Bitcoin is an asset that has recorded the highest long-term returns, but in the short-term, it repeats strong volatility and seasonal patterns. By organizing Bitcoin's weekly, monthly, quarterly, and annual returns, we will check the relative position of the flow based on indicators such as frequency of rise and fall, average returns, and median. [Editor's Note]

Bitcoin continues its weak trend since August, adjusting downward in most key return indicators. With monthly, weekly, and year-to-date returns all slowing down, the short-term adjustment and volatility expansion phase continues.

According to CoinGlass, Bitcoin has entered the 31st week of 2025 and is currently maintaining a flat trend with a weekly return of +0.02%. This is above the historical average return of -0.26% and median of -0.49% for the same week.

Recently, Bitcoin ▲rose 8.76% in the 27th week, ▲fell -1.44% in the 28th week, ▲rebounded +2.00% in the 29th week, but ▲fell again to -4.30% in the 30th week.

On a daily basis, from August 1st to 5th, it recorded fluctuations of ▲–2.14% ▲–0.56% ▲+1.47% ▲+0.71% ▲–0.67%. Small rebounds and declines are repeated, showing a coexistence of short-term adjustment and volatility expansion without a clear upward trend.

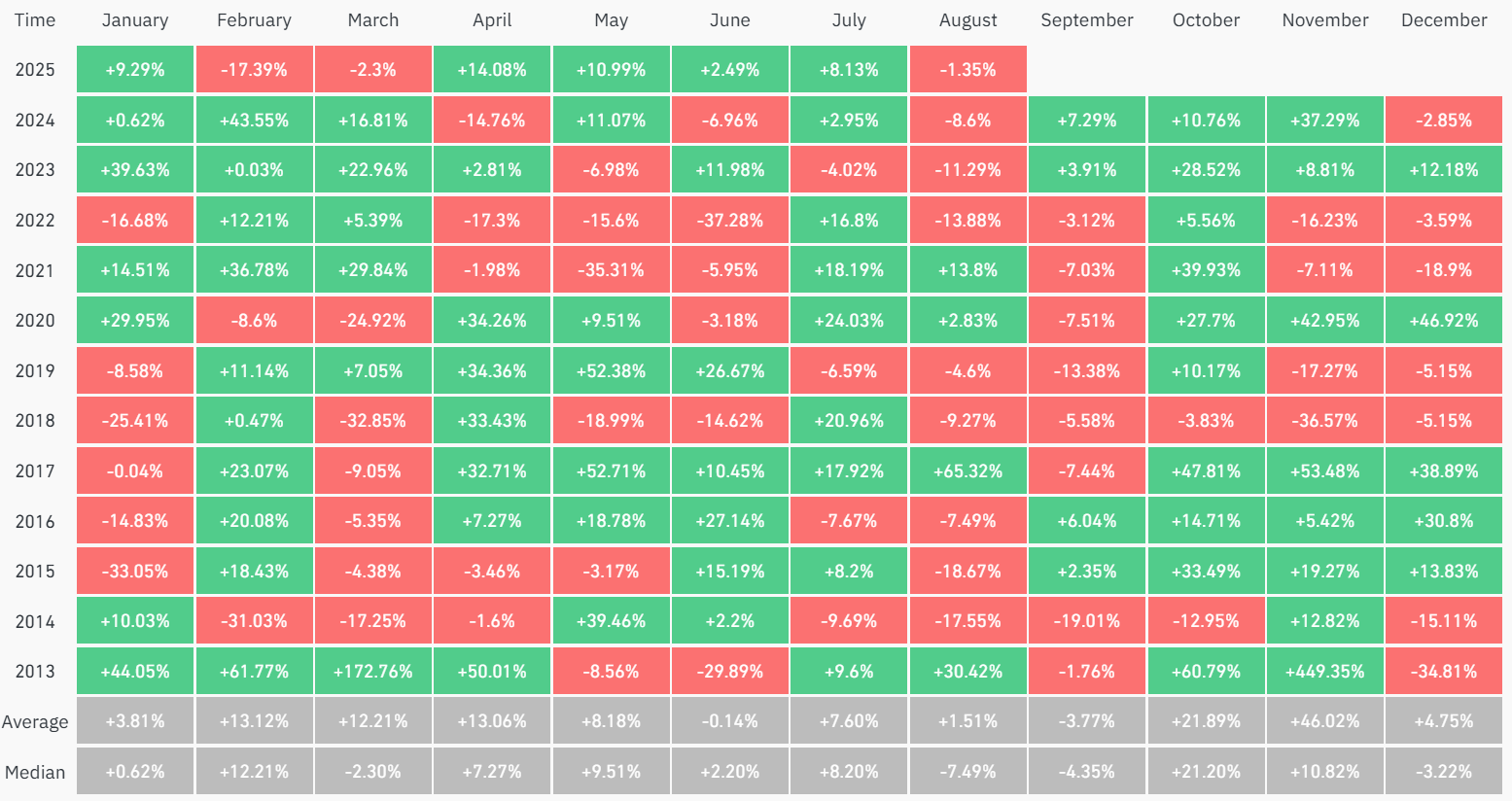

It has declined by 1.35% so far this month. The historical August average return is 1.51%, with a median of –7.49%, and out of 12 previous Augusts, 4 ended in gains and 8 ended in losses.

