Author: GLC & OAK Research Team; Translation: Jinse Finance xiaozou

Welcome to the Hyperliquid Semi-Annual Report, which provides a comprehensive analysis of the development and metrics of Hyperliquid and HyperEVM through the first half of 2025. It's a long read, but definitely worth it.

summary:

Hyperliquid leads the perpetual contract DEX market with a 73% market share , while continuing to expand in the CEX sector, accounting for 6.1% of total trading volume and 17.8% of open interest.

HyperEVM has experienced explosive growth , with TVL (total locked value) exceeding US$2.08 billion in five months, surpassing Avalanche and Polygon, thanks to the rapidly expanding native ecosystem (Kinetiq, Hyperlend, Liminal).

Unit, CoreWriter, and HIP-3 protocols lay the foundation for a new generation of perpetual contract markets , enabling native multi-asset deposits and full-chain composability.

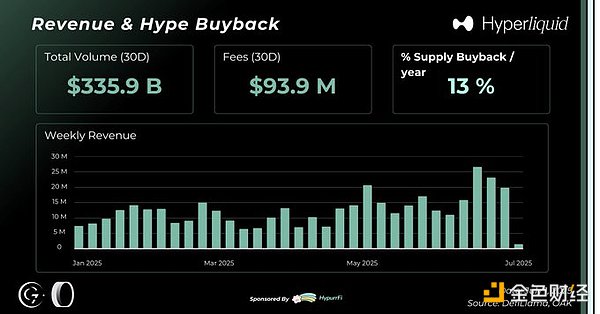

High-Impact Buyback Model : 92% of fees are used to buy back HYPE tokens, generating over $800 million in annualized revenue, driving a 64.8% price increase in Q1 2025, and attracting public companies to establish HYPE treasuries.

Strategic Partnerships Accelerate Growth : Phantom Perps integration via Builder Codes opens new revenue stream (potential +2% to +4% annual growth), demonstrating Hyperliquid's ability to seamlessly integrate with a large-scale third-party ecosystem.

1. Hyperliquid on-chain indicator analysis

With the first half of 2025 now complete, we're now evaluating Hyperliquid's growth trajectory based on core on-chain metrics. As a leading perpetual swap DEX, we'll analyze its performance across various metrics, including TVL (total value locked), inflows, open interest, trading volume, trader activity, and protocol revenue.

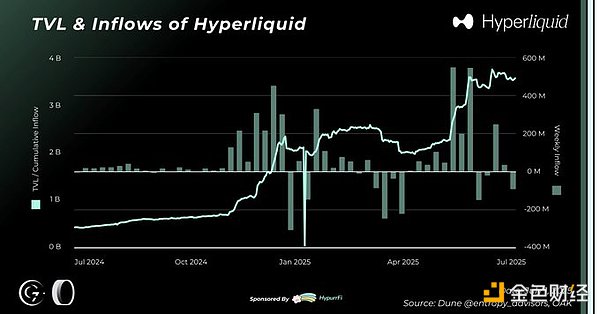

(1) TVL and capital inflow

The successful launch and airdrop of the HYPE token did not lead to a loss of users. Instead, the fourth quarter of 2024 marked the beginning of a period of explosive growth for Hyperliquid, which continued into the first half of 2025.

Specifically, Hyperliquid saw a surge in inflows in November 2024, with a single-day peak exceeding $50 million. Its TVL soared from $564 million to over $2 billion, a 269% increase in the fourth quarter of 2024.

Continuing this trend, Hyperliquid further solidified its dominance in the decentralized perpetual swaps trading space in the first half of 2025. As of June 30, 2025, Hyperliquid's TVL (total value locked) reached $3.5 billion, a net increase of 70.8% from the beginning of the year ($2.1 billion).

During this period, despite the severe challenge of a net outflow of $59 billion in March, net inflows of $58 million per week were maintained on average.

Note: As of the time of writing, Hyperliquid TVL has exceeded $5 billion.

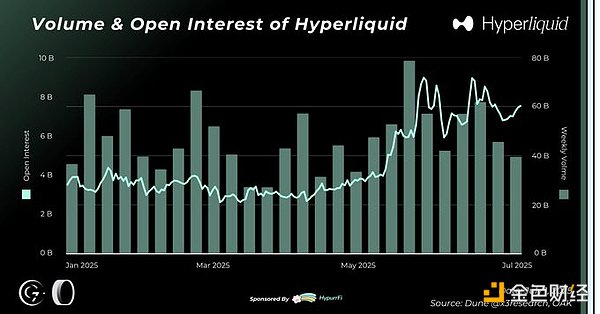

(2) Trading volume and open interest

In the fourth quarter of 2024, Hyperliquid's open interest exceeded the $1 billion mark for the first time and reached a historical peak of $3.27 billion at the end of the year.

