Bitcoin's price has been under pressure at the beginning of August, dropping to 114,337 USD. This decline could be due to various factors, including broader market uncertainty caused by Trump's trade war.

However, an important factor seems to be diminishing: the impact of investor sentiment. Bitcoin's price action is now more influenced by market conditions than investor panic.

Bitcoin Investor Selling Activity Cooling Down

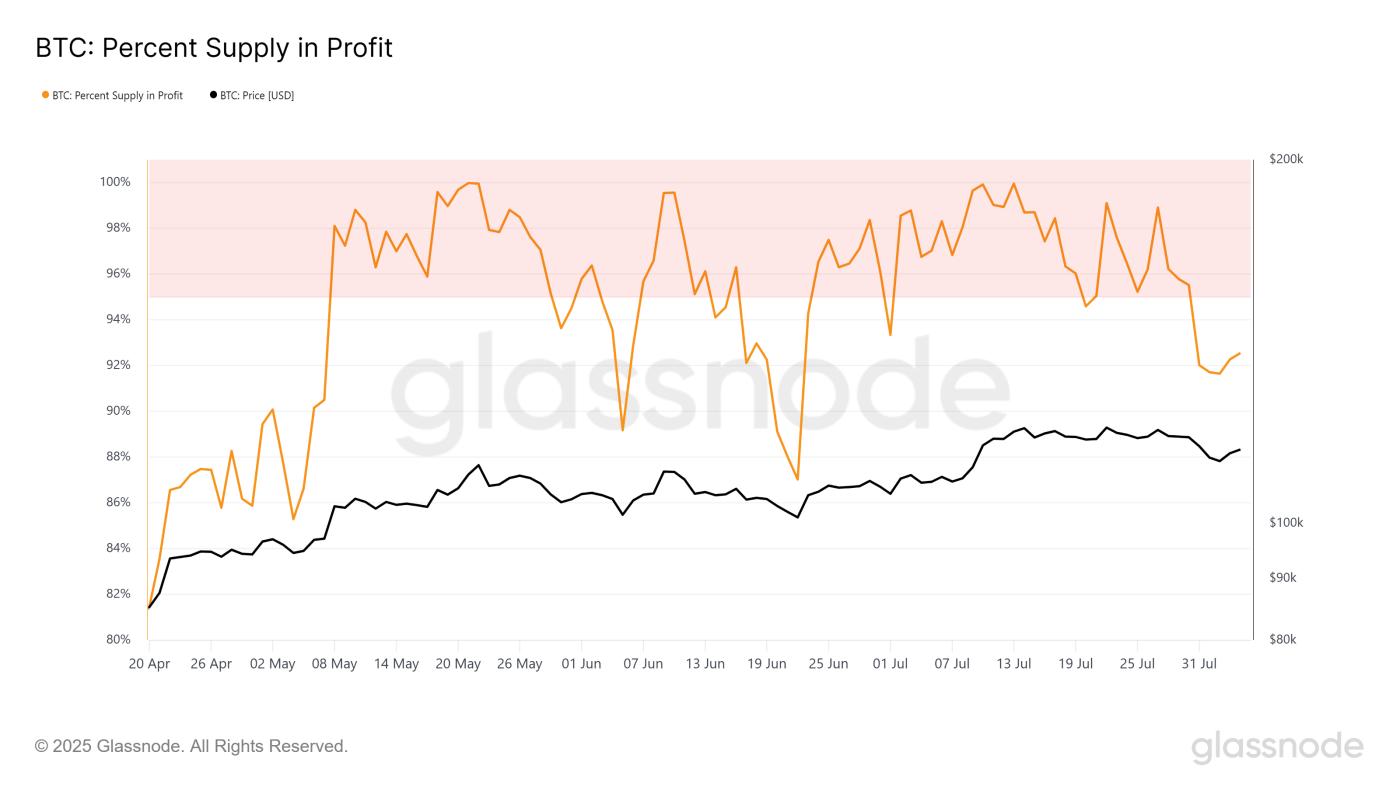

This week, the profitable Bitcoin supply has dropped below the 95% threshold, which has historically indicated a market peak. For over a month, the Bitcoin supply has been maintained in the 95% profit zone, signaling an overly optimistic market.

Typically, this creates increased selling pressure when the market is saturated with optimism. With the profitable supply now reduced to 92.5%, that pressure is beginning to ease, potentially signaling a shift to a more neutral or positive momentum.

To receive information about Token and market updates: Want more information about Token like this? Subscribe to the Daily Crypto Newsletter by Editor Harsh Notariya here.

Bitcoin Supply In Profit Source: glassnode

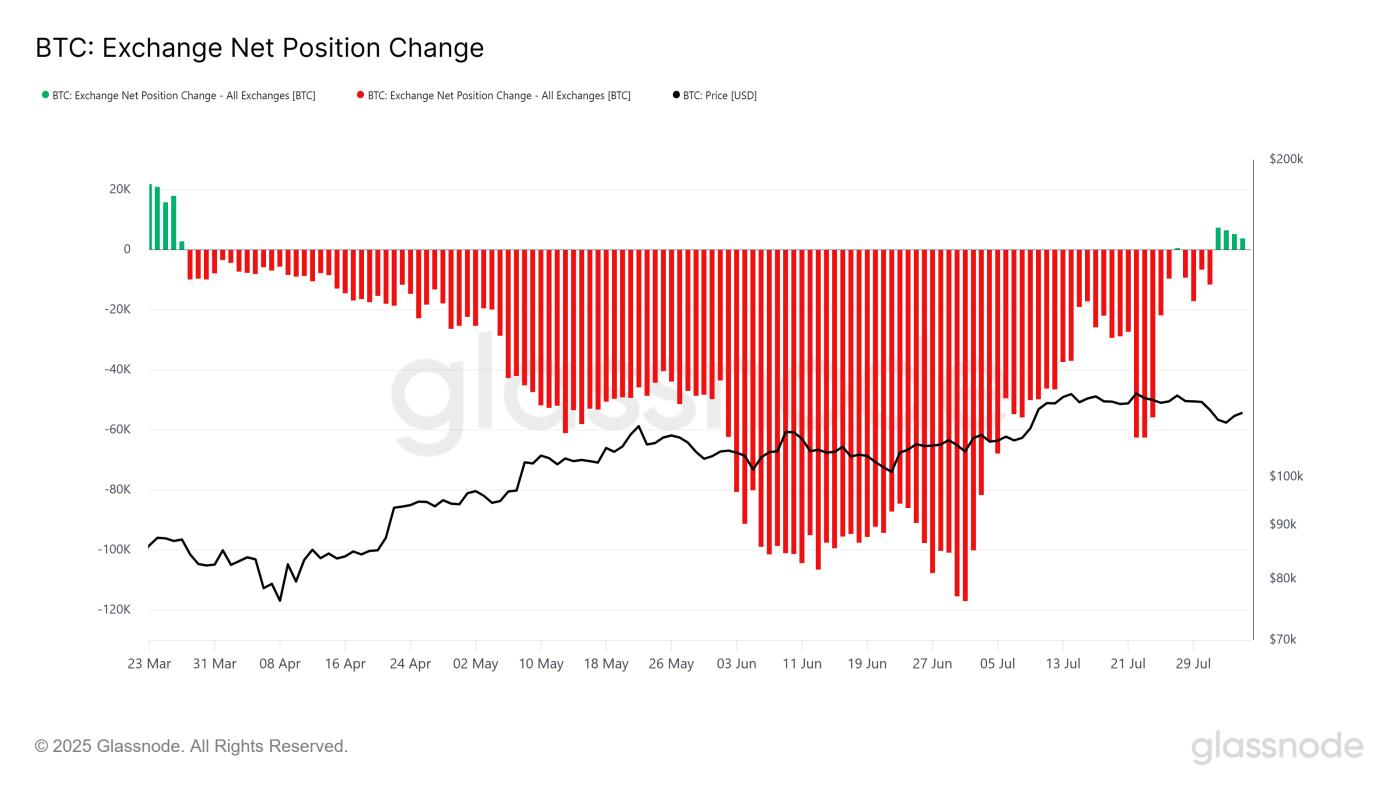

Bitcoin Supply In Profit Source: glassnodeThe recent net position change on exchanges has reached a four-month high, reflecting the impact of market peak conditions. An increase in exchange balances typically indicates higher selling activity, as the market cannot sustain upward momentum.

However, recent selling trends seem to be losing steam. Uncertainty surrounding upcoming events, such as Trump's trade decision, is likely causing market hesitation.

With reduced selling pressure, Bitcoin may enter an accumulation phase. This creates an opportunity for BTC to recover its lost position, especially as the broader market stabilizes.

Bitcoin Net Exchange Position Change Source: glassnode

Bitcoin Net Exchange Position Change Source: glassnodeBTC Price Holding Steady

The current Bitcoin price is 114,337 USD, experiencing downward pressure. The Parabolic SAR is above the candles, indicating a downward momentum. However, the 50-day Exponential Moving Average (EMA) remains a support, suggesting the broader market sentiment is not entirely negative. Bitcoin may continue to accumulate, seeking stability around the 110,000 USD level.

With current factors, Bitcoin's price is likely to accumulate within the 110,000 USD range at this time. If Bitcoin can break above 115,000 USD and hold it as support, an increase to 117,261 USD is possible. However, surpassing 120,000 USD seems unlikely in the near future.

Bitcoin Price Analysis. Source: TradingView

Bitcoin Price Analysis. Source: TradingViewIf the market faces downward pressure due to external factors like the upcoming trade announcement, Bitcoin may face further decline. If it loses support at 111,187 USD, Bitcoin could drop to 109,476 USD, with potential for further weakening. If Bitcoin breaks below 110,000 USD, bullish or neutral prospects could be neutralized.