Bitcoin closed with gains of ▲+9.29% in January ▲+14.08% in April ▲+10.99% in May ▲+2.49% in June, and declined ▲–17.39% in February ▲–2.30% in March. July once recorded a monthly rise of 10.01% but ultimately closed with an 8.13% increase.

Quarterly and Annual Settlement

The quarterly return is 6.64%. It still remains above the historical third quarter average return of 6.08% and median of 0.96%. Bitcoin has ended 6 times up and 6 times down out of 12 times in this quarter.

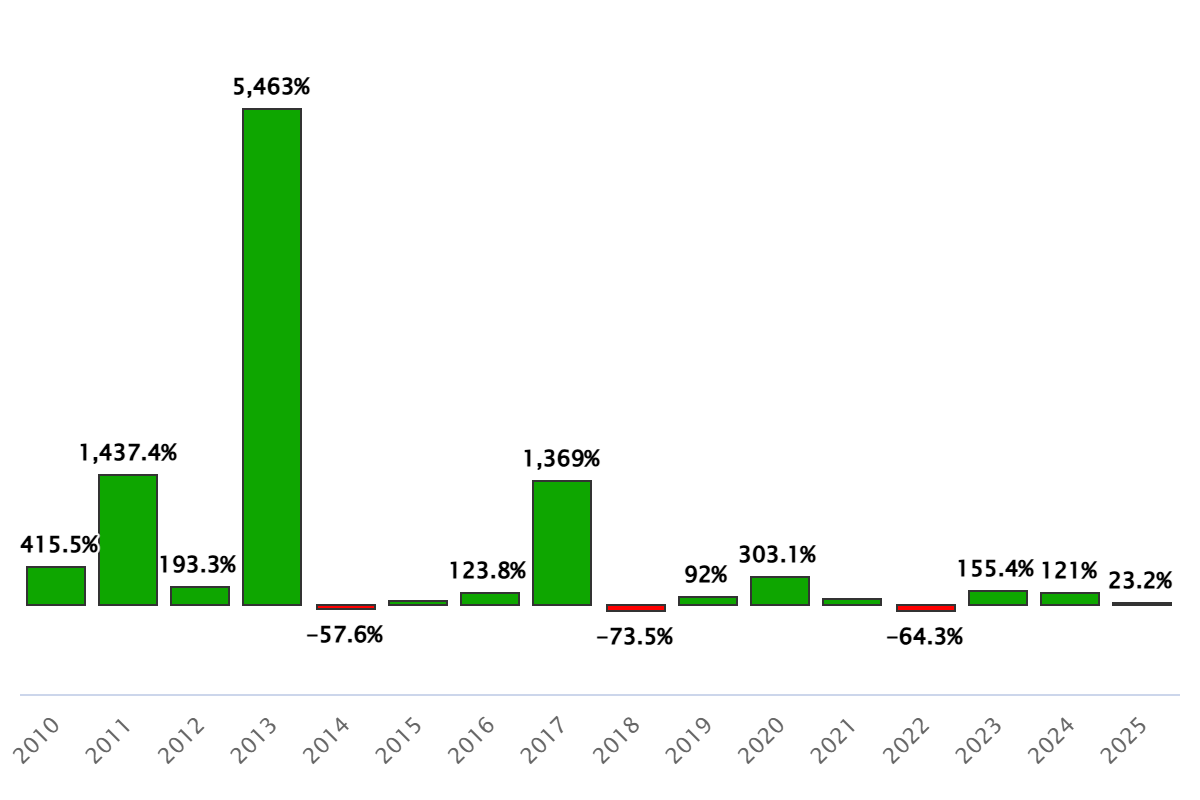

According to StatMuse, Bitcoin's year-to-date return is calculated at 23.2%. This is a 4.7%p decrease from the previous week (27.9%). The annual return for the past 3 years is ▲–64.3% in 2022 ▲+155.4% in 2023 ▲+121% in 2024.

According to TokenPost Market, Bitcoin is trading at $118,384 as of 3:15 PM on the 22nd, down 1.07% from the previous day.

[This article does not provide financial advice, and the investment results are the sole responsibility of the investor.]

News in real-time...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>