After an exceptionally strong first half of 2025, Hyperliquid’s open interest reached a new high of nearly $7.5 billion. As of this writing (just weeks after the semester ended), that figure has climbed to $15 billion—a figure equivalent to 61% of ByBit, 105% of OKX, and 120% of Bitget.

Hyperliquid's weekly trading volume jumped from approximately $13 billion in the fourth quarter of 2024 to an average of $47 billion in the first half of 2025, reaching an all-time peak of over $78 billion in the week of May 12.

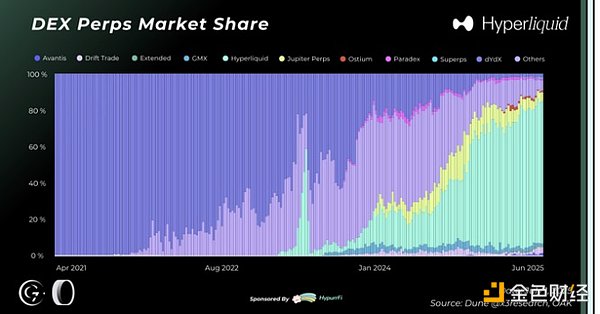

By the end of 2024, Hyperliquid will account for approximately 56% of the trading volume on decentralized perpetual swap platforms. Its dominance continues to grow, exceeding 73% market share by the end of the first quarter of 2025.

In terms of user growth, Hyperliquid's number of addresses increased from 291,000 at the beginning of 2025 to 518,000 at the end of the first half of the year, a 78% increase in six months. Notably, the cumulative liquidation position of these addresses exceeded US$53 billion.

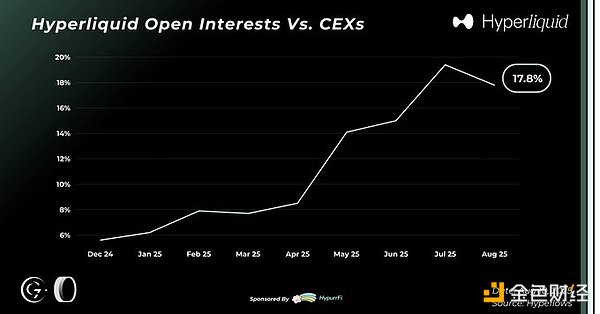

(3) Hyperliquid vs. Centralized Exchanges

We’re used to seeing Hyperliquid dominate the perpetual contract DEX market, but what’s most striking about the first half of 2025 is its growth performance relative to the declining centralized exchanges.

As of this writing, Hyperliquid occupies:

6.1% of centralized exchange trading volume (up 3.9% from January)

17.8% of open interest on centralized exchanges (up 12.3% from January)

The core reasons for Hyperliquid's explosive growth compared to CEX and DEX are as follows:

Hyperliquid boasts a number of competitive advantages that make it a highly attractive trading venue. First, it offers one of the lowest costs for trading spot and perpetual contracts in the ecosystem, while also offering the deepest on-chain liquidity—for some assets, the order book depth rivals that of leading CEXs. For example, during the PUMP token launch, Hyperliquid demonstrated the deepest market depth, highest trading volume, and tightest spreads for that asset, setting an unprecedented milestone in DEX history.

Another major advantage: Hyperliquid has consistently been the premier platform for new perpetual swaps in recent months (particularly since the launch of the Trump meme coin), and with the launch of UNIT, this advantage has been extended to the spot market. This has created a powerful customer acquisition engine, reinforcing traders' perception that Hyperliquid is the go-to place for trading hot new coins.

The launch of PUMP is a prime example. One of the most anticipated Token Generation Events (TGEs) in history, its ICO raised approximately $500 million in just 12 minutes, setting a new record. Hyperliquid became the first platform to offer both spot and futures trading for the token. Even more notably, it was the first major platform to offer pre-trading for PUMP.

Today, Hyperliquid maintains its core decentralized advantages (permissionless access, on-chain transparency, and native composability) while achieving transaction speed, liquidity, and user experience comparable to leading CEXs. Any asset, position, or trade can be directly integrated with smart contracts, dApps, or other protocols on the HyperEVM, making it not only a trading venue but also a cornerstone of on-chain financial infrastructure.

(4) HLP performance analysis

The Hyperliquidity Provider (HLP) plays a central role in the Hyperliquid ecosystem: a community-curated pool of USDC that provides partial liquidity for order books, market making, and automated liquidation management. HLP aggregates the profits and losses generated by various strategies, including the Liquidator Vault, while providing users with non-directional risk exposure.

