In June 2025, when Circle went public on its first day of trading, its stock performance ignited market enthusiasm, surging over 168%. However, while this was a celebration for secondary market investors, a deeper data point stung many: according to Venture Capital Journal, early-stage venture capital firms now had a book return of around 8 times their total investment.

The primary market's cake is large, yet closed. The trillion-dollar IPO pre-market remains dominated by a few.

Ventuals wants to change this situation, with the aim of "fragmenting" these unicorn equities, thereby lowering barriers, breaking the venture capital monopoly, and allowing ordinary investors to have a share before company listing.

Project Advantages and Innovation

Alvin Hsia and Emily Hsia came with their crazy idea: What if ordinary people could short OpenAI's valuation bubble like hedge funds, or use $100 to long the next SpaceX?

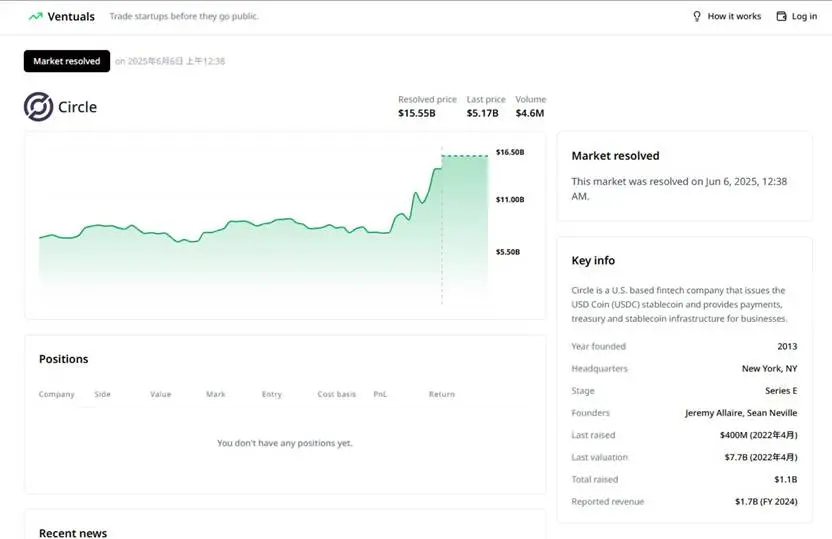

As X user @LS J1mmy commented: Investing in unicorn company Circle using Ventuals, you could long at a $7 billion valuation before its IPO; without Ventuals, you could only buy stocks at a $15.5 billion opening valuation. Ultimately, the former's return rate reached 240%, while the latter was only 55%.

Ventuals' core challenge, and its greatest innovation, lies in how to price private equity without a public trading market. Traditional oracles rely on exchange prices, but OpenAI has no exchange, no K-lines, no depth, not even daily trading. How does valuation come about?

Ventuals' solution consists of two parts: high-performance underlying infrastructure and an elegant pricing mechanism.

First, it chose the hardest path: building a perpetual contract market on Hyperliquid. The reason for choosing Hyperliquid is clear: sub-second latency, 100,000 orders per second. This is not an ordinary blockchain, but a financial infrastructure born for high-frequency trading, providing performance guarantees for complex derivative trading.

Second, and most critically, Ventuals designed an "Optimistic Oracle" to solve the valuation challenge. Simply put: Anyone can submit a valuation and stake a margin. If someone disagrees, they can initiate a challenge; if no one challenges, the valuation is considered the market consensus "truth"; if disputes exist, they are resolved through voting.

This mechanism transforms the power struggle of "who gets to decide" into an economic game of "who dares to speak with money", credibly introducing an off-chain consensus on-chain. In the crypto world, this is called "implementing justice through code".

Founding Team's Technical Evolution

The background and credentials of the founding team are crucial for such a bold concept. Alvin and Emily Hsia did not emerge out of thin air. As former entrepreneurs-in-residence at Paradigm, their previous project Shadow had already proven itself—securing a $9 million seed round led by Paradigm.

Looking back at the Hsia siblings' entrepreneurial trajectory, an exceptionally clear logic chain can be discovered:

Shadow solved "how to efficiently extract data from the chain". By mirroring the public chain state, it created a read-only execution environment, allowing developers to obtain chain information at low cost. This was a process of "outputting" data.

Ventuals solves "how to credibly introduce off-chain subjective data on-chain". It needs to handle unlisted company valuations, which are essentially off-chain consensus, requiring a mechanism to transform them into on-chain facts. This is a process of "inputting" data.

The two projects seem different but are actually interconnected: both are building a more powerful data layer for blockchain. This perhaps explains why the top fund known for technical research, Paradigm, continues to bet on them. In their view, data infrastructure is the next frontier of DeFi. This clear technological evolution path is the most solid basis of trust for the Ventuals project.

Next CME or High-Risk Playground?

Ventuals' ambition extends beyond trading. Imagine a scenario where when OpenAI's next funding round valuation is too high, the market expresses dissatisfaction through large-scale shorting; when a unicorn scandal is exposed, its valuation contract instantly plummets. Every on-chain transaction is transparent, with financial media reporting in real-time, public opinion pressure forcing corporate reform. This is true market democratization—not letting everyone buy stocks, but allowing everyone to express their judgment of a company's value.

But revolutionaries often die during the revolution. Regulation is the Sword of Damocles hanging overhead. Will the SEC classify these contracts as unregistered securities? Will the CFTC determine this as illegal futures trading? More concerning is oracle security; once valuation is manipulated, large-scale liquidation will destroy all trust. In a system that relies on "consensus" for pricing, trust collapse means everything goes to zero.

When MicroStrategy rewrote corporate financial rules by holding Bitcoin, when Tesla's stock price looks more like a cryptocurrency than a traditional stock, financial boundaries are melting. Ventuals stands at this crossroads. To the left, it might become a niche high-risk trading arena. To the right, it might become the CME of the private market, redefining the pricing mechanism of a trillion-dollar market.

As the huge return difference on Circle's IPO first day reveals: The excess profits created by information asymmetry are precisely what DeFi aims to eliminate. In this David versus Goliath game, the two Paradigm disciples might just be holding that crucial stone.