[Percentage Change by Period]

Sophen (SOPH/KRW) recorded the highest weekly increase of +14.35% over the past week, followed by Sahara AI (SAHARA/KRW) with a +4.78% increase. TRON (TRX/KRW) also continued its steady rise with a +3.61% increase. This is interpreted as an example of showing upward potential amid a relatively stable supply flow.

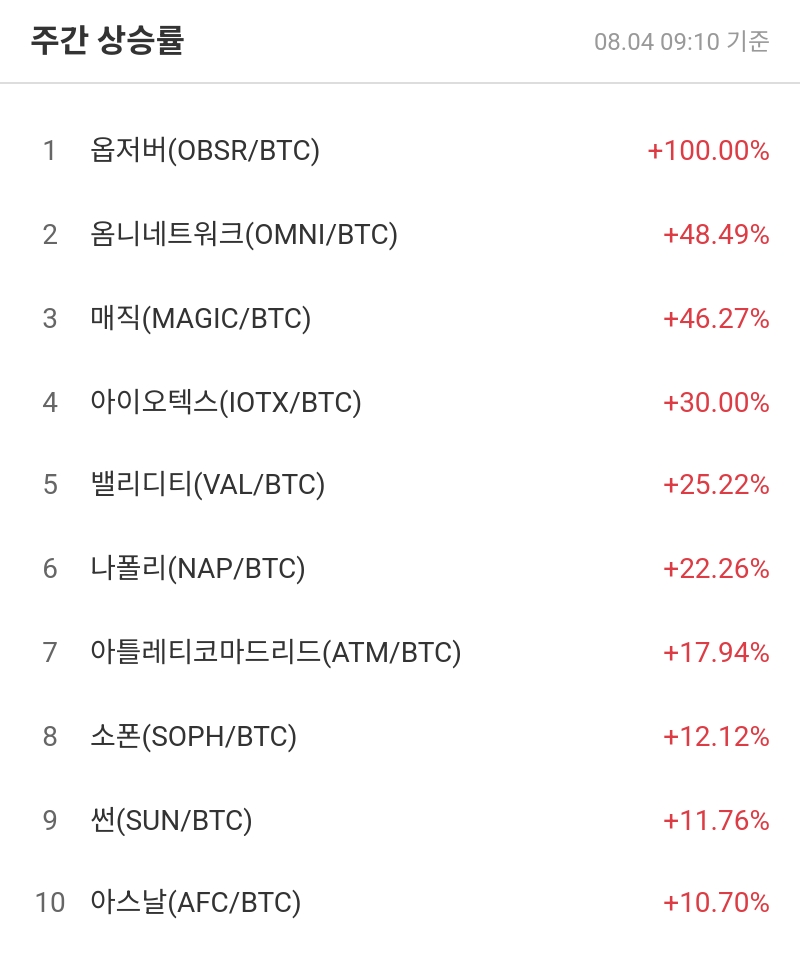

[Top 10 Weekly Percentage Changes]

1st Observer (OBSR/BTC) +100.00%

2nd Omni Network (OMNI/BTC) +48.49%

3rd Magic (MAGIC/BTC) +46.27%

In the BTC market this week, Observer (OBSR) recorded a strong rally with a 100% surge. Omni Network (OMNI) and Magic (MAGIC) also ranked by surging +48.49% and +46.27% respectively. Particularly, OBSR is analyzed to have concentrated buying amid expectations of DApp scalability.

[Daily Purchase Settlement Intensity Top 5]

1st Storj (STORJ/KRW) 500.00%

2nd WAXP (WAXP/KRW) 500.00%

3rd IOTA (IOTA/KRW) 500.00%

4th Cow Protocol (COW/KRW) 500.00%

5th Orca (ORCA/KRW) 500.00%

Storj, WAXP, and IOTA all recorded 500% in daily average settlement intensity, showing a steep buying trend. This is interpreted as reflecting abundant buying inflow and expectations of trend reversal.

[Daily Selling Settlement Intensity Top 5]

1st MTL (MTL/KRW) 0.00%

2nd Volta (A/KRW) 0.00%

3rd ONG (ONG/KRW) 0.00%

4th Mask Network (MASK/KRW) 0.00%

5th Wallace (WAL/KRW) 0.00%

In contrast, MTL and Mask Network showed a clear selling advantage with a 0.00% settlement intensity. This can be interpreted as a selling flow due to supply outflow or technical fatigue.

This week's cryptocurrency market showed increased volatility between assets with extreme buying and selling trends. As the weekly strong market was concentrated in some BTC market assets, investors need to carefully monitor supply flows and liquidity concentration by theme.

Real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>