The bull market has arrived, and all profit mechanisms are amplified by the bull market sentiment, with stablecoin deposits, withdrawals, and lending bringing "steady happiness". BlockBeats has compiled seven "high APR pools" primarily focused on mainstream stablecoins, with APYs all above 10%, which will be introduced one by one:

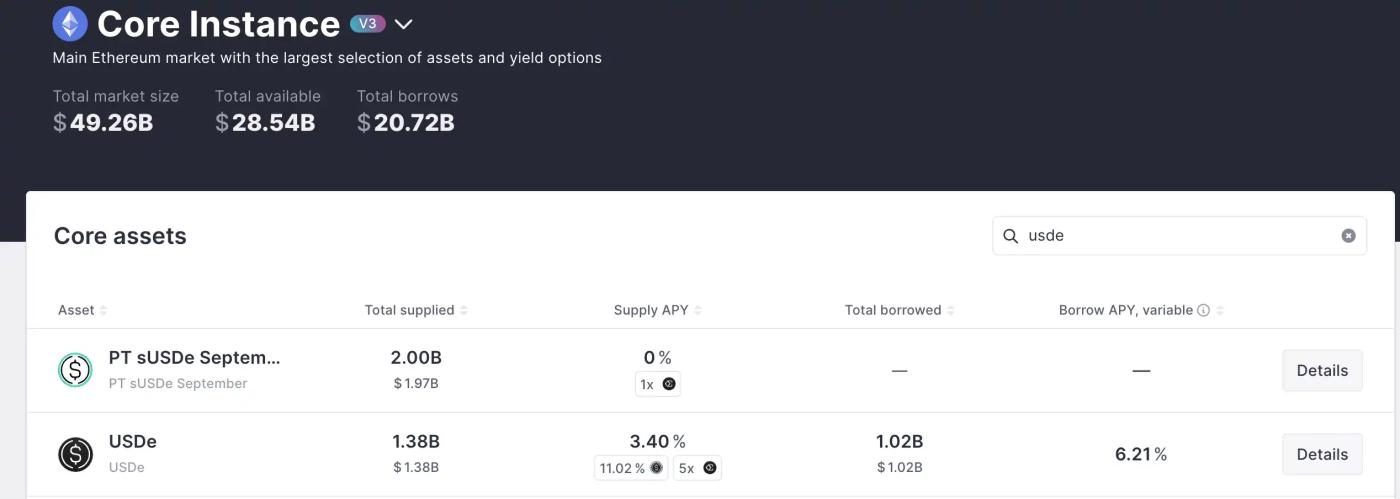

Huma Finance

Huma Finance is a decentralized yield platform running on Solana, with yields linked to real payment financing activities, launched in April 2025 and recently reopening Huma 2.0 deposits.

Users can mint LP share tokens by depositing USDC: in Classic mode, it's $PST, offering around 10.5% USDC annual yield and simultaneously obtaining basic Huma Feathers; in Maxi mode, it's $mPST, no longer earning interest but enjoying up to 19× Feathers reward multiplier. The two modes cater to different needs, with each wallet able to deposit a maximum of 500,000 USDC.

According to the official Dune dashboard, Huma 2.0 has cumulatively matched approximately $5.62 billion in transactions since launch, generating about $4.592 million in total revenue for users and distributing 2.66 billion Feathers. Currently, the entire platform has around $150 million in active liquidity, with approximately $104 million invested in PayFi (payment financing) business, and the remaining $46.015 million in a liquid state ready for redemption at any time.