Across various metrics, HLP's TVL (total value locked) surged significantly by the end of 2024, particularly after the airdrop of HYPE tokens to users, jumping from $150 million at the end of November to $400 million by early 2025. Despite reaching a historical peak of $512 million, HLP's TVL remained stable throughout the first half of the year, ultimately remaining at $372 million.

During the same period, HLP's net profit increased from $50 million to nearly $68 million, providing users with an average annualized return of approximately 11%. The net return in the first quarter of 2025 was +5.2%, with a maximum drawdown of less than 3.5% (even during the JELLY incident).

It should be noted that in March 2025, Hyperliquid suffered a carefully planned attack that primarily targeted certain limitations of the liquidation system. The attacker attempted to force HLP to take on high-risk positions worth millions of dollars in order to destroy the mechanism.

(5) Unit: The core pillar of Hyperliquid's future

Unit, launched on February 14, 2025, is no ordinary project; it is the core infrastructure that will determine the future development of the protocol. Just a few months after its launch, its strategic value is undeniable.

Unit, Hyperliquid's asset tokenization layer, supports native deposit and withdrawal functionality for a wide range of assets. After users deposit their assets, Unit is assigned a corresponding trading code through Hyperliquid's auction system and directly listed on the spot market. The service initially supported BTC and quickly expanded to include ETH, SOL, FARTCOIN, PUMP, BONK, and other assets.

This is a major breakthrough in DeFi spot trading. Hyperliquid becomes the first DEX to offer the same convenient deposit and withdrawal experience as centralized exchanges. With Unit, traders can access their own dedicated deposit address and trade within minutes, without the need for wrappers or cross-chain bridging.

The value of Unit goes far beyond trading. It underpins numerous protocols and products within the Hyperliquid ecosystem. For example, the delta-neutral yield protocol Liminal leverages Unit to achieve sustainable, independent market returns. Phantom recently integrated Unit through the Builder Codes project, providing underlying support for Phantom Perps.

Since its launch, Unit's TVL (total value locked) has reached $800 million, making it the second-largest project in the ecosystem after Kinetiq. Assets listed on Unit generated over $15 billion in trading volume in the first half of the year. However, Hyperliquid's spot/perpetual trading volume still accounts for only 2%, far below the 15%-30% of mainstream CEXs.

We will continue to track these metrics in subsequent reports. With the listing of new tokens, the potential expansion of asset classes, and the development of more protocols based on Unit, there is still ample room for growth for Hyperliquid Spot and Unit.

2. HyperEVM on-chain indicator analysis

HyperEVM, a key pillar of the Hyperliquid ecosystem, officially launched in February 2025. This EVM-compatible blockchain is built directly on the Hyperliquid infrastructure and supports the deployment of smart contracts and decentralized applications.

Unlike many blockchains that struggle to gain market acceptance, HyperEVM boasts a unique advantage: direct, native access to Hyperliquid's liquidity and order book. This deep integration has underpinned its remarkable growth trajectory, which we'll explore in more detail.

(1) Technical background and innovative breakthroughs

The HyperEVM mainnet launch in February 2025 was particularly abrupt and minimalist. First, there was no prior announcement (neither to the public nor to developers), a move the foundation stated was intended to ensure "equal access and a fair starting point for everyone."

The network's initial functionality is extremely basic, lacking even the initial core features. In fact, users can only transfer HYPE tokens through specific smart contracts. This gradual deployment strategy aims to limit the impact of the HyperEVM on HyperLiquid's underlying infrastructure, HyperCore.

In March 2025, HyperCore and HyperEVM will be interconnected for the first time, enabling users to transfer other asset types from the Hyperliquid spot market. In April 2025, the mainnet will deploy precompiled contracts, enabling HyperEVM smart contracts to access HyperCore data (perpetual contract positions, treasury balances, oracle prices, and staked deposits).

In May 2025, the HyperEVM "small block" block time was shortened to 1 second, significantly improving network performance. It should be noted that HyperEVM uses a dual-block architecture to balance speed and performance:

Small blocks: 1 second block time, 2 million gas limit, and support for near-instant transfers.

Large blocks: 1 minute block time, 30 million gas limit, capable of carrying heavy tasks.

Finally, on July 5, 2025, CoreWriter was deployed to the HyperEVM mainnet. This marked the final step in achieving perfect composability for Hyperliquid's two-layer architecture—HyperEVM smart contracts can now write data to the infrastructure layer, HyperCore.

