CEX Trust Crisis: The Centralization Tragedy

Centralized exchanges (CEX) may have advantages in transaction speed and user experience, but their centralized nature exposes serious trust issues.

· Asset Custody Risk: Single Point of Failure Vulnerability Users' private keys are controlled by the platform, creating a "single point of failure". In February this year, an exchange was stolen nearly $1.5 billion due to a cold wallet multi-signature vulnerability, profoundly revealing the fragility of manual risk control.

· Black Box Operations and Price Manipulation Doubts: The closed nature of exchange order books often triggers price manipulation controversies. Especially in small and medium-sized exchanges, a considerable portion of trading volume comes from wash trading, and the slippage loss users actually bear is often higher than the platform's published value.

· Freedom Restricted under Compliance Shackles: Increasingly stringent global KYC policies force CEX to frequently expel users from specific countries and regions, with Chinese-speaking investors being the first to suffer, with their trading freedom and privacy rights substantially stripped away.

CEX inevitably falls into a triple paradox: efficiency depends on centralization, security depends on human nature, and freedom depends on regulatory tolerance. The trust crisis of CEX is precisely the core industry pain point that Enclave Markets is committed to solving.

DEX's Hidden Exploitation: The Cost of Decentralization

While DEX breaks the custody risk of CEX through "self-asset custody", it has spawned a more covert economic exploitation chain.

· Profit Harvesting in the Dark of MEV: According to Flashbots statistics, the annual MEV extraction value on the Ethereum chain exceeds hundreds of millions of dollars, with bots ruthlessly intercepting user profits through front-running and trailing attacks.

· Slippage Loss and AMM's Hidden Costs: In the AMM model, large transactions easily trigger non-linear price curves, and users ultimately pay far more than the explicit gas fees, bearing high implicit slippage costs.

· Operational Complexity, User Thresholds and Risks: Cross-chain transactions require manual asset bridging, with complex steps like gas fee adjustments and contract interactions, which exclude many ordinary users and bring significant security risks.

When CEX and DEX fall into a zero-sum game of "efficiency-security-freedom", users still need a trading venue that can guarantee fund safety, fair operations, and provide a smooth experience. Enclave Markets was born to operate, combining the advantages of CEX and DEX, launching an innovative fully encrypted exchange (FEX), and is opening up a third path beyond the limitations of traditional CEX and DEX.

As a project from the Avalanche ecosystem extending outward, Enclave Markets has a close relationship with the Avalanche official team, having obtained incubation from Ava Labs and investment from the Avalanche public fundraising fund Blizzard Fund.

Enclave's FEX Architecture Analysis

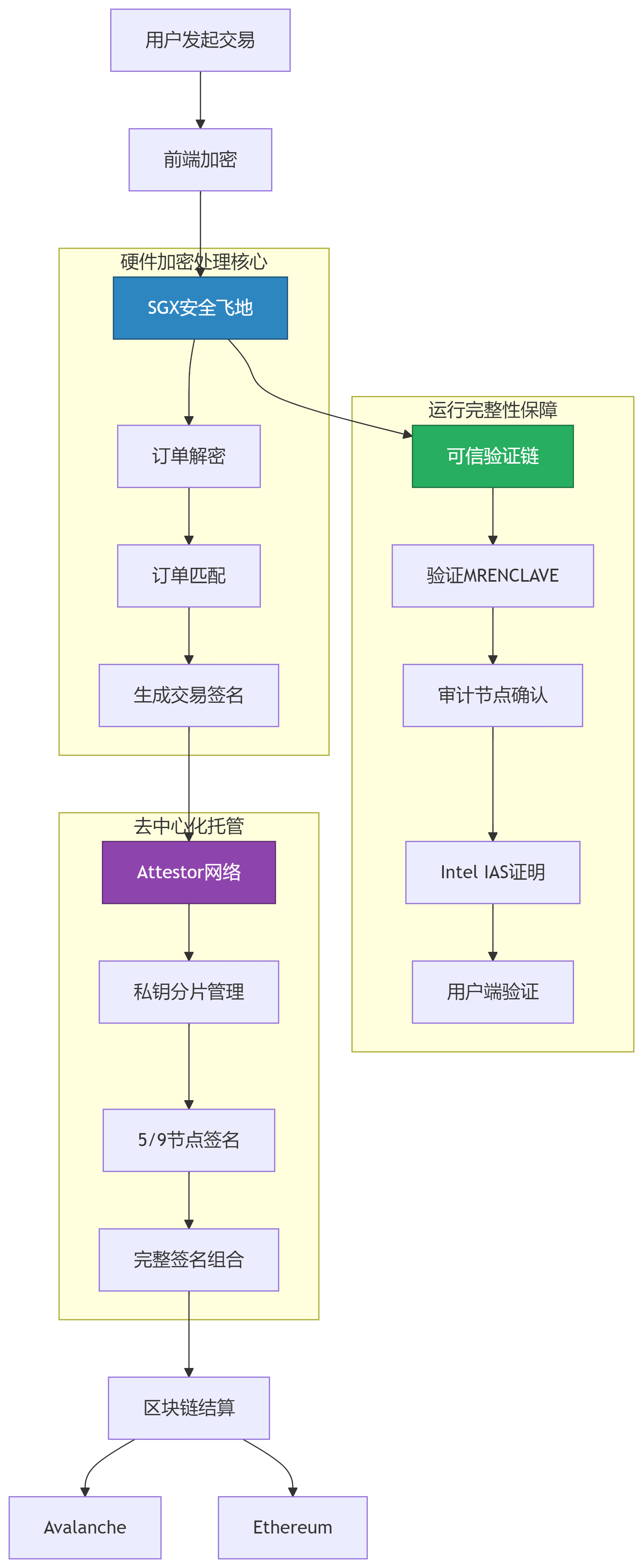

Enclave Markets' FEX model is based on Intel SGX (Software Guard Extensions), with all transaction data processed in an encrypted environment, preventing front-running and data leakage. The order book runs offline, providing instant trading, zero slippage, and zero gas fees, with the Attestor network ensuring decentralized custody and protecting user funds.

[The translation continues in the same manner for the rest of the text...]As the lightest and most agile community entry point in the Enclave ecosystem, Edge Bot is not only a tool for simplified operations but also a key channel for participating in early project growth and Pre-TGE. Every transaction made by users through this bot can earn Enclave Points, enhancing future airdrop shares. For Avalanche ecosystem users, this is a golden window to seize early dividends through Edge Bot - capturing value opportunities before Enclave's explosion while avoiding complex contract interactions.

The Enclave Points program launched by Enclave Markets is becoming the core pipeline for users to capture early value. The program will continue until the end of the third quarter of 2025, and users can accumulate points through four main paths:

· Trading for Points: Earn corresponding points for each perpetual contract transaction on EnclaveX based on trading volume;

· Strategy Following Bonus: Subscribe and follow Smart Money strategies in Alpha Strats;

· Community Viral Incentive: Invite new users to complete their first transaction, with both the inviter and invitee earning points;

· Edge Bot Acceleration Channel: Execute perpetual contracts and other operations through Telegram bot.

Experience Link:

The content of this article does not represent Wu Blockchain's perspective.