Bitcoin's price has fluctuated in recent days, ranging from $117,261 to $120,000. However, recent market conditions and external factors, such as the Federal Open Market Committee (FOMC) meeting on Wednesday, have caused a temporary decline.

Currently, Bitcoin is priced at $118,419, slightly recovering after dropping to $115,700. Despite the recovery, Bitcoin's path remains unclear due to factors like selling pressure.

Bitcoin Shows Signs of Upcoming Price Decline

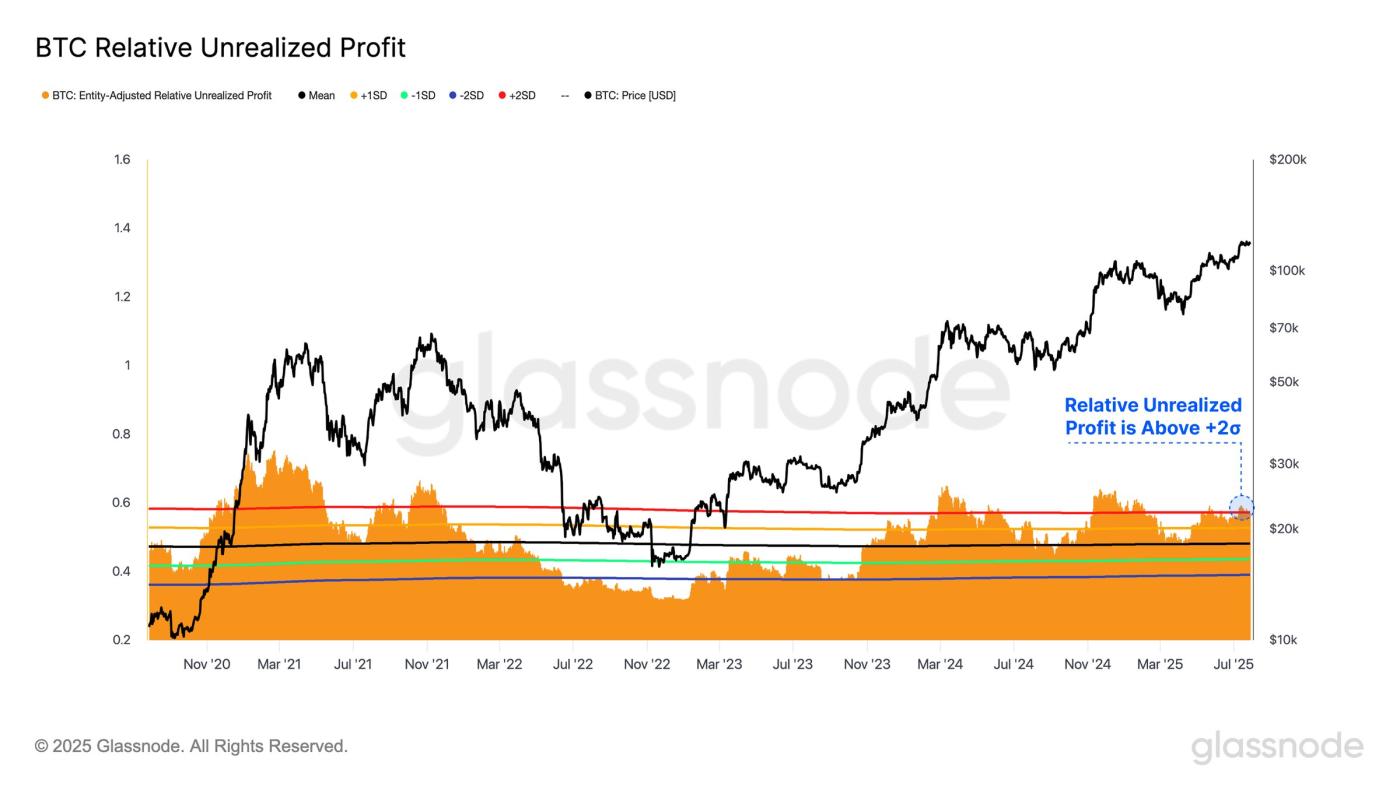

The Relative Unrealized Profit (RUP) index recently crossed the +2σ band, a level typically associated with market euphoria. History shows this setup often appears before market peaks, signaling potential selling pressure that could push prices lower.

The current RUP status suggests a potential correction in the coming days, likely pushing Bitcoin's price out of its consolidation range. Based on previous models, a shift towards selling could lead to additional downward pressure.

For token and market updates: Want more information about such tokens? Subscribe to the Daily Crypto Newsletter by Editor Harsh Notariya here.

Bitcoin's Unrealized Profit Source: glassnode

Bitcoin's Unrealized Profit Source: glassnodeThe Squeeze Momentum Indicator (SMI) signals that Bitcoin is entering a consolidation phase. History shows these consolidation periods, where price movement becomes more restricted, often precede significant price volatility when the squeeze is released.

As compression continues to increase, Bitcoin's price may make a strong move in one direction. If the broader market maintains a downward trend, Bitcoin could experience a significant drop, especially if SMI confirms this negative trend in the coming days.

Bitcoin SQM. Source: TradingView

Bitcoin SQM. Source: TradingViewBTC Price Needs to Increase

Bitcoin is currently trading at $118,410, after dropping to $115,700 on Wednesday when the FOMC report was released. The market's reaction to the Federal Reserve's decision to maintain interest rates led to BTC's recovery, but fundamental market conditions still pose risks.

Bitcoin's price could continue to decline if investors start taking profits, potentially pushing the cryptocurrency below the $117,261 support level. A drop below this support could drive Bitcoin's price to $115,000 or even lower.

Bitcoin Price Analysis. Source: TradingView

Bitcoin Price Analysis. Source: TradingViewThe only way to neutralize this declining outlook is if Bitcoin can hold above $120,000 and reclaim $122,000 as support. A surge beyond these levels could provide the necessary momentum to push Bitcoin to new highs. However, until that occurs, Bitcoin's price remains vulnerable to market pressures.