Bitcoin experienced a sharp correction this week, significantly falling from its recent peak. While macroeconomic factors contributed to the decline, the selling actions of Bitcoin's large holders played a crucial role.

Particularly, the actions of these two major holders directly impacted the price.

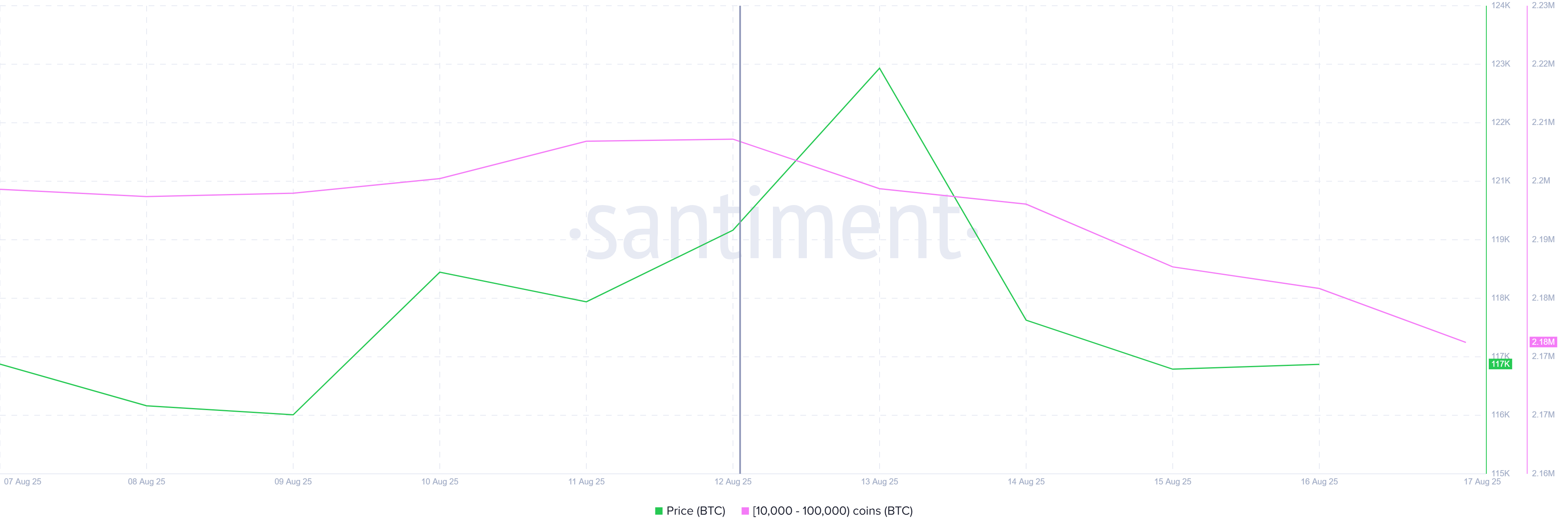

Bitcoin Holders Reducing Positions

Over the past 6 days, Bitcoin whales—addresses holding 10,000 to 100,000 BTC—sold over 30,000 BTC, worth more than $345 million. This massive sell-off appears to be driven by a desire to secure profits when Bitcoin reached its peak. According to cryptoquant analyst JA Martoon, this selling pattern aligns with previous whale behavior during price increases.

"While Bitcoin rose to $120,000, whales are taking advantage of the rise with a third wave of selling."

Due to the significant impact these whales have on Bitcoin's price, their actions triggered a sharp decline. The surge of BTC to exchanges created selling pressure, causing the price to drop.

Token TA and Market Update: Want more such token insights? Subscribe to editor Harshi Notariya's daily crypto newsletter here.