The core value of HyperEVM stems from its seamless compatibility with HyperCore. While other DeFi ecosystems still struggle for liquidity, HyperEVM has directly inherited Hyperliquid's infrastructure, order book, and liquidity access rights.

(2) TVL (Total Value Locked) and Growth Trends

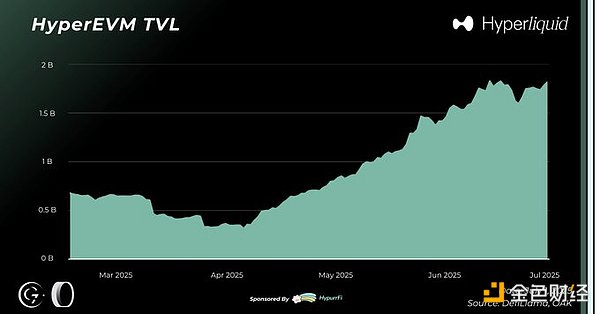

The launch of HyperEVM immediately triggered a surge of activity in the ecosystem: despite initial TVL being less than $50 million in early February, it surpassed the $1 billion mark in mid-April, just two months after the mainnet launch. This rapid growth continued throughout the first half of the year, with TVL doubling to $2.08 billion by June 30, 2025.

In the first half of the year, HyperEVM saw an average weekly TVL growth of approximately $185 million, peaking during periods of native protocol launch or ramp-up. This strong momentum propelled HyperEVM into the top ten blockchains by TVL and growth in just a few months, surpassing established networks such as Avalanche, Aptos, Polygon, and Sui.

This dynamic is driven by multiple catalysts: firstly, the market traction of Hyperliquid and the successful performance of the HYPE token, secondly, the expectation of a second round of HYPE airdrops that HyperEVM users may receive, and the launch of multiple points reward activities by the native protocol.

(3) On-chain activities and user growth

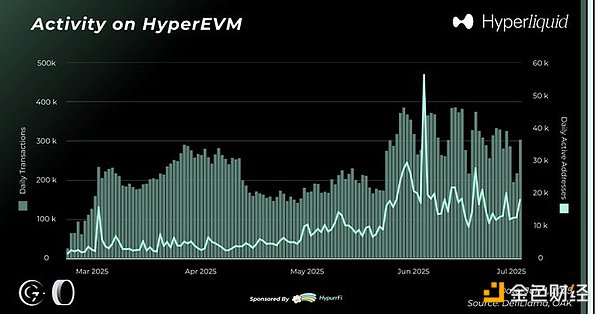

In addition to TVL, on-chain activity has also shown similar growth. Daily active users have steadily increased, exceeding 44,000 addresses during the most active weeks of June. The average daily active addresses for the first half of 2025 is approximately 33,000, which is still relatively conservative.

The number of transactions also showed the same trend, reaching 315,000 transactions per day during the peak period of activity and an average daily transaction volume of approximately 208,000 transactions in the first half of the year.

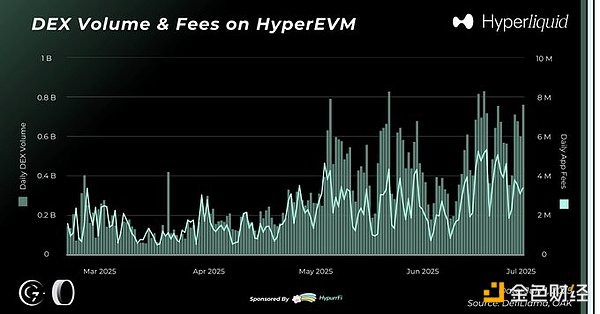

From an economic perspective, applications deployed on HyperEVM generate an average of $1,926,550 in fees per day, reaching a peak of $4,855,130 on May 21, 2025, and a daily low of $537,935 on March 22, 2025. Since the blockchain’s launch, a cumulative $256.2 million in fees has been generated, making HyperEVM one of the most profitable blockchains in terms of DeFi monetization.

(4) Overview of key dApps in the ecosystem

The TVL distribution on HyperEVM demonstrates both the depth of the ecosystem and the diversity it has developed in a short period of time. As of the end of the first half of 2025, the following major applications have performed particularly well:

Kinetiq: TVL $1.2 billion

Kinetiq is a liquid staking protocol that officially launched on the HyperEVM on July 15, 2025. Despite its late launch, the protocol has experienced explosive growth, leveraging its status as "Hyperliquid's first native LST" and its integration with major DeFi protocols, with its TVL quickly exceeding $1 billion.

