However, this also requires clearer governance and equity design, otherwise it may easily touch upon legal risks of unregistered securities. In the long run, building a decentralized social platform with a social relationship graph and content discovery algorithm is the key to forming a true on-chain content ecosystem. Currently, Zora's insufficient distribution capabilities were discussed, with Trend's founder Mable Jiang understanding Jesse's original intention and acknowledging Toly's criticism. Just recently, she launched a Zora-"similar" product called Trend on Solana, highlighting several key points:

Most content lacks value. In today's generative AI era of almost zero-cost content creation, the vast majority of content lacks scarcity and enduring value. Many trending posts remain untradeable even when published by famous IPs.

The lack of distribution and social graph makes content on Zora difficult to discover and generate value.

Some content indeed has commemorative value, such as recording historical events or artistic moments, and such content tokens might have long-term "weight". But these are rare; most content tokens will not generate transactions, which is a crucial reason why most content tokens lack value.

The Wool Comes from the Sheep - Does Blockchain Have a Creator Economy?

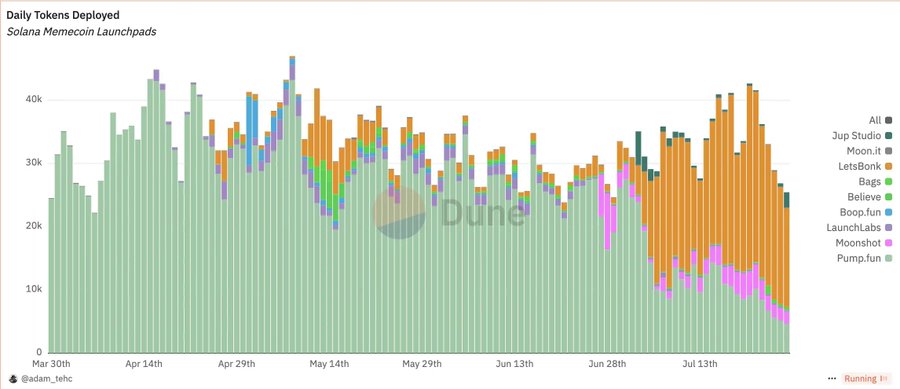

[The rest of the translation follows the same professional and accurate approach, maintaining the original meaning while translating to English.]Although the "casino concept" of Solana is deeply rooted, its problems have also emerged. The market adds an average of 20,000 to 30,000 new tokens daily, making it increasingly difficult to attract attention, and the total market value of these Memecoins continues to decline. @thecryptoskanda further analyzes that Solana has adopted a migration strategy, first collaborating with OG communities and institutional forces to suppress "continuous SOL selling" on Pump.fun, and attempting to establish a more controllable and long-term stable market-making system (LetsBonk), avoiding the uncontrollable "public sea gambling ship" driven by market sentiment. The collaboration with Kraken aims to shift speculative trading from old platforms to new sub-platforms, continuously providing a "sudden wealth opportunity" for a small group of people while stabilizing most users and maintaining the financial stability of the SOL ecosystem.

Daily token deployment ratio of Solana's major launch platforms, source: Dune

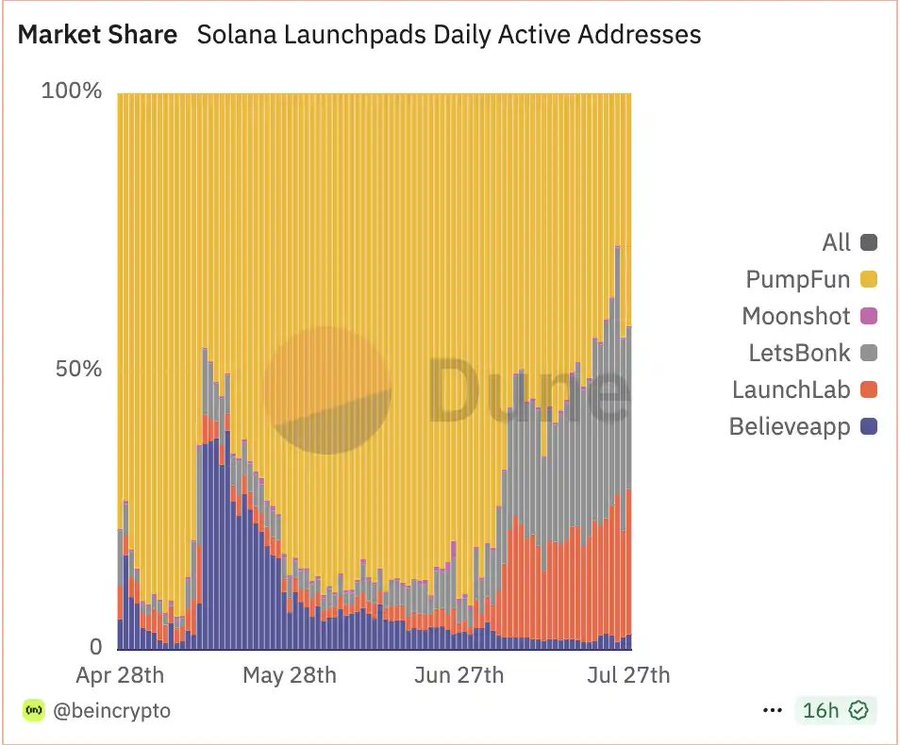

However, the migration strategy is not smooth sailing. Both internal and external challenges are significant. Internally, they successfully pushed BONK, a team that will continue to contribute to the ecosystem, to gain market share beyond Pumpfun, but this is merely a stopgap measure. Its positioning is still Memecoins. The true meaning of opening a sub-platform should be the previously mentioned "ICM" and "coin stock concept", but these have not met expectations. The market share of Believe, the leading platform for ICM, continues to decline, and with the emergence of multiple "SCAM startups", the market merely sees it as a variant of Memecoins.

