Cathie Wood's Ark Invest, an investment management company, has acquired 2.53 million shares of the newly listed cryptocurrency exchange Bullish (BLSH).

This purchase was made alongside Bullish's notable listing, with the stock price surging 83.78% after the listing.

Cathie Wood's Ark Invest Buys 2.53 Million BLSH Shares

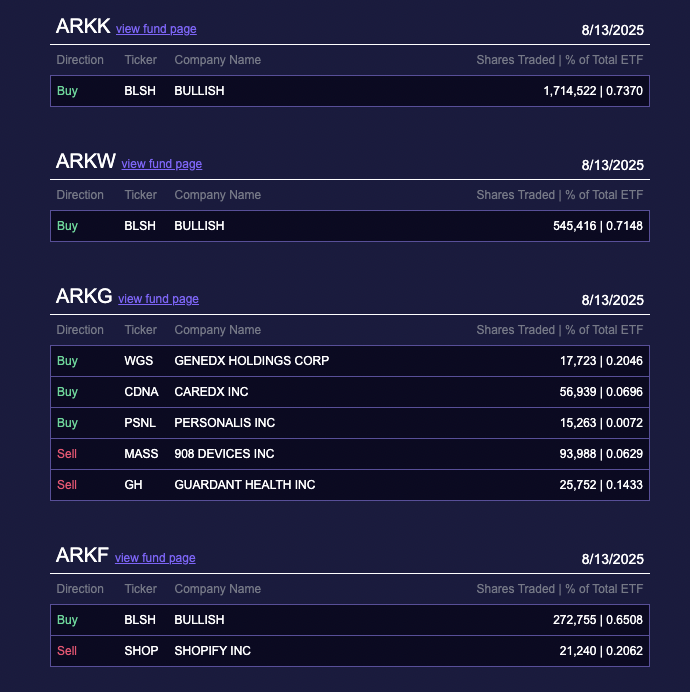

According to the official announcement disclosed on X (formerly Twitter), Ark executed this purchase on August 13th. The investment was distributed across three of the company's Exchange Traded Funds (ETFs).

The ARK Innovation ETF (ARKK) added 1.71 million Bullish shares, the ARK Next Generation Internet ETF (ARKW) acquired 545,416 shares, and finally, the ARK Fintech Innovation ETF (ARKF) purchased 272,755 shares.

This acquisition was valued at approximately $172.2 million, based on Bullish's closing price of $68 per share. In addition to BLSH, Ark Invest also purchased shares of GeneDx Holdings Corp, CareDx Inc, and Personalis.

Simultaneously, the company sold shares of 908 Devices, Guardant Health, and Shopify.

Meanwhile, Ark Invest's BLSH share acquisition follows the company's successful initial public offering (IPO). On August 11th, Bullish, supported by notable investors including Peter Thiel, increased its offering from 20.3 million to 30 million common shares and adjusted its price range from $28-$31 to $32-$33 per share.

"Bullish will use the proceeds from this offering for general corporate and operational purposes, including potential future acquisition funding." – Announcement

However, BeInCrypto reported that the company priced its IPO at $37 per share, raising $11 billion. The shares were listed on the New York Stock Exchange on August 13th, showing strong market performance.

According to Yahoo Finance data, the stock was valued at $68 at market close, an 83.78% increase from its IPO price. BLSH shares also rose an additional 12.84% in pre-market trading.

Bullish's move is part of a broader trend of cryptocurrency companies entering the public market. Circle went public in June, raising over $1.1 billion.

Additionally, companies like Figma, Grayscale, BitGo, and Gemini have filed for listing with the U.S. Securities and Exchange Commission (SEC). These applications have increased during a favorable regulatory environment during Trump's term, as he promised to make the U.S. the 'cryptocurrency capital of the world'.