ZORA's price has been trending downward in the past 24 hours, moving further away from its new All-Time-High of $0.105.

This downward trend occurred after whale activity decreased and inflows to exchanges slightly increased, signaling the beginning of a profit-taking cycle.

ZORA Whales Retreat as Token Approaches Peak — Is a Correction Coming?

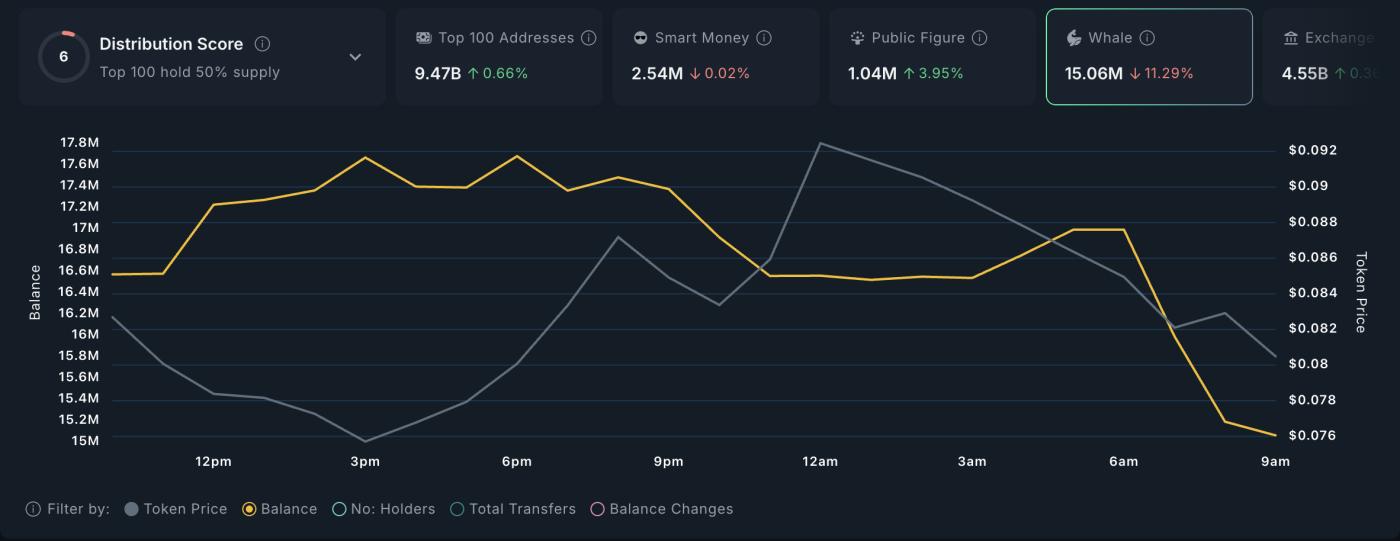

Data from Nansen shows that ZORA's large investor activity has significantly declined in the past 24 hours.

According to the on-chain data provider, balances held by high-value wallets – those holding over $1 million in ZORA value – have decreased by nearly 11% in just one day, indicating a significant change among key shareholders.

For TA and token market updates: Want more detailed information about such tokens? Subscribe to Harsh Notariya's Daily Crypto Newsletter here.

ZORA whale activity. Source: Nansen

ZORA whale activity. Source: NansenThis sudden decline occurred after ZORA reached its All-Time-High of $0.105. With increasing market volatility and uncertainty spreading across the broader altcoin space, whales seem to be reducing their exposure while the token price remains high.

This profit-taking wave from these whales could also create a domino effect among smaller retail investors. With confidence in the short-term trend weakening, smaller investors may tend to follow suit, increasing downward price pressure on ZORA.

