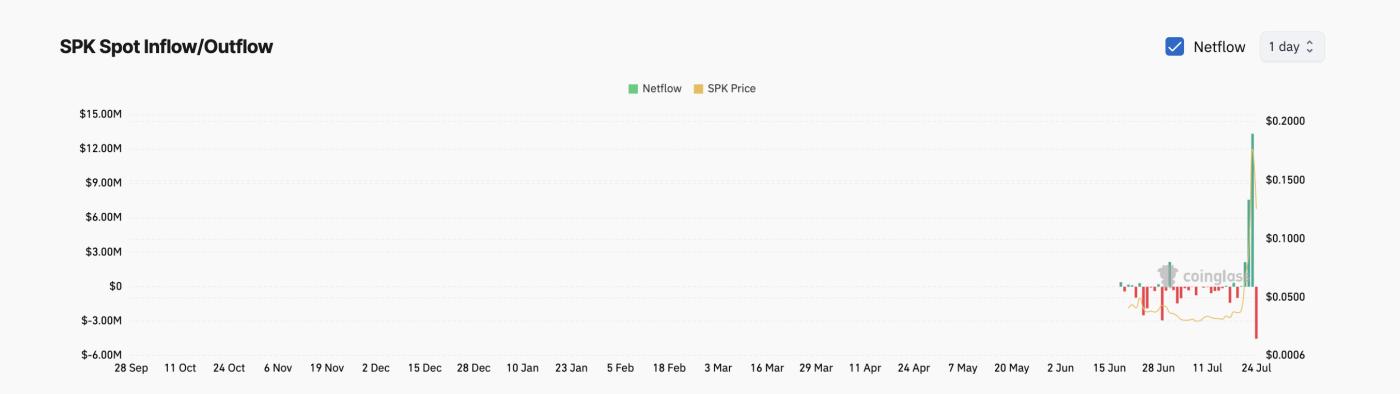

An assessment of SPK's net flow in the spot market provides insight into the cooling of the price surge. According to Coinglass, this altcoin saw a significant increase in net outflow from the spot market in today's trading session, totaling $4.53 million at the time of writing.

For TA and token updates: Want more detailed information about such tokens? Subscribe to the Daily Crypto Newsletter by Editor Harsh Notariya here.

SPK Net Flow. Source: Coinglass

SPK Net Flow. Source: CoinglassThe increase in net outflow from the spot market means more tokens are being withdrawn from exchanges than deposited. This trend reflects SPK investors taking profits, who leveraged the token's month-long price surge to lock in gains.

As a result, downward price pressure has increased, raising the likelihood that the price will continue to decline from its All-Time-High.

Moreover, the sentiment in SPK's futures market is becoming increasingly negative. This is reflected in its funding rate, which has only recorded negative values since July 21.

SPK Funding Rate. Source: Coinglass

SPK Funding Rate. Source: CoinglassThe funding rate is a periodic payment exchanged between long-term and short-term traders in perpetual futures contracts to keep the contract price aligned with the spot price of the underlying asset. When its value is negative, short sellers are paying long-term holders.

This indicates a negative sentiment prevailing in the SPK market, with many traders betting on a price decline.

Profit-Taking Pulls SPK Lower; Will $0.12 Hold or Will $0.11 Be Next?

The increase in net outflow from SPK and negative funding rate suggest the token is entering a correction phase. Although the token's long-term fundamentals may remain solid as DeFi activity increases, short-term indicators suggest SPK may face further price declines in the next few trading sessions.

In that scenario, its value could drop below $0.12 and tend towards $0.11.

SPK Price Analysis. Source: TradingView

SPK Price Analysis. Source: TradingViewHowever, if profit-taking slows down, SPK may regain strength and attempt to break above $0.15 to reclaim its All-Time-High of $0.19.