According to analysts, the US Dollar Index (DXY), which measures the strength of the US dollar against a basket of major currencies, is showing signs of improving momentum. They believe the index may be approaching its Dip, with the potential for recovery in the near future.

However, a stronger dollar could have significant impacts on cryptocurrency, especially Bitcoin (BTC). This largest cryptocurrency has historically shown an inverse relationship with DXY.

DXY Shows Reversal Signs, but Bitcoin May Face Pressure

In a recent post on X (formerly Twitter), Barchart shared that on the weekly chart, DXY is about to form a 'death cross' for the first time since January 2021.

To understand better, death cross is a technical analysis pattern that occurs when the short-term moving average crosses below the long-term moving average. This is considered a bearish signal, typically leading traders to predict continued price decline.

However, Barchart points out that the two most recent times this occurred (2018 and 2021), it marked the market's Dip. Therefore, although the signal is bearish, historical trends suggest it may indicate a potential recovery for the dollar.

For Token and market updates: Want more detailed information about such tokens? Subscribe to the Daily Crypto Newsletter by Editor Harsh Notariya here.

DXY market Dip prediction. Source: X/Barchart

DXY market Dip prediction. Source: X/BarchartHenrik Zeberg, Chief Macro Economist at Swissblock, also shares a similar view. In his latest video, he notes that many currently have a bearish perspective on the dollar. However, he believes this view may not be accurate at this time.

Zeberg observed that the Relative Strength Index (RSI) is showing higher Dips. This is often a sign that the current trend is losing momentum. He added that although the dollar is currently in a downtrend, there could be a short-term recovery or stabilization.

However, ultimately, DXY may still face a final decline phase. This phase could bring the index to new lows before the market begins to recover or change direction, likely around September.

"When we see people starting to become very pessimistic about the dollar, it might be time for us to start thinking about where we might see the Dip," he said.

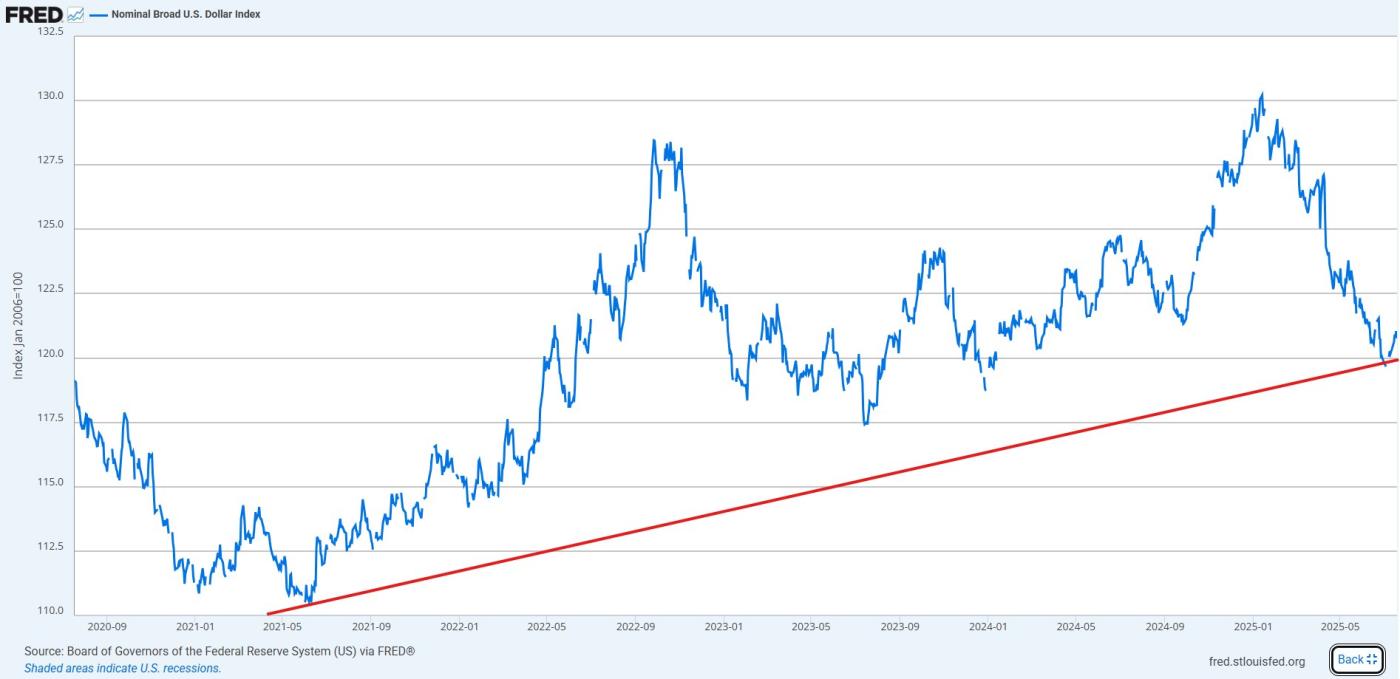

Meanwhile, Andrea Lisi, a certified financial analyst, argued in a recent statement that concerns about USD weakness are based on fluctuations in the DXY index. However, he believes the Nominal Broad US Dollar Index (Nominal DXY) is a more reliable indicator to assess whether the dollar is entering a Bear market.

"Currently, the Nominal DXY remains firmly within the established price channel, with primary support identified at 120. Importantly, we have not seen a decisive break below this level, suggesting that any short-term weakness may be exaggerated," Lisi stated.

Nominal Broad US Dollar Index Performance. Source: X/Andrea Lisi

Nominal Broad US Dollar Index Performance. Source: X/Andrea LisiAlthough all this is positive for the dollar, its impact on Bitcoin is not very favorable. BeInCrypto has previously reported that Bitcoin prices often move inversely to the dollar's value.

For example, previous tensions between Federal Reserve Chairman Jerome Powell and President Trump, or broader economic developments that put pressure on DXY, often had positive impacts on Bitcoin's price movement.

Therefore, if DXY increases, Bitcoin is likely to decrease. Moreover, Bitcoin's potential decline due to the dollar is also influenced by other market factors.

BeInCrypto recently highlighted some signs of potential slowdown or price correction in Bitcoin's current price surge. These signs include increased whale flows to exchanges, high Coin Days Destroyed (CDD), and negative correlation between Altcoins and Bitcoin. All of these suggest potential selling pressure and increasing volatility.

Additionally, historical data from CoinGlass indicates that the third quarter is typically a weaker period for Bitcoin. Average profits only reach 6.16%, lower than other quarters.

These seasonal trends, combined with DXY's potential recovery, could create a challenging environment for Bitcoin.