Kinetiq's launch coincides with the deployment of the CoreWriter module—a key component that enables Kinetiq to natively integrate with HyperCore infrastructure, specifically interacting directly with Hyperliquid validators. This means Kinetiq can directly stake users' HYPE tokens and proactively allocate funds across validators, a capability unavailable with other liquid staking protocol.

Hyperlend: TVL $700 million (including lending amount)

Hyperlend is a decentralized lending protocol built natively on the HyperEVM, supporting deposits and lending across multiple assets (HYPE and its LSTs, BTC, ETH, and various stablecoins). The protocol is directly connected to HyperCore, allowing users to stake assets within the Hyperliquid app for lending.

Felix: TVL $390 million

Felix is the first Collateralized Debt Position (CDP) protocol on the HyperEVM. It allows users to borrow the feUSD stablecoin against a variety of collateral (HYPE, kHYPE, and BTC), while also offering classic Vanilla Markets for multi-asset lending. Felix's Vanilla Markets utilize the Morpho smart contract standard and, with $390 million in TVL, has become one of the core native protocols in the ecosystem.

Liminal: TVL $90 million

Liminal is a delta-neutral yield protocol built natively on the HyperEVM. It provides sustainable, market-independent returns by capturing the funding rates of Hyperliquid leveraged traders. Drawing on Ethena's strategy, users deposit USDC and select target assets (HYPE, PUMP, FARTCOIN, SOL, etc.). The system automatically establishes equal long spot and short perpetual positions. This structure hedges market risk while generating real yield through positive funding rates. Since its launch, Liminal has achieved an annualized return of approximately 14%, attracted over 10,000 unique depositors, and reached $90 million in TVL, ranking it among the top ten HyperEVM protocols.

(5) Focus on HypurrFi

HypurrFi is a partner in this Hyperliquid Semi-Annual Report, and we thank them for their support of this research.

HypurrFi is not only a native lending protocol on the HyperEVM, but also a complete on-chain debt servicing infrastructure. Beyond basic lending functionality, the protocol provides a comprehensive framework for debt management, refinancing, restructuring, and optimization, leveraging Hyperliquid's growing liquidity.

HypurrFi currently offers a variety of asset pools and segregated markets (HYPE and its primary LSTs, Hyperliquid spot market listed assets, and stablecoins). As the issuer of the USDXL stablecoin, the protocol utilizes an overcollateralized model—primarily backed by user deposits, with a partial credit enhancement of US Treasuries purchased from protocol revenue.

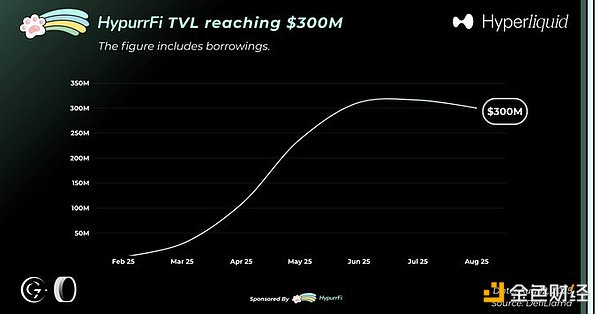

As of the time of writing, HypurrFi’s TVL (including lending amounts) reached $300 million, with approximately $2.7 million in USDXL in circulation.

HypurrFi has a clear goal for the second half of 2025: to become the leading debt servicing infrastructure for the Hyperliquid ecosystem. To achieve this goal, the protocol plans to deploy a comprehensive suite of tools that will enable users to optimize debt management (collateral swaps, low-interest refinancing, risk management, additional functionality, etc.).

Key development plans include:

pawSwap : An order flow auction mechanism designed to optimize the liquidation and swap processes on the HyperEVM, including direct access to the Hyperliquid Core order book.

Swype Card : A payment card product that allows users to spend directly from their HypurrFi positions without having to sell their assets in advance. Currently supporting over 100 million merchants worldwide, the company plans to expand its offerings to include corporate discounts, loyalty programs, and co-branded cards.

New Vaults and Segregated Marketplaces : Developed with undisclosed partners to provide efficient yield strategies for developers, funds, and end users.

Hyperscan : A planned developer-friendly environment reconstruction solution to simplify the process of creating and integrating new products on HyperEVM.

Institutional Access : Establishing a compliant path for teams and foundations to deploy funds into the HyperCore and HyperpurrFi markets.

3. HYPE Token Analysis

(1) Coin holdings, trading volume, and price performance

Hyperliquid's HYPE token launched on November 29, 2024, with the largest airdrop in crypto history. The token enjoyed a bull run in December, reaching a new all-time high of $35 for the first time, a nearly 1,200% increase.