Launch platform market share, source: Dune

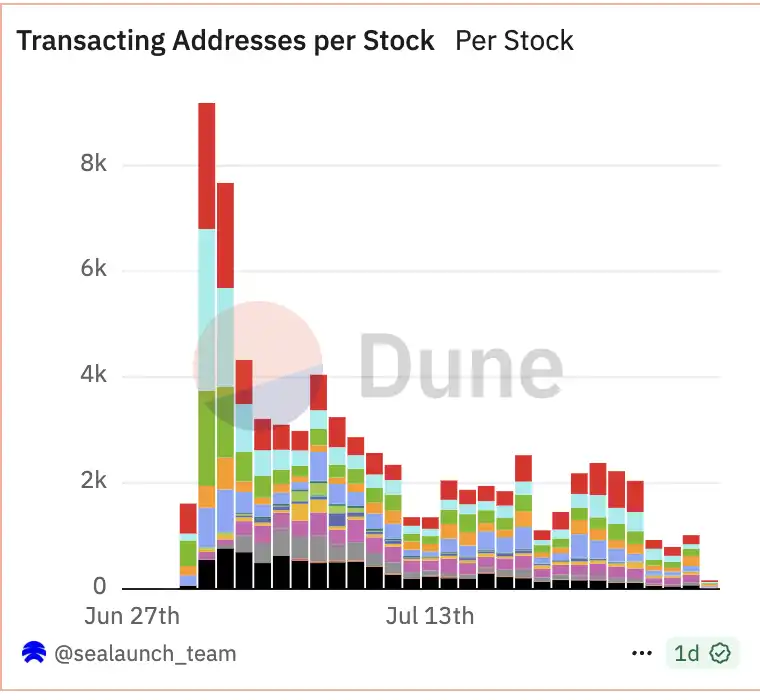

The on-chain US stocks concept only sparked discussion in the first few days of issuance, but the actual number of participants is extremely low. In the past week, the total number of addresses participating in all on-chain US stocks is barely over a thousand. The total trading volume has only accumulated to around $75 million in the past month.

xStock trading addresses, source: Dune

xStock trading addresses, source: Dune

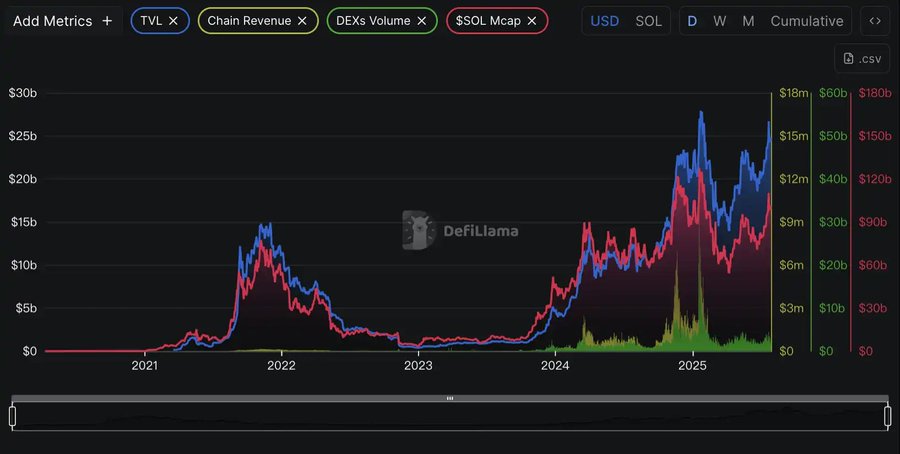

Additionally, @thecryptoskanda mentioned that Solana's biggest competitor is not Base, but Binance. He believes Binance is a USDT-based casino, while Solana is a SOL-based casino, and they are in direct competition. Binance attracts SOL's liquidity through mechanisms like Alpha and refuses to list Solana Memecoins on spot/futures, forcing Solana to accelerate building its own closed-loop market.

Source: Defillma

With internal concerns and external challenges, more and more coin stock companies and ETFs are choosing to build Solana reserves through deep on-chain binding. This serves both as interest income for financial products and as a "base" to maintain token price. Regardless of the approach, Solana has reached a crossroads that requires accelerating its search for a way forward.

They are not arguing about content and Memecoins' fundamentals, but the current crypto fundamentals

The debate between Base and Solana's co-founders around "content tokens" reflects a collision of two perspectives in the crypto field. One side hopes to capture the value of the attention economy through tokenization, providing creators with new income sources. The other side is wary of speculation and marketing gimmicks, believing that tokens lacking cash flow and use value can hardly be considered "fundamental investments". Based on existing data and academic research, most content tokens and meme coins have strong Veblen good characteristics, with their value depending on social identity and emotional spillover, rather than intrinsic returns. Platforms like Zora have iterated on on-chain content trading methods, but their user scale is hundreds of times smaller than mainstream social platforms, with the ecosystem still limited to crypto circles. Therefore, content fundamentals are largely still a vision, requiring solutions to "attracting and large-scale retention", "IP copyright and ecosystem merchant recognition", and "defining regulatory frameworks". Under these immature conditions, content tokens and meme coins remain primarily speculative or collectibles, with their emotional spillover similar to luxury goods or trendy brands. For creators, exploring on-chain tools to build community economies is understandable, but they still need to grasp scarcity, value promises, and long-term reputation, avoiding becoming a temporary traffic game. In this era, content supply is infinite, but attention is scarce.