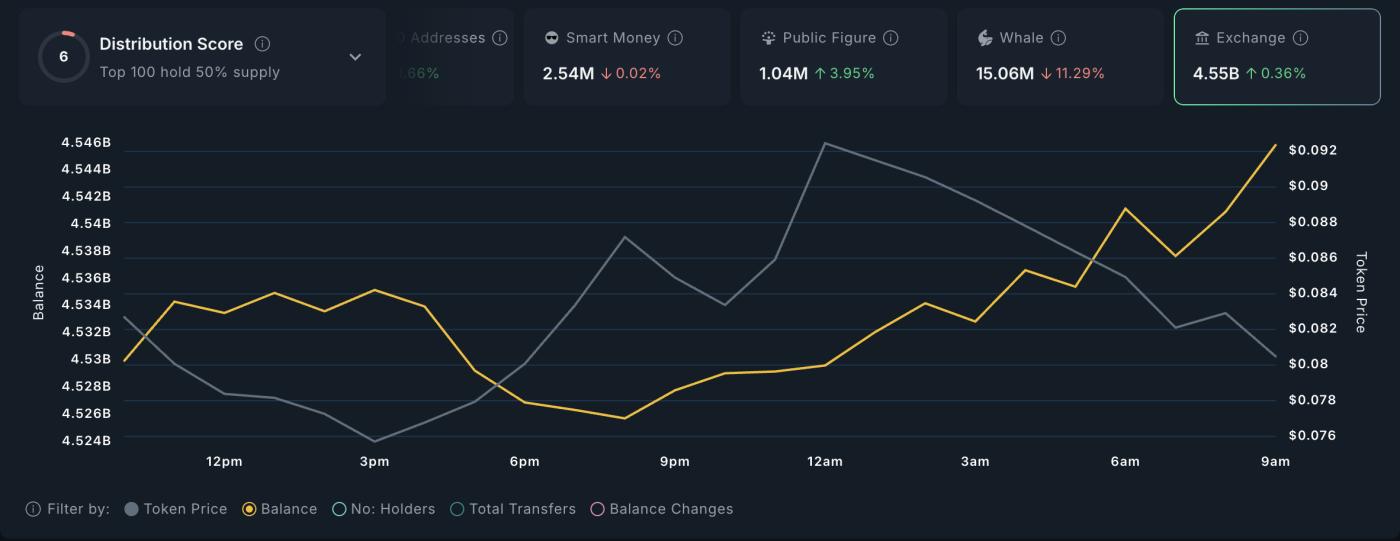

Moreover, ZORA has recorded a slight 0.36% increase in tokens held on exchanges over the past day. This indicates an increased number of tokens being sent to trading platforms since ZORA reached its All-Time-High.

ZORA trading activity. Source: Nansen

ZORA trading activity. Source: NansenWhen an asset's exchange inflows spike dramatically, it's typically a sign that investors are preparing to sell. Increased inflows combined with reduced whale activity and diminishing buying momentum further increase downward price pressure, increasing the likelihood of a short-term ZORA price correction.

ZORA Weakens as Sellers Gain Advantage

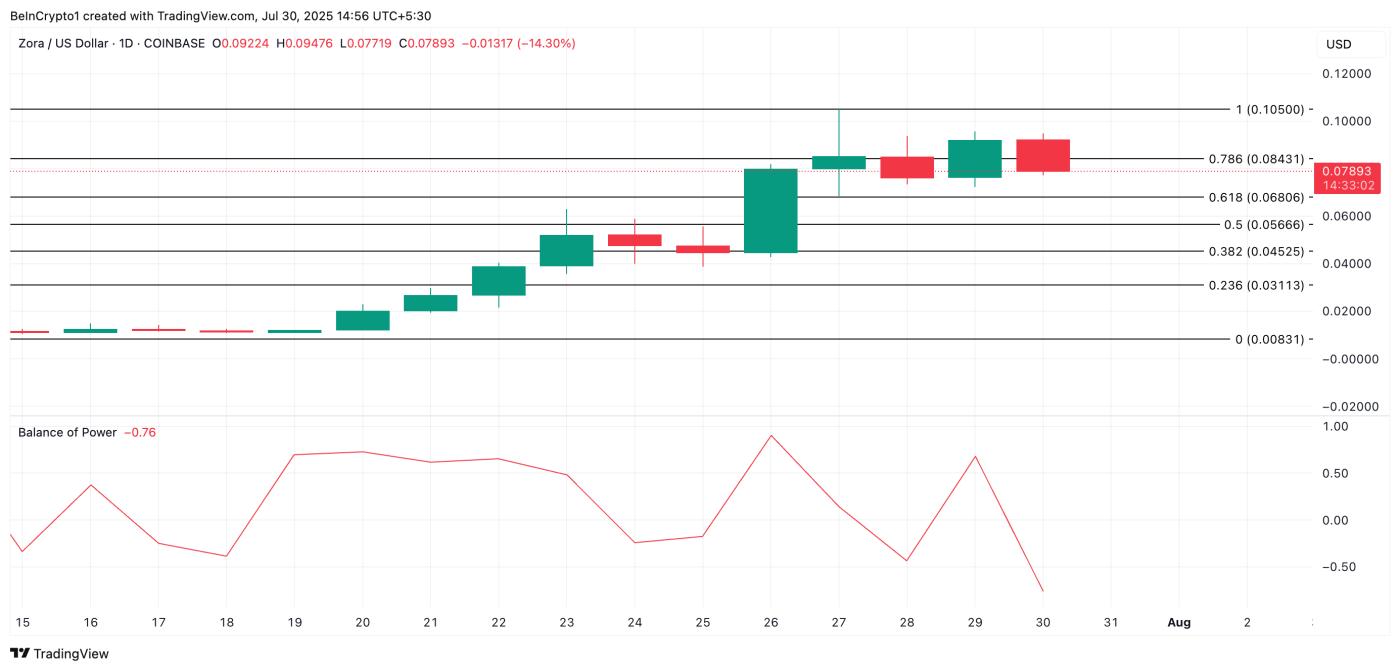

From a technical perspective, ZORA's Balance of Power (BoP) indicator is currently negative at the time of writing, emphasizing a clear decline in buying pressure. At the time of writing, the momentum indicator, which measures buying and selling pressure, is at -0.76

This suggests that the buying side is losing control and sellers are beginning to drive market direction.

If this continues, ZORA's price could drop to $0.068.

ZORA price analysis. Source: TradingView

ZORA price analysis. Source: TradingViewOn the other hand, an increase in buying strength could trigger a breakout above the resistance level at $0.084 and a return to $0.105.