Dogecoin (DOGE) price has been showing a downward trend since August 17th, losing approximately 9% of its value over the past three days.

As the token declines, futures traders who opened positions expecting a rise have incurred losses. With new demand still minimal, meme coin longing traders may be at risk of further decline.

DOGE Decline Triggers Long Liquidations

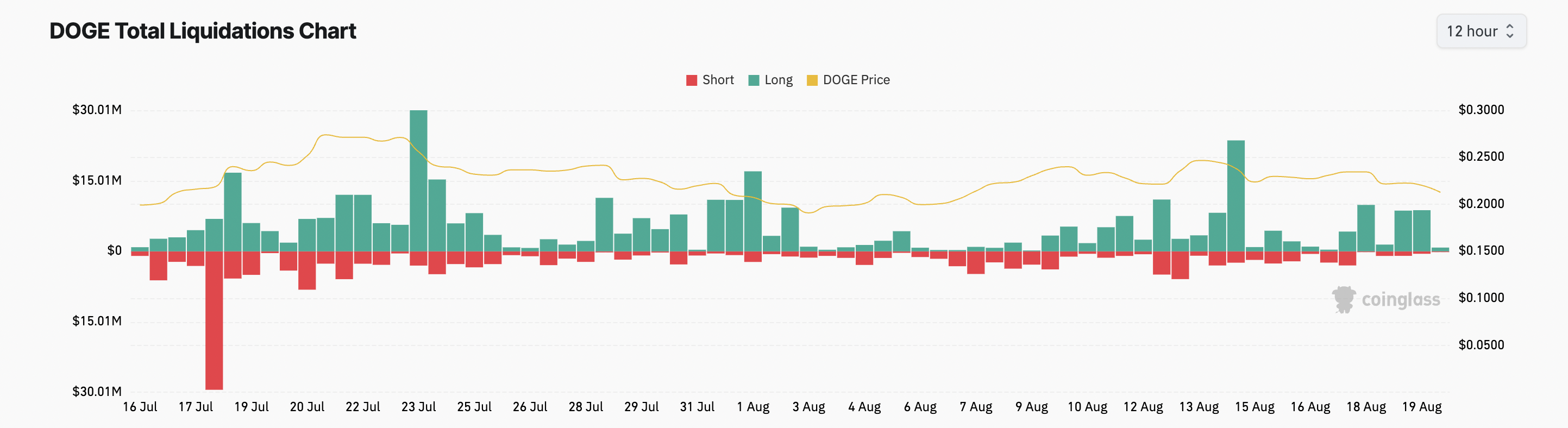

DOGE's recent price drop was exacerbated by broader market decline, triggering a wave of long liquidations in the futures market. According to Glassnode, a total of $10 million in long liquidations occurred as the meme coin continued to decline over the past 24 hours.

Token Technical Analysis and Market Update: Want more such token insights? Subscribe to editor Harshi Notariya's daily crypto newsletter here.

