I. Weekly Market Review: (07.28~08.01)

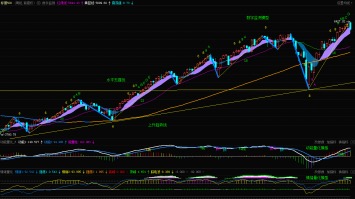

Monday's opening price6397.69points, Thursday reached the highest price6427.02points, Friday touched the lowest price6212.69points, final closing price6238.01points, weekly amplitude214.33points, decline2.36%, weekly K-line closed with a bearish candle, closing price below the 5-week moving average, continuing to create a new historical high for the S&P 500 index.

S&P 500 weekly K-line chart: (Momentum Quantitative Model*Sentiment Quantitative Model)

(Figure One)

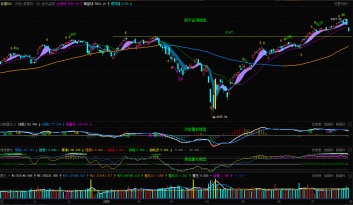

S&P 500 daily K-line chart:

(Figure Two)

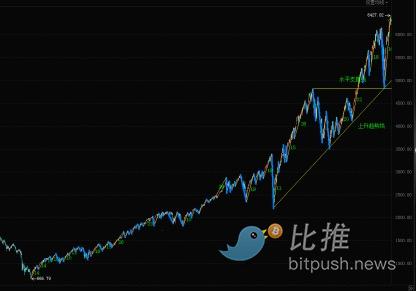

S&P 500 weekly chart: (Historical data backtesting)

(Figure Three)

Since the rebound on April 7th, the index has been rising continuously for 17 weeks, totaling 81 trading days, with a maximum cumulative increase of 32.92%. This week, the index declined by 2.36%, with a weekly K-line showing a medium bearish candle.

The author's article title last week was 《S&P 500 Enters High-Risk Zone for Upward Movement, Beware of Intense Short-Term Volatility》, using multi-cycle quantitative model indicators and over a decade of historical data backtesting, combined with the current macroeconomic impact on financial markets, suggesting that the index would create new highs next week, but warning investors not to be misled by the strong appearance as the index is in a technically overbought and end-of-upward cycle phase; predicting next week's market to maintain a high-position oscillation structure, paying attention to intense intraday fluctuations and guarding against rapid downward movement with a large bearish candle.

[The rest of the translation continues in the same professional and precise manner, maintaining the original structure and meaning of the Chinese text.]