As Bitcoin reaches a new high, cryptocurrencies are becoming increasingly important in the global financial system, and their regulatory issues are receiving high attention from governments and international organizations. According to bitsCrunch data, 154 wallets involving major criminal activities were discovered on Ethereum and Polygon networks alone, and cross-chain analysis identified 633 sanctioned addresses, highlighting the potential risks of cryptocurrencies in illegal financial activities.

What are Crypto Sanctions?

Sanctions, as an important regulatory tool, typically involve prohibiting or restricting commercial dealings and financial transactions with specific countries, entities, or individuals. These measures include not only asset freezes and transaction restrictions but also extend to travel bans and trade controls. The sanctions system can be divided into primary and secondary sanctions, with the former requiring all domestic entities to comply and the latter aimed at preventing third parties from transacting with sanctioned targets.

In November 2023, the U.S. Treasury's Office of Foreign Assets Control (OFAC) sanctioned Russian national Ekaterina Zhdanova for providing cryptocurrency money laundering services to Russian elites and ransomware groups. In October of the same year, OFAC took sanctions against Hamas-affiliated financial service institutions. In June, the United States, Japan, and South Korea jointly sanctioned the North Korean hacker group Kimsuky to combat its cyber espionage activities and support for nuclear weapons programs.

The Tornado Cash case became a significant turning point in cryptocurrency regulation. Since its operation in 2019, the mixing token service has processed over $7 billion in cryptocurrency transactions, with a considerable portion involving money laundering activities. In August 2022, OFAC imposed sanctions on it, but a recent ruling by the U.S. Fifth Circuit Court of Appeals considered that its immutable smart contract does not meet OFAC's definition of "property" and thus is not within the scope of sanctions. Nevertheless, last year, the New York federal prosecutor charged Tornado Cash's two founders, Roman Semenov and Roman Storm, with money laundering and sanctions violations.

In the current complex international regulatory environment, cryptocurrency industry participants must be extremely cautious. Although some situations may temporarily be outside regulatory oversight, any transactions involving sanctioned entities could face severe penalties. Various regulatory agencies, including the U.S. OFAC, Canadian OSFI, the European Union, UK Treasury, and the United Nations, are continuously improving their sanctions regulatory systems.

[The rest of the translation follows the same professional and accurate approach, maintaining the technical terminology and context.]Overall, wallets have adopted different fund transfer strategies, with some focusing on large transfers, some preferring frequent small transfers, and some primarily operating through custodial wallets. This differentiated behavioral pattern provides important reference value for understanding and monitoring sanction evasion activities.