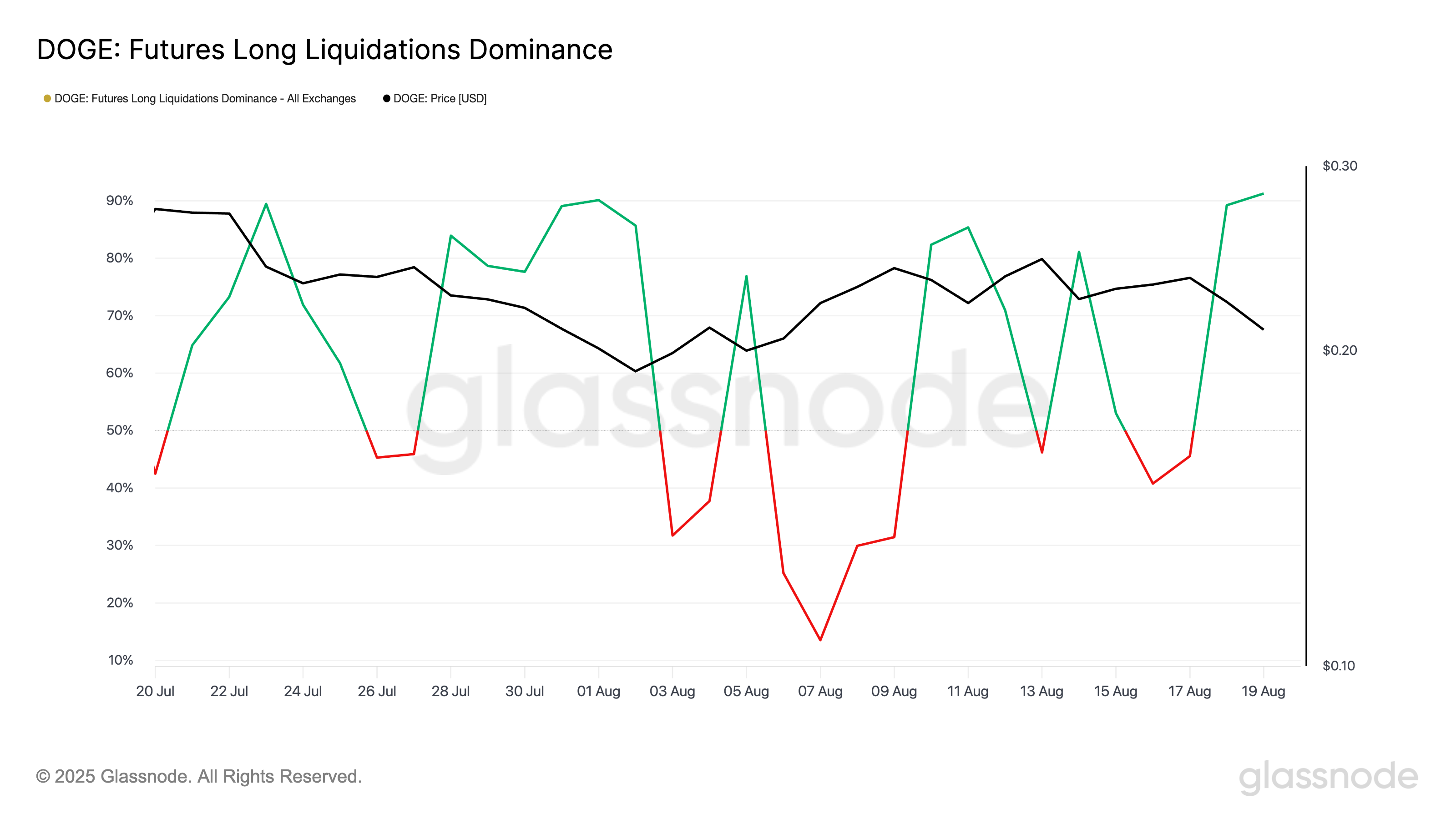

Yesterday, DOGE futures long liquidation dominance rose to 98%, indicating that most liquidated positions were long bets.

Liquidations occur when an asset's value moves in the opposite direction of a trader's position. In this case, the trader's position is forcibly liquidated due to insufficient funds to maintain it.

Long liquidations happen when an asset's price drops below a specific threshold, causing traders expecting price increases to be expelled from the market.

These excessive liquidation losses can weaken market sentiment among DOGE holders and futures traders, potentially triggering additional selling. This could intensify the meme coin's decline and extend the downward trend in the short term.

DOGE Buyers Lose Momentum

At the time of writing, DOGE's Relative Strength Index (RSI) is struggling below the 50 neutral line, supporting the downward trend forecast. The RSI at 46.36 reflects decreased buying activity among market participants.

The RSI indicator measures an asset's overbought and oversold market conditions. Generally, an RSI exceeding 70 may indicate an overbought state (potentially overvalued) with an expected rebound. Conversely, values below 30 may suggest an oversold state (potentially undervalued) and hint at an anticipated upward reversal.

DOGE's RSI at 46.36 indicates weakened upward momentum. This suggests buyers are struggling to maintain control amid recent selling pressure, and if this continues, the meme coin could decline to $0.1758.

Conversely, a rebound in buying pressure could push the price above $0.2347.