BTC Recovers to 159 Million Won with Buying Pressure ETH Rises by 3%... XRP Also Shows Slight Strength API3 Rises by About 7%, Altcoins Mixed

Bitcoin (BTC) rebounded on the 20th with short-term buying pressure despite cautious sentiment ahead of the Jackson Hole Meeting and interest rate uncertainty.Although the recent sharp rise in the US Producer Price Index (PPI) weakened expectations of interest rate cuts, it is interpreted that buying pressure due to excessive short-term price drops has flowed into the market.

While Bitcoin showed a rebound, Ethereum (ETH) rose by 3.36% to 5,873,000 won. XRP rose slightly by 1.43%, and Chainlink (LINK) continued to rise by nearly 5%. In contrast, Waves dropped by 4.9%, and Strike (STRK) fell by over 32%.

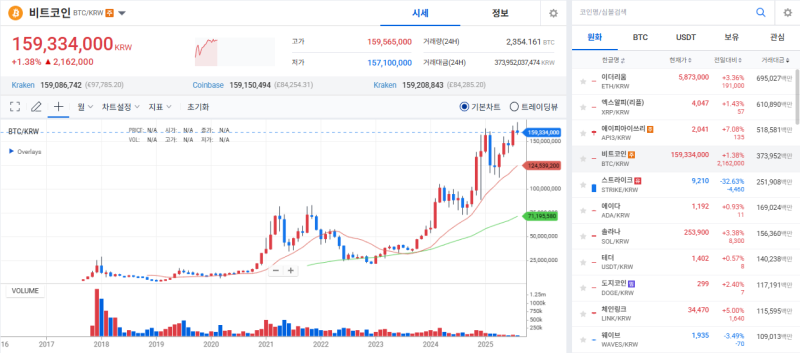

◇Bitcoin = As of 4 PM on the 20th on Upbit, Bitcoin price was 159,334,000 won, up 1.38% from the previous day. Bitcoin dominance was 57.90%.

According to on-chain analysis platform Sigbit, the long-short ratio in the Bitcoin futures market was 63.19% and 36.81%, respectively.

Experts said, "While it's a short-term rebound phase, breaking through the resistance in the early 160 million won range is crucial" and "Volatility may expand after the Jackson Hole Meeting".

◇Rising Coins = As of 4 PM on the 20th on Upbit, the cryptocurrency with the largest increase for the day was API3, rising by about 7.08%.

API3 is a project building a decentralized oracle network, and investor interest is growing due to the recent expansion of DeFi demand.

◇Fear and Greed Index = The digital asset Fear-Greed Index provided by Alternative is maintaining the 'Fear' stage at 44 points. The fear stage (20-39) is a period when cryptocurrency price volatility and trading volume increase, indicating a potential price decline. Caution is advised for buying as the possibility of a short-term bottom formation increases.

The Relative Strength Index (RSI) provided by Sigbit recorded 35.8, in a 'neutral' state. RSI measures the relative strength between upward and downward pressure on a specific asset price and indicates the overbought and oversold levels of an asset.

Reporter Jeong Ha-yeon yomwork8824@blockstreet.co.kr