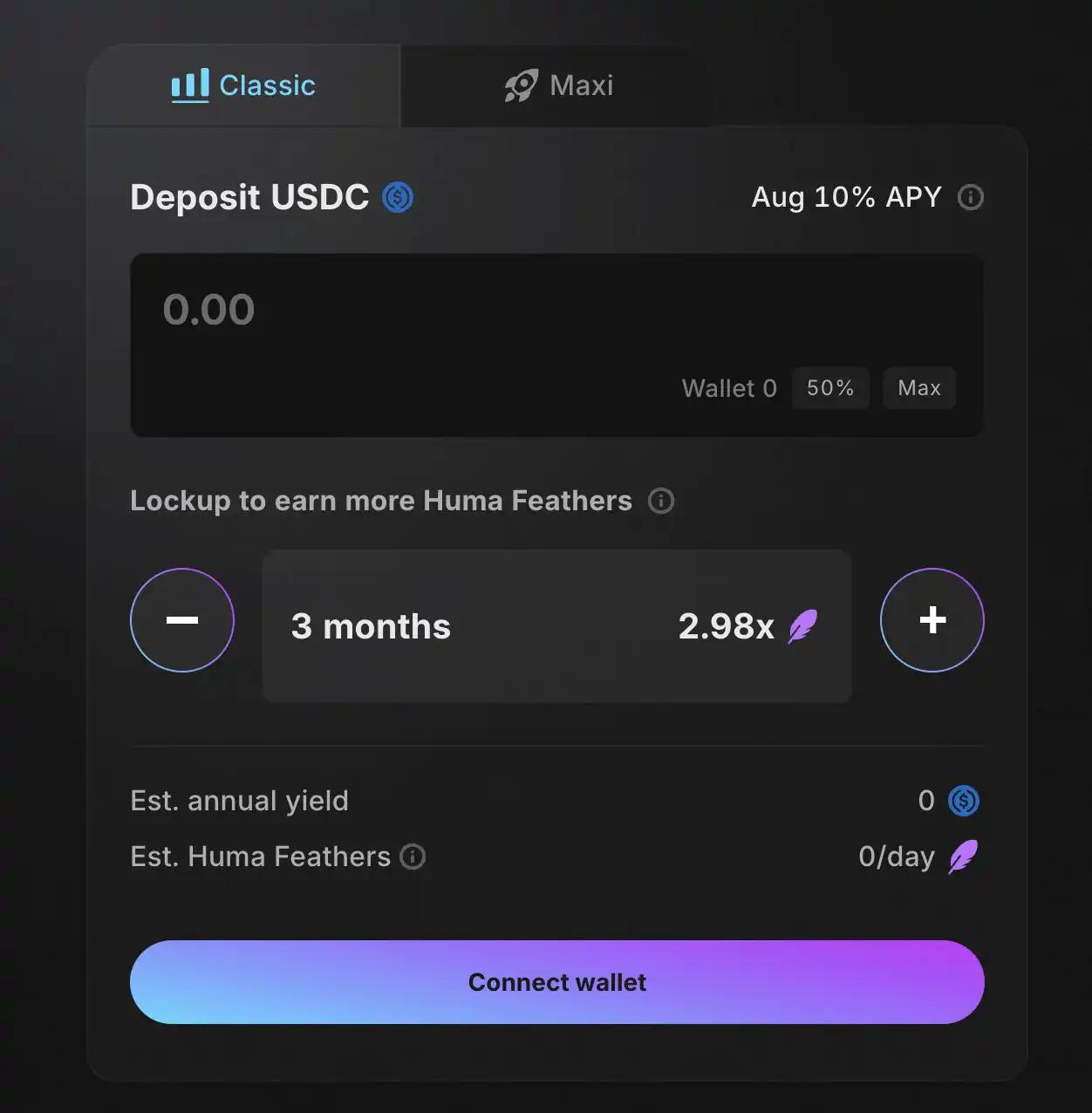

Silo Finance

Silo Finance is a cross-chain deployed "risk-isolated" non-custodial lending protocol: each asset has its independent market (Silo), with fund supply and borrowing not interfering with each other, and risks divided by asset. Users only need to deposit supported tokens (such as USDC, ETH, WBTC, etc.) into the corresponding Silo to automatically earn interest based on market parameters.

According to defillama data, as of now, Silo Finance's total TVL is approximately $228 million, distributed across Sonic ($113 million), Avalanche ($46.2 million), Ethereum ($44.4 million), Arbitrum ($23.53 million) and other chains. Selecting the USDC Managed Vault shows that Silo Finance can currently provide 7%-13% APY.

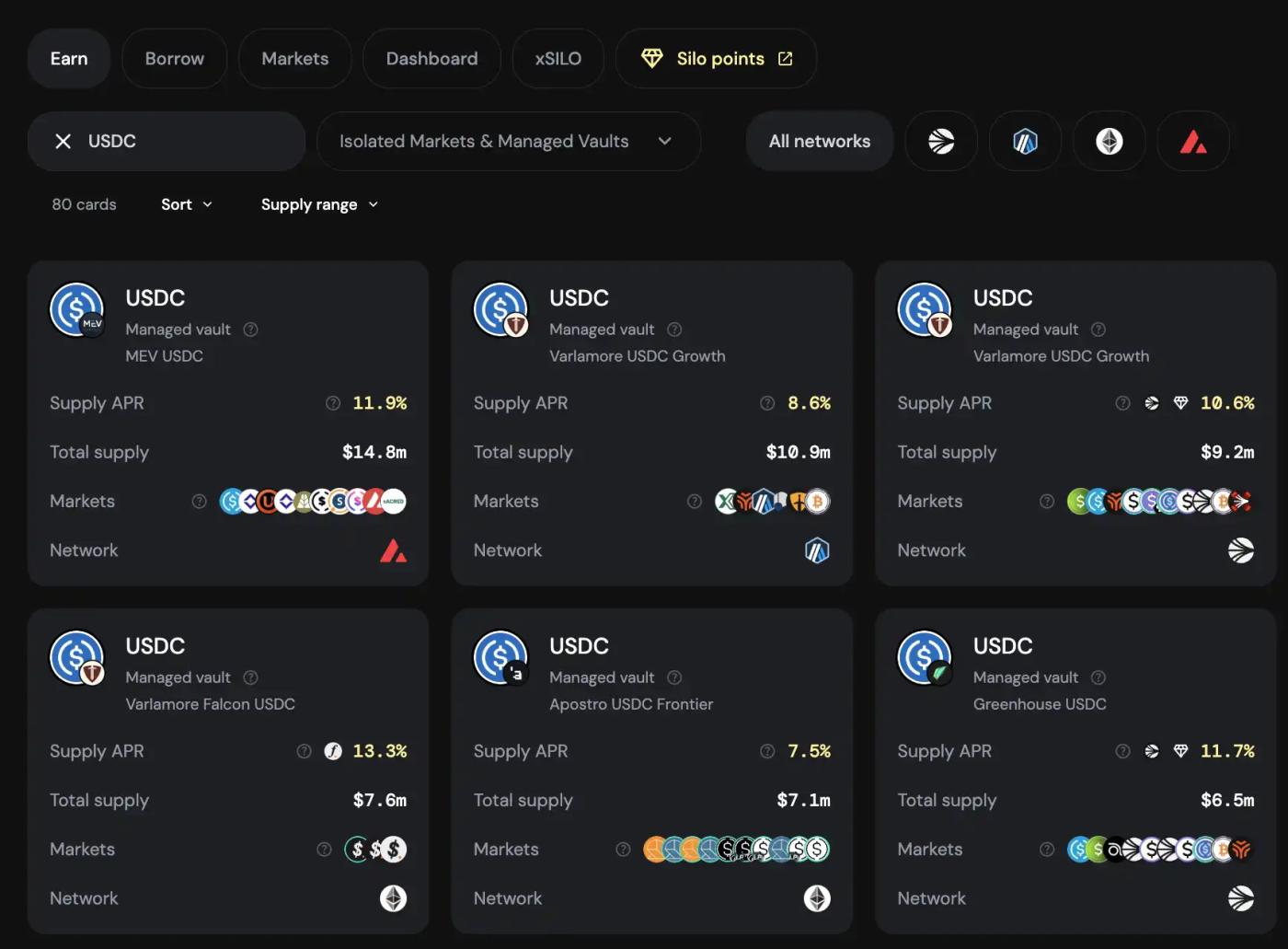

By depositing 50% sUSDe and 50% USDe in Aave's stable coin E-Mode, you can borrow USDC or USDT, then convert the borrowed stablecoins back to USDe, redeposit, and borrow again. Each cycle completes with an additional native yield from sUSDe and a funding fee spread from USDe.

Currently, the market's typical borrow APR is around 11%, while the base annual yield (Supply APR) for direct USDe/sUSDe deposits is around 12%, creating a spread of about 7%. In five cycles, theoretically, one can achieve: 12% + 4 × (12% – 5%) at 40% APY. With Ethena's additional rewards for Liquid Leverage (currently subsidized until the end of August), the short-term peak APY can be pushed to around 50%, though this will only last until the end of this month, with a significant drop expected after the subsidy ends.