Data source: bitsCrunch.com

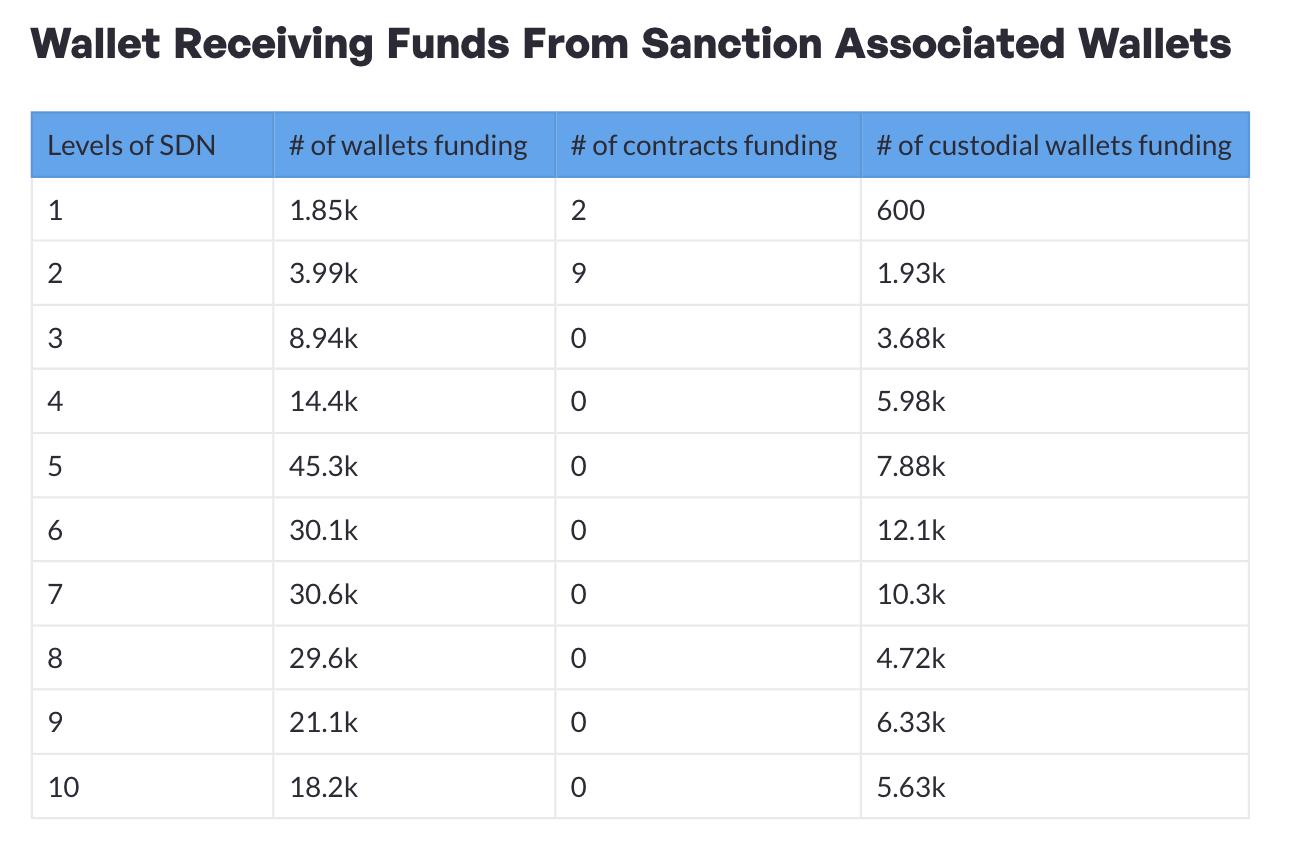

From the wallet data receiving sanctioned funds, it can be observed that as the level increases, the number of wallets receiving funds shows a clear growth trend, peaking at level 5 with approximately 45.3k wallets, after which it gradually declines. The data shows that only levels 1 and 2 of SDN used decentralized smart contracts, with 2 and 9 respectively. This indicates that sanction-related wallets tend to use traditional and stable fund transfer methods, such as custodial wallets, ultimately possibly to achieve fund withdrawal or exchange.

This fund flow pattern reflects the complexity of fund transfers in blockchain transactions and the challenges faced in tracking and monitoring these fund flows. Especially in fund transfers across multiple levels, tracing the source of funds becomes increasingly difficult, which highlights the importance of strengthening blockchain regulation and transparency.

Non-Fungible Token Money Laundering Analysis

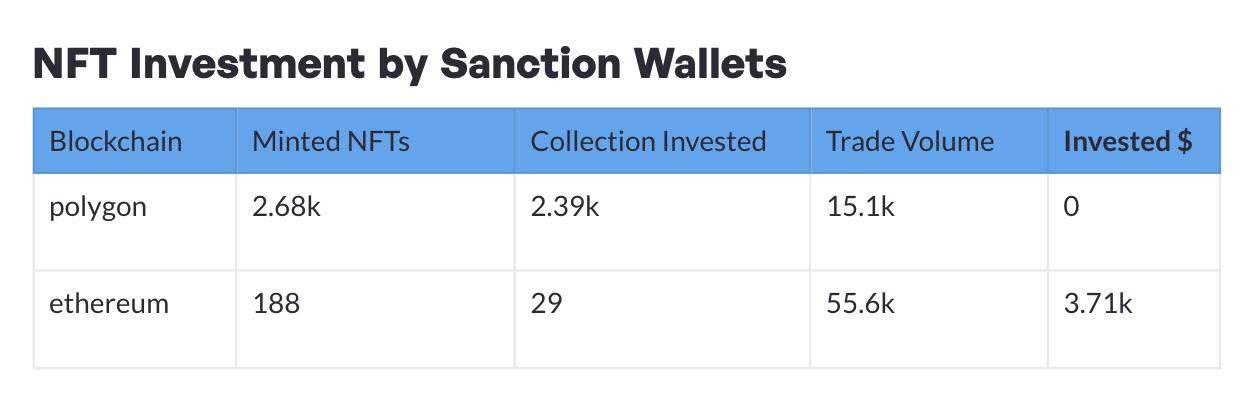

According to bitsCrunch data, we conducted an in-depth analysis of investment behaviors of sanctioned wallets in the Non-Fungible Token market. Sanctioned wallets invested in a total of 2,400 Non-Fungible Token collections, with a total transaction volume of approximately $70,000. However, up to 88% of the investments were related to fraudulent Non-Fungible Tokens. These scam collectibles typically have low market credibility and are often used as a means to further obscure funds.

Data source: bitsCrunch.com

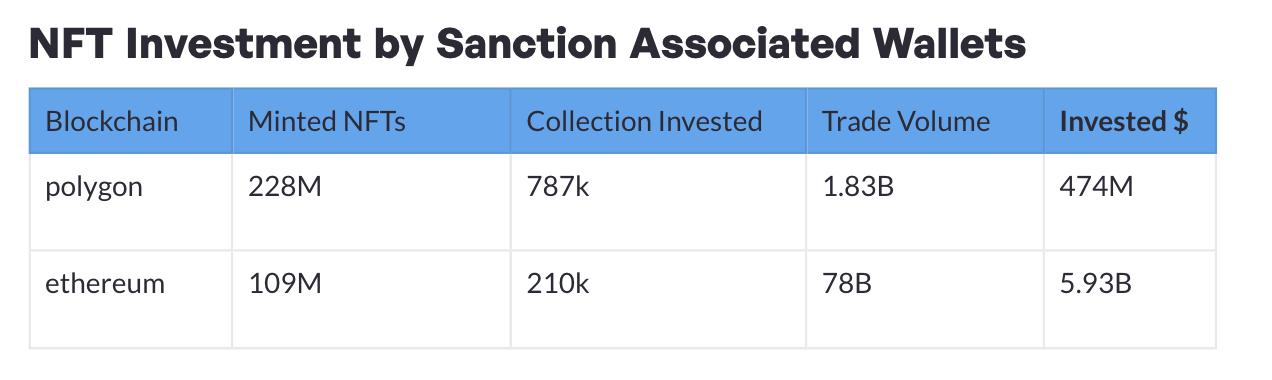

Wallets associated with sanctions involve more extensive transaction volumes and amounts. According to bitsCrunch data, transactions involved 3.37 billion Non-Fungible Tokens across 99.8 thousand collections, with a total transaction volume of $79 billion. Among these, 58% of the transactions were identified as "wash trades", with the Non-Fungible Token market being used as a crucial tool for laundering sanctioned funds.

Data source: bitsCrunch.com

How to Reduce Risks?

Geolocation and User Screening

In the increasingly complex global financial regulatory environment, precise geolocation and user screening have become key strategies for virtual currency service providers to reduce risks.

As government cryptocurrency regulation intensifies, virtual currency exchanges must take proactive measures to ensure the platform is not used for illegal activities that violate international sanctions. This is not only a legal compliance requirement but also an important measure to maintain platform reputation and financial system security.

An effective sanction compliance solution requires a multi-layered risk management approach. The primary task is to establish comprehensive user identity and geographical location verification mechanisms. By deploying advanced IP geolocation and address blocking technologies, trading platforms can identify and block users and transactions from sanctioned jurisdictions in real-time.

On-Chain Analysis Sanction Screening

Sanction screening is another key link. Through blockchain analysis technologies, regulators can effectively identify suspicious addresses. Once an address is blacklisted, all parties need to cut off transaction dealings with that address. Meanwhile, to address evolving risk situations, the scope of blacklists is also being dynamically adjusted.

We can also establish a comprehensive screening system based on multiple international sanction and politically exposed persons watch lists, including lists from authoritative institutions such as the US Treasury's Office of Foreign Assets Control (OFAC), the European Union, and the UK Treasury. These screenings should re-examine existing users for each transaction. By analyzing transaction records and related addresses in the blockchain, suspicious transaction patterns can be identified, including mixing addresses, ransomware-related addresses, and known criminal networks.

Conclusion

The complexity of the cryptocurrency ecosystem poses enormous challenges for regulators. Funds can quickly circulate through hundreds of wallets and contracts, and traditional tracking methods are no longer applicable. Looking towards 2025, the cryptocurrency ecosystem will also evolve towards a more standardized direction. Market participants can leverage advanced on-chain analysis tools, focus on compliance, and enhance risk management capabilities. This includes not only implementing effective KYC and anti-money laundering measures but also closely monitoring global sanction lists and carefully screening customers' geographical locations and transaction histories. Only then can the risk of incurring substantial fines for violating sanction regulations be minimized.

Overall, the controversy surrounding cryptocurrency sanctions will continue, and the game between regulatory bodies and the industry will not end. It is believed that through continuous improvement of legal practices and industry innovation, a sustainable development path will ultimately be found.