A governance proposal within Curve Finance is causing controversy in the DeFi community. One contributor is demanding to halt the protocol's expansion to Ethereum Layer 2 networks.

On July 31st, a CurveDAO member submitted a proposal. They argued that Curve's Layer 2 deployment generates almost no revenue and is diverting resources from more valuable initiatives like its own stablecoin crvUSD. Layer 2 networks were designed to improve Ethereum's scalability and have been popular for years.

Curve Earns More Daily Ethereum Revenue Than 450 L2s Combined

The proposal emphasized that Curve is generating disappointing revenue across 24 Layer 2 networks. According to the proposal, the protocol earns about $1,500 per day across all Layer 2 chains, which is only $62 per network.

Considering this, the proposal specified that such revenue does not justify the engineering costs and long-term maintenance expenses for supporting rapidly changing blockchain networks.

"There have been attempts to bring Curve to Layer 2, but the statistics speak for themselves. It consumes a lot of developer time with almost no revenue, and maintenance costs are much higher due to its rapidly changing and short-lived nature," the author mentioned.

Comparatively, Curve's Ethereum mainnet remains a much more profitable revenue source.

The protocol earns about $28,000 per day in Ethereum pools, which is more than 18 times the daily revenue of Layer 2 operations.

"Curve's Ethereum pools generate $28,000 in revenue even on slow days, which is equivalent to about 450 Layer 2s based on average revenue," he stated.

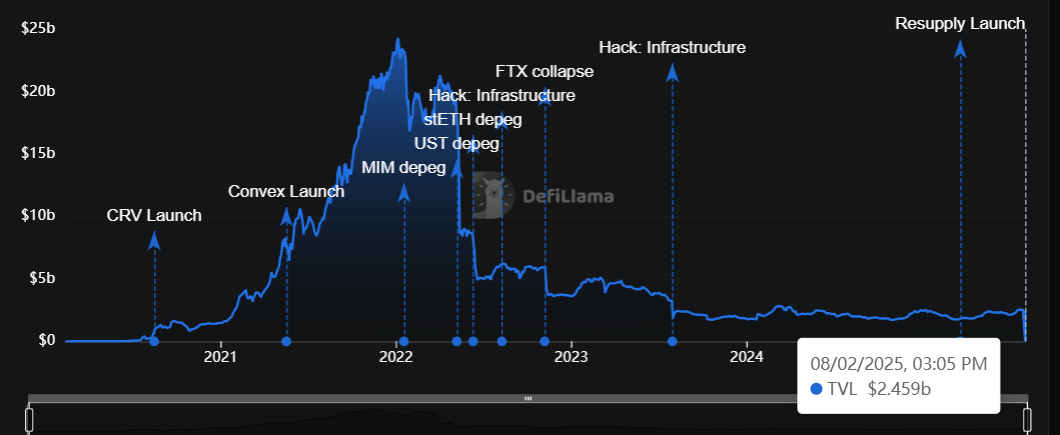

This is unsurprising considering that, according to defillama data, over 90% of Curve's total value locked (TVL) remains on blockchain networks.

Therefore, the proposal urged the protocol to halt all Layer 2 network development and focus on Ethereum.

"Each chain requires the same management as Ethereum but returns very little. By stopping all development in this direction, Curve can regain the flexibility to move in a more profitable direction," the author wrote.

Meanwhile, the proposal's radical stance has sparked discussions about multi-chain expansion within the DeFi protocol community.

DeFi analyst Ignas mentioned. Another major DeFi protocol, Aave, is also experiencing similar issues.

According to him, Aave's expansion across multiple chains is unprofitable, reflecting the difficulties many DeFi protocols face when deploying across multiple Layer 2 networks.

Ignas suggested that lack of user inflow on most Layer 2 networks is the root cause, hinting that the Ethereum Layer 2 ecosystem might be reaching saturation.

"We have reached Layer 2 saturation... it's a really tough time for undifferentiated Layer 2s," Ignas said.

L2Beats data supports this perspective, showing that only a few Ethereum Layer 2 networks like Polygon, Arbitrum, and Optimism are showing significant activity.

Meanwhile, Curve's core team distanced itself from the proposal, stating that it does not reflect the current roadmap.

"To be clear: this post is not from the team currently working at Curve, and no one on the team agrees with it (so we probably won't go in that direction)," the protocol stated.