Now, let’s evaluate how the positive metrics for Hyperliquid and HyperEVM translate to the performance of the HYPE token in the first half of 2025. Below are the key token metrics for the period from January 1st to June 30th, 2025:

Number of coin holders : +100% (from 70,000 to 140,000)

Weekly trading volume : +70% (from ~$1.4 billion in January to ~$2.4 billion in June)

HYPE Price : +64.8% (from $24.12 to $39.76)

HYPE closed at $39.76 at the end of the period, reaching a new all-time high. This price also reached the first target price set in our valuation model published on March 15, 2025 (when the token price was only $14.20).

Note: We are updating our valuation model to incorporate significant developments in Hyperliquid since our initial analysis.

(2) HYPE market performance is excellent

Next, we compare HYPE’s performance with other major crypto assets. In the first half of 2025, HYPE not only outperformed its peers but was also the only large-cap token to achieve positive returns, aside from BTC (up 16%).

However, HYPE's outperformance was entirely concentrated in the second quarter. In the first quarter, HYPE underperformed its peers, falling 51% compared to an average decline of 30% for the benchmark group.

The underperformance in the first quarter stemmed primarily from overall market weakness and macro uncertainties, including tariff concerns and heightened geopolitical tensions. Furthermore, HYPE is expected to perform particularly strongly in the fourth quarter of 2024, making a short-term pullback logical.

However, in the second quarter, market conditions improved with a 90-day tariff pause, easing global tensions, and an improved regulatory environment for cryptocurrencies. HYPE capitalized on this new environment, surging 206%, while its peers averaged a 25% gain.

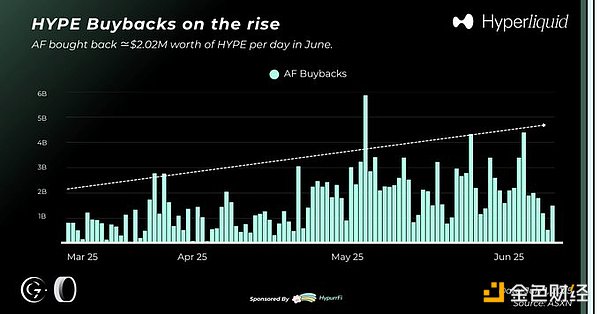

This rebound was also supported by the accelerated buybacks by the bailout fund, which played a key role in restoring market confidence. Notably, in June alone, the bailout fund repurchased an average of $2.02 million of HYPE per day. As of this writing, the average daily buying pressure is approximately $3 million.

(3) HYPE income and repurchase mechanism

Unlike most DeFi protocols today, the Hyperliquid team does not profit directly from platform activity fees. All fees go to HLP (Hyperliquidity Provider) and the aid fund.

Specifically, HLP is a community treasury that allows users to participate in Hyperliquid market making and earn returns, while the assistance fund is a reserve fund denominated in HYPE, designed to provide liquidity support when necessary.

The team has not yet disclosed the specific allocation ratio between HLP and the aid fund. However, based on public data, approximately 92% of the fees have gone to the aid fund in recent months, with only 8% allocated to HLP.

The Assistance Fund implements a HYPE spot buyback program, which means that 92% of the fees generated by Hyperliquid are used to purchase HYPE on the spot market. These revenues are directly distributed to token holders and provide support for the HYPE price.

In just a few months, Hyperliquid has become the most profitable protocol in the crypto industry. Since the beginning of 2025, its revenue has reached $406 million (over $810 million annualized), second only to Tether and Circle.

Note: Based on data from the last 30 days, the current annualized revenue is approximately US$1 billion, and the price-to-earnings ratio (P/E) based on circulation volume is approximately 15 times.

In the first half of 2025, Hyperliquid's fee revenue increased significantly, climbing from approximately $1 million per day at the beginning of the year to an average of over $3 million currently, with peaks exceeding $5 million. The Assistance Fund currently holds over $1.22 billion worth of HYPE tokens, with a cumulative acquisition cost of just over $400 million.

At the current pace, Hyperliquid's buyback mechanism is capable of repurchasing approximately 13% of the circulating supply of HYPE annually. With the implementation of HIP-3 and the expansion of Builder Codes (currently represented by Phantom), protocol revenue will continue to grow exponentially, further strengthening this model.

4. Hyperliquid Event Review

As expected, the past six months have seen a lot of significant events. Here are the key developments in Hyperliquid and HyperEVM since January 2025:

January 8, 2025: Verification node expansion

Hyperliquid uses a Proof-of-Stake (PoS) consensus mechanism, which requires validating nodes to maintain network security. Initially, the protocol had only four validating nodes, raising concerns about centralization.

In response to these concerns, the team announced in early January that they would increase the number of validating nodes to 16, with plans to continue expanding to enhance decentralization. As of this writing, the number of validating nodes has reached 27 (25 of which are active), a significant improvement from the initial 4.

January 18, 2025: TRUMP token launch

The launch of the Trump Token on January 18, 2025, marked a pivotal moment for the crypto world. This controversial meme coin, launched by the US President's team, generated massive trading volume, and was followed by the equally controversial Melania Token.

The most crucial takeaway from these events is the clear shift in trader sentiment. Hyperliquid became the first platform to list these two meme coins in perpetual contracts, hours ahead of major centralized exchanges. This led to two consecutive days of record-breaking trading volume: $21 billion on January 20th and $22 billion on January 21st.

These events established Hyperliquid's position in the industry as the "best trading platform for new token launches."

February 14, 2025: Unit launches

A key milestone in the first half of the year was the launch of HyperUnit (Unit), Hyperliquid's asset tokenization layer. Unit initially supported deposits, withdrawals, and trading of BTC, and subsequently expanded to ETH (March 27), SOL, and FARTCOIN (May 13) during the semester. By the end of June, Unit had processed over $400 million in native asset deposits and facilitated $8.4 billion in spot trading volume.

Unit is further integrating the PUMP token and continues preparations for the launch of tokenized stocks. We will track these developments in Q3 – Unit’s strategic position will become increasingly important as new perpetual markets are launched in the future.

February 18, 2025: HyperEVM goes online

The launch of HyperEVM on February 18th marked a turning point for Hyperliquid. This EVM-compatible smart contract layer enables developers to deploy decentralized applications and natively benefit from Hyperliquid's deep liquidity and high-performance infrastructure.

The launch sparked heated debate within the ecosystem, with many considering it too sudden and even risky. The team opted for a low-key launch, unlike other blockchains, with no marketing campaign or incentive program.

Despite its unconventional approach, adoption has been impressive. Since its launch, over 400,000 accounts have been created and 11,000 smart contracts have been deployed. With zero incentives, HyperEVM has achieved $2 billion in organic TVL (total value locked), outperforming competitors that have invested millions to bootstrap the ecosystem.

March 26, 2025: The Jelly Incident

We also need to face up to difficult times. The Jelly incident on March 26, 2025, almost became a dramatic turning point for Hyperliquid.

On the same day, the attacker manipulated the positions of the JELLY meme coin and used the liquidation mechanism to launch a complex attack on Hyperliquid, resulting in a book loss of approximately US$12 million in the HLP treasury, seriously threatening the protocol's solvency.

Hyperliquid responded quickly: the team activated the oracle override mechanism to eliminate the impact and promised to compensate affected users (except the attacker).

While this intervention raised questions about the protocol’s decentralization, it was generally agreed that the team acted in the best interests of the community. Since then, additional security measures have prevented a similar incident from occurring again.

May 2, 2025: HIP-3 testnet launch

HIP-3 marks a significant step forward for Hyperliquid's decentralization by opening up perpetual contract market creation to the community. By simply staking 1 million HYPE as collateral, any participant can permissionlessly propose and deploy new markets (indices, stocks, meme tokens, and more).

Market creation rights are allocated through a Dutch auction held every 31 hours. The highest bidder has full configuration rights, including oracle selection, leverage limits, rate setting, collateral acceptance, and can earn up to 50% of market creation fees.

HIP-3 leverages incentive mechanisms to create new business models around market creation, accelerating product diversification while ensuring protocol security. Currently in the testnet phase, the solution is expected to launch on the mainnet soon.

May 5, 2025: Pledge tier system

On May 5, Hyperliquid launched the "Staking Tiers" feature, allowing HYPE stakers to enjoy transaction fee discounts based on the amount of stake.

Bronze tier users can enjoy a 5% fee reduction starting from staking 10+ HYPE tokens, while Diamond tier users can receive a 40% discount for staking over 500,000 HYPE tokens. This initiative significantly increases the utility of HYPE tokens, strongly incentivizing traders to accumulate and stake more tokens for greater returns.

May 5, 2025: "Home of Stablecoins": USDT0 and USDe

In the first half of 2025, Hyperliquid expanded its stablecoin product line by introducing Ethena's USDe (May 5) and USDT0 (May 9), both of which are now available on the Hyperliquid exchange and HyperEVM.

Previously, USDC was Hyperliquid's primary stablecoin. The addition of this option sends a positive signal, helping to optimize risk diversification and reduce reliance on USDC.

This move also promotes the development of the DeFi ecosystem on HyperEVM, attracts new users who prefer USDT0 or USDe, and further consolidates Hyperliquid's "moat" advantage based on deep liquidity.

June 17, 2025: HYPE Enterprise Fund

The first half of the year also saw the rise of HYPE corporate treasuries, a strategy that emulated Michael Saylor's pioneering investment in Bitcoin at MicroStrategy. In the first half of 2025, Eyenovia (NASDAQ: EYEN) and Lion Group Holding (NASDAQ: LGHL) began adding HYPE to their corporate treasury holdings. Following the end of the semester, Sonnet BioTherapeutics (NASDAQ: SONN), Hyperion DeFi (NASDAQ: HYPD), and Nuvve Holding Corp. (NASDAQ: NVVE) also joined.

This means that many listed companies are actively allocating HYPE as a strategic reserve asset - a status that only a very few assets in financial history have achieved. HYPE thus becomes the fourth crypto asset to be adopted at the corporate treasury level, following BTC, ETH, and SOL.

The logic behind Wall Street's heavy investment in HYPE is clear: Hyperliquid is one of the most profitable commercial entities in history, with annualized revenue exceeding $800 million, and it uses 97% of its revenue for daily HYPE repurchases.

July 5, 2025: CoreWriter goes online

The Read Precompiles feature deployed on the mainnet on April 28th was the first to achieve a breakthrough, allowing HyperEVM developers to access HyperCore data through smart contract groups, opening up new use cases for dApps.

But this is just the first step. Starting July 5th, CoreWriter (formerly known as a precompiled contract writer) has also been launched on HyperEVM. Developers can not only read HyperCore data, but now they can also write to it, enabling trustless two-way communication between HyperCore and HyperEVM.

This progress marks the completion of the full functional composability of the two-layer architecture, paving the way for a new generation of innovative applications.

July 8, 2025: Builder Codes (Phantom integration case)

While Builder Codes isn't launching this semester (it was originally slated for October 2024), its potential won't be fully realized until Phantom Perps goes live.

As you know, Hyperliquid's core advantage lies in its unrivaled on-chain liquidity—a competitive advantage that is extremely difficult to replicate. This is precisely where Builder Codes comes in: it allows any application to connect its interface directly to the Hyperliquid backend, expanding the protocol's user base while sharing revenue with partners.

Phantom Perps, launched on July 8, 2025, is a prime example: wallet users can trade over 100 perpetual contract pairs without leaving the app. Since its launch, this integration has generated $1.2 million in Builder Codes revenue, $1.3 million in referral income, and introduced over 20,000 new users to the ecosystem. We estimate this integration will generate $15-30 million in annualized revenue for Hyperliquid.

With the success of Phantom, more applications are expected to join the program in the coming months.

5. Conclusion

In the first half of 2025, Hyperliquid solidified its undisputed leadership in the decentralized perpetual swap market, with significant growth in on-chain metrics, accelerated adoption of the HyperEVM, and a rapidly expanding native application ecosystem. The performance of the HYPE token, supported by a unique buyback model and record revenue, underscores the robustness and sustainability of the protocol's economic framework.

From a broader perspective, Hyperliquid has forged new paths while strengthening its liquidity and infrastructure moats through the development of HIP-3, CoreWriter, and Builder Codes. These developments, combined with the onboarding of strategic partners like Phantom and the rise of native protocols on the HyperEVM, have laid the foundation for strong growth in the second half of the year.

Of particular note, HIP-3 will be a key catalyst: anyone holding $1 million in HYPE can deploy perpetual contract pairs and earn up to 50% of trading fees. Participants don't need to build infrastructure; they can focus on launching perpetual products with strong market demand, and Hyperliquid will handle the rest.

The Phantom integration has proven to be a significant success story for both parties, with this single integration expected to generate 2%-4% annualized cash flow growth. If dozens of wallets or front-ends follow suit, the potential impact will be multiplied.

With the U.S. Securities and Exchange Commission (SEC)’s new initiative to bring more asset classes onto the blockchain, Hyperliquid is expected to support a wider range of asset classes on an existing basis, thereby unlocking more growth opportunities.

This is our first semi-annual analysis focused solely on Hyperliquid. Given the rapid pace of innovation and evolving metrics, we've decided to transition to a quarterly reporting format starting next year to provide more timely and insightful analysis of significant ecosystem developments.

Finally, we would like to express our special thanks to HypurrFi, the sponsor of this report, for their support and commitment to building a top-tier debt servicing infrastructure on the HyperEVM. Their contribution embodies the collaborative spirit that has always been one of Hyperliquid’s core strengths.