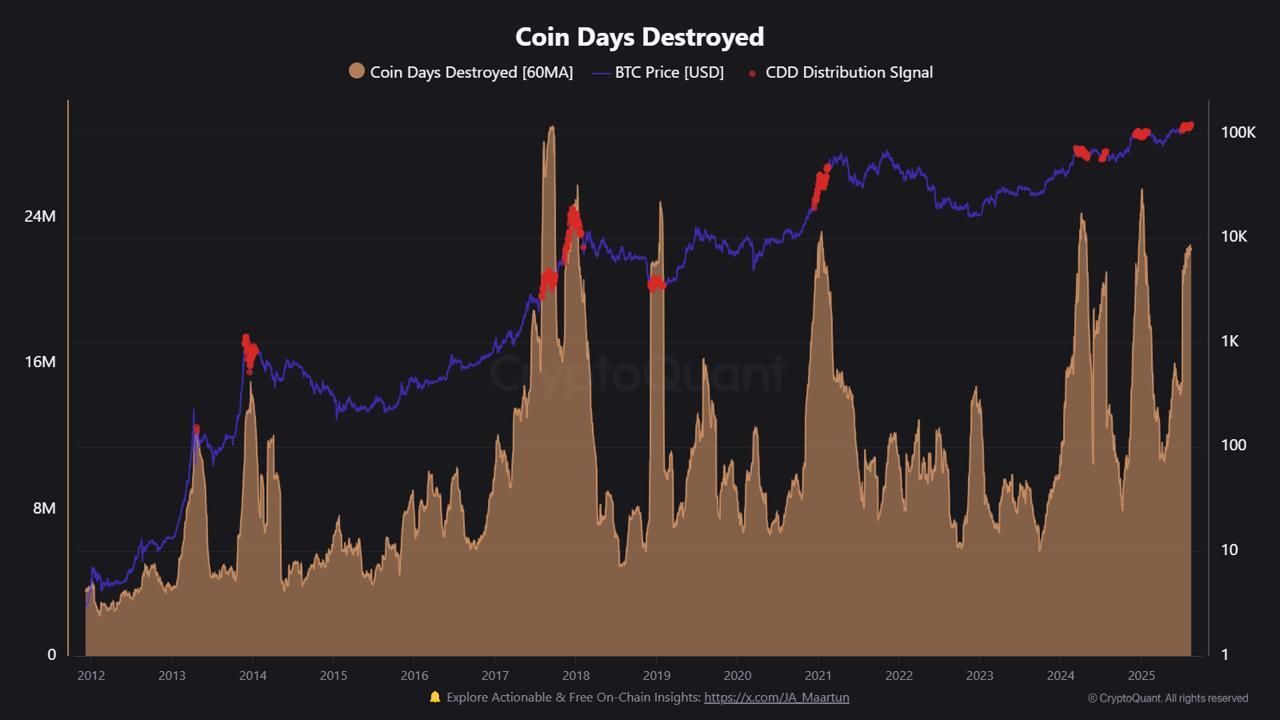

Bitcoin's overall macro momentum is also showing weakness. A notable indicator is the recent surge in "Coin Days Destroyed". This is used to track Long-Term Holders' (LTH) movements. According to cryptoquant data, this is the second major surge this year, indicating increased selling activity by LTHs.

Like whales, LTHs significantly impact Bitcoin's price. A large surge in Coin Days Destroyed suggests long-term holders are liquidating their holdings. These selling actions by whales and LTHs have added downward pressure on the price, exacerbating Bitcoin's short-term challenges.

BTC Price May Further Decline

Bitcoin price is currently hovering near $115,130, barely maintaining the $115,000 support level. The 6% decline over the past few days, triggered by whale sales and LTH movements, suggests BTC could fall further in the short term.

If selling pressure continues, Bitcoin could drop to the $112,526 support level. Further decline could test BTC at $110,000, representing nearly a six-week low. This scenario reflects the continuation of current weak momentum and raises concerns about additional market weakness.

However, if Bitcoin rebounds from the $115,000 support level, it could recover to $117,261 due to changing investor sentiment or more favorable market conditions. Successfully surpassing this level could potentially lead to a rise to $120,000, potentially invalidating